Aseana Properties Limited Aseana First Distribution Update (8128H)

December 03 2015 - 2:00AM

UK Regulatory

TIDMASPL

RNS Number : 8128H

Aseana Properties Limited

03 December 2015

Aseana Properties Limited

("Aseana")

First Distribution Update

The Board wishes to update Shareholders on the status of the

first capital repayment. The intention had been to make a first

return of capital of US$10m to shareholders as of the end of

September 2015 and to then make further returns of capital as cash

was raised by the Company as a result of disposals of assets in the

portfolio. It is still the firm intention of the Board and the

Manager to do this.

The process of raising cash has been progressing steadily with a

full sale of the Waterside Estates land already announced for a

consideration of US$9.29m with payment in full due to be received

by the year end and partial sales of the stake in Nam Long

Investment Corporation raising US$5.4m since June 2015. Progress on

selling other assets is also well underway, although no further

sales are yet at a stage that the Board feels able to announce the

likely terms or timing. The Company's cash balance as at 30

September 2015 was approximately US$25.0m and this figure is

expected to grow further by the end of 2015. The unaudited Net

Asset Value of the Company at 30 September 2015 was US$134.4m.

Further details on the portfolio and the NAV as at 30 September

2015 can be found in the Company's Q3 2015 Investor Update which

can be found on the Company's website:

www.aseanaproperties.com.

An application to make the first capital distribution was

submitted to the Company's lenders at the end of August but at

present the consent from two lenders remains outstanding. We

understand that market conditions in Malaysia caused by the recent

political events in the country and the depreciation of the

Malaysian Ringgit this year have caused concerns for a number of

the Company's lenders who have therefore become cautious about the

Company returning capital to Shareholders. At the present time the

Board believes that further discussion with the lenders and more

portfolio realisations will help to resolve this situation.

However, it is possible that capital repayments may not occur until

there have been further realisations within the portfolio and the

Company has paid down a portion of its project related debts as a

result.

We will continue to work closely with all the Company's bankers

in order to be able to make the capital distributions that the

Shareholders approved at the EGM on 22 June and will update

Shareholders as events progress.

For further information:

Aseana Properties Limited Tel: +603 6411 6388

Chan Chee Kian Email: cheekian.chan@ireka.com.my

N+1 Singer Tel: 020 7496 3000

James Maxwell / Liz Yong (Corporate

Finance)

Sam Greatrex (Sales)

Tavistock Tel: 020 7920 3150

Jeremy Carey / James Verstringhe Email: jcarey@tavistock.co.uk

Notes to Editors:

London-listed Aseana Properties Limited (LSE: ASPL) is a

property developer investing in Malaysia and Vietnam.

Ireka Development Management Sdn Bhd ("IDM") is the exclusive

Development Manager for Aseana. It is a wholly-owned subsidiary of

Ireka Corporation Berhad, a company listed on the Bursa Malaysia

since 1993, which has over 45 years of experience in construction

and property development. IDM is responsible for the day-to-day

management of Aseana's property portfolio and the introduction and

facilitation of new investment opportunities.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCZMMGZMZLGKZZ

(END) Dow Jones Newswires

December 03, 2015 02:00 ET (07:00 GMT)

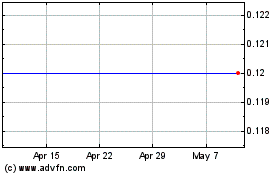

Aseana Properties (LSE:ASPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

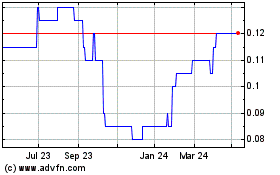

Aseana Properties (LSE:ASPL)

Historical Stock Chart

From Apr 2023 to Apr 2024