TIDMASPL

RNS Number : 2538X

Aseana Properties Limited

18 November 2014

18 November 2014

Aseana Properties Limited

("Aseana" or "the Company")

Interim Management Statement and Quarterly Investor Update

Aseana Properties Limited (LSE: ASPL), a property developer in

Malaysia and Vietnam, listed on the Main Market of the London Stock

Exchange, today issues the following Interim Management Statement

for the period 1 July 2014 to 17 November 2014.

The Company has also issued its Quarterly Investor Update for

the quarter ended 30 September 2014, a copy of which can be

obtained from Aseana's website at:

http://www.aseanaproperties.com/quarterly.htm.

Operational highlights:

-- The Aloft Kuala Lumpur Sentral Hotel ("Aloft") won the Hotel

category in the FIABCI Malaysia Property Awards. The hotel was

also awarded the Best Short Stay Excellence Award by Expatriate

Lifestyle for the Best of Malaysia Travel Awards. Aloft's average

occupancy rate stood at 64% for the nine-month period ended

30 September 2014.

-- Sale of properties at SENI Mont' Kiara advanced marginally to

92% compared to 91% recorded in August 2014. A further 5% of

properties are reserved with deposits paid.

-- The RuMa Hotel and Residences ("The RuMa") achieved 45% sales

based on sales and purchase agreements signed, with a further

6% reserved with deposit paid.

-- Occupancy rate of 42% was recorded at the Four Points by Sheraton

Sandakan Hotel ("FPSS") for the nine-month period ended 30 September

2014.

Financial highlights:

-- Unaudited revenue of US$46.24 million for the nine-month period

ended 30 September 2014 (30 September 2013 (unaudited): US$21.00

million)

-- Unaudited profit before tax for the nine-month period ended

30 September 2014 of US$12.37 million (30 September 2013 (unaudited):

loss of US$17.21 million)

-- Unaudited profit after tax for the nine-month period ended 30

September 2014 of US$3.48 million (30 September 2013 (unaudited):

loss of US$19.28 million)

-- Unaudited consolidated comprehensive income of US$3.40 million

for the nine months period ended 30 September 2014 (30 September

2013 (unaudited): loss of US$22.42 million)

-- Unaudited net asset value of US$163.86 million at 30 September

2014 (30 June 2014 (unaudited): US$154.63 million) or US$0.773

per share* (30 June 2014 (unaudited): US$0.729 per share)

-- Unaudited realisable net asset value of US$266.64 million at

30 September 2014 (30 June 2014 (unaudited): US$270.82 million)

or US$1.258 per share* (30 June 2014 (unaudited): US$1.277 per

share)

* NAV per share and RNAV per share as at 30 September 2014 are

calculated based on 212,025,000 voting shares (30 June 2014:

212,025,000 voting shares).

The Company has also published its Quarterly Investment Update

(including updates on projects and RNAV figures) for the period to

30 September 2013, which can be obtained on its website at

www.aseanaproperties.com/quarterly.htm.

Following the recent publication of the FCA's Policy Statement

(PS14/15), the requirement for listed companies to produce interim

management statements has been removed. In light of this rule

change, the Company will no longer publish interim management

statements going forward. However, Shareholders will continue to

receive meaningful and timely reporting through the Company's

Quarterly Investment Update and through ad hoc regulatory

announcements as required under the FCA's Disclosure and

Transparency Rules.

For further information:

Aseana Properties Limited Tel: 603 6411 6388

Chan Chee Kian Email: cheekian.chan@ireka.com.my

N+1 Singer Tel: 020 7496 3000

James Maxwell (Corporate Finance) Email: james.maxwell@n1singer.com

/Sam Greatrex (Sales) /sam.greatrex@n1singer.com

Tavistock Communications Tel: 020 7920 3150

Jeremy Carey / James Verstringhe Email: jcarey@tavistock.co.uk

Notes to Editors:

London-listed Aseana Properties Limited (LSE: ASPL) ("Aseana")

is a property developer investing in Malaysia and Vietnam.

Ireka Development Management Sdn Bhd ("IDM") is the exclusive

Development Manager for Aseana. It is a wholly-owned subsidiary of

Ireka Corporation Berhad, a company listed on the Bursa Malaysia

since 1993, which has over 47 years of experience in construction

and property development. IDM is responsible for the day-to-day

management of Aseana's property portfolio and the introduction and

facilitation of new investment opportunities.

