TIDMAST

RNS Number : 0252S

Ascent Resources PLC

28 September 2017

28 September 2017

Ascent Resources plc

("Ascent" or the "Company")

Interim results for the period ended 30 June 2017

Ascent Resources plc, the AIM quoted European oil and gas

exploration and production company is pleased to report its interim

results for the six months ended 30 June 2017.

Highlights:

-- Recompletion and flow testing of well Pg-10.

-- Construction of the new pipeline connection at MRS Lendava

(land acquired by Ascent from Trameta in July 2016) required to

export gas production to Croatia.

-- Refurbishment of separation equipment at the existing CPP (a

gas separation facility) owned and operated by our partner Petrol

Geoterm.

-- Raised GBP2,988,000 through a successful Placing on the

PrimaryBid platform which allowed private and other investors the

opportunity to participate on equal terms.

-- Reduction in debt of almost GBP6 million through loan note conversions.

Post Period Highlights:

-- Recompletion of well Pg-11A

-- Company poised to commence supplying gas to INA

-- Further loan note conversions of GBP2.3 million which has

virtually eliminated convertible loan notes from the balance sheet,

debt down to less than GBP50K.

Colin Hutchinson, CEO of Ascent, commented:

"2017 has been a transformational year for the Company and

probably the most successful in its history. We have begun selling

gas, reported revenues for the first time since 2013 and are now

virtually debt free. The Company is now in a strong position to

look to expand our operations into new territories and face the

future with increased optimism."

Enquiries:

Ascent Resources plc

Clive Carver, Chairman

Colin Hutchinson, CEO 0207 251 4905

WH Ireland Limited

James Joyce / Alex Bond 0207 220 1666

Yellow Jersey

Tim Thompson

Harriet Jackson

Henry Wilkinson 0203 735 8825

Chairman's statement

The period under review and subsequently has been probably the

most successful in the Company's history.

We achieved first gas selling to local customers from our Pg-10

well in April 2017.

During the first half of the year we refurbished infrastructure

and installed pipeline connections to facilitate the export of gas

to Croatia under the gas sales agreement signed in July 2016.

Following recompletion work we brought on stream our second well

Pg-11A in September 2017.

We are now poised to commence supplying gas to INA and are

waiting only on a final approval from one of the Croatian

ministries.

Additionally, over the past 18 months we have dramatically

improved our balance sheet via conversion of almost GBP12 million

of loan notes leaving less than GBP50,000 of outstanding

convertible debt.

The impact of the above successes has been to transform the

company from a pre-income explorer into a cash positive producer,

which has inevitably led to a rerating of our shares.

The future

In the coming months, we look forward to updating the market

with news of the IPPC permit, which is again with the Slovenian

Administrative Court. We await yet further confirmation from the

Slovenian regulatory system that all is fine with our plans for the

Petišovci gas field. We also note that it is only the refusal by a

single environmental protestor to accept the several previous

regulatory rulings that is delaying the progress of the project to

the detriment of the Slovenian state. In the meantime, we will

intend to sell our untreated gas to INA in Croatia.

Our successes now allow us to consider both the future

development of both the Petišovci gas field and investments in

other projects from a position of strength compared to previous

periods.

We again thank our shareholders and partners for their continued

support.

Clive Carver

Non-executive Chairman

CEO's report

The first half of the year saw Ascent Resources move from an

exploration company to a production company after ten years of

operation in Slovenia. Bringing Pg-10 and then Pg-11A into

production were momentous events. We have also completed the

necessary infrastructure refurbishment at the CPP and work on the

export pipeline; and we now look forward to the imminent

commencement of export sales.

During the period under review and subsequently there have been

a series of significant developments:

Recompletion of well Pg-10

In January 2017, we finalised the recompletion work on the first

of two wells, Pg-10, and perforated the production tubing at a

depth of 3,102 metres. The well was subsequently tested and a

maximum stabilised flow rate of 249,000 cubic metres (8.8MMscfd)

was achieved on a 12mm choke. The well was subsequently shut in

while it was connected to infrastructure.

