TIDMASPL

RNS Number : 0601Q

Aseana Properties Limited

27 August 2014

27 August 2014

Aseana Properties Limited

("Aseana" or the "Company")

Half-Year Results for the Six Months Ended 30 June 2014

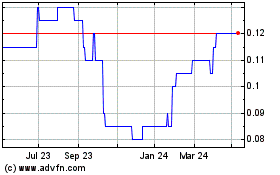

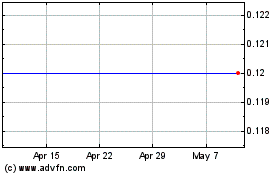

Aseana Properties Limited (LSE: ASPL), a property developer

investing in Malaysia and Vietnam, listed on the Main Market of the

London Stock Exchange, announces its half-year results for the

six-month period ended 30 June 2014.

Operational highlights:

-- SENI Mont' Kiara won the World Silver Award at The

International Real Estate Federation ("FIABCI") World Prix

d'Excellence Awards 2014 in the residential (High Rise) category.

Sale of properties at SENI Mont' Kiara is progressing well

achieving 91% sales to date, compared to 88% recorded in April

2014. A further 6% is reserved with deposit paid.

-- The RuMa Hotel and Residences ("The RuMa") achieved 43% sales

based on sales and purchase agreement signed, with a further 8%

reserved with deposit paid.

-- The Aloft Kuala Lumpur Sentral Hotel's ("Aloft") average

occupancy rate stood at 68% for the six-month period ended 30 June

2014, while Four Points by Sheraton Sandakan Hotel's ("FPSS") was

at 42%.

-- Aseana entered into a share sale agreement with Malaysian

Resources Corporation Berhad ("MRCB") to dispose of its 40% stake

in Excellent Bonanza Sdn. Bhd. ("EBSB") for a cash consideration of

RM20.0 million (US$6.2 million). EBSB is the developer of the Kuala

Lumpur Sentral Office Towers and Hotel project ("KL Sentral

Project"). The transaction was completed on 19 August 2014.

-- A plot of land measuring 4.7 hectares (11 acres) at the

International Hi-Tech Healthcare Park ("IHTHP") was sold and

development rights transferred to AEON Vietnam Co. Ltd. ("AEON

Vietnam"). The transaction was completed on 1 August 2014.

Financial highlights:

-- Unaudited revenue of US$31.49 million for the six-month

period ended 30 June 2014 (30 June 2013 (unaudited): US$10.22

million)

-- Unaudited loss before tax for the six-month period ended 30

June 2014 of US$4.76 million (30 June 2013 (unaudited): loss of

US$13.73 million)

-- Unaudited loss after tax for the six-month period ended 30

June 2014 of US$7.66 million (30 June 2013 (unaudited): loss of

US$14.44 million)

-- Unaudited consolidated comprehensive loss of US$6.66 million

for the six months period ended 30 June 2014 (30 June 2013

(unaudited): loss of US$13.57 million)

-- Unaudited net asset value of US$154.63 million at 30 June

2014 (31 December 2013 (audited): US$158.57 million) or US$0.729

per share* (31 December 2013 (audited): US$0.748 per share)

-- Unaudited realisable net asset value of US$270.82 million at

30 June 2014 (31 December 2013 (unaudited): US$266.04 million) or

US$1.277 per share* (31 December 2013 (unaudited): US$1.255 per

share)

* NAV per share and RNAV per share as at 30 June 2014 are

calculated based on 212,025,000 voting shares (31 December 2013:

212,025,000 voting shares).

Commenting on the results, Mohammed Azlan Hashim, Chairman of

Aseana, said:

"We are pleased that the results for the first half of 2014 have

improved significantly compared to the corresponding period in

2013, despite challenges in the property markets in both Malaysia

and Vietnam. The Group will continue to pursue an opportunistic yet

cautious approach in managing and realising cash flows from its

projects. As we move into the second half of 2014, the Group will

continue to focus on improving the operation and performance of its

key operating assets."

The Group has also published its Quarterly Investment Update

(including updates on projects and RNAV figures) for the period to

30 June 2014, which can be obtained on its website at

www.aseanaproperties.com/quarterly.htm.

For further information:

Aseana Properties Limited Tel: 603 6411 6388

Chan Chee Kian Email: cheekian.chan@ireka.com.my

N+1 Singer Tel: 020 7496 3000

James Maxwell (Corporate Finance) Email: james.maxwell@n1singer.com

/Sam Greatrex (Sales) /sam.greatrex@n1singer.com

Tavistock Communications Tel: 020 7920 3150

Jeremy Carey / Faye Walters Email: jcarey@tavistock.co.uk

Notes to Editors:

London-listed Aseana Properties Limited (LSE: ASPL) is a

property developer investing in Malaysia and Vietnam.

Ireka Development Management Sdn Bhd ("IDM") is the exclusive

Development Manager for Aseana. It is a wholly-owned subsidiary of

Ireka Corporation Berhad, a company listed on the Bursa Malaysia

since 1993, which has over 45 years' experience in construction and

property development. IDM is responsible for the day-to-day

management of Aseana's property portfolio and the introduction and

facilitation of new investment opportunities.

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report on the half-year results for Aseana

Properties Limited ("Aseana") and its group of companies ("the

Group") for the six months ended 30 June 2014.

In the year to date, the global economy has shown signs of

recovery though political unrest in Ukraine and the Middle East

pose notable challenges. Investment remains subdued amid the uneven

economic growth in the United States of America and Europe. China's

growth has also been curtailed amid by its government's reform

policies. Closer to home, the Malaysian economy has proven

resilient despite these global economic headwinds. Over the medium

term, however, there are important long-standing structural issues

such as the high levels of household debt which increased to 86.8%

of its Gross Domestic Product ("GDP") as at the end of 2013, among

the highest in Asia. The Central Bank of Malaysia recently

announced a hike in Overnight Policy Rate ("OPR") by 25 basis

points to 3.25%, the first rise in three years, to mitigate the

risk of broader economic and financial imbalances that could

undermine the growth prospects of the Malaysian economy.

The Vietnamese economy has resumed its path of gradual recovery

in the first half of 2014. GDP expanded 5.18% during the first six

month of the year and the Central Bank of Vietnam has recently

devalued the Vietnamese Dong by 1% to boost exports following the

domestic disturbances back in May triggered by the territorial

dispute with China. Vietnam's total Foreign Direct Investment

("FDI") disbursement reached US$5.75 billion in the first half of

2014, an increase of 0.9% y-o-y.

Results

For the six months ended 30 June 2014, Aseana and its group of

companies (the "Group") recorded unaudited revenue of US$31.49

million (H1 2013 (unaudited): US$10.22 million), which was mainly

attributable to the sale of completed units in SENI Mont' Kiara and

Tiffani. No revenue was recognised for The RuMa, in accordance with

IFRIC 15 - Agreements for Construction of Real Estate which

prescribes that revenue be recognised only when the properties are

completed and occupancy permits are issued.

The Group recorded an unaudited loss before tax for the period

of US$4.76 million (H1 2013 (unaudited): loss of US$13.73 million),

predominantly due to operating losses and financing costs of Four

Points by Sheraton Sandakan Hotel and Harbour Mall Sandakan

totaling US$2.74 million, together with an operating loss and

financing cost of City International Hospital of US$4.91

million.

The Group's unaudited loss after tax for the six-months ended 30

June 2014 stood at US$7.66 million (30 June 2013 (unaudited): loss

of US$14.44 million). Other comprehensive income include a foreign

currency translation gain of US$0.98 million (30 June 2013

(unaudited): loss of US$3.50 million) which was attributable to the

strengthening of the Ringgit against the US dollars. This resulted

in an unaudited consolidated comprehensive loss for the period of

US$6.66 million (30 June 2013 (unaudited): loss of US$13.57

million).

