TIDMAST

RNS Number : 6114A

Ascent Resources PLC

30 September 2015

Ascent Resources plc / Epic: AST / Index: AIM / Sector: Oil and

Gas

Ascent Resources plc

("Ascent" or "the Company")

Interim results for the period ended 30 June 2015

Ascent presents its unaudited results for the six months ended

30 June 2015.

Introduction

Good progress was made during the period under review on

acquiring the permits required to develop the Petišovci gas field

in Slovenia ("the Petišovci Project"). The Integrated Pollution

Prevention ("IPPC Permit") was provisionally awarded to the Company

in June 2015 following a public consultation. However two parties

have subsequently filed appeals against the decision. These appeals

will be heard by the Environment Ministry in the first instance

with a potential further appeal through the courts. Whilst

guidelines for the duration of these appeals suggest they should be

completed within six to nine months, it is not possible to say with

certainty how long they will take.

In view of these further delays resulting from the appeals

process, a decision has been made by the Board, to make further

cuts in expenditure, and reduce amounts currently being incurred on

field development to a minimum from 1 October 2015.

In parallel with our efforts to secure the permits required to

produce gas into the Slovenian national grid, the Company is

exploring alternative routes to market for gas production which

would not require the IPPC Permit and which would require

significantly lower capital expenditure. Discussions are currently

in progress with third parties.

Petišovci Project

Background

Ascent has an interest in the Petišovci gas field in Slovenia

with its partner Geoenergo. Forty-two million euros have been spent

on the development of the field which could supply a significant

proportion of Slovenia's future gas requirements thereby reducing

its dependency on imported gas. In recognition of the key strategic

importance of the project, earlier this year the Slovenian

government designated Nafta Lendava, which holds an interest in the

concession through its shareholding in Geoenergo, as one of 21

important national assets. The preferred field development plan is

to install a gas gathering and separation station ("GGSS") to

reduce the carbon dioxide content of the gas to meet national gas

grid specifications, upgrade a metering station at the entry point

to the national grid and connect the wells via the GGSS to the

metering station.

IPPC Permit

Under Directives adopted by all EU Governments, the installation

of the GGSS requires an IPPC Permit. The application was completed

in July 2014 and submitted to the Environmental Agency ("ARSO") for

approval. The Agency approved the permit in December 2014 subject

to public consultation and in June 2015 it announced that,

following the completion of this consultation, the Permit had been

provisionally awarded subject to a statutory period for appeals. In

August 2015, the Company received formal notification that two

parties had lodged appeals to which Ascent submitted its responses

in August 2015. The appeals will be heard in the first instance by

the Environment Ministry with potentially a further appeal to the

courts if either of them is found to have substance.

Based on legal and informal advice received by the Board, it

remains firmly of the view that the required IPPC Permit will be

issued in final form. Slovenian government guidelines indicate that

the first appeal should take a maximum of three months and the

second an average of six months. If the decision has to be referred

to the Slovenian courts, the final permit may not be awarded until

sometime in 2016.

In view of the slow progress on the IPPC Permit post-provisional

award, the Company has decided to minimise expenditure until the

award is unconditional. In the meantime, negotiations are underway

to explore alternative routes to market for the gas.

In order to minimise expenditure while we wait for the IPPC

Permit the Company has decided to reduce its headcount in Slovenia,

terminate retained consultants and for Non-executive Directors to

defer fees.

Current Funding

In February 2015 the Company drew down the final GBP500,000

which remained undrawn on the 2014 convertible loan notes

("CLNs").

The variation of the terms of the 2013 and 2014 notes was

approved by shareholders and note holders on 19 February 2015. This

pushed out the redemption date to 19 November 2015 and in return

the conversion price on the notes was adjusted to 1,000 ordinary

shares for every GBP1 Loan note. Further details are included in

Note 6 below.

In May 2015 the Company agreed a GBP7 million facility with

Henderson Global Investors. Whilst the facility was not intended to

be used to cover delays in permitting, the Company agreed the

drawdown of the first GBP250,000 to fund its working capital

requirements in August and intends to make a further drawdown of

GBP100,000 in the next few days. The Company is presently reliant

on this facility to fund its working capital requirements with

drawdowns made solely at the discretion of Henderson.

The CLNs which were varied in February 2015 and the liabilities

to EnQuest are due for redemption on 19 November 2015.