Commentary

For the nine months ended 30 September 2014, Aseana and its

group of companies (the "Group") recorded unaudited revenue of

US$46.24 million (30 September 2013 (unaudited): US$21.00 million),

which was mainly attributable to the sale of completed units in

SENI Mont' Kiara and Tiffani. No revenue was recognised for The

RuMa, in accordance with IFRIC 15 - Agreements for Construction of

Real Estate which prescribes that revenue be recognised only when

the properties are completed and occupancy permits are issued.

The unaudited other income of the Group stood at US$38.76

million for the nine months ended 30 September 2014 (30 September

2013 (unaudited): US$9.59 million). This was mainly attributable to

revenues from ASPL's four operating assets totalling US$18.86

million; a gain on disposal of land to AEON Vietnam Co. Ltd. ("AEON

Vietnam") of US$13.52 million; and a gain on the disposal of the

Company's 40% stake in Excellent Bonanza Sdn. Bhd. ("EBSB") of

US$5.54 million.

The Group recorded an unaudited profit before tax for the period

of US$12.37 million (30 September 2013 (unaudited): loss of

US$17.21 million). The Group's unaudited profit after tax for the

nine-months ended 30 September 2014 stood at US$3.48 million (30

September 2013 (unaudited): loss of US$19.28 million). This

includes profit attributable to SENI Mont' Kiara and Tiffani of US$

6.65 million, gains on disposal of land to AEON Vietnam and

disposal of 40% stake in EBSB of US$5.35 million and US$5.07

million respectively; offset by operating losses and financing

costs largely attributable to Four Points by Sheraton Sandakan

Hotel and Harbour Mall Sandakan totalling US$4.24 million, together

with operating losses and financing costs of City International

Hospital of US$7.49 million.

Total other comprehensive expense include a foreign currency

translation loss of US$0.61 million (30 September 2013 (unaudited):

loss of US$5.92 million) which was attributable to the weakening of

Ringgit against the US dollars and an increase in fair value of the

share of investment in Nam Long Investment Corporation of US$0.52

million. This resulted in an unaudited consolidated comprehensive

income for the period of US$3.40 million (30 September 2013

(unaudited): loss of US$22.42 million).

Unaudited net asset value for the Group for the period under

review increased to US$163.86 million (30 June 2014 (unaudited):

US$154.63 million) or US$0.773 per share (30 June 2014: US$0.729

per share) mainly due to gains on the disposal of the 40% stake in

EBSB and on the disposal of land to AEON Vietnam during the period.

However, unaudited realisable net asset value decreased to

US$266.64 million as at 30 September 2014 (30 June 2014

(unaudited): US$270.82 million) or US$1.258 per share (30 June 2014

(unaudited): US$1.277 per share) as a result of the weakening of

the Ringgit against the US Dollars.

The cash and cash equivalent of the Group stood at US$40.91

million as at 30 September 2014 (30 June 2014: US$26.91 million) of

which US$9.14 million was on lien to support the Medium Term Notes

("MTN") programme. The cash placed in fixed deposits and money

market funds (classified under held-for-trading financial

instrument) stood at US$28.34 million as at 30 September 2014,

compared to US$19.17 million as at 30 June 2014. The higher cash

and cash equivalents are mainly attributable to better cash

collections from the sale of properties at SENI Mont' Kiara and

Tiffani, as well as the cash proceeds received from the disposal of

the 40% stake in EBSB.

The borrowings of the Group as at 30 September 2014 have

decreased to US$221.66 million, compared to US$233.25 million as at

30 June 2014, mainly due to repayments of loan facilities utilising

proceeds from sale of land to AEON Vietnam.

Performance Summary

Period ended Period ended

30 September 30 September

2014 2013

(unaudited) (unaudited)

------------------------------------ -------------- --------------

Profit/ (Loss) before tax (US$ m) 12.37 (17.21)

Profit/ (Loss) after tax (US$ m) 3.48 (19.28)

Total comprehensive income/ (loss)

(US$ m) 3.40 (22.42)

------------------------------------ -------------- --------------

Period ended Period ended

30 September 30 June 2014

2014

(unaudited) (unaudited)

---------------------------------------- -------------- --------------

Net asset value ("NAV") (US$ m) 163.86 154.63

NAV per share (US$) (1) 0.773 0.729

Realisable net asset value ("RNAV")