Unaudited net asset value for the Group for the period under

review decreased to US$154.63 million (31 December 2013 (audited):

US$158.57 million) or US$0.729 per share (31 December 2013:

US$0.748 per share) due to losses incurred for the period. However,

unaudited realisable net asset value improved to US$270.82 million

as at 30 June 2014 (31 December 2013 (unaudited): US$266.04

million) or US$1.277 per share (31 December 2013 (unaudited):

US$1.255 per share) mainly due to the improved market values of

IHTHP lands based on the latest market valuation exercise.

Review of Activities and Property Portfolio

Sales status (based on Sales and Purchase agreements

signed):

Projects % sales as

% sales as at

at December

31 July 2014 2013

-------------------------------- -------------- -----------

Tiffani by i-ZEN 99% 98%

SENI Mont' Kiara

* Proceeds received 87% 80%

* Pending completion 4% 4%

The RuMa Hotel and Residences 43% 38%

-------------------------------- -------------- -----------

Malaysia

SENI Mont' Kiara won the prestigious Silver prize in the FIABCI

(World Chapter) Prix D' Excellence Award 2014 for the High Rise

Residential Category, in May 2014. In line with this achievement,

sales recorded for SENI Mont' Kiara increased to 91%, compared to

88% previously. A further 6% is reserved with deposit paid.

The recent cooling measures imposed by the Malaysian Government

have affected the sales performance at The RuMa Hotel and

Residences. Sale of units at The RuMa inched up marginally to 43%

based on sales and purchase agreements signed, with a further 8%

being reserved with deposit paid. The Manager has planned numerous

sales events and initiatives over the next few months and will

continue to explore all opportunities to drive sales. Meanwhile,

construction of the main building is in progress and completion is

targeted for 2017.

The 482-room Aloft Kuala Lumpur Sentral Hotel ("Aloft"), managed

and operated by Starwood Asia Pacific Hotels Resort Pte. Ltd, has

achieved an average occupancy rate of 68% for the six-months ended

30 June 2014.

Aseana has entered into a share sale agreement with Malaysian

Resources Corporation Berhad ("MRCB") to dispose of its 40% stake

in Excellent Bonanza Sdn. Bhd. ("EBSB") for a cash consideration of

RM20 million (US$6.21 million). The transaction was completed on 19

August 2014. Aseana is expected to record a gain of approximately

RM16.4 million (US$5.1 million) from the disposal of 40% stake in

EBSB. EBSB, a joint venture company between MRCB and Aseana, is the

developer of the Kuala Lumpur Sentral Office Towers and Hotel

project. The disposal represents an early exit and realisation of

profits from the project which was originally planned for December

2015.

Sabah's tourism continues to be adversely impacted by the

disappearance of flight MH370 in March 2014 and also the recent

flight MH17 tragedy, along with the several kidnapping cases of

both tourists and locals, off the east coast of Sabah, over the

last few months. In Sandakan, the business environment remains

uncertain. Travel advisory notices were issued for the coastal

areas of eastern Sabah by countries such as the United States of

America, United Kingdom, Canada, Australia and New Zealand. The

Malaysian Government has imposed night time curfews along the

coastline of eastern Sabah as a new security measure. Average

occupancy rate at the Four Points by Sheraton Sandakan Hotel

("FPSS") stood at 42% for the six-months ended 30 June 2014. The

Management of FPSS continues to look at ways to improve efficiency

of the hotel operation and to work with relevant authorities to

increase tourist arrivals to Sandakan. The Harbour Mall Sandakan is

similarly affected and tenancy rate has remained at 47.0% as at

July 2014.

Moving forward, Aseana will focus on the operation and

performance of its key operating assets. The Company will also

continue its efforts to dispose of the remaining units at SENI

Mont' Kiara and Tiffani as well as to drive new sales for The

RuMa.

Vietnam

As at 3 August 2014, The City International Hospital ("CIH")

registered inpatient days of 1,459 days with average revenue per

inpatient admission of US$2,014. Outpatient visits as at 3 August

2014 stood at 5,144 visits with average revenue per visit of US$82.

Whilst the average revenues per patient are within the expected

range, the volume of patients has fallen short of expectations. The

Manager is working closely with the operator of CIH to improve

performance through targeted sales and marketing campaign, and

introduction of new service lines offered by CIH.

Aseana, through its 67%-owned subsidiary, Hoa Lam Shangri-La 3

Limited Liability Company ("HLSL3"), has entered into an agreement

with AEON Vietnam Co., Ltd. ("AEON Vietnam") to develop a retail

mall at the International Hi-Tech Healthcare Park ("IHTHP"). AEON

Vietnam is a subsidiary of AEON Co., Ltd. based in Japan, one of

the world's largest retailing groups with over 18,000 stores across

Japan and Asia. The transaction involves the disposal of a 4.7

hectares (11 acres) plot of land at IHTHP and also the transfer of

the development rights to AEON Vietnam. AEON Vietnam has on 21 June

2014, been awarded the Investment Certificate for the development,

and on 1 August 2014 successfully transferred the development

rights to AEON Vietnam. HLSL 3 will receive a net cash

consideration of approximately US$23 million from the transaction.

To date, 95% of the consideration has been received and the

remaining 5% will be disbursed by AEON Vietnam upon completion of

certain road infrastructure for the plot of land, expected in Q4

2014. From the cash proceeds received by HLSL3, US$14.6 million was

used to repay bank borrowings of IHTHP, with the remaining proceeds

being used for payment of infrastructure costs for the land,

Corporate Income Tax and working capital of the project.

The Vietnam Stock Index ("VN Index") has recovered following a

gradual decline between the end of March 2014 and the beginning of

August 2014, reflecting a more positive economic outlook for

Vietnam. At the date of this publication, Nam Long shares closed at

VND18,600 per share, improving from VND17,400 per share as at 30

June 2014.

MOHAMMED AZLAN HASHIM

Chairman

26 August 2014

DEVELOPMENT MANAGER'S REVIEW

Malaysia Economic Update

The Malaysian economy recorded a strong growth of 6.4% in the

first half of 2014, underpinned mainly by a surge in exports and

aided by low base effect. However, there are indications that

growth will taper moving into the second half of 2014. This

reflects the impact of the fiscal and monetary policy adjustments

by the Government such as the on-going subsidy rationalisation and

the upcoming Goods and Services Tax ("GST"). Although these

measures by the Government will undeniably dampen the domestic

demand especially consumer spending and Government expenditures,

GDP growth is expected to remain resilient. Malaysia continues to

build on its competitive position in electronics, automotive and

machinery manufacturing industries to move up the value chain into

high-technology and skill-intensive segments. AT Kearney has ranked

Malaysia 15(th) in its list of 2014 Foreign Direct Investment

Confidence Index, compared to being in the 25(th) position in

previous year.

Fitch Ratings has also reaffirmed Malaysia's sovereign ratings

at "A-" accompanied by cautious commentary on the credit weakness

in public finances relative to other "A" range peers. This remains

a source of downward pressure on the ratings for Malaysia. There

are concerns over the Malaysian Government's lack of progress on

structural budgetary reform and with the rising interest rates

which could impair household debt servicing capacity, the outlook

for Malaysia's long term default rating remains at "negative".

In July 2014, the central bank of Malaysia raised the overnight

policy rate ("OPR") by 25 basis points to 3.25%, the first increase

in three years, with the expectations that Malaysia's overall

economic growth momentum will be sustained. Amid the high and

rising household debt to GDP ratio, this increase will add to

consumers' costs of living and also reduce purchasing powers.

Prior to the announcement of the OPR hike, the Ringgit had hit

an eight-month high against the US dollar, reflecting renewed

investor confidence in the currency and making it the second

best-performing currency among the other Asean countries such as

Thailand, Indonesia, Singapore and Philippines.

