TIDMAST

RNS Number : 4262F

Ascent Resources PLC

12 November 2015

Ascent Resources plc

("Ascent" or "the Company")

Proposed Placing of 70,350,000 New Ordinary Shares at 1.0 pence*

per share to raise GBP703,500

Amendment of Convertible Loan Note Instruments

Capital Reorganisation

and

Notice of General Meeting

Ascent is pleased to announce that is has conditionally raised

GBP703,500 (before expenses) by way of the proposed Placing of

70,350,000 New Ordinary shares at a price of 1.0 pence* per share.

The Company has also agreed a drawdown of an additional GBP296,500

from the Henderson Facility.

The Directors believe that this GBP1 million should allow the

Company to meet its short-term obligations and work towards its new

goal of achieving first gas within 12 months.

Highlights:

-- Advanced stage of discussions with new industry partners,

which, if completed, would allow the Company to produce and sell

gas from the Petišovci field without the need to construct a new

gas treatment facility which should significantly shorten the time

to first gas and materially reduce upfront capital costs

-- The Board expects to be in a position to enter into a binding

agreement with an industry partner by the end of Q1 2016, with

first gas revenue by the end of Q3 2016

-- The Slovenian Environment Minister has informed the Company

that she has rejected the appeals against the award in July 2015 of

the IPPC permit, required to construct a gas treatment facility.

Project partners are in discussions with the objectors to find ways

to address their concerns without the need for a court review of

the Minister's decision

-- An agreement reached with the holders of a majority of the

principal amounts outstanding pursuant to the Loan Notes to extend

the maturity date of the Loan Notes by one year and to rebase the

conversion price to the Issue Price

-- A capital reorganisation to reduce the nominal value of an

Ordinary Share from 0.1 pence to 0.01 pence and subsequently

consolidate the Ordinary Shares by a factor of 20 to increase the

nominal value to 0.2 pence per Ordinary Share

Having made a concerted effort over recent months to attract

investment into the Company and having held discussions with a

number of potential investors whose offers were less attractive

than those put forward by the Placees, the Directors believe that

they have secured the most favourable financing available to the

Company at the current time.

*Following the proposed Capital Reorganisation

Circular

A Circular will be posted to shareholders today, the purpose of

which is, amongst other things, is to outline the reasons for, and

to explain the terms of the Proposals and to explain why the Board

considers the Proposals (including the Resolutions) to be in the

best interests of the Company and Shareholders as a whole and why

the Directors recommend that you vote in favour of the Resolutions

at the General Meeting as they intend to do in respect of the

Ordinary Shares held by them. Extracts from the circular can be

found below and a full copy will be made available on the Company's

website www.ascentresources.com.uk shortly.

The General Meeting of the Company is to be held at 2.00 p.m. on

30 November 2015 at the offices of finnCap, 60 New Broad Street,

London, EC2M 1JJ, at which the Resolutions will be proposed.

Expected Timetable

2015

Announcement of the Proposals 12 November

Dispatch of the Circular 12 November

Latest time and date for receipt of Forms 2.00 p.m. on 26 November

of Proxy for the General Meeting

General Meeting 2.00 p.m. on 30 November

Announcement of result of General Meeting 30 November

Record date for Capital Reorganisation 5.00 p.m. on 30 November

New Ordinary Shares admitted to trading 8.00 a.m. on 1 December

on AIM and dealings in the New Ordinary

Shares commence and enablement in CREST

Despatch of definitive share certificates by 10 December

for New Ordinary Shares in certificated

form

References to time are to London time unless otherwise stated.

Save for the date of dispatch of this document, each of the times

and dates above are subject to change. Any such change will be

notified to Shareholders by an announcement on a Regulatory

Information Service.

Other

Unless otherwise defined, all capitalised terms in this

announcement shall have the meaning given to them in the

Circular.