Issues of equity

On 2 May 2015 the Company raised GBP550,000 (GBP525,250 net of

costs) through the placing (the "Placing") of 275,000,000 ordinary

shares in the capital of the Company at a price of 0.2p per

Ordinary Share with investors using the Primarybid.com platform.

PrimaryBid is a trading name of Darwin Strategic Limited which is

regulated and authorised by the Financial Conduct Authority

(FCA).

At the general meeting of shareholders on 3 September 2015,

shareholders voted to give the Directors the authority to issue a

further GBP1,500,000 nominal value of Ascent ordinary shares.

Other funding discussions

The Company has held discussions with a range of parties

interested in participating in a farm out. Discussions are well

advanced with several parties, the completion of which is likely to

be subject to either the IPPC Permit being issued in final form or,

failing that, an alternative method of transporting gas to market

is found.

The Company continues to have positive discussions with banks

who, following lengthy, technical due diligence, have expressed

firm interest in providing up to EUR20 million of debt funding to

the project. These funds would be available after the IPPC Permit

has been declared valid and additional equity investment has been

secured.

Board Changes

In line with the decision to limit expenditure management

changes were implemented with a view to conserving the Company's

cash until the IPPC Permit is awarded in final form or an

alternative is found.

As part of this process, Len Reece, Ascent's CEO for the past

three years, resigned as a director of the Company on 14 August

2015 and on 10 September the Company and Mr. Reece entered into a

settlement agreement to terminate his employment. Colin Hutchinson,

Finance Director, has become interim Chief Executive and with the

support of the Non-executive Directors will lead the day-to-day

activities of the Company.

The Board of Ascent would like to extend its thanks and

appreciation for Len's work in leading the Company over the past

three years. Len oversaw the move from a collection of disparate

assets spread over five countries to a focus on its prime Slovenian

asset. More recently he has been instrumental in moving the IPPC

Permit forwards. We wish Len well for the future.

Results for the period

The result for the period was a loss of GBP2,684,000 (2014:

GBP1,886,000)

Outlook

The attractions of the Petišovci Project remain strong: the

verified gas in place is significant and the proximity to

infrastructure means that once the permitting issue has been

resolved the project should move forward into production. The

decision in June 2015 to award the IPPC Permit provisionally was a

major step forward. The Board is advised that the current

challenges to that decision are unlikely to succeed and that the

IPPC will be unconditionally awarded at the end of the permitted

reviews and challenges. When this happens, the intended funding

from the banks or new financial partners should become available to

us.

During the past few months the Company and its partners have

been exploring the possibility of bringing their unprocessed gas to

market thereby bypassing the need for the IPPC Permit and the

capital expenditure associated with the required processing plant.

Whilst encouraging discussions are underway with a number of

parties, at the time of writing it is not possible to say with

certainty whether such arrangements will be concluded and a further

announcement will be made in due course.

Enquiries:

Ascent Resources plc 0207 251 4905

Clive Carver, Chairman

Colin Hutchinson, Interim CEO

finnCap Limited, Nominated Adviser 0207 220 0500

Christopher Raggett

Consolidated Income Statement

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:00 ET (06:00 GMT)

for the Period ended 30 June 2015

Six months Six months

ended ended

30 June 30 June

2015 Unaudited 2014 Unaudited

Notes GBP '000s GBP '000s

Continuing Operations

Administrative expenses (1,011) (1,105)

---------------- ----------------

Loss from operating activities (1,011) (1,105)

Finance income 1 2

Finance cost (1,674) (783)

---------------- ----------------

Net finance costs (1,673) (781)

Loss before taxation (2,684) (1,886)

Income tax expense - -

---------------- ----------------

Loss for the period (2,684) (1,886)

Basic & fully diluted loss

per share (pence) (0.17) (0.13)

Consolidated Statement of Comprehensive Income

for the Period ended 30 June 2015

Six months Six months

ended ended

30 June 30 June

2015 2014

Unaudited Unaudited

GBP '000s GBP '000s

Loss for the period (2,684) (1,886)

Other comprehensive income

Currency translation differences

on foreign operations (1,809) (752)

Total comprehensive loss for

the year (4,493) (2,638)