The Consumer Sentiment Index and the Business Conditions Index

issued by the Malaysian Institute of Economic Research ("MIER") for

the second quarter of 2014 continue to move in tandem for four

consecutive quarters, reflecting synchronisation in both consumer

and business sentiments. The Consumer Sentiment Index rose 3.3

points to pass the 100-point benchmark to settle at 100.1 points

(Q1 2014: 96.8 points). This indicates neutral consumer sentiment

towards the outlook for employment. The Business Conditions Index

rose to 113.0 points (Q1 2014: 103.1 points) contributed by

increased sales in the manufacturing sector, strong domestic and

export orders and higher investment in new plant and equipment.

Overview of Property Market in Klang Valley, Malaysia

Offices

* 1 new office building was completed in Q2 2014,

increasing the total supply of office space in the

Klang Valley to 106.1 million sq.ft. Overall

occupancy increased to 81% (Q1 2014: 80%).

* Market rentals and prices remained stable, while

rental yield remained between 6% and 8%.

* En-bloc transaction during the quarter: (i) Platinum

Sentral (Prime A 5 blocks of 4 to 7 stories) located

in Kuala Lumpur Sentral was sold at RM1,576 psf (US$

482 psf).

* Occupancy rates are expected to remain around 80% as

some developers are likely to defer their project

completion dates. A total of 2.57 million sq.ft. is

scheduled to be completed by end 2014.

Retail

* Market prices and market rentals for retail centres

in Klang Valley were generally stable.

* Retail transactions in Q2 2014: (i) Pandan Safari

Lagoon (63 units of retail lots, 2 level of car parks

and roof top of the retail centre) were acquired by

CHN Commodity Trade Centre Sdn Bhd for RM147 psf

(US$45 psf) or total purchase consideration of RM50

million (US$15.31 million).

* Average occupancy rate in Klang Valley remained

stable at 84% in Q2 2014.

Residential

* 27 projects with 7,381 units condominium in Klang

Valley were completed in Q2 2014.

* 26 projects with 9,294 units were launched in Q2

2014.

* Market prices and market rental rates remained stable

in Q2 2014.

* Selected new launches: (i) Expressionz Professional

Suites - Blocks A&B (447 units), launched in Mar 2014

with an average price of RM1,300 psf (US$398 psf)

achieved 70% take-up rate; (ii) Residensi 22 Mont

Kiara - Block B (270 units), launched in April 2014

with an average price of RM850 psf (US$260 psf) is

50% sold.

Hospitality

* In Q2 2014, average daily room rate for International

class hotels in the Klang Valley (within Kuala Lumpur

City) and Business class hotels increased y-o-y by

7.1% and 2.5% respectively.

* Average occupancy rates for International class

hotels in Klang Valley increased to 73.3% as at April

2014, whilst average occupancy rates for Business

class hotels increased to 66.0% compared to the same

period in 2013.

* 9.3 million tourists visited Malaysia in first 4

months of 2014, an increase of 9.9% compared to Q2

2013.

* Tourism into Sabah has been adversely affected by

recent kidnapping cases and the loss of Flights MH370

and MH17.

-------------------------------------------------------------

Source: Bank Negara Malaysia website, Jones Lang Wootton Q2

report, MIER, various publications

Exchange rate - 30 June 2014: US$1:RM3.2113

Vietnam Economic Update

The Vietnamese economy picked up in the first half of 2014, with

growth of 5.2% following interest rate cuts by the central bank

alongside rising foreign investment and strong exports growth. The

World Bank forecasted Vietnam's 2014 GDP growth to be at 5.4% while

Vietnam's National Financial Supervisory Committee ("NFSC") expects

stronger growth of 5.7% to 5.8%. The central bank of Vietnam has

also devalued the Vietnamese dong by 1% to help boost exports

following the unrest in May triggered by the anti-Chinese protests

and also to create stability for the foreign exchange market.

On the back of continued macro-economic stability, Standard

& Poor ("S&P"), a global ratings firm has retained its BB

long term and B short term sovereign credit ratings on the country.

Furthermore, Moody's Investors Service upgraded Vietnam's credit

rating by raising the Government bond ratings from B2 to B1 with a

stable outlook and also raised the long term foreign currency bond

ceiling from B1 to Ba2 as well as its long term foreign currency

deposit ceiling from B3 to B2.

Vietnam's June 2014 CPI grew at the slowest pace in 13 years,

with a growth of 1.38% as compared to December 2013 and edged up by

4.98% compared to the same period last year, indicating subdued

consumer sentiments.

Foreign investment plays an important role in bolstering the

growth of many sectors. According to the Ministry of Planning and

Investment of Vietnam, statistics showed that the country attracted

US$6.85 billion in foreign direct investment ("FDI") in the first

half of 2014, including newly registered funds and extra capital

from operational projects. The total amount of FDI for the property

sector reached US$692.3 million, a 65% increase year on year. This

shows that Vietnam's property sector is once again attractive to

foreign investors. With the implementation of the new Land Law with

effect from 1 July 2014, foreign real estate investors are now

allowed to be allocated lands for the purpose of construction of

residential housing projects for sale or lease by the Government of

Vietnam. Previously, investors were only able to lease those lands

from the Government.

Although foreign tourist arrivals to Vietnam in the first six

months of the year increased by 21.2% to over 4.3 million,

political and safety concerns will remain issues for tourism in the

second half of 2014, especially for the hotels and resorts industry

following the East Sea tension between China and Vietnam in

May.

Overview of Property Market in Vietnam

Offices

* 1 Grade B and 2 Grade C office buildings entered the

market increasing the total supply to 1.43mil sqm by

2% q-o-q and 6% y-o-y.

* Overall occupancy rate decreased by 1% q-o-q but up

by 2% y-o-y to 89%. The decrease is due to soft

performance in Grade B office buildings.

* Average rental rates decreased by 1% q-o-q but up by

3% y-o-y, mainly due to decrease in Grade B and Grade

C office buildings average rent.

* Total office take-up decreased by 56% q-o-q and 46%

y-o-y, lowest compared to the 3 preceding years.

Grade C office buildings which accounted for 76% of

total take-up remained a preferred choice by tenants.

Retail

* Retail stock increased by 2.1% q-o-q and 11.7% y-o-y

contributed by the entrance of a shopping centre

(Saigon Mall, Go Vap District), 2 retail podiums

(Saigon Airport Plaza, Tan Binh District and Sunrise

City - Phase 1, District 7).

* Average rent in Q2 2014 stood at US$60 psm per month,

a decline of 1% q-o-q while average occupancy stood

at 87% with an increase of 2.1% q-o-q.

* HCMC's retail sales for the first 6 months of 2014

was estimated at US$14.8 billion, increased by 7.7%

y-o-y without inflation. However, the growth rate

remained low compared to 2013 (8.1%) and 2012 (8.9%).

Residential

* 11 new apartment projects and new phases of 8

existing apartment projects were launched in Q2 2014.

Total stock decreased by 2.6% q-o-q and 0.4% y-o-y as

several projects were put on hold.

* Overall apartments' absorption rate was at 17%, an

increase of 7% q-o-q and 9% y-o-y.

* 1 new townhouse project (38 units), 1 new phase of an

existing townhouse project (100 units) and 1 villa

project (48 units), were launched in Q2 2014,

increasing the supply of villa/townhouse by 6% q-o-q

and 9% y-o-y. 3 new projects with 335 land plots

launched in Q2 2014 increased land plot supply by

144% y-o-y but reduced by 11% q-o-q.

* Villa/townhouse market's absorption rate increased by

36% q-o-q while the absorption rate for land plot

increased by 25% q-o-q.

Hospitality

* 1 new 3-star hotel (85 rooms) entered the market, 1

3-star hotel reopened (86 rooms) while 1 3-star hotel

(61 rooms) was closed for renovation during Q2 2014,

increasing the stock by 1% q-o-q and 8% y-o-y.

* Average occupancy rate stood at 61%, a decline of 13%

q-o-q and 1% y-o-y, while average room rate decreased

by 9% q-o-q and 4% y-o-y to US$81 per room per night.

The decline in average room rate is seasonal and

reflects the tourism low season.