Enquiries:

Ascent Resources plc

Clive Carver, Chairman

Colin Hutchinson, Interim

CEO 0207 251 4905

finnCap Limited, Nominated

Adviser

Christopher Raggett

Emily Watts 0207 220 0500

IFC Advisory Ltd, Financial

PR and IR

Graham Herring

Tim Metcalfe

Heather Armstrong 0203 053 8671

The following has been extracted from the Circular which will be

sent to Shareholders today.

LETTER FROM THE CHAIRMAN OF THE COMPANY

1. Introduction

The Board of Ascent is pleased to announce that the Company is

in an advanced stage of discussions with new industry partners,

which, if completed, would allow the Company to produce and sell

gas from the Petišovci field without the need to construct a new

gas treatment facility. It is the opinion of the Ascent Board that

this should significantly shorten the time to first gas and

materially reduce upfront capital costs.

Based on progress to date, the Ascent Board expects to be in a

position to enter into a binding agreement with an industry partner

by the end of Q1 2016, with first gas revenue by the end of Q3

2016.

Additionally, the Board of Ascent is pleased to confirm that the

Slovenian Environment Minister has informed the Company that she

has rejected the appeals against the award in July 2015 of the IPPC

permit, required to construct a gas treatment facility. Our project

partners are in discussions with the objectors to find ways to

address their concerns without the need for a court review of the

Minister's decision.

The Board continues to view construction of the gas treatment

facility as the long-term solution for the project.

Conditional on shareholder approval, the Company has today

raised GBP703,500 by way of the proposed Placing of 70,350,000 New

Ordinary shares at a price of 1.0 pence, following the proposed

Capital Reorganisation. The Company has also agreed a drawdown of

an additional GBP296,500 from the Henderson Facility. The Directors

believe that this GBP1 million should allow the Company to meet its

short-term obligations and work towards its new goal of achieving

first gas within 12 months.

As part of the Proposals, the Company has agreed with the

holders of a majority of the principal amounts outstanding pursuant

to the Loan Notes to extend the maturity date of the Loan Notes by

one year, from 19 November 2015 to 19 November 2016 and it has

agreed to rebase the conversion price to the Issue Price.

The Company is also seeking shareholder approval for a capital

reorganisation to reduce the nominal value of an Ordinary Share

from 0.1 pence to 0.01 pence and subsequently consolidate the

Ordinary Shares by a factor of 20 to increase the nominal value to

0.2 pence per Ordinary Share.

The purpose of this letter is to outline the reasons for, and to

explain the terms of the Proposals and to explain why the Board

considers the Proposals (including the Resolutions) to be in the

best interests of the Company and Shareholders as a whole and why

the Directors recommend that you vote in favour of the Resolutions

at the General Meeting as they intend to do in respect of the

Ordinary Shares held by them.

Set out at the end of the Circular is a notice convening a

General Meeting of the Company to be held at 2.00 p.m. on 30

November 2015 at the offices of finnCap, 60 New Broad Street,

London, EC2M 1JJ, at which the Resolutions will be proposed.

2. The Petišovci project

Ascent has a 75% interest in the Petišovci gas field in

Slovenia, with its partner Geoenergo holding the remaining 25%

through a concession signed in 2002 with a 19.5 year term, which is

due for renewal in 2022. Ascent is liable for 100% of the financing

obligations for the project. In 2011, two wells were drilled and

flowed at commercial rates; however development has been delayed

due to the permitting issues described in further detail below.

EUR42 million has been spent to date on the development of the

field, which could supply a significant portion of Slovenia's

future gas requirements thereby reducing its dependency on imported

gas. The Board believes that Ascent's investment in the Petišovci

project is the largest UK investment in Slovenia and Ascent's share

of the project has an estimated NPV10 of EUR200 million.

In recognition of the key strategic importance of the project,

earlier this year the Slovenian government designated Nafta

Lendava, which holds an interest in the concession through its

shareholding in Geoenergo, as one of 21 important national

assets.