Recompletion of well Pg-11A

The workover at Pg-11A started in April 2017 and was completed

in August 2017. The work consisted of an operation to remove and

replace a section of the production tubing and install production

well head equipment. The operation took longer than anticipated

after a wireline tool became stuck in the tubing during the final

procedures to remove the bottom hole plug. We commenced the sale of

gas from Pg-11A in September 2017.

Construction of flow lines

The 500metre flowline between well Pg-10 and the existing

separating station (CPP) which is owned by our partner Petrol

Geoterm, was laid during January 2017 and connected to well Pg-10

once the flow test had been completed in March 2017.

The 40metre flowline between well Pg-11A and the production line

which runs to the CPP was completed during June 2017 and connected

to well Pg-11A once the workover had been completed.

Refurbishment of the CPP

In order to produce gas for export it was necessary to refurbish

certain infrastructure in the CPP. The main work involved

installing a replacement separator, sufficient for the increased

pressures and flow rates expected on the export line. This work was

completed in July 2017 and the replacement separator is capable of

processing 240,000 cubic metres per day (8.5MMscfd).

Connection and certification of the export pipeline

The 8" export line which runs from the land at MRS Lendava owned

by our 100% owned subsidiary, Trameta, to the field operated by INA

at Medjimurje in Croatia was pressure tested and certificated by

the Slovenian authorities in November 2016.

The 6" production pipeline which runs from the CPP past MRS

Lendava was refurbished and recertified during the period under

review. At the same time, the surface infrastructure required to

clean and maintain the pipeline was installed at MRS Lendava.

Following the work on the production pipeline, the connection

between the two lines was installed and tested and an operational

certificate issued by the Slovenian authorities.

Finally, in July 2017, the Croatian authorities reviewed the

application from our partner, INA, to recertify the pipeline on

their side of the border, which INA have advised they expect to

receive imminently.

Once operational, the export pipeline could accommodate daily

production of over 800,000 cubic metres per day (28MMscfd).

Commencement of production

In April 2017, the Joint Venture commenced production from well

Pg-10 which was sold locally to industrial customers after

separation at the CPP. The revenues for the period to 30 June 2017

were EUR180,644 (GBP154,000). In total 1,113,217 cubic metres

(39,313Mcf) of gas and 24,992 litres (157 barrels) of condensate

were sold during the period. Average daily production for the

period was 84boepd.

Whilst the volumes and revenues are modest in the context of our

long-term plans for the project, commencing production after ten

years of operations in Slovenia was a hugely significant

milestone.

Supply under the INA contract is expected to commence shortly,

once the final Croatian ministerial approval has been received.

The terms of the INA contract set an upper and lower limit on

production calculated in megawatt hours (MwH). For the first two

months, these translate into a range of 58,182 to 77,577 cubic

metres per day; which based on the average rates over the last

twelve months would generate revenue to Ascent of between

EUR220,000 and EUR290,000 per month. In the subsequent ten months

of the contract the range is 63,031 to 82,425 cubic metres per day;

which based on the average rates over the last twelve months would

generate revenue to Ascent of between EUR240,000 and EUR310,000 per

month. Production at these levels, and average rates remaining

reasonably stable over the period, will make the Company profitable

at an EBITDA level and generate positive operating cash flow.

The contract provides for the maximum level to be increased

following the agreement of both parties and the infrastructure has

been constructed and refurbished in such a way as to allow for

production to be increased.

Financial performance

The financial highlights for the period are the reporting of

revenues for the first time since 2013 and the significant

reduction of debt which has reduced to less than GBP50,000 since

the end of the period.

-- Revenues for the period of GBP154,000 were wholly derived

from hydrocarbon sales in Slovenia as discussed above.

-- An additional charge of GBP115,000 was made to cost of sales

bring the gross margin to zero as production during the period is

considered 'test' production.

-- The loss from operating activities during the period

increased on the comparable period in 2016 by GBP105,000 to

GBP781,000 as a result of the increase in activities required to

bring the field into production.

-- The loss before tax reduced by GBP265,000 to GBP1,079,000 as

the result of the reduced finance costs on loan notes following

early conversion.

-- Borrowings have reduced by GBP7 million over the past 12

months and by nearly GBP4 million since the beginning of the year.

Further conversions since the end of the period have reduced the

amount of outstanding notes to less than GBP50,000.