* Foreign currency translation differences from foreign

operations may be recycled through the income statement in the

future if certain conditions arise

Consolidated Statement of Changes in Equity

for the Period ended 30 June 2015

Share Share Equity Shares Share Translation Retained Total

Capital Premium reserve to based Reserve Earnings

be payment

issued reserve

Balance at

1 January 2014 1,451 55,833 518 84 1,896 (498) (34,171) 25,113

Comprehensive

expense

Loss for the

year - - - - - - (1,886) (1,886)

Other comprehensive

expense

Currency translation

differences - - - - - (752) - (752)

Total comprehensive

income - - - - - (752) (1,886) (2,638)

Transactions

with owners

Shares issued 8 76 - (84) - - - -

Issue of convertible

loan notes - - 91 - - - - 91

Share-based

payments and

expiry of options - - - - (1,040) - 1,113 73

--------

Balance at

30 June 2014 1,459 55,909 609 - 856 (1,250) (34,944) 22,639

Balance at

1 January 2014 1,451 55,833 518 84 1,896 (498) (34,171) 25,113

Comprehensive

income

Loss for the

year - - - - - - (5,623) (5,623)

Other comprehensive

income

Currency translation

differences - - - - - (1,248) - (1,248)

Total comprehensive

income - - - - - (1,248) (5,623) (6,871)

Transactions

with owners

Issue of convertible

loan notes - - 2,058 - - - - 2,058

Conversion

of loan notes - 2 - - - - - 2

Issue of shares

during the

year net of

costs 8 76 - (84) - - - -

Share-based

payments and

expiry of options - - - - (1,035) - 1,181 146

--------

Balance at

31 December

2014 1,459 55,911 2,576 - 861 (1,746) (38,613) 20,448

Balance at

1 January 2015 1,459 55,911 2,576 - 861 (1,746) (38,613) 20,448

Comprehensive

income

Loss for the

year - - - - - - (2,684) (2,684)

Other comprehensive

income

Currency translation

differences - - - - - (1,809) - (1,809)

Total comprehensive

income - - - - - (1,809) (2,684) (4,493)

Transactions

with owners

Issue of shares

during the

year net of

costs 275 250 - - - - - 525

Extinguishment

of convertible

loan notes - - (2,576) - - - 2,576 -

Extension of

convertible

loan notes - - 1,910 - - - - 1,910

Share-based

payments - - - - 73 - - 73

--------- --------- --------- -------- --------- ------------ ---------- --------

Balance at

30 June 2015 1,734 56,161 1,910 - 934 (3,555) (38,721) 18,463

Consolidated Statement of Financial Position

As at 30 June 2015

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Assets

Non-current assets

Property, plant and

equipment 2 2 2

Exploration and evaluation

costs 31,455 33,221 33,166

----------- ----------- ------------

Total non-current assets 31,457 33,223 33,168

Current assets

Trade and other receivables 142 88 98

Cash and cash equivalents 239 937 456

----------- ----------- ------------

Total current assets 381 1,025 554

Total assets 31,838 34,248 33,722

=========== =========== ============

Equity and liabilities

Share capital 1,734 1,459 1,459

Share premium account 56,161 55,911 55,911

Equity reserve 1,910 609 2,576

Share-based payment

reserve 934 856 861

Translation reserves (3,555) (1,250) (1,746)

Retained earnings (38,721) (34,944) (38,613)

Total equity 18,463 22,639 20,448

----------- ----------- ------------

Non-current liabilities

Provisions 370 420 410

Other non-current liabilities - 2,417 -

----------- ----------- ------------

Total non-current liabilities 370 2,837 410

Current liabilities

Trade and other payables 535 457 647

Borrowings 9,691 8,315 9,624

Other current liabilities 2,779 - 2,593

----------- ----------- ------------

Total current liabilities 13,005 8,772 12,864

Total liabilities 13,375 11,609 13,274

Total equity and liabilities 31,838 34,248 33,722

=========== =========== ============

Consolidated Statement of Cash Flows

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:00 ET (06:00 GMT)

for the six months ended 30 June 2015

Six months Six months Year

ended ended ended

30 June 30 June 30 December

2015 2014 2014

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Cash flows from operations

Loss before tax for

the year (2,684) (1,886) (5,623)

DD&A charge - 1 2

(Increase) / Decrease

in receivables (44) 22 12

(Decrease) / Increase

in payables (112) 49 238

Share-based payment

charge 73 73 146

Exchange differences 30 6 (42)