The preferred field development plan to date has been to install

a Gas Gathering and Separation Station ("GGSS") to reduce the

carbon dioxide content of the gas to meet national gas grid

specifications, upgrade a metering station at the entry point to

the national grid and connect the wells via the GGSS to the

metering station at an estimated combined capital cost of EUR13

million.

(MORE TO FOLLOW) Dow Jones Newswires

November 12, 2015 02:00 ET (07:00 GMT)

Under Directives adopted by all EU Governments, the installation

of the GGSS requires an IPPC Permit. The application was completed

in July 2014 and submitted to the Environmental Agency ("ARSO") for

approval. ARSO approved the permit in December 2014, subject to

public consultation, and in June 2015 announced that, following the

completion of this consultation, the Permit had been provisionally

awarded, subject to a statutory period for appeals. In August 2015,

the Company received formal notification that two non-government

organisations had lodged appeals, to which Ascent submitted its

responses in August 2015. The Slovenian Environment Minister

recently informed the Company that she had rejected the appeals

against the July 2015 award of the IPPC permit. The Company and its

partners are in discussions with the objectors in an attempt to

address their concerns and avoid a further appeal through the

courts.

Whilst the award of the permit is not guaranteed, based on legal

advice, the Board remains firmly of the view that the required IPPC

Permit will eventually be issued in final form. However, if the

matter has to be referred to the Slovenian courts then the final

outcome may not be known until sometime in 2016.

3. Alternative routes to first gas

The Company has identified two potential routes to market for

its gas which are independent of the ongoing IPPC permitting

process. Whilst neither route has been confirmed as viable and

whilst there are still obstacles to overcome, the Ascent Board

believes the Company now has a reasonable prospect of bringing its

gas to market within the next twelve months.

3.1 Methanol plant

Adjacent to the field is a methanol plant (the "Plant"), which

was previously operational in 2011 when it was owned by Nafta

Petrochem. The Plant was purchased at auction on 30 September 2015

for EUR5.6 million by United States Methanol Corporation ("USMC")

and completion of the sale is expected within three months. USMC, a

Californian based company, has stated publicly that it intends to

bring the Plant into operation and Ascent is in initial discussions

with a view to supplying its gas. This would not require new

processing facilities and could occur in advance of the IPPC

Permit.

Once the sale process has completed, the Plant will need to be

recommissioned, which is currently estimated to take approximately

six months. As soon as this has been achieved the Board understands

that the Plant could potentially take all of the Petišovci field's

production during Phase One (10 MMscfd). In order to produce gas

into the Plant, Ascent would need to recomplete and tie in the

existing wells and carry out some work on the pipelines, which is

estimated to cost approximately EUR3 million.

3.2 Outsourced processing

Ascent has recently identified a route from the Petišovci field

to a third party owned processing facility in a neighbouring

jurisdiction. The route is through a combination of existing

pipeline and a length of planned pipeline which is being

constructed by an unconnected third party. The existing pipeline

has not been operational for many years and will therefore require

some technical and legal work before it can be confirmed as viable.

The Company has been advised that this process will take an

estimated three months.

The Company is in an advanced stage of discussions with this new

partner, which, if resulting in agreement, would allow the Company

to produce and sell gas from the Petišovci field without the need

to construct a new gas treatment works. It is intended that the gas

will be transported along the existing and planned pipelines to the

third party owned facility where it could be processed to a

standard acceptable to the Slovenian national grid and returned for

sale. In the opinion of the Ascent Board, this would significantly

shorten the time to first gas, could potentially take 10 MMscfd of

the field's production and would require an investment of

approximately EUR3.2 million.

Based on progress to date, the Ascent Board hopes it will be in

a position to enter a binding agreement in respect of the above in

Q1 2016, with first revenue following by the end of Q3 2016.