-- Raised GBP2,988,000 before costs in equity during February

2017 through a heavily subscribed offer through the PrimaryBid

platform which ensured the maximum practical access to the

offering.

Outlook

2017 has been a transformative year so far for the Company. We

look forward to the continued development of the Petišovci field.

Wells Pg-10 and Pg-11A are intended to prove the commerciality of

the field and the significant reserves and resources contained

within.

While we anticipate receiving the IPPC permit to construct our

own processing facility in due course this is no longer as

important to the Company. We have refurbished the existing

infrastructure to give ourselves room to grow independent of the

IPPC Permit.

Additionally, as the Company is now generating revenue and is

virtually debt free, we are in a strong position to look to expand

our operations into new territories.

Consolidated Income Statement

for the Period ended 30 June 2017

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

Notes GBP '000s GBP '000s GBP '000s

Revenue 154 - -

Cost of sales (154) - -

----------- ----------- ------------

Gross profit - - -

Administrative expenses 2 (921) (676) (1,888)

Loss from operating activities (921) (676) (1,888)

Finance income 3 7 153 159

Finance cost 3 (305) (821) (1,453)

----------- ----------- ------------

Net finance costs (298) (668) (1,294)

Loss before taxation (1,219) (1,344) (2,676)

Income tax expense - - -

----------- ----------- ------------

Loss for the period (1,219) (1,344) (2,676)

Loss per share

Basic & fully diluted

loss per share (Pence)

* 4 0.08 0.52 0.49

Consolidated Statement of Comprehensive Income

for the Period ended 30 June 2017

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Loss for the period (1,219) (1,344) (2,676)

Other comprehensive income

Foreign currency translation

differences for foreign

operations 500 2,293 2,997

Total comprehensive gain

/ (loss) for the period (719) 949 321

Consolidated Statement of Changes in Equity

for the Period ended 30 June 2017

Share

based

Share Share Equity payment Translation Accumulated

capital premium reserve reserve reserve losses Total

GBP GBP GBP GBP GBP

'000s GBP '000s '000s '000s '000s '000s GBP '000s

Balance at 1 January 2016 1,878 56,693 1,572 483 (2,805) (37,147) 20,674

Loss for the period - - - - - (1,344) (1,344)

Currency translation

differences - - - - 2,293 - 2,293

Total comprehensive income - - - - 2,293 (1,344) 949

Conversion of loan notes 565 2,260 (369) - - 369 2,825

Issue of shares during

the period net of costs 405 1,010 - - - - 1,415

Share-based payments and

expiry of options - - - 83 - - 83

Balance at 30 June 2016 2,848 59,963 1,203 566 (512) (38,122) 25,946

------------------------------- --------- ---------- --------- --------- ------------ ------------ ----------

Balance at 1 January 2016 1,878 56,693 1,572 483 (2,805) (37,147) 20,674

Loss for the period - - - - - (2,676) (2,676)

Currency translation

differences - - - - 2,997 - 2,997

Total comprehensive income - - - - 2,997 (2,676) 321

Acquisition of Trameta - - - 1,103 - - 1,103

Extinguishment of convertible

loan notes - - (1,572) - - 1,572 -

Extension of convertible

loan notes - - 2,787 - - - 2,787

Issue of convertible loan

notes - - 360 - - - 360

Conversion of loan notes 749 2,996 - - - - 3,745

Issue of shares during

the period net of costs 1,105 3,584 - - - - 4,689

Share-based payments and

expiry of options - - - 94 - 94 188

Balance at 31 December

2016 3,732 63,273 3,147 1,680 192 (38,157) 33,867

------------------------------- --------- ---------- --------- --------- ------------ ------------ ----------

Balance at 1 January 2017 3,732 63,273 3,147 1,680 192 (38,157) 33,867

Loss for the period - - - - - (1,219) (1,194)

Currency translation

differences - - - - 500 - 500

Total comprehensive income - - - - 500 (1,219) (1,008)

Conversion of loan notes 813 3,259 (1,826) - - 1,826 4,072

Issue of shares during

the period net of costs 323 2,503 - - - - 2,826

Share-based payments - - - 102 - - 102

Balance at 30 June 2017 4,868 69,035 1,321 1,782 692 (37,550) 40,418

------------------------------- --------- ---------- --------- --------- ------------ ------------ ----------