Finance income (1) (2) (3)

Finance cost 1,674 783 3,516

----------- ----------- -------------

Net cash flows from

operating activities (1,064) (954) (1,754)

Cash flows from investing

activities

Interest received 1 2 3

Payments for investing

in exploration (174) (389) (773)

Disposal of property,

plant & equipment - - (1)

----------- ----------- -------------

Net cash used in investing

activities (173) (387) (771)

Cash flows from financing

activities

Interest paid and other

finance fees (1) (55) (60)

Proceeds from loans 500 2,150 3,650

Loans repaid (1) - (761)

Loan issue costs - - (32)

Proceeds from issue 550 - -

of shares

Share issue costs (25) - -

----------- ----------- -------------

Net cash generated from

financing activities 1,015 2,095 2,797

Net increase in cash

and cash equivalents

for the year (214) 754 272

Effect of foreign exchange

differences (3) (1) -

Cash and cash equivalents

at beginning of the

year 456 184 184

----------- ----------- -------------

Cash and cash equivalents

at end of the year 239 937 456

=========== =========== =============

1. Accounting Policies

Reporting entity

Ascent Resources plc ('the Company') is a company domiciled in

England. The address of the Company's registered office is 5 New

Street Square, London EC4A 3TW. The unaudited consolidated interim

financial statements of the Company as at 30 June 2015 comprise the

Company and its subsidiaries (together referred to as the

'Group').

Basis of preparation

The interim financial statements have been prepared using

measurement and recognition criteria based on International

Financial Reporting Standards (IFRS and IFRIC interpretations)

issued by the International Accounting Standards Board (IASB) as

adopted for use in the EU. The interim financial information has

been prepared using the accounting policies which will be applied

in the Group's statutory financial statements for the year ended 31

December 2015 and were applied in the Group's statutory financial

statements for the year ended 31 December 2014.

All amounts have been prepared in British pounds, this being the

Group's presentational currency.

The interim financial information for the six months to 30 June

2015 and 30 June 2014 is unaudited and does not constitute

statutory financial information. The comparatives for the full year

ended 31 December 2014 are not the Group's full statutory accounts

for that year. The information given for the year ended 31 December

2014 does not constitute statutory financial statements as defined

by Section 435 of the Companies Act. The statutory accounts for the

year ended 31 December 2014 have been filed with the Registrar and

are available on the Company's web site www.ascentresources.co.uk.

The auditors' report on those accounts was unqualified and included

an emphasis of matter drawing attention to the importance of

disclosures made in the annual report regarding going concern. It

did not contain a statement under Section 498(2)-(3) of the

Companies Act 2006

Going Concern

The financial statements of the Group are prepared on a going

concern basis.

In July 2015 the Company drew GBP250,000 from a working capital

facility provided by Henderson. In order to continue to operate as

a going concern the Company is currently wholly reliant on this

facility. The Directors are pursuing a range of funding options,

including a strategic investor or a farm-in arrangement. The

Company is also wholly reliant on the support from shareholders to

meets its current liabilities as recorded in trade and other

payables, the majority of which are owed to partners in

Slovenia.

However, there can be no guarantee over the outcome of these

negotiations and as a consequence there is a material uncertainty

of the Group's ability to raise additional finance, which may cast

significant doubt on the Group's ability to continue as a going

concern. Further, the Group may be unable to realise its assets and

discharge its liabilities in the normal course of business.

The Directors, however, remain confident of the Group's ability

to operate as a going concern given the funding discussions that

have and continue to take place and in light of the recent support

from existing shareholders.

Liquidity and Capital Resources:

The Company continues to be an emerging business and currently

has no production cash flows; consequently, it manages its working

capital and liquidity position by balancing the timing of critical

expenditure with available funds. Further information on future

funding arrangements and the Directors' assessment of the Group's

going concern position is set out above.

Principal Risks and Uncertainties:

The principal risks and uncertainties affecting the business

activities of the Group remain those detailed on pages 50-52 of the

Annual Review 2014, a copy of which is available on the Company's

website at www.ascentresources.co.uk.

