Ashmore Group PLC Q2 AuM Statement (9910B)

January 13 2015 - 2:00AM

UK Regulatory

TIDMASHM

RNS Number : 9910B

Ashmore Group PLC

13 January 2015

Ashmore Group plc

+0700 13 January, 2015

SECOND QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces today the following

update to its assets under management ("AuM") in respect of the

quarter ended 31 December 2014.

Assets under Management

Actual Estimated Movement

30 September

2014 31 December 2014 Q2 vs Q1

Theme (US$ billion) (US$ billion) (%)

--------------------- --------------- ------------------- ----------

External debt 13.3 12.4 -6.8

--------------------- --------------- ------------------- ----------

Local currency 17.1 15.7 -8.2

--------------------- --------------- ------------------- ----------

Corporate debt 7.9 7.4 -6.3

--------------------- --------------- ------------------- ----------

Blended debt 20.7 18.0 -13.0

--------------------- --------------- ------------------- ----------

Equities 5.2 4.3 -17.3

--------------------- --------------- ------------------- ----------

Alternatives 2.2 1.3 -41.0

--------------------- --------------- ------------------- ----------

Multi-strategy 2.2 2.0 -9.1

--------------------- --------------- ------------------- ----------

Overlay / liquidity 2.7 2.6 -3.7

--------------------- --------------- ------------------- ----------

Total 71.3 63.7 -10.7

--------------------- --------------- ------------------- ----------

Assets under management declined during the quarter to US$63.7

billion as a result of negative investment performance of US$2.8

billion, net outflows of US$4.2 billion and the disposal of the

Group's interest in a Chinese real estate joint venture that

reduced alternatives AuM by US$0.6 billion.

Investment performance predominantly reflects the sharp sell-off

in markets in early December that particularly affected local

currency markets. Performance was therefore weakest in the local

currency and blended debt themes, with the latter having an

allocation to local currency assets. External debt, corporate debt

and multi-strategy also saw negative investment performance.

Equities, alternatives and overlay/liquidity were flat.

Net outflows in the blended debt theme resulted from a small

number of segregated accounts and net outflows were also

experienced in equities, external debt and, to a lesser extent, in

local currency, multi-strategy, corporate debt and overlay /

liquidity. Capital was returned as planned to investors in the

alternatives theme.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"Weaker commodity prices, US dollar strength and increased price

volatility impacted upon Emerging Markets during the quarter,

although the diverse range of return opportunities in the asset

class continued to show through. While asset prices have fallen,

uncertainty over the timing and pace of Federal Reserve rate

increases is likely to weigh on sentiment in the near term.

However, Emerging Markets' fundamentals remain sound and previous

uncertainties, such as election cycles, have abated. Therefore, as

is typically the case following a sharp and widespread fall in

asset prices, Emerging Markets provide very attractive near-term

return opportunities, particularly in blended debt, local currency

and equities, for Ashmore's investment processes to capture on

behalf of clients."

Notes:

1. For the translation of US dollar-denominated balance sheet

items, the GBP/USD exchange rate was 1.5577 at 31 December 2014 (30

June 2014: 1.7106). For the translation of US dollar management

fees, the average GBP/USD exchange rate achieved for the first half

of the year was 1.6289 (H1 2013/14: 1.5868).

2. The Group's share of profits or losses from the Chinese real

estate joint venture is recognised in the consolidated statement of

comprehensive income in a single line, 'Share of gains/(losses)

from associates and joint ventures'. There is no impact from the

disposal on the alternatives net management fee margin, which is

stated after excluding the joint venture AuM, and the effect of the

disposal on the Group's profit before tax is immaterial.

Ashmore will announce its interim results in respect of the six

months ended 31 December 2014 on 24 February 2015.

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

FTI Consulting

Andrew Walton +44 (0)20 3727 1514

Paul Marriott +44 (0)20 3727 1341

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSFASMDFISELF

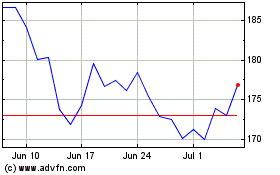

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

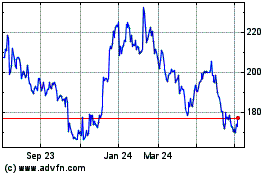

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2023 to Apr 2024