Consolidated Statement of Financial Position

As at 30 June 2017

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

GBP GBP

Assets Notes '000s '000s GBP '000s

Non-current assets

Property, plant and equipment 4 4 4

Exploration and evaluation

costs 5 40,024 35,214 37,541

---------- ---------- ------------

Total non-current assets 40,028 35,218 37,545

Current assets

Trade and other receivables 556 23 32

Cash and cash equivalents 2,708 860 3,153

---------- ---------- ------------

Total current assets 3,073 883 3,185

Total assets 43,236 36,101 40,730

========== ========== ============

Equity and liabilities

Share capital 7 4,868 2,848 3,732

Share premium account 7 69,035 59,963 63,273

Equity reserve 1,321 1,203 3,147

Share-based payment reserve 1,782 566 1,680

Translation reserves 692 (512) 192

Accumulated losses (37,550) (38,122) (38,157)

---------- ---------- ------------

Total equity 40,148 25,946 33,867

---------- ---------- ------------

Non-current liabilities

Borrowings - - 6,162

Provisions 460 434 447

Total non-current liabilities 460 434 6,609

Current liabilities

Trade and other payables 292 297 254

Borrowings 6 2,392 9,424 -

Total current liabilities 2,684 9,721 254

Total liabilities 3,144 10,155 6,863

---------- ---------- ------------

Total equity and liabilities 43,292 36,101 40,730

========== ========== ============

Consolidated Statement of Cash Flows

for the six months ended 30 June 2017

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Cash flows from operations

Loss after tax for the

period (1,219) (1,344) (2,676)

Adjustment related to

test production 115 - -

Decrease/ (increase) in

receivables (524) 38 29

Increase / (Decrease)

in payables 38 (211) (252)

Increase in share based

payments 102 83 188

Exchange differences (23) (8) 1

Finance income (7) (153) (159)

Finance cost 305 821 1,453

Net cash used in operating

activities (1,213) (774) (1,416)

---------- ---------- -------------

Cash flows from investing

activities

Interest received - - 1

Payments for fixed assets - - (1)

Payments for investing

in exploration (2,062) (158) (677)

Disposal / (Purchase)

of property, plant and

equipment - (1) -

Net cash used in investing

activities (2,062) (159) (677)

---------- ---------- -------------

Cash flows from financing

activities

Interest paid and other

finance fees (2) - (73)

Proceeds from loans - 350 1,400

Loan issue costs - (6) (800)

Proceeds from issue of

shares 2,988 1,455 4,999

Share issue costs (162) (40) (311)

Net cash generated from

financing activities 2,824 1,759 5,215

---------- ---------- -------------

Net increase in cash and

cash equivalents for the

period (445) 826 3,122

Effect of foreign exchange

differences 6 2 (1)

Cash and cash equivalents

at beginning of the period 3,153 32 32

Cash and cash equivalents

at end of the period 2,708 860 3,153

========== ========== =============

1. Accounting Policies

Reporting entity

Ascent Resources plc ('the Company') is a company domiciled in

England. The address of the Company's registered office is 5 New

Street Square, London EC4A 3TW. The unaudited consolidated interim

financial statements of the Company as at 30 June 2017 comprise the

Company and its subsidiaries (together referred to as the

'Group').

Basis of preparation

The interim financial statements have been prepared using

measurement and recognition criteria based on International

Financial Reporting Standards (IFRS and IFRIC interpretations)

issued by the International Accounting Standards Board (IASB) as

adopted for use in the EU. The interim financial information has

been prepared using the accounting policies which will be applied

in the Group's statutory financial statements for the year ended 31

December 2017 and were applied in the Group's statutory financial

statements for the year ended 31 December 2016.

All amounts have been prepared in British pounds, this being the

Group's presentational currency.

The interim financial information for the six months to 30 June

2017 and 30 June 2016 is unaudited and does not constitute

statutory financial information. The comparatives for the full year

ended 31 December 2016 are not the Group's full statutory accounts

for that year. The information given for the year ended 31 December

2016 does not constitute statutory financial statements as defined

by Section 435 of the Companies Act. The statutory accounts for the

year ended 31 December 2016 have been filed with the Registrar and

are available on the Company's web site www.ascentresources.co.uk.