2. Operating loss is stated after charging

Six months Six months

ended ended

30 June 30 June

2015 2014

Unaudited Unaudited

Operating loss is stated GBP '000s GBP '000s

after charging

Employee costs 397 382

Share based payments

charge 73 73

Foreign exchange differences - -

Included within Admin

Expenses

Audit Fees 26 26

Fees payable to the - -

Company's auditor for

other services

----------- -----------

26 26

----------- -----------

3. Finance income and costs recognised in loss

Six months Six months

ended ended

30 June 30 June

2015 2014

Unaudited Unaudited

GBP '000s GBP '000s

Finance income

Income on bank deposits 1 2

----------- -----------

1 2

Finance cost

Interest payable on

borrowings (624) (564)

Bank Charges (1) (1)

Unwinding of EnQuest

liability (186) (162)

Loss on extinguishment (854) -

of convertible loan

notes

Foreign exchange movements

realised (9) (56)

----------- -----------

(1,674) (783)

4. Loss per share

Six months Six months

ended ended 30 June

30 June 2014 Unaudited

2015

Unaudited

GBP '000s GBP '000s

Total loss for the period

attributable to equity

shareholders (2,684) (1,856)

Wight average number

of ordinary shares

For basic earnings per

share 1,541,219,096 1,451,164,395

Total loss per share

(pence) (0.17) (0.13)

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:00 ET (06:00 GMT)

Potential shares to be issued are antidilutive so the basic

earnings per share is equivalent to the diluted earnings per

share.

5. Exploration and Evaluation Costs

Slovenia Total

Cost

At 1 January 2014 33,628 33,628

Additions 389 389

Effects of movements

in exchange rates (796) (796)

--------- --------

At 30 June 2014 33,221 33,221

At 1 July 2014 33,221 33,221

Additions 384 384

Effects of movements

in exchange rates (439) (439)

--------- --------

At 31 December 2014 33,166 33,166

At 1 January 2015 33,166 33,166

Additions 174 174

Effects of movements

in exchange rates (1,885) (1,885)

--------- --------

At 30 June 2015 31,455 31,455

Carrying value

At 30 June 2015 33,221 33,221

At 31 December 2014 33,628 33,628

At 1 July 2014 33,061 33,061

6. Borrowings

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Current

Loan with financial - 317 -

institution

Convertible loan note 9,691 7,998 9,624

----------- ----------- ------------

9,691 8,315 754

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Fair value of consideration

received 10,017 2,000 3,500

Equity component (1,056) (91) (107)

----------- ----------- ------------

Liability component

on initial recognition 8,961 1,909 3,393

Liability brought forward 9,624 5,561 5,561

Convertible loan notes

drawn in 2015 500 0 0

Loan notes extinguished (10,017) - (463)

Converted notes (1) - (2)

Interest expense 624 549 1,168

Exchange movements - (21) (1)

Liability on initial

recognition 8,961 1,909 3,393

Deferral of set up costs - - (32)

----------- ----------- ------------

Liability at 31 December 9,691 7,998 9,624

2013 & 2014 Convertible Loan Notes ("CLNs")

On 19 February 2015 the shareholders and note holders approved

the variation of the terms on the 2013 and 2014 CLNs. In total

GBP4.95 million had been drawn under the 2013 CLNs and GBP4.0

million had been drawn under the 2014 CLNs: the final GBP0.5

million having been drawn on 4 February 2015. In total, including

accrued interest, some GBP10 million in aggregate was due for

repayment under the 2013 and 2014 CLNs, in part on 23 December 2014

and in part on 31 January 2015. In return for extending the

maturity date of the Loan Notes to 19 November 2015 and terminating

the accrual of further interest, the Board of Ascent agreed to

adjust the conversion price in respect of both the 2013 and 2014

CLNs from 0.5p and 0.2p respectively to 0.1p for all loan

notes.

The 2013 and 2014 CLNs were extinguished and replaced with

another convertible loan. On initial recognition the liability and

equity element of the CLNs have been fair valued. As part of this

transaction, a loss on extinguishment of GBP0.85m was recognised as

a finance costs. The loan has been recognised at a discount rate of

15% and the interest charge will accrete over the loan period. The

loan amount is convertible at any time into ordinary shares of the

Company. The loan matures on 19 November 2015 and is repayable in

full on that date.

Conversion of convertible loan notes ("CLNs")

During the period under review there have been two drawdown

requests received by loan note holders to convert loan notes and

the interest accrued thereon into ordinary shares.