(US$ m)(4) 266.64 270.82

RNAV per share (US$) (1) 1.258 1.277

Cash and bank equivalents (net of bank

overdrafts) (US$ m) 40.91 26.91

Debt-to-equity ratio (%) (2) 126.43 142.31

Net debt-to-equity ratio (%) (3) 102.88 125.65

---------------------------------------- -------------- --------------

Notes: (1) NAV per share and RNAV per share as at 30 September

2014 are calculated based on 212,025,000 voting shares (30 June

2014: 212,025,000 voting shares)

(2) Debt-to-equity ratio = (Total Borrowings ÷ Total Equity) x 100% (3) Net debt-to-equity ratio = (Total Borrowings less Cash and Cash Equivalent and Held-for-trading Financial Instrument ÷ Total Equity) x 100% (4) Aseana has valued each project based on either net asset value (using cost or fair value basis) or market values (using discounted cash flow method or residual/comparison method) for the RNAV calculation. RNAV data is unaudited. NAV and RNAV contribution of

each project are listed below:

Projects Project NAV as Project RNAV

at as at 30 September

30 September 2014

2014 US$ m

US$ m (unaudited)

(unaudited)

---------------------------------- --------------- --------------------

Malaysian projects:

Tiffani by i-ZEN 5.32 5.32 (1)

Sandakan Harbour Square 37.04 45.44 (3)

SENI Mont' Kiara 46.12 68.94 (2)

Aloft Kuala Lumpur Sentral hotel (2.84) 44.50 (3)

The RuMa Hotel & Residences 13.44 13.44 (1)

Kota Kinabalu Seafront Resort

& Residences 12.30 16.04 (3)

Vietnamese projects:

International Hi-Tech Healthcare

Park 15.60 34.77 (3)

City International Hospital 9.77 11.07 (3)

Equity investment in Nam Long 13.22 (4) 13.22 (4)

Waterside Estates 8.75 8.75 (1)

Others 0.03 0.04 (5)

Total Project NAV / RNAV 158.75 261.53

Cash and bank (6) 5.55 5.55

Other assets & liabilities (0.44) (0.44)

---------------------------------- --------------- --------------------

Total NAV / RNAV 163.86 266.64

---------------------------------- --------------- --------------------

NAV / RNAV per share (US$) 0.773 1.258

---------------------------------- --------------- --------------------

Notes:

1 Projects carried at cost.

2 Market value based on the valuation prepared on discounted

cash flows by international independent valuers as at 30 June 2014,

which excludes any taxes; whether corporate, personal, real

property or otherwise, that are payable. These market values are

further adjusted for assumed taxes by the Manager.

3 Market values based on residual/comparison/investment method

of land/property value by international independent valuers.

4 Fair value determined with reference to closing market price as at 30 September 2014.

5 Comprise of projects which have been discontinued.

6 Relating to cash and cash equivalent solely at Aseana company level.

7 Please see Valuation Methodology for further information.

Property Portfolio Highlights

Malaysia

Continuing its positive performance, sale of properties at SENI

Mont' Kiara is progressing well achieving 92% sales to date. A

further 30 units, representing approximately 5% of sales, are

currently reserved by interested buyers, pending execution of the

sales and purchase agreements. The Manager has commenced marketing

efforts on penthouses and plaza units at SENI Mont' Kiara.

Meanwhile, sales at The RuMa Hotel and Residences progressed to

45% to date, based on sales and purchase agreements signed, with a

further 6% being reserved with deposit paid. Sale of units at The

RuMa was affected by cooling measures imposed by the Government and

the Manager continues to explore all opportunities to enhance sales

at The RuMa with renewed marketing efforts which include numerous

marketing events abroad, the latest being at Taipei and Manila.

Construction of the main building is in-progress and completion is

expected in 2017.

The 482-room Aloft hotel was awarded the prestigious FIABCI

Malaysia Property Awards 2014 in the Hotel category in recognition

of its development concept and design, marketing appeal and

sustainability. Occupancy rate at Aloft stood at 64% for the nine

months ended 30 September 2014.

Average occupancy rate at FPSS stood at 42% for the nine months

ended 30 September 2014. Tourism and business environment in Sabah

continue to be adversely impacted by the flight tragedies along

with several kidnapping cases off the east coast of Sabah, over the

last eight months. Adverse travel advisory notices concerning the

coastal area of eastern Sabah, issued by countries such as the

United States of America, United Kingdom, Canada, Australia and New

Zealand are still in place. In Budget 2015, the Malaysian

government announced that RM660 million (US$201 million) will be

allocated to Eastern Sabah Security Command ("ESSCOM") to further

enhance the safety and security conditions of eastern Sabah. The

Management of FPSS continues to look into ways and opportunities to

improve on the efficiency of operations of the hotel, and also to

drive business from local corporates. To date, tenancy rate of

Harbour Mall Sandakan remained unchanged at approximately 47.5% as

at October 2014. The Manager is currently reviewing the tenancy mix

of Harbour Mall Sandakan to improve its performance.