3.3 Going forward

The Company continues to pursue all potential routes to market

for its gas with the priority being to identify which is the

quickest and most certain. The Company will progress its plans to

obtain the IPPC permit which the Board views as the long term

solution for the project. In the short term the Board believes that

methanol or outsourced processing provide good interim solutions,

with significantly shorter timelines to first gas, lower upfront

cash commitment and no reliance on government permits. This will

allow the Company to prove the significant potential of the field

prior to making the more substantial investment required for the

processing facilities at Petišovci.

4. Funding

To fund the Company whilst it pursues these opportunities, the

Company has conditionally raised GBP703,500 at 1.0 pence per share

by way of the Placing, arranged by PrimaryBid Limited, subject to

approval by Shareholders.

PrimaryBid Limited is a wholly owned subsidiary of Darwin

Strategic which is regulated and authorised by the Financial

Conduct Authority (FCA).

The Company has also agreed a drawdown of GBP296,500 under the

Henderson Facility. The Directors believe that this GBP1 million

should allow the Company to meet its short-term obligations and

work towards its new goal of achieving first gas within 12

months.

For the avoidance of doubt neither Darwin Strategic or

PrimaryBid are subscribing for Placing Shares in their own right

and there are no enduring arrangements between the Company and

Darwin Strategic.

5. Amendment of the Convertible Loan Note Instruments

The 2013 CLNs and 2014 CLNs are due to mature on 19 November

2015. On maturity, the 2013 CLNs and 2014 CLNs will either convert

into Ordinary Shares or be repaid.

The Company's ability to raise additional finance to repay the

2013 CLNs and 2014 CLNs in the absence of an IPPC permit and

project funding is extremely limited and, as such, the Company does

not have the cash resources available to it to repay the Loan Notes

by the maturity date. Henderson has indicated that it does not wish

to convert the Loan Notes it holds into Ordinary Shares.

Accordingly, the Company has agreed with the majority holder in

principal amount of the 2013 CLNs and 2014 CLNs amendments to amend

the 2013 Convertible Loan Note Instrument and the 2014 Convertible

Loan Note Instrument (the "Second Supplemental Loan Note

Instruments"), as follows:

-- the 2013 Convertible Loan Note Instrument and 2014

Convertible Loan Note Instrument have been amended to provide a

maturity date of either 19 November 2016, or, if earlier, the

occurrence of a Liquidity Event; and

-- the 2013 CLNs and 2014 CLNs now have an effective conversion

price equivalent to the Issue Price such that the holders of 2013

CLNs and 2014 CLNs (assuming full draw-down of the Loan Notes and

assuming all Loan Note holders convert) will on conversion hold

some 88.7 per cent. of the enlarged share capital of the Company on

a fully diluted basis (including Deferred Shares).

Henderson has confirmed that it will not convert the Loan Notes

held by it in such amounts as would cause its holding of voting

rights in the Company to equal or exceed 30%.

Shareholders should note that, unlike the previous position in

relation to the 2013 CLNs and 2014 CLNs, conversion of the 2013

CLNs and 2014 CLNs following the amendments described above will

not be subject to a waiver of the provisions of Rule 9 on the City

Code on Takeovers and Mergers. Accordingly, if Henderson or any

other holders of the 2013 CLNs or the 2014 CLNs exercise their

right of conversion and they hold equal to or more than 30 per

cent. of the total voting rights in the Company, such holder will

be required to make a mandatory bid for the remaining ordinary

shares in the capital of the Company not held by them in accordance

with the City Code on Takeovers and Mergers.

Henderson holds 95 per cent. of the 2013 CLNs and 66 per cent.

of the 2014 CLNs and have approved the amendments to the 2013 CLNs

and 2014 CLNs described above. The other holders of 2013 CLNs and

2014 CLNs are accordingly now subject to the same changes and, as

such, other holders of 2013 CLNs and 2014 CLNs are no longer able

to seek repayment of the 2013 CLNs or 2014 CLNs held by them until

the new maturity date described above.

6. Working capital

The Company has to date been reliant on the continued support of

its shareholder Henderson Global Investors ("Henderson") through

the GBP7,000,000 loan facility entered into in May this year, which

the Company can draw down only at Henderson's discretion.