The auditors' report on those accounts was unqualified. It did not

contain a statement under Section 498(2)-(3) of the Companies Act

2006.

During the period, the Group has generated revenue from test

production on well Pg-10. There has been a credit to costs of sales

of GBP115,000 begin the gross margin on production which has been

recorded against capitalised exploration costs.

Going Concern

The Financial Statements of the Group are prepared on a going

concern basis. Provided that the INA contract proceeds as

anticipated the Directors consider the Company has sufficient cash

to fund its current obligations for at least the next 12

months.

Principal Risks and Uncertainties:

The principal risks and uncertainties affecting the business

activities of the Group remain those detailed on pages 46-48 of the

Annual Review 2016, a copy of which is available on the Company's

website at www.ascentresources.co.uk.

2. Operating loss is stated after charging

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Employee costs 449 277 560

Share based payment charge 102 83 188

Foreign Exchange differences - (1) -

Included within Admin

Expenses

Audit Fees 31 25 60

Fees payable to the company's

auditor other services - - 2

----------- ----------- ------------

31 25 62

3. Finance income and costs recognised in loss

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Finance income

Income on bank deposits - - -

Foreign exchange movements

realised 7 - 6

Other income - 153 153

7 153 159

=========== =========== ============

Finance cost

Interest payable on borrowings - (32) (51)

Accretion charge on loan

notes (303) (782) (1,380)

Bank Charges (2) (8) (16)

Foreign exchange movements

realised - 1 (6)

(305) (821) (1,453)

=========== =========== ============

The liability of GBP153,000 written off as other income

represented a creditor dating back more than five years which the

Company no longer deems to be payable.

Convertible loan notes were restructured during the prior

periods and a full commentary is contained within the audited

financial statements for the year ended 31 December 2016 and are

available at www.ascentresources.co.uk.

4. Loss per share

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Result for the period

Total loss for the period

attributable to equity

shareholders 1,219 1,344 2,676

Weighted average number

of ordinary shares Number Number Number

For basic earnings per

share 1,580,679,071 258,096,858 544,270,848

Loss per share (Pence) 0.08 0.52 0.49

5. Exploration and Evaluation Costs

Slovenia

Exploration Costs &Total

Cost

At 1 January 2016 32,711

Additions 144

Effects of exchange rate

movements 2,345

At 30 June 2016 35,200

---------

At 1 July 2016 35,200

Additions 1,635

Effects of exchange rate

movements 706

At 31 December 2016 37,541

---------

At 1 January 2017 37,541

Additions 2,073

Adjustment related to

test production (115)

Effects of exchange rate

movements 536

At 30 June 2017 40,024

---------

Carrying value

At 30 June 2017 40,024

---------

At 31 December 2016 37,541

---------

At 30 June 2016 32,711

---------

6. Borrowings

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Current

Short term loan facility - 838 -

Convertible loan notes 2,392 8,586 6,162

2,392 9,424 6,162

---------- ---------- ------------

30 June 30 June 31 December

Convertible Loan Notes 2017 2016 2016

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Liability brought forward 6,162 10,778 10,778

Interest expense 303 786 1,380

Conversion loan notes (4,073) (2,825) (3,745)

Modification to convertible

loan notes - derecognition

Nov 2016) - - (8,140)

Modification to convertible

loan notes - recognition

of amended loan notes

(Nov 2016) - - 5,352

Fair value of new convertible

loan notes issued (Nov

2016) - - 690

Other movements - (153) (153)

Liability carried forward 2,392 8,586 6,162

---------- ---------- ------------

7. Share Capital

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

GBP

GBP '000s '000s GBP '000s

Allotted, called up and

fully paid

Ordinary shares of 0.20

pence each 4,868 2,848 1,878

Reconciliation of share

capital movement Number Number Number

At 1 January 1,084,074,224 157,306,900 157,306,900

-------------- ------------ --------------

Placing of ordinary shares 161,500,000 202,380,960 552,281,987

Conversion of loan notes 590,046,319 282,542,511 374,485,337

At end of period 1,835,620,543 642,230,371 1,084,074,224

============== ============ ==============

Equity raised

On 14 February 2017, the Company raised GBP2,987,750

(GBP2,825,863 net of costs) via a Placing of 161,500,000 Ordinary

Shares through the PrimaryBid.com platform.