* 2 new serviced apartments (32 units) and 1 existing

project (9 units) entered the market in Q2 2014.

Average occupancy rate remained stable at 82%, an

increase of 3% y-o-y.

-------------------------------------------------------------

Source: General Statistics Office of Vietnam, Savills, CBRE,

various publications

Exchange rate - 30 June 2014: US$1:VND21,315

LAI VOON HON

President / Chief Executive Officer

Ireka Development Management Sdn. Bhd.

Development Manager

26 August 2014

PROPERTY PORTFOLIO AS AT 30 JUNE 2014

Project Type Effective Approx.

Ownership Gross

Floor Approx.

Area Land Area Actual/Scheduled

(sq m) (sq m) completion

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Completed projects

---------------------------------------------------------------------------------------------------------------------

Tiffani by i-ZEN Completed August

Kuala Lumpur, Malaysia Luxury condominiums 100.0% 81,000 15,000 2009

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Office suites,

office tower

1 Mont' Kiara by i-ZEN and retail Completed in November

Kuala Lumpur, Malaysia mall 100.0% 96,000 14,000 2010

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Phase 1: Completed

April 2011

SENI Mont' Kiara Phase 2: Completed

Kuala Lumpur, Malaysia Luxury condominiums 100.0% 225,000 36,000 October 2011

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Retail lots Completed

2009

Retail mall: Completed

Retail lots, March 2012

Sandakan Harbour Square hotel and retail Hotel: Completed

Sandakan, Sabah, Malaysia mall 100.0% 126,000 48,000 May 2012

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Kuala Lumpur Sentral Office towers Office Towers: Completed

Office Towers & Hotel and a business December 2012

Kuala Lumpur, Malaysia hotel 40.0% 107,000 8,000 Hotel: January 2013

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Aloft Kuala Lumpur Business-class

Sentral hotel hotel (a Starwood Completed in January

Kuala Lumpur, Malaysia Hotel) 100.0% 28,000 5,000 2013

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Phase 1: City International

Hospital, International

Hi-tech Healthcare

Park,

Ho Chi Minh City, Private general Completed in March

Vietnam hospital 67.2% 48,000 25,000 2013

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Projects under development

---------------------------------------------------------------------------------------------------------------------

The RuMa Hotel and Luxury residential

Residences Kuala Lumpur, tower and boutique First quarter of

Malaysia hotel 70.0% 40,000 4,000 2017

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Listed equity investment

---------------------------------------------------------------------------------------------------------------------

Listed equity investment Listed equity 12.9% n/a n/a n/a

in Nam Long Investment investment

Corporation,

an established developer

in Ho Chi Minh City,

Vietnam

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Pipeline projects

---------------------------------------------------------------------------------------------------------------------

Waterside Estates,

Ho Chi Minh City, Villas and

Vietnam high-rise apartments 55.0% 94,000 57,000 n/a

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Other developments Commercial

in International Hi-tech and residential

Healthcare Park, development

Ho Chi Minh City, with healthcare

Vietnam theme 67.2% 972,000 351,000 n/a

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

Kota Kinabalu seafront (i) Boutique 100.0% n/a 327,000 n/a

resort & residences resort hotel

resort villas

Kota Kinabalu, Sabah, (ii) Resort 80.0%

Malaysia homes

----------------------------- ----------------------- ----------- -------- ----------- -------------------------

*Shareholding as at 31 December 2013

n/a: Not available / not applicable

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

SIX MONTHS ENDED 30 JUNE 2014

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Continuing activities Notes US$'000 US$'000 US$'000

---------------------------------------------- ------ ----------- -------------------- ----------------------

Revenue 31,494 10,222 29,269

Cost of sales 5 (24,953) (8,379) (22,768)

---------------------------------------------- ------ ----------- -------------------- ----------------------

Gross profit 6,541 1,843 6,501

Other income 13,349 4,573 16,122

Administrative expenses (366) (872) (1,622)

Foreign exchange loss 6 (9) (443) (1,105)

Management fees (1,653) (1,821) (3,762)

Marketing expenses (591) (1,328) (1,953)

Other operating expenses (16,265) (8,978) (23,635)

---------------------------------------------- ------ ----------- -------------------- ----------------------

Operating profit/(loss) 1,006 (7,026) (9,454)

----------- -------------------- ----------------------

Finance income 227 208 424

Finance costs (5,760) (3,884) (9,766)

----------- -------------------- ----------------------

Net finance costs (5,533) (3,676) (9,342)

Share of loss of associate, net

of tax (229) (3,029) -

---------------------------------------------- ------ ----------- -------------------- ----------------------

Net loss before taxation (4,756) (13,731) (18,796)

Taxation 7 (2,906) (705) (2,854)

---------------------------------------------- ------ ----------- -------------------- ----------------------

Loss for the period/year (7,662) (14,436) (21,650)

---------------------------------------------- ------ ----------- -------------------- ----------------------

Other comprehensive income/(expense),

net of tax

Items that are or may be reclassified

subsequently to profit or loss

Foreign currency translation

differences for foreign operations 977 (3,498) (6,220)

Increase in fair value of available-for-sale

investments 26 4,361 126

---------------------------------------------- ------ ----------- -------------------- ----------------------

Total other comprehensive

income/(expense) for the

period/year 1,003 863 (6,094)

---------------------------------------------- ------ ----------- -------------------- ----------------------

Total comprehensive

loss for the

period/year (6,659) (13,573) (27,744)

---------------------------------------------- ------------------- -------------------- ----------------------

Loss attributable to:

Equity holders of the parent (5,198) (13,776) (19,006)

Non-controlling interests (2,464) (660) (2,644)

---------------------------------------------- ------------------- -------------------- ----------------------

Total (7,662) (14,436) (21,650)

---------------------------------------------- ------------------- -------------------- ----------------------

Total comprehensive

loss attributable to:

Equity holders of the parent (3,939) (12,661) (24,971)

Non-controlling interests (2,720) (912) (2,773)

---------------------------------------------- ------ ----------- -------------------- ----------------------

Total (6,659) (13,573) (27,744)

---------------------------------------------- ------ ----------- -------------------- ----------------------

Loss per share

Basic and diluted (US cents) 8 (2.45) (6.50) (8.96)

---------------------------------------------- ------ ----------- -------------------- ----------------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2014

Unaudited Unaudited Audited

-------------------------------- ------

As at As at As at

30 June 30 June 31 December

--------------------------------

2014 2013 2013

Notes US$'000 US$'000 US$'000

-------------------------------- ------ ------------------- ---------------------- -------------------

Non-current assets

Property, plant and equipment 1,091 1,126 1,146

Investment in an associate 2,023 - 2,252

Available-for-sale investments 12,723 16,932 12,697

Intangible assets 13,208 13,738 13,525

Deferred tax assets 682 - 595

-------------------------------- ------ ------------------- ---------------------- -------------------

Total non-current assets 29,727 31,796 30,215

-------------------------------- ------ ------------------- ---------------------- -------------------

Current assets

Inventories 416,597 426,284 428,609

Held-for-trading financial

instrument 388 383 375

Trade and other receivables 14,651 10,747 9,912

Amount due from an associate 943 - 853

Current tax assets 127 251 233

Cash and cash equivalents 26,911 19,745 24,585

-------------------------------- ------ ------------------- ---------------------- -------------------

Total current assets 459,617 457,410 464,567

-------------------------------- ------ ------------------- ---------------------- -------------------

TOTAL ASSETS 489,344 489,206 494,782

-------------------------------- ------ ------------------- ---------------------- -------------------

Equity

Share capital 10,601 10,626 10,601

Share premium 218,926 218,926 218,926

Capital redemption reserve 1,899 1,874 1,899

Translation reserve (1,872) (260) (3,105)

Fair value reserve 152 4,361 126

Accumulated losses (75,074) (64,604) (69,876)

-------------------------------- ------ ------------------- ---------------------- -------------------