As previously announced the Company has made significant

reductions in its operating expenses through headcount reductions

and efficiency savings.

Until the Company has established a clear route to first gas,

the Company is limited in its ability to raise additional capital

to develop the Petišovci asset.

Therefore, the proceeds from the Placing and the draw-down on

the Henderson facility, together totalling GBP1 million, both

conditional on the passing of the Resolutions, are expected to be

sufficient to cover existing amounts due to our Petišovci partners

(estimated at approximately EUR0.7 million) and to fund the reduced

operating costs of the Company until Q1 2016, when further funding

will be required to achieve first gas, once the route to first gas

is formally confirmed.

In addition, as detailed in paragraph 5 above, the Company has

been given an assurance by Henderson that the Loan Notes held by it

will not be called for payment until 19 November 2016, or, if

earlier, the occurrence of a Liquidity Event.

(MORE TO FOLLOW) Dow Jones Newswires

November 12, 2015 02:00 ET (07:00 GMT)

Shareholders are advised that in the event that the Proposals

are not implemented the Company may have insufficient working

capital to continue trading in the near term.

7. Capital Reorganisation

Prior to the proposed Capital Reorganisation, the Issue Price

would have been less than the current nominal value of an Ordinary

Share and, under the Act, a company cannot issue shares at a price

below their nominal value.

The Directors propose, therefore, subject to the passing of

Resolutions 1 and 2, that the Company effects the Capital

Reorganisation on the basis that:

(a) the Existing Ordinary Shares of 0.1 pence each will be

subdivided into:

i. one Redenominated Ordinary Share (being an ordinary share in

the capital of the Company with a nominal value of 0.01 pence);

ii. one Deferred Share (being a deferred share in the capital of

the Company with a nominal value of 0.09 pence); and

(b) the Redenominated Ordinary Shares of 0.01 pence each

(resulting from the subdivision referred to in paragraph (a) above)

be will consolidated into new ordinary shares of 0.2 pence each

(the "New Ordinary Shares") on the basis of one ordinary share for

every 20 ordinary shares of 0.01 pence each.

Where the Capital Reorganisation results in any Shareholder

being entitled to a fraction of a New Ordinary Share, such fraction

shall be aggregated and the Directors intend to sell (or appoint

another person to sell) such aggregated fractions in the market and

retain the net proceeds for the benefit of the Company.

The Deferred Shares will not be admitted to trading on AIM (or

any other investment exchange). The Deferred Shares will have

limited rights, and will be subject to the restrictions, as set out

in the Company's New Articles, proposed to be adopted at the

General Meeting, and as summarised below.

The Deferred Shares will not be transferable. The holders of the

Deferred Shares shall not, by virtue or in respect of their

holdings of Deferred Shares, have the right to receive notice of

any general meeting of the Company or the right to attend, speak or

vote at any such general meeting.

The Deferred Shares will not entitle their holders to receive

any dividend or other distribution. The Deferred Shares will on a

return of assets in a winding up entitle the holder only to the

repayment of GBP1.00 for the entire class of Deferred Shares after

repayment of the capital paid up on the New Ordinary Shares plus

the payment of GBP10,000,000 per New Ordinary Share.

The Company will have irrevocable authority at any time to

appoint any person to execute on behalf of the holders of the

Deferred Shares a transfer thereof and/or an agreement to the

transfer of the same to such person as the Company may determine or

as the Company determines as custodian thereof, without making any

payment to the holders thereof, and/or consent to cancel the same

(in accordance with the provisions of the Act) without making any

payment to or obtaining the sanction of the holders thereof. The

Company may, at its option at any time, purchase all or any of the

Deferred Shares then in issue, at a price not exceeding GBP1.00 for

each aggregate holding of Deferred Shares so purchased. The

Directors consider the Deferred Shares, so created, to be of no

economic value.