Vietnam

The performance of the City International Hospital ("CIH") to

date has been below expectations largely as a result of lower than

expected patient volumes and challenges in human resources. As at

26 October 2014, CIH registered 2,390 inpatient days with average

revenue per inpatient admission of US$2,138. Outpatient visits as

at 26 October 2014 were 8,649 visits with average revenue per visit

of US$83. The Manager is working closely with Parkway, the operator

of CIH, to improve performance through targeted sales and marketing

campaigns, and introduction of new service lines offered by

CIH.

The International Monetary Fund cut its outlook on the global

economic growth in early October 2014 and cited that the recovery

continues to be uneven. As a result, the equity market experienced

a global sell off and the Vietnam Stock Index ("VN Index") is once

again on a gradual declining trend. However, Fitch Rating has in

November 2014 upgraded Vietnam sovereign rating from "B+" to "BB-"

due to improvement in the country's economy and finances. At the

date of this publication, Nam Long shares closed at VND17,900 per

share, compared to VND18,000 per share as at 30 September 2014.

Sales Update as at 31 October 2014

Projects % sold*

-------------------------------- --------

Tiffani by i-ZEN 99%

SENI Mont' Kiara

* Proceeds received 90%

2%

* Pending completion

The RuMa Hotel and Residences 45%

-------------------------------- --------

* Based on sales and purchase agreements signed. Please see

Snapshot of Property Portfolio below for further information on

existing investments.

Construction Update as at 31 October 2014

The RuMa Hotel and Residences, Kuala Lumpur, Malaysia

Piling works commenced in February 2013 and were completed in

October 2013. Construction of main building works commenced in

October 2013 and is targeted to complete in 2017.

Snapshot of Property Portfolio

Tiffani by i-ZEN, Kuala Lumpur, Malaysia

399 units of luxury condominiums within two 28-storey and a

36-storey block

Expected GDV: US$124 million

Effective Ownership: 100%

Project NAV as at 30/9/2014: US$5.32 million

Project RNAV as at 30/9/2014: US$5.32 million (1)

Status:

- 99% sold based on sales and purchase agreements signed

- Targeted sale: 100% sales by Q2 2015

Sandakan Harbour Square, Sandakan, Sabah, Malaysia

129 retail lots, Harbour Mall Sandakan, 299-room Four Points by

Sheraton Sandakan hotel

Expected GDV: US$157 million

Effective Ownership: 100%

Project NAV as at 30/9/2014: US$37.04 million

Project RNAV as at 30/9/2014: US$45.44 million (3)

Status:

- Retail lots: 100% sold

- Harbour Mall Sandakan and Four Points by Sheraton Sandakan Hotel commenced operation in 2012

- Planned sale in year 2017

SENI Mont' Kiara, Kuala Lumpur, Malaysia

605 units of luxury condominiums within two 12-storey and two

40-storey blocks

Expected GDV: US$490 million

Effective Ownership: 100%

Project NAV as at 30/9/2014: US$46.12 million

Project RNAV as at 30/9/2014: US$68.94 million (2)

Status:

- Winner of FIABCI Malaysia Property Award 2013 for Best High

Rise Residential Development and FIABCI Prix d'Excellence Silver

Award 2014 for High Rise Residential Development

- 92% sold based on sales and purchase agreements signed

- Targeted sales: 97% by end of 2014; 100% in year 2015

Aloft Kuala Lumpur Sentral hotel, Kuala Lumpur, Malaysia

482-room business-class hotel

Effective Ownership: 100%

Project NAV as at 30/9/2014: -US$2.84 million

Project RNAV as at 30/9/2014: US$44.50 million (3)

Status:

- Hotel managed by Starwood

- Opened on 22 March 2013

- Winner of FIABCI Malaysia Property Award 2014 for Hotel category

- Winner of the Best Short Stay Excellence Award by Expatriate

Lifestyle for the Best of Malaysia Travel Awards

- Planned sale in year 2015

The RuMa Hotel and Residences Project, Kuala Lumpur,

Malaysia

199 luxury residences and a 253-room boutique hotel

Expected GDV: US$197 million

Effective Ownership: 70%

Project NAV as at 30/9/2014: US$13.44 million

Project RNAV as at 30/9/2014: US$13.44 million (1)