Shareholders' equity 154,632 170,923 158,571

Non-controlling interests 9,271 12,321 11,429

-------------------------------- ------ ------------------- ---------------------- -------------------

Total equity 163,903 183,244 170,000

-------------------------------- ------ ------------------- ---------------------- -------------------

Non-current liabilities

Amount due to non-controlling

interests 1,085 - 1,440

Loans and borrowings 9 68,972 51,094 49,309

Medium term notes 10 143,333 159,312 140,877

-------------------------------- ------ ------------------- ---------------------- -------------------

Total non-current liabilities 213,390 210,406 191,626

-------------------------------- ------ ------------------- ---------------------- -------------------

Current liabilities

Trade and other payables 79,474 56,527 83,640

Amount due to an associate - 557 -

Amount due to non-controlling

interests 9,587 10,177 9,008

Loans and borrowings 9 6,934 26,677 25,466

Medium term notes 10 14,013 - 13,739

Current tax liabilities 2,043 1,618 1,303

-------------------------------- ------ ------------------- ---------------------- -------------------

Total current liabilities 112,051 95,556 133,156

-------------------------------- ------ ------------------- ---------------------- -------------------

Total liabilities 325,441 305,962 324,782

-------------------------------- ------ ------------------- ---------------------- -------------------

TOTAL EQUITY AND LIABILITIES 489,344 489,206 494,782

-------------------------------- ------ ------------------- ---------------------- -------------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD ENDED 30 JUNE 2014 - UNAUDITED

Total Equity

Attributable

Capital Fair to Equity Non-

Share Share Redemption Translation Value Accumulated Holders of Controlling Total

Capital Premium Reserve Reserve Reserve Losses the Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- --------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

At 1 January

2014 10,601 218,926 1,899 (3,105) 126 (69,876) 158,571 11,429 170,000

Non-controlling

interests

contribution - - - - - - - 562 562

Loss for the

period - - - - - (5,198) (5,198) (2,464) (7,662)

Total other

comprehensive

income - - - 1,233 26 - 1,259 (256) 1,003

--------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

Total

comprehensive

loss - - - 1,233 26 (5,198) (3,939) (2,720) (6,659)

----------------- --------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

Shareholders'

equity at

30 June 2014 10,601 218,926 1,899 (1,872) 152 (75,074) 154,632 9,271 163,903

================= ========= ========= ============ ============ ========= ============ ============= ============= =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD ENDED 30 JUNE 2013 - UNAUDITED

Total Equity

Attributable

Capital Fair to Equity Non-

Share Share Redemption Translation Value Accumulated Holders of Controlling Total

Capital Premium Reserve Reserve Reserve Losses the Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- --------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

At 1 January

2013 10,626 218,926 1,874 2,986 - (50,828) 183,584 13,063 196,647

Non-controlling

interests

contribution - - - - - - - 170 170

Loss for the

period - - - - - (13,776) (13,776) (660) (14,436)

Total other

comprehensive

income - - - (3,246) 4,361 - 1,115 (252) 863

--------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

Total

comprehensive

loss - - - (3,246) 4,361 (13,776) (12,661) (912) (13,573)

----------------- --------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

Shareholders'

equity at

30 June 2013 10,626 218,926 1,874 (260) 4,361 (64,604) 170,923 12,321 183,244

================= ========= ========= ============ ============ ========= ============ ============= ============= =========

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2013 - AUDITED

Total

Equity

Attributable

to Equity

Capital Fair Holders Non-

Share Share Redemption Translation Value Accumulated of the Controlling Total

Capital Premium Reserve Reserve Reserve Losses Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- --------- ---------- ------------ ------------- -------- ------------- ------------- ------------- -----------

1 January

2013 10,626 218,926 1,874 2,986 - (50,828) 183,584 13,063 196,647

Changes

in ownership

interests

in subsidiaries - - - - - (42) (42) 42 -

Non-controlling

interests

contribution - - - - - - - 1,097 1,097

--------- ---------- ------------ ------------- -------- ------------- ------------- ------------- -----------

Loss of

the year - - - - - (19,006) (19,006) (2,644) (21,650)

Total other

comprehensive

expense - - - (6,091) 126 - (5,965) (129) (6,094)

--------- ---------- ------------ ------------- -------- ------------- ------------- ------------- -----------

Total

comprehensive

loss - - - (6,091) 126 (19,006) (24,971) (2,773) (27,744)

Cancellation

of shares (25) - 25 - - - - - -

----------------- --------- ---------- ------------ ------------- -------- ------------- ------------- ------------- -----------

Shareholders'

equity at

31 December

2013 10,601 218,926 1,899 (3,105) 126 (69,876) 158,571 11,429 170,000

================= ========= ========== ============ ============= ======== ============= ============= ============= ===========

CONSOLIDATED STATEMENT OF CASH FLOWS

SIX MONTHS ENDED 30 JUNE 2014

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

US$'000 US$'000 US$'000

--------------------------------------------- ------------ ------------ --------------------

Cash Flows from Operating Activities

Net loss before taxation (4,756) (13,731) (18,796)

Finance income (227) (208) (424)

Finance costs 5,760 3,884 9,766

Share of losses of associates, net

of tax 229 3,029 -

Unrealised foreign exchange loss 1 378 1,065

Impairment of goodwill 317 107 320

Depreciation of property, plant

and equipment 59 61 114

Property, plant and equipment written

off - - 7

Fair value (gain)/ loss on held-for-trading

financial instrument (1) 5 5

--------------------------------------------- ------------ ------------ --------------------

Operating profit/ (loss) before

working capital changes 1,382 (6,475) (7,943)

Changes in working capital:

Decrease/ (increase) in inventories 16,711 (85,533) (96,690)

(Increase)/ decrease in receivables (4,597) 1,978 2,063

(Decrease)/ increase in payables (5,497) 2,498 28,884

--------------------------------------------- ------------ ------------ --------------------

Cash generated from/ (used in) operations 7,999 (87,532) (73,686)

Interest paid (5,760) (5,141) (9,766)

Tax paid (2,197) (1,124) (4,029)

--------------------------------------------- ------------ ------------ --------------------

Net cash generated from/ (used in)

operating activities 42 (93,797) (87,481)

--------------------------------------------- ------------ ------------ --------------------

Cash Flows From Investing Activities

Advances from non-controlling interests 486 370 1,081

Issuance of ordinary shares of subsidiaries

to non-

controlling interests 562 170 1,097

(Advances to)/ repayment from associate (88) 239 (630)

Disposal of held-for-trading financial

instrument - 982 899

Purchase of property, plant and

equipment (13) (50) (154)

Finance income received 227 208 424

--------------------------------------------- ------------ ------------ --------------------

Net cash generated from investing

activities 1,174 1,919 2,717

--------------------------------------------- ------------ ------------ --------------------

Consolidated Statement of Cash Flows (CONT'D)

SIX MONTHS ENDED 30 JUNE 2014

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

US$'000 US$'000 US$'000

--------------------------------------------- ------------ ------------ --------------------

Cash Flows From Financing Activities

Repayment of loans and borrowings

and medium term notes (6,212) (5,111) (17,341)

Drawdown of loans and borrowings

and medium term notes 7,075 101,243 110,860

(Increase)/ decrease in pledged

deposits placed in licensed banks (30) - 77

--------------------------------------------- ------------ ------------ --------------------

Net cash generated from financing

activities 833 96,132 93,596

--------------------------------------------- ------------ ------------ --------------------

Net changes in cash and cash equivalents

during the period/year 2,049 4,254 8,832

Effect of changes in exchange rates 247 (845) (248)

Cash and cash equivalents at the

beginning of the period/year 14,166 5,582 5,582

--------------------------------------------- ------------ ------------ --------------------

Cash and cash equivalents at the

end of the period/year 16,462 8,991 14,166

--------------------------------------------- ------------ ------------ --------------------

Cash and Cash Equivalents

Cash and cash equivalents included in the consolidated statement

of cash flows comprise the following consolidated statement of financial

position amounts:

Cash and bank balances 8,125 6,345 11,498

Short term bank deposits 18,786 13,400 13,087

--------------------------------------------- ------------ ------------ --------------------

26,911 19,745 24,585

Less: Deposits pledged (10,449) (10,754) (10,419)

--------------------------------------------- ------------ ------------ --------------------

Cash and cash equivalents 16,462 8,991 14,166

--------------------------------------------- ------------ ------------ --------------------

During the financial period/year, the Group acquired property,

plant and equipment with an aggregate cost of US$13,000 (30 June

2013: US$91,000; 31 December 2013: US$194,000) of which US$Nil (30

June 2013: US$41,005; 31 December 2013: US$40,000) was acquired by

means of finance leases.