-- On 26 March 2015 the Company issued 138,520 ordinary shares

of 0.1pence each pursuant to a conversion notice received from the

holder of 123 CLNs of GBP1 each.

-- On 30 April 2015 the Company issued 473,030 ordinary shares

of 0.1pence each pursuant to a conversion notice received from the

holder of 123 CLNs of GBP1 each.

Subsequent to the end of the period on 27 July 2015 the Company

issued 244,392 ordinary shares of 0.1pence each pursuant to a

conversion notice received from the holder of 217 CLNs of GBP1

each.

GBP7million short term funding facility

On 12 May 2015 the Company announced that it had agreed a

GBP7million loan facility (the "Loan") for general corporate

purposes with Henderson Global Investors Limited ("Henderson").

The Loan can be drawn at any time from signing to 30 June 2016

at the discretion of Henderson. The Loan accrues interest at the

rate of 7.5% per annum on the amount drawn and this is added to the

amount of the Loan. The Loan is subject to a drawdown fee of 1.75%

per tranche which is deducted from the funds advanced. The Loan is

also subject to a repayment fee of 1.25% on any amounts repaid by

the Company. The balance outstanding is repayable on demand at any

time.

The first GBP250k was drawn on the 21 August 2015 and the

Company is currently reliant on this facility for working capital

funding going forward.

7. Other current liabilities

The other current liability of GBP2,779,000 (December 2014:

GBP2,417,000) relates to the grant in 2011 of a nil cost option

over 29,686,000 new ordinary shares of 0.1p each in the Company to

EnQuest. Where the share price of the Company is below 10 pence on

the exercise date the agreement provided for the liability to be

settled in cash for GBP2,968,000; given the current share price,

the Company considers it to be likely that the option will be

settled in cash rather than through the issue of equity. As a

result this was reclassified in 2012 from equity to current

liabilities. This is held at a discounted rate and repayment is due

in December 2015.

The discount rate used for the purposes of calculating accretion

interest is 15% and the interest accreted for the period was

GBP161,831.

Subsequent to the end of the reporting period the Company

entered into an agreement to restructure this liability as detailed

in Note 8 below.

8. Events subsequent to the reporting date

a) EnQuest restructuring

As detailed in Note 8 above, in December 2010 Ascent entered

into an agreement with EnQuest to acquire their 48.75% interest in

the Petišovci Project in Slovenia. The consideration consisted

of:

-- 150,903,958 new ordinary shares of 0.1p each in the Company,

which were issued fully paid to EnQuest at closing;

-- GBP14,830 payable in cash for each year between closing and

the fifth anniversary of the date of closing payable on 20 December

2015 in total GBP74,150; and

-- GBP2,968,000 consideration payable in cash on 20 December

2015 contingent on the share price being lower than 10 pence per

share.

The total of GBP3,042,150 was to become due for payment to

EnQuest on 20 December 2015 and has now been restructured into

GBP2,038,241 of CLNs. The terms of these CLNs are identical to the

GBP4million of notes issued in 2014 to Henderson Global Investors

("Henderson") and will benefit from security over the Company's

shareholding in Ascent Slovenia Limited which owns an interest in

the Petišovci concession. The notes accrue no interest, are

redeemable on 19 November 2015 or can be converted at the option of

the noteholder at the rate of 1,000 shares for every GBP1 of Loan

Note.

b) Authority to allot shares

On 3 September 2015 the Company held a General Meeting at which

the Directors received the authority to allot shares in the Company

for a nominal value of up to GBP1,500,000. This was intended to

give Directors the flexibility to raise additional funding for

working capital or for the development of the project from sources

other than the GBP7m Henderson facility.

c) Management changes

On 11 September 2015 the Company announced that CEO Len Reece,

Ascent's CEO had resigned as a director of the Company. Following

further discussions, the Company and Len Reece have entered into a

settlement agreement to terminate his employment effective from 10

September 2015. Colin Hutchinson, Finance Director, has become

interim Chief Executive and with the support of the Non-executive

Directors will lead the day-to-day activities of the Company.

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:00 ET (06:00 GMT)

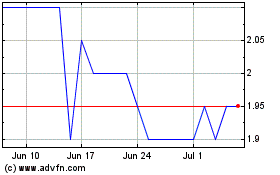

Ascent Resources (LSE:AST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Apr 2023 to Apr 2024