The Company also raised funds through placings during the prior

year:

-- On 12 April 2016, the Company raised GBP500,000 (GBP477,500

net of costs) via the Placing of 35,714,285 Ordinary Shares with

investors using the PrimaryBid.com platform.

-- On 7 June 2016, the Company raised GBP500,000 (GBP477,500 net

of costs) via the Placing of 83,333,333 Ordinary Shares with

investors using the PrimaryBid.com platform.

-- On 15 June 2016, the Company raised GBP500,000 (GBP500,000

net of costs) via the Placing of 83,333,333 Ordinary Shares to

Henderson Global Investors.

-- On 31 October 2016, the Company raised GBP2,627,500

(GBP2,402,434 net of costs) via the Placing of 262,750,000 Ordinary

Shares.

-- On 7 November 2016, the Company raised GBP871,510 (GBP871,510

net of costs) via the Placing of 87,151,027 Ordinary Shares to

Henderson Global Investors.

Loan note conversions

Over the course of the period a total of 590,076,850 shares were

issued as a result of loan note conversions. In total GBP5,900,769

of liabilities were converted into equity. This is the cash value

of the loan notes which is lower than the accounting value in Note

6 which had been discounted to net present value.

During 2016 a total of 374,485,337 shares were issued as a

result of loan note conversions. In total GBP3,744,853 of

liabilities were converted into equity.

Loan notes converted Shares issued

including accrued

interest

-----------

2016 2017 2016 2017

----------- ----------- ---------- ------------ ------------

January 0 0 0 0

February 0 2,652,107 0 265,210,704

March 0 1,597,018 0 159,701,787

April 1,088,390 1,581,609 108,838,990 158,160,880

May 463,113 69,709 46,311,258 6,970,931

June 1,273,923 325 127,392,263 32,548

July 0 0

August 845,053 84,505,321

September 563 56,312

October 0 0

November 73,455 7,345,491

December 357 35,702

3,744,853 5,900,769 374,485,337 590,076,850

----------- ----------- ---------- ------------ ------------

8. Events subsequent to the end of the reporting period

There were GBP3,018,831 of loan note principal converted during

July 2017 into 311,713,705 Ordinary Shares. As at 26 July 2017 all

of the loan notes issued to Henderson Global Investors

(subsequently Lombard Odier) have been converted in full. The

balance of GBP49,423 (including rolled up interest) is held by

other investors.

On 4 August 2017, the Company announced that all of the

infrastructure required to produce to INA had been installed and

the new infrastructure was being used for local production.

On 7 September 2017, the Company announced that well Pg-11a had

been successfully recompleted and production would begin on 8

September 2017 to be sold locally.

DIRECTORS AND ADVISERS

Directors Clive Nathan Carver

Colin Hutchinson

William Cameron Davies

Nigel Sandford Johnson Moore

Secretary Colin Hutchinson

Registered Office 5 New Street Square

London EC4A 3TW

Nominated Adviser WH Ireland Corporate Brokers

& Broker

24 Martin Lane

London EC4R 0DR

WH Ireland Corporate Brokers

Auditors BDO LLP

55 Baker Street

London W1U 7EU

Solicitors Taylor Wessing LLP

5 New Street Square

London EC4A 3TW

Bankers Barclays Corporate Banking

1 Churchill Place

London E14 5HP

Share Registry Computershare Investors Services

plc

The Pavilions

Bridgwater Road

Bristol BS13 8AE

IR & PR Yellow Jersey PR Limited

30 Stamford Street

London SE1 9LQ

Company's registered

number 05239285

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAXNXAELXEFF

(END) Dow Jones Newswires

September 28, 2017 02:02 ET (06:02 GMT)

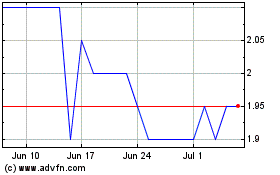

Ascent Resources (LSE:AST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Apr 2023 to Apr 2024