During the financial period/year, US$562,000 (30 June 2013:

US$170,000; 31 December 2013: US$1,097,000) of ordinary shares of

subsidiaries were issued to non-controlling shareholders, of which

US$562,000 (30 June 2013: US$170,000; 31 December 2013:

US$1,097,000) was satisfied via cash consideration.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX

MONTHS ENDED 30 JUNE 2014

1 General Information

The principal activities of the Group are acquisition,

development and redevelopment of upscale residential, commercial,

hospitality and healthcare projects in the major cities of Malaysia

and Vietnam. The Group typically invests in development projects at

the pre-construction stage and may also selectively invests in

projects in construction and newly completed projects with

potential capital appreciation.

2 Summary of Significant Accounting Policies

2.1 Basis of Preparation

The interim condensed consolidated financial statements for the

six months ended 30 June 2014 has been prepared in accordance with

IAS 34, Interim Financial Reporting.

The interim condensed consolidated financial statements should

be read in conjunction with the annual financial statements for the

year ended 31 December 2013 which has been prepared in accordance

with IFRS.

Taxes on income in the interim period are accrued using the tax

rate that would be applicable to expected total annual

earnings.

The interim results have not been audited nor reviewed and do

not constitute statutory financial statements.

The preparation of financial statements in conformity with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of expenses during

the reporting period. Although these estimates are based on

management's best knowledge of the amount, event or actions, actual

results ultimately may differ from those estimates.

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 31 December 2013 as

described in those annual financial statements.

The interim report and financial statements were approved by the

Board of Directors on 26 August 2014.

3 SegmentAL Information

The Group's assets and business activities are managed by Ireka

Development Management Sdn. Bhd. ("IDM") as the Development Manager

under a management agreement dated 27 March 2007.

Segmental information represents the level at which financial

information is reported to the Executive Management of IDM, being

the chief operating decision maker as defined in IFRS 8. The

Executive Management consists of the Chief Executive Officer, the

Chief Financial Officer, Chief Operating Officer and Chief

Investment Officer of IDM. Management determines the operating

segments based on reports reviewed and used by the Executive

Management for strategic decision making and resource allocation.

For management purposes, the Group is organised into project

units.

The Group's reportable operating segments are as follows:

(i) Investment Holding Companies - investing activities;

(ii) Ireka Land Sdn. Bhd. - develops Tiffani by i-ZEN and 1

Mont' Kiara by i-ZEN;

(iii) ICSD Ventures Sdn. Bhd. - owns and operates Harbour Mall

Sandakan and Four Points by Sheraton Sandakan Hotel;

(iv) Amatir Resources Sdn. Bhd. - develops SENI Mont' Kiara;

(v) Iringan Flora Sdn. Bhd. - owns and operates Aloft Kuala

Lumpur Sentral Hotel; and

(vi) Hoa Lam-Shangri-La Healthcare Group - owns and develops

City International Hospital and Hi-Tech

Healthcare Park.

Other non-reportable segments comprise the Group's new

development projects. None of these segments meets any of the

quantitative thresholds for determining reportable segments in 2014

and 2013.

Information regarding the operations of each reportable segment

is included below. The Executive Management monitors the operating

results of each segment for the purpose of performance assessments

and making decisions on resource allocation. Performance is based

on segment gross profit/(loss) and profit/(loss) before taxation,

which the Executive Management believes are the most relevant in

evaluating the results relative to other entities in the industry.

Segment assets and liabilities are presented inclusive of

inter-segment balances and inter-segment pricing is determined on

an arm's length basis.

The Group's revenue generating development projects are

currently only in Malaysia since development activities in Vietnam

are still at early stages of development and operation.

Operating Segments - ended 30 June 2014 - Unaudited

Hoa

Investment Amatir Iringan Lam-Shangri-La

Holding Ireka Land ICSD Ventures Resources Flora Sdn. Healthcare

Companies Sdn. Bhd. Sdn. Bhd. Sdn. Bhd. Bhd. Group Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- ----------- ----------- -------------- ----------- ------------- ----------------- ----------

Segment

(loss)/profit

before taxation (694) 415 (2,929) 4,939 (245) (5,418) (3,932)

================= =========== =========== ============== =========== ============= ================= ==========

Included in the

measure of

segment

(loss)/profit

are:

Revenue - 4,069 - 27,425 - - 31,494

Cost of

acquisition

written down - (110) - (5,844) - - (5,954)

Goodwill

impairment - - - (317) - - (317)

Marketing

expenses - - - (226) - - (226)

Depreciation

of

property, plant

and equipment - - (5) - (4) (48) (57)

Finance costs - - (2,130) - (2,469) (1,161) (5,760)

Finance income 2 7 152 34 12 17 224

================= =========== =========== ============== =========== ============= ================= ==========

Segment assets 16,911 4,687 107,704 67,744 81,327 117,201 395,574

Included in the

measure of

segment

assets are:

Addition to

non-current

assets other

than financial

instruments and

deferred tax

assets - - 12 - - - 12

================= =========== =========== ============== =========== ============= ================= ==========

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Statement of comprehensive income US$'000

---------------------------------------- ------------------------

Total loss for reportable segments (3,932)

Other non-reportable segments (825)

Depreciation (2)

Finance income 3

---------------------------------------- ------------------------

Consolidated loss before taxation (4,756)

======================================== ========================

Operating Segments - ended 30 June 2013 - Unaudited

Hoa

Investment Amatir Iringan Flora Lam-Shangri-La

Holding Ireka Land ICSD Ventures Resources Sdn. Bhd. Healthcare

Companies Sdn. Bhd. Sdn. Bhd. Sdn. Bhd. Group Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

---------------- ----------- ----------- -------------- ----------- ---------------- --------------- ----------

Segment

(loss)/profit

before

taxation (4,731) (121) (2,954) 93 (3,000) (1,569) (12,282)

================ =========== =========== ============== =========== ================ =============== ==========

Included in the

measure of

segment

(loss)/profit

are:

Revenue - 436 401 9,385 - - 10,222

Cost of

acquisition

written down - (8) (68) (1,976) - - (2,052)

Goodwill

impairment - - - (107) - - (107)

Marketing

expenses - - - (437) - - (437)

Depreciation

of

property,

plant

and equipment - (2) (5) (1) (3) (49) (60)

Finance costs - - (2,240) (201) (1,310) (133) (3,884)

Finance income 2 2 150 11 26 14 205

================ =========== =========== ============== =========== ================ =============== ==========

Segment assets 17,254 10,364 109,177 92,062 81,692 94,167 404,716

Included in the

measure of

segment

assets are:

Addition to

non-current

assets other

than financial

instruments

and

deferred tax

assets - - 6 - 62 23 91

================ =========== =========== ============== =========== ================ =============== ==========

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Statement of comprehensive income US$'000

---------------------------------------- ------------------------

Total loss for reportable segments (12,282)

Other non-reportable segments (1,451)

Depreciation (1)

Finance income 3

---------------------------------------- ------------------------

Consolidated loss before taxation (13,731)

======================================== ========================

Operating Segments - ended 31 December 2013 - Audited

Hoa

Investment Ireka Amatir Iringan Lam-Shangri-La

Holding Land Sdn. ICSD Ventures Resources Flora Sdn. Healthcare

Companies Bhd. Sdn. Bhd. Sdn. Bhd. Bhd. Group Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