The Articles have been amended, inter alia, to reflect the

creation of the Deferred Shares and to set out the rights attaching

to them and, accordingly, Resolution 9 in the notice of General

Meeting seeks approval to adopt the New Articles of the Company

reflecting, inter alia, these changes.

No share certificates will be in issued in respect of the

Deferred Shares. Existing share certificates will remain valid for

the Redenominated Ordinary Shares.

The New Ordinary Shares will be freely transferable and

application will be made for the New Ordinary Shares to be admitted

to trading on AIM. The record date for the Capital Reorganisation

is 5.00 p.m. on 30 November 2015, unless otherwise agreed by the

Board.

The rights attaching to the New Ordinary Shares will be

identical in all respects to those of the Existing Ordinary

Shares.

One consequence of the Capital Reorganisation is that

Shareholders holding fewer than 20 Existing Ordinary Shares will

receive no New Ordinary Shares, they will, however, receive

Deferred Shares.

8. Related Party Transactions

8.1. Placing Commission

PrimaryBid is a trading name of PrimaryBid Limited which is

wholly owned by Darwin Strategic Limited which is regulated and

authorised by the FCA.

Pursuant to the Placing, the Company will pay to PrimaryBid

Limited a commission of 4.5 per cent. of the gross proceeds of the

Placing (the "Commission"). PrimaryBid is acting as a broker for

this transaction.

Darwin Strategic is an investment held by funds managed by

Henderson. Funds managed by Henderson are themselves substantial

shareholders in Ascent, holding in aggregate 10.7 per cent. of the

voting rights of the Company and as such are considered to be a

related party of the Company for the purpose of the AIM Rules.

Darwin Strategic is therefore also a related party of the Company

for the purpose of the AIM Rules. The payment of the Commission to

Darwin Strategic therefore constitutes a related party transaction

pursuant to AIM Rule 13. The Independent Directors of the Company,

having consulted with the Company's nominated adviser, finnCap,

consider that the terms of the payment of the Commission to

PrimaryBid are fair and reasonable insofar as the Company's

shareholders are concerned.

8.2. Second Supplemental Loan Note Instruments

The approval by Henderson as a substantial shareholder of the

Company of the amendments contained in the Second Supplemental Loan

Note Instruments by Henderson, constitutes a related party

transaction for the purposes of AIM Rule 13.

The Independent Directors, having consulted with the Company's

nominated adviser, finnCap, consider that the amended Loan Note

Instruments are fair and reasonable insofar as the Company's

shareholders are concerned.

9. Settlement and dealings

Application will be made to the London Stock Exchange for the

New Ordinary Shares to be admitted to trading on AIM. It is

expected that such Admission will become effective in accordance

with Rule 6 of the AIM Rules and that dealings will commence at

8.00 a.m. on 1 December 2015.

10. General Meeting

Set out at the end of the Circular is a notice convening a

General Meeting of the Company to be held at 2.00p.m. on 30

November 2015 at the offices of finnCap, 60 New Broad Street,

London, EC2M 1JJ, at which the Resolutions will be proposed.

The Resolutions:

(a) approve the subdivision of the entire issued share capital

of the Company into redenominated ordinary shares and deferred

shares;

(b) approve the consolidation of the redenominated ordinary

shares;

(c) grant authority to the Directors under section 551 of the

Act, to allot relevant securities in relation to the issue of the

Placing Shares;

(d) grant authority to the Directors under section 551 of the

Act, to allot relevant securities in relation to the conversion of

the Loan Notes;

(e) grant authority to the Directors under section 551 of the

Act, to allot relevant securities in relation to the issue of

equity securities up to an aggregate nominal amount of

GBP600,000;

(f) empower the Directors, pursuant to section 570 of the Act,

to dis-apply the statutory pre-emption rights in relation to the

allotment of equity securities to allow the issue of the Placing

Shares;

(g) empower the Directors, pursuant to section 570 of the Act,

to dis-apply the statutory pre-emption rights in relation to the

allotment of equity securities to allow the conversion of the Loan

Notes;

(h) empower the Directors, pursuant to section 570 of the Act,

to dis-apply the statutory pre-emption rights in relation to the

allotment of equity securities up to an aggregate nominal amount of

GBP600,000;

(i) approve the adoptions of the New Articles.