Status:

- Construction work commenced in February 2013 and opened for sale in March 2013

- Off-plan sales for residences and hotel suites

- 45% sold based on sales and purchase agreements signed

- Completion expected in 2017

Seafront resort & residential development, Kota Kinabalu,

Sabah, Malaysia

Boutique resort hotel, villas and homes on 80 acres

Expected GDV: US$16 million

Effective Ownership (Resort villas and hotel): 100%

Effective Ownership (Resort homes): 80%

Project NAV as at 30/9/2014: US$12.30 million

Project RNAV as at 30/9/2014: US$16.04 million (3)

Status:

- The Board has decided to dispose of the land; buyers are being sought

- Planned sale in year 2015

International Hi-Tech Healthcare Park, Binh Tan District, Ho Chi

Minh City, Vietnam

37 hectares of commercial and residential development with

healthcare theme

Expected GDV: US$670 million

Effective Ownership: 67.2%

Project NAV as at 30/9/2014: IHTHP: US$15.60 million; CIH:

US$9.77 million

Project RNAV as at 30/9/2014: IHTHP: US$34.77 million(3) ; CIH:

US$11.07 million(3)

Status:

- Phase 1: CIH is managed by Parkway Pantai Limited

- Construction of CIH completed in March 2013 and business

commenced in September 2013 with limited services; official opening

in January 2014

- Planned partial divestment of CIH in short term and full divestment in year 2016

- Other parcels of land to be developed or sold on as-is basis

Equity Investment in Nam Long Investment Corporation, Ho Chi

Minh City, Vietnam

Listed equity investment

Effective Ownership: 12.9%

Project NAV as at 30/9/2014: US$13.22 million (4)

Project RNAV as at 30/9/2014: US$13.22 million (4)

Status:

- Listed on Ho Chi Minh Stock Exchange on 8 April 2013

- Share price as at 17 November 2014: VND17,900 per share

Waterside Estates, District 9, Ho Chi Minh City, Vietnam

37 villas and 460 units within high-rise apartments

Expected GDV: US$100 million

Effective Ownership: 55%

Project NAV as at 30/9/2014: US$8.75 million

Project RNAV as at 30/9/2014: US$8.75 million (1)

Status:

- Development plan approved

- Assessing divestment and/or development options

Notes:

1. Projects carried at cost

2. Market value based on the valuation prepared on discounted

cash flows by international independent valuers as at 30 June 2014,

which excludes any taxes; whether corporate, personal, real

property or otherwise, that are payable. These market values are

further adjusted for assumed taxes by the Manager

3. Market values based on residual/comparison/investment method

of land/property value by international independent valuers

4. Fair value determined with reference to closing market price as at 30 September 2014

5. All NAV and RNAV data are unaudited

Exchange rate - 30 September 2014: US$1:3.2808; US$1:VND21,220;

30 June 2014: US$1:RM3.2113; US$1:VND21,315 (Source: Bank Negara

Malaysia, State Bank of Vietnam)

Valuation Methodology

The Realisable Net Asset Value of the Company as at 30 September

2014 has been computed by the Company based on the Company's

management accounts for the period ended 30 September 2014 and the

Market Values of the property portfolio as at 30 June 2014. The

Market Value of the property portfolio is determined on a

discounted cash flow basis, comparison method, residual method or

investment method on land or properties values by an independent

firm of valuers. The Market Values, excluded any taxes; whether

corporate, personal, real property or otherwise, that are

payable.

The valuations by independent firm of valuers have been

performed in accordance with the International Valuation Standards

("IVS") or in accordance with the Royal Institution of Chartered

Surveyor Guidelines ("RICS").

In arriving at the Realisable Net Asset Value of the Company,

the Company has made assumptions on potential taxes deductible from

Market Values, where applicable. These may include corporate income

tax, real property gains tax or any transactional taxes, where

applicable.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSFFLFMWFLSELF

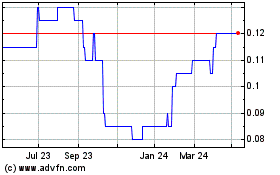

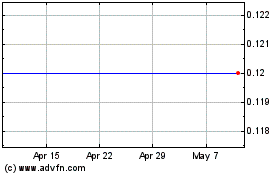

Aseana Properties (LSE:ASPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aseana Properties (LSE:ASPL)

Historical Stock Chart

From Apr 2023 to Apr 2024