---------------- ------------- ------------ --------------- ------------ ------------ --------------- ---------

Segment (loss)/

profit before

taxation (2,217) (323) (5,927) 4,169 (4,382) (7,559) (16,239)

================ ============= ============ =============== ============ ============ =============== =========

Included in

the measure

of segment

(loss)/profit

are:

Revenue - 1,278 433 27,558 - - 29,269

Cost of

acquisition

written down - (33) (68) (5,918) - - (6,019)

Goodwill

impairment - - - (320) - - (320)

Marketing

expenses - - - (711) - - (711)

Depreciation

of property,

plant and

equipment - (2) (10) (1) (7) (91) (111)

Finance costs - - (4,464) (252) (3,841) (1,209) (9,766)

Finance income 7 4 301 28 44 27 411

================ ============= ============ =============== ============ ============ =============== =========

Segment assets 18,273 9,703 105,954 81,743 79,231 110,545 405,449

Included in

the

measure of

segment assets

are:

Addition to

non-

current assets

other than

financial

instruments

and

deferred tax

assets - - 5 - 44 145 194

================ ============= ============ =============== ============ ============ =============== =========

Reconciliation of reportable segment revenues, profit or loss, assets

and liabilities and other material items

Statement of comprehensive income US$'000

------------------------------------ ---------

Total loss for reportable segments (16,239)

Other non-reportable segments (2,567)

Depreciation (3)

Finance income 13

------------------------------------ ---------

Consolidated loss before taxation (18,796)

==================================== =========

30 June 2014 - Unaudited Addition to

US$'000 non-current

Revenue Depreciation Finance costs Finance income Segment assets assets

-------------------------- -------- ------------- -------------- --------------- --------------- -------------

Total reportable segment 31,494 (57) (5,760) 224 395,574 12

Other non-reportable

segments - (2) - 3 93,770* 1

-------------------------- -------- ------------- -------------- --------------- --------------- -------------

Consolidated total 31,494 (59) (5,760) 227 489,344 13

========================== ======== ============= ============== =============== =============== =============

30 June 2013 - Unaudited Addition to

US$'000 non-current

Revenue Depreciation Finance costs Finance income Segment assets assets

-------------------------- -------- ------------- -------------- --------------- --------------- -------------

Total reportable segment 10,222 (60) (3,884) 205 404,716 91

Other non-reportable

segments - (1) - 3 84,490* -

-------------------------- -------- ------------- -------------- --------------- --------------- -------------

Consolidated total 10,222 (61) (3,884) 208 489,206 91

========================== ======== ============= ============== =============== =============== =============

31 December 2013 - Audited Addition to

US$'000 non-current

Revenue Depreciation Finance costs Finance income Segment assets assets

---------------------------- -------- ------------- -------------- --------------- --------------- -------------

Total reportable segment 29,269 (111) (9,766) 411 405,449 194

Other non-reportable

segments - (3) - 13 89,333* -

---------------------------- -------- ------------- -------------- --------------- --------------- -------------

Consolidated total 29,269 (114) (9,766) 424 494,782 194

============================ ======== ============= ============== =============== =============== =============

* Included in segment asset for other non-reportable segments is

US$53,675,000 (30 June 2013: US$42,449,000; 31 December 2013:

S$49,696,000) in relation to assets of Urban DNA Sdn. Bhd..

Geographical Information - ended 30 June 2014 - Unaudited

Malaysia Vietnam Consolidated

US$'000 US$'000 US$'000

-------------------- --------- -------- -------------

Revenue 31,494 - 31,494

Non-current assets 5,288 24,439 29,727

==================== ========= ======== =============

For the financial period ended 30 June 2014, no single customer

exceeded 10% of the Group's total revenue.

Geographical Information - ended 30 June 2013 - Unaudited

Malaysia Vietnam Consolidated

US$'000 US$'000 US$'000

-------------------- --------- -------- -------------

Revenue 10,222 - 10,222

Non-current assets 3,138 28,658 31,796

==================== ========= ======== =============

For the financial period ended 30 June 2013, no single customer

exceeded 10% of the Group's total revenue.

Geographical Information - ended 31 December 2013 - Audited

Malaysia Vietnam Consolidated

US$'000 US$'000 US$'000

-------------------- ---------- -------- -------------

Revenue 29,269 - 29,269

Non-current assets 5,741 24,474 30,215

==================== ========== ======== =============

For the financial year ended 31 December 2013, no single

customer exceeded 10% of the Group's total revenue.

4 Seasonality

The Group's business operations are not materially affected by

seasonal factors for the period under review.

5 Cost of Sales

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

US$'000 US$'000 US$'000

------------------------------ ----------- ----------- -------------

Direct costs attributable to

property development 24,953 8,379 22,768

------------------------------ ----------- ----------- -------------

6 Foreign exchange loss

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

US$'000 US$'000 US$'000

---------------------------------- ----------- ----------- ------------------

Foreign exchange loss comprises:

Realised foreign exchange loss (8) (65) (40)

Unrealised foreign exchange

loss (1) (378) (1,065)

(9) (443) (1,105)

---------------------------------- ----------- ----------- ------------------

7 Taxation

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

US$'000 US$'000 US$'000

--------------------------------------- ----------- ----------- --------------

Current tax expense 2,980 705 3,470

Deferred tax credit (74) - (616)

--------------------------------------- ----------- ----------- --------------

Total tax expense for the period/year 2,906 705 2,854

--------------------------------------- ----------- ----------- --------------

The numerical reconciliation between the income tax expense and

the product of accounting results multiplied by the applicable tax

rate is computed as follows:

Unaudited Unaudited Audited

Six months Six months Year

ended ended Ended

30 June 30 June 31 December

2014 2013 2013

US$'000 US$'000 US$'000

--------------------------------------- ----------- ----------- -------------

Net loss before taxation (4,756) (13,731) (18,796)

--------------------------------------- ----------- ----------- -------------

Income tax at a rate of 25%* (1,189) (3,433) (4,699)

Add :

Tax effect of expenses not deductible

in determining taxable profit 1,596 2,437 4,989

Movement of unrecognised deferred

tax benefits 1,673 1,773 1,833

Tax effect of different tax rates

in subsidiaries** 1,027 108 960

Less :

Tax effect of income not taxable

in determining taxable profit (201) (183) (377)

Under provision - 3 148

--------------------------------------- ----------- ----------- -------------

Total tax expense for the period/year 2,906 705 2,854

--------------------------------------- ----------- ----------- -------------

* The applicable corporate tax rate in Malaysia and Vietnam is 25%.

** The applicable corporate tax rate in Singapore is 17%. A

subsidiary of the Group, Hoa Lam-Shangri-La Healthcare Ltd

Liability Co is granted a preferential corporate tax rate of 10%

for its profit/(loss) arising from hospital income. The

preferential income tax rate is given by the government of Vietnam

due to the subsidiary's involvement in the healthcare and education

industries.

The Company is treated as a tax resident of Jersey for the

purpose of tax laws and is subject to a tax rate of 0%.

A Goods and Services Tax was introduced in Jersey in May 2008.

The Company has been registered as an International Services Entity

so that it does not have to charge or pay local GST. The cost for

this registration is GBP200 per annum.

The Directors intend to conduct the Group's affairs such that

the central management and control is not exercised in the United

Kingdom and so that neither the Company nor any of its subsidiaries

carries on any trade in the United Kingdom. The Company and its

subsidiaries will thus not be residents in the United Kingdom for

taxation purposes. On this basis, they will not be liable for

United Kingdom taxation on their income and gains other than income

derived from a United Kingdom source.