11. Action to be taken in respect of the General Meeting

Please check that you have received the following with the

Circular:

-- a Form of Proxy for use in respect of the General Meeting; and

-- a reply-paid envelope for use in connection with the return

of the Form of Proxy (in the UK only).

Whether or not you propose to attend the General Meeting in

person, you are strongly encouraged to complete, sign and return

your Form of Proxy in accordance with the instructions printed

thereon as soon as possible, but in any event so as to be received,

by post at Computershare Investor Services PLC, The Pavilions,

Bridgwater Road, Bristol, BS99 6ZY or, during normal business hours

only, by hand, at Computershare Investor Services PLC, The

Pavilions, Bridgwater Road, Bristol, BS13 8AE by no later than 2.00

p.m. on 26 November 2015 (or, in the case of an adjournment of the

General Meeting, not later than 48 hours before the time fixed for

the holding of the adjourned meeting).

This will enable your vote to be counted at the General Meeting

in the event of your absence. The completion and return of the Form

of Proxy will not prevent you from attending and voting at the

General Meeting, or any adjournment thereof.

12. Recommendation

Having made a concerted effort over recent months to attract

investment into the Company and having held discussions with a

number of potential investors whose offers were less attractive

than those put forward by the Placees, the Directors believe that

they have secured the most favourable financing available to the

Company at the current time.

The Directors intend to vote in favour of the Resolutions in

respect of their aggregate shareholdings of 269,500 Ordinary Shares

representing approximately 0.2 per cent. of the Company's Existing

Issued Share Capital.

(MORE TO FOLLOW) Dow Jones Newswires

November 12, 2015 02:00 ET (07:00 GMT)

ADMISSION STATISTICS

Issue Price per New Ordinary Share under the Placing 1.0 pence

(post Capital Reorganisation)

Number of Existing Ordinary Shares in issue 1,737,110,763

Number of ordinary shares of 0.01 pence post Subdivision

pre-Consolidation(1) 1,737,110,763

Number of Deferred Shares of 0.09 pence post Subdivision(1) 1,737,110,763

Number of New Ordinary Shares of 0.2 pence post

Consolidation(1) 86,855,538

Total amount outstanding on 2013 CLNs including GBP5,825,819

accrued interest

Total amount outstanding on 2014 CLNs including GBP6,226,870

accrued interest

Number of Placing Shares 70,350,000

Additional draw down under the Henderson Facility GBP296,500

(4)

Maximum number of New Ordinary Shares in issue

immediately following Admission(2),(3) 157,205,538

Market capitalisation of the Company at Admission GBP1,572,055

at the Issue Price(2),(3)

Maximum percentage of enlarged issued share capital

represented by the Placing Shares immediately following

Admission(2),(3) 44.8%

Maximum gross proceeds receivable by the Company GBP703,500

under the Placing(2)

Estimated maximum net proceeds receivable by the GBP671,843

Company under the Placing(2)

Ordinary Share ISIN pre General Meeting GB00B03W6Y84

Ordinary Share SEDOL pre General Meeting B03W6Y8

New Ordinary Share ISIN post General Meeting GB00BZ16J374

New Ordinary Share SEDOL post General Meeting BZ16J37

AIM TIDM AST

Notes:

1. Assuming the Resolutions are passed at the General Meeting

2. Assuming all of the Placing Shares are issued under the Placing.

3. Excluding Loan Notes

4. The Placing is conditional on the total of the Placing plus

draw-downs under the Henderson facility totalling GBP1 million.

This includes GBP100,000 advanced on 3 November 2015

DEFINITIONS

"2013 CLNs" or "2013 Convertible the 4,948,708 convertible loan

Loan Notes" notes of GBP1 each on which

interest of GBP877,111 had accrued

to 31 January 2014 which are

convertible into 1,000 Ordinary

Shares or repayable on 19 November

2015, and were issued on the

terms of the 2013 Convertible

Loan Note Instrument and which

include the Incentive Loan Notes

"2013 Convertible Loan Note the convertible loan note instrument

Instrument" dated 23 December 2012 pursuant

to which the 2013 Convertible

Loan Notes were originally constituted

"2014 CLNs" or "2014 Convertible the 6,038,240 convertible loan

Loan Notes" notes of GBP1 each on which

GBP188,630 interest had accrued

to 23 December 2014 which are

convertible into 1,000 Ordinary

Shares or are repayable on 19

November 2015 and which include

the GBP2,038,241 loan notes

issued to EnQuest PLC under

the terms of the debt conversion

agreed on 7 July 2015

"2014 Convertible Loan Note the convertible loan note instrument

Instrument" dated 3 February 2014 pursuant

to which the 2014 Convertible

Loan Notes were originally constituted

"Act" the Companies Act 2006, as amended

from time to time

"Admission" admission of the Placing Shares

to trading on AIM becoming effective

in accordance with the AIM Rules

"AIM" the market of that name operated

by the London Stock Exchange

"AIM Rules" the AIM rules for Companies

published by the London Stock

Exchange from time to time

"Articles" the articles of association

of the Company prior to the

Capital Reorganisation

"Capital Reorganisation" together, the Subdivision and

the Consolidation

"certificated form" or "in certificated an ordinary share recorded on

form" a company's share register as

being held in certificated form

(namely, not in CREST)

"Circular" the Circular containing information

about the Proposals and the

General Meeting

"Closing Price" the closing middle market quotation

of a share as derived from the

AIM Appendix to the Daily Official

List of the London Stock Exchange

"Company" or "Ascent" Ascent Resources plc

"Computershare" Computershare Investor Services

PLC

"Consolidation" following the Subdivision, the

consolidation of every 20 Redenominated

Ordinary Shares into one New

Ordinary Share

"CREST" the relevant system (as defined

in the Uncertificated Securities

Regulations 2001) in respect

of which Euroclear is the operator

(as defined in those regulations)

"CREST Manual" the rules governing the operation

of CREST, consisting of the

CREST Reference Manual, Crest

International Manual, CREST

Central Counterparty Service

Manual, CREST Rules, Registrars

Service Standards, Settlement

Discipline rules, CREST Courier

and Sorting Services Manual,

Daily Timetable, CREST Application

Procedures and CREST Glossary

of Terms (all as defined in

the CREST Glossary of Terms

promulgated by Euroclear on

15 July 1996, as amended) as

published by Euroclear

"Darwin Strategic" Darwin Strategic Limited, a

company regulated and authorised

by the FCA

"Deferred Shares" the deferred shares of 0.09

pence each in the capital of

the Company immediately following

the Subdivision, having the

rights set out in the New Articles

"Directors" or "Board" the directors of the Company

as at the date of the Circular

whose names and functions are

set out on page 9 of the Circular,

or any duly authorised committee

thereof

"Euroclear" Euroclear UK & Ireland Limited

"EU" the European Union

"Existing Ordinary Shares" the Ordinary Shares in issue

at the date of the Circular

"Existing Issued Share Capital" 1,737,110,763 Ordinary Shares

"FCA" the UK Financial Conduct Authority

"finnCap" finnCap Ltd, the Company's nominated

adviser and broker

(MORE TO FOLLOW) Dow Jones Newswires

November 12, 2015 02:00 ET (07:00 GMT)

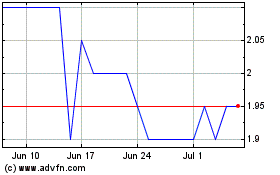

Ascent Resources (LSE:AST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Apr 2023 to Apr 2024