8 LOSS Per Share

Basic and diluted loss per ordinary share

The calculation of basic and diluted loss per ordinary share for

the period/year ended was based on the loss attributable to equity

holders of the parent and a weighted average number of ordinary

shares outstanding, calculated as below:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

US$'000 US$'000 US$'000

------------------------------------- ------------------- ----------- -------------

Loss attributable to equity holders

of the parent (5,198) (13,776) (19,006)

Weighted average number of shares 212,025 212,025 212,025

Loss per share

Basic and diluted (US cents) (2.45) (6.50) (8.96)

------------------------------------- ------------------- ----------- -------------

9 Loans and Borrowings

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2014 2013 2013

Group US$'000 US$'000 US$'000

--------------------------- --- ---------- ---------- -------------

Non-current

Bank loans 68,936 51,040 49,267

Finance lease liabilities 36 54 42

-------------------------------- ---------- ---------- -------------

68,972 51,094 49,309

------------------------------- ---------- ---------- -------------

Current

Bank loans 6,920 26,666 25,452

Finance lease liabilities 14 11 14

-------------------------------- ---------- ---------- -------------

6,934 26,677 25,466

------------------------------- ---------- ---------- -------------

75,906 77,771 74,775

------------------------------- ---------- ---------- -------------

The effective interest rates on the bank loans and hire purchase

arrangement for the period ranged from 5.25% to 14.90% (30 June

2013: 5.20% to 23.00%; 31 December 2013: 5.25% to 17.70%) per annum

and 2.50% (30 June 2013: 2.50%; 31 December 2013: 2.50% to 3.50%)

per annum respectively.

Borrowings are denominated in Ringgit Malaysia, United States

Dollars and Vietnam Dong.

Bank loans are repayable by monthly, quarterly or semi-annually

instalments.

Bank loans are secured by land held for property development,

work-in-progress, operating assets of the Group, pledged deposits

and some by the corporate guarantee of the Company.

Finance lease liabilities are payable as follows:

Present value

of minimum

Future minimum lease payment

lease payment Interest 30 June

30 June 30 June 2014

Group - Unaudited 2014 US$'000 2014 US$'000 US$'000

---------------------------- --------------- -------------- ---------------

Within one year 16 2 14

Between one and five years 42 6 36

---------------------------- --------------- -------------- ---------------

58 8 50

---------------------------- --------------- -------------- ---------------

Present value

of minimum

Future minimum lease payment

lease payment Interest 30 June

30 June 30 June 2013

Group - Unaudited 2013 US$'000 2013 US$'000 US$'000

---------------------------- --------------- -------------- ---------------

Within one year 13 2 11

Between one and five years 62 8 54

---------------------------- --------------- -------------- ---------------

75 10 65

---------------------------- --------------- -------------- ---------------

Present value

of minimum

Future minimum Interest lease payment

lease payment 31 December 31 December

31 December 2013 2013

Group - Audited 2013 US$'000 US$'000 US$'000

---------------------------- --------------- ------------- ---------------

Within one year 16 2 14

Between one and five years 49 7 42

---------------------------- --------------- ------------- ---------------

65 9 56

---------------------------- --------------- ------------- ---------------

10 Medium Term Notes

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2014 2013 2013

US$'000 US$'000 US$'000

----------------------------------- ---------- ---------- ------------

Outstanding medium term notes 160,060 162,630 156,924

Net transaction costs (2,714) (3,318) (2,308)

Less:

Repayment due within twelve

months (14,013) - (13,739)

----------------------------------- ---------- ---------- ------------

Repayment due after twelve months 143,333 159,312 140,877

----------------------------------- ---------- ---------- ------------

The medium term notes ("MTN") were issued by a subsidiary to

fund two development projects known as Sandakan Harbour Square and

Aloft Kuala Lumpur Sentral Hotel in Malaysia. US$76.3 million were

drawn down in 2011 for Sandakan Harbour Square. US$4.7 million were

drawn down in 2012 for Aloft Kuala Lumpur Sentral Hotel and the

remaining US$79.1 million in 2013. The weighted average interest

rate of the MTN was 5.51% per annum at the statement of the

financial position date. The effective interest rates of the medium

term notes and their outstanding amounts are as follows:

Interest rate

Maturity Dates % per annum US$'000

------------------------- ------------------ -------------- ----------

Series 1 Tranche FG 8 December

001 2014 5.38 7,785

Series 1 Tranche BG 8 December

001 2014 5.33 6,228

Series 1 Tranche FG 8 December

002 2015 5.46 14,013

Series 1 Tranche BG 8 December

002 2015 5.41 9,342

Series 2 Tranche FG 8 December

001 2015 5.46 21,798

Series 2 Tranche BG 8 December

001 2015 5.41 17,127

Series 3 Tranche FG001 1 October 2015 5.40 3,114

Series 3 Tranche BG001 1 October 2015 5.35 1,557

29 January

Series 3 Tranche FG002 2016 5.50 4,671

29 January

Series 3 Tranche BG002 2016 5.45 3,114

Series 3 Tranche FG003 8 April 2016 5.65 40,171

Series 3 Tranche BG003 8 April 2016 5.58 31,140

------------------------- ------------------ -------------- ----------

160,060

-------------------------------------------- -------------- ----------

The medium term notes are secured by way of:

(i) bank guarantee from two financial institutions in respect of the BG Tranches;

(ii) financial guarantee insurance policy from Danajamin

Nasional Berhad in respect to the FG Tranches;

(iii) a first fixed and floating charge over the present and

future assets and properties of Silver Sparrow Berhad, ICSD

Ventures Sdn. Bhd. and Iringan Flora Sdn. Bhd. by way of a

debenture;

(iv) a third party first legal fixed charge over ICSD Ventures Sdn. Bhd.'s assets and land;

(v) assignment of all Iringan Flora Sdn. Bhd.'s present and

future rights, title, interest and benefits in and under the Sales

and Purchase Agreement to purchase the Aloft Kuala Lumpur Sentral

Hotel from Excellent Bonanza Sdn. Bhd.;

(vi) first fixed land charge over the Aloft Kuala Lumpur Sentral

Hotel and the Aloft Kuala Lumpur Sentral Hotel's land (to be

executed upon construction completion);

(vii) a corporate guarantee by Aseana Properties Limited;

(viii) letter of undertaking from Aseana Properties Limited to

provide financial and other forms of support to ICSD Ventures Sdn.

Bhd. to finance any cost overruns associated with the development

of the Sandakan Harbour Square;

(ix) assignment of all its present and future rights, interest

and benefits under the ICSD Ventures Sdn. Bhd.'s and Iringan Flora

Sdn. Bhd.'s Put Option Agreements and the proceeds from the Harbour

Mall Sandakan, Four Points by Sheraton Sandakan Hotel and Aloft

Kuala Lumpur Sentral Hotel;

(x) assignment over the disbursement account, revenue account,

operating account, sales proceed account, debt service reserve

account and sinking fund account of Silver Sparrow Berhad; revenue

account of ICSD Ventures Sdn. Bhd. and escrow account of Ireka Land

Sdn. Bhd.;

(xi) assignment of all ICSD Ventures Sdn. Bhd.'s and Iringan

Flora Sdn. Bhd.'s present and future rights, title, interest and

benefits in and under the insurance policies; and

(xii) a first legal charge over all the shares of the Silver

Sparrow Berhad, ICSD Ventures Sdn. Bhd. and Iringan Flora Sdn. Bhd.

and any dividends, distributions and entitlements.

11 Related Party Transactions

Transactions between the Group and the Company with Ireka

Corporation Berhad ("ICB") and its group of companies are

classified as related party transactions based on ICB's 23.07%

shareholding in the Company.

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

US$'000 US$'000 US$'000

------------------------------------- ----------- ----------- -------------

Accounting and financial reporting

services fee charged by an ICB

subsidiary 27 27 53

Construction progress claims

charged by an ICB subsidiary 9,036 9,341 11,035

Management fees charged by an

ICB subsidiary 1,653 1,821 3,762

Marketing commission charged

by an ICB subsidiary 825 121 330

Project management fee for interior

fit out works charged by an ICB

subsidiary - 62 90

Project staff costs reimbursed

to an ICB subsidiary 397 309 682