TIDMAST

RNS Number : 7430R

Ascent Resources PLC

16 September 2014

Ascent Resources plc / Epic: AST / Index: AIM / Sector: Oil and

Gas

Ascent Resources plc

("Ascent" or "the Company")

Interim results for the period ended 30 June 2014

Ascent presents its unaudited results for the six months ended

30 June 2014

Introduction

During the period under review we report steady progress toward

our goal of bringing the Petišovci project into production. As

mentioned in the announcement on 8th September 2014, the key

Integrated Pollution Prevention & Control ("IPPC") permit was

submitted to the Slovenian Environmental Agency in June 2014. The

Company has been informed that the decision making process normally

lasts approximately six months.

Your Board continues to work hard to replace the funds promised

by Global Power Sources s.r.l ("GPS") and their partners, Salomon

Werner HAB Privée Limited, formerly known as Salomon Partners WRS

Werner Rothschild & CIE Limited ("WRS") which have as yet

failed to materialise. There are a small number of discussions with

potential funders ongoing although there can be no promise that

these will result in funds being invested. However, Henderson has

agreed to provide a further GBP2 million of funding which will

repay the Darwin loan and should provide adequate funds to reach

the granting of the IPPC.

Background

Following the disposal of our interests in assets in Hungary,

the Netherlands, Switzerland and Italy, the Company's focus has

been entirely on our Slovenian asset, Petišovci.

Slovenia is a country of some 2 million people and the estimates

of the potential production from the Petišovci project once fully

developed will significantly reduce the country's reliance on

foreign gas imports.

Ascent has an effective 75% working interest in the project but

a requirement to fund 100% of the costs of development. Ascent's

partners in the Petišovci project are Petrol; the leading energy

supplier in Slovenia and Nafta Lendava, a Slovenian state-owned

company engaged in hydrocarbon exploration, extraction, storage and

associated services. The Petišovci gas field complex is situated in

the east of Slovenia close to the Hungarian border.

Steps to production start-up

In order to begin commercial production of gas, Ascent, working

with its partners in Slovenia will carry out the following

works:

-- Construct a pipeline to connect the processing facility to

the national grid. This will measure just over 1,100 metres in

length and is expected to take eight weeks to construct at an

estimated cost of EUR0.4 million once the tenders have been

compared and a supplier chosen. We have already obtained easement

rights from over half of the landowners covering the route

preferred by the company and the local authorities.

-- Install a new gas processing facility for dew point control

and to reduce the CO2 content of the gas to meet national pipeline

specifications. The proposed plant is expected to cost EUR7 million

to fabricate and install. The entire process is expected to be

completed in early 2016 with commencement of the procurement

process due to start in early Q4 2014.

-- Upgrade the Lendava Measuring and Control Station and supply

and install two measuring and control lines along with the

associated equipment for gas purification and quality control, for

onward transmission into the national grid. This facility is

expected to cost around EUR1.5 million and take 14 months from

signature of contracts. This is expected to be the final

significant step before the commencement of production.

-- Remove temporary plugs from existing wells and construct

flowlines of less than 500 metres to tie these in to the new gas

processing facility. The Pg-11A well requires a 30 metre flow line

to link in to the existing gas gathering line. In the case of the

Pg10 well, approval has been received to build a 475 metre flow

line to the new gas processing plant. The total cost to tie in both

wells is expected to be around EUR1.5 million.

-- The company is in advanced discussions with a potential bank

funder to provide a significant proportion of the capital funds

required.

Progress in 2014

In the last six months the Company has made significant progress

in submitting the key permits and successfully negotiating the

contract for connection into the national grid. However unexpected

delays were caused by the proposed routing of a high voltage power

line close to our proposed site and also as a result of the

exceptionally high level of technical detail required by the

Slovenian authorities in the permitting application, as further

described below.

The most significant development in 2014 has been the submission

of the Integrated Pollution Prevention & Control ("IPPC")

permit in June 2014. The Company has been informed that the

decision making process normally lasts approximately six months.

Once the IPPC permit has been issued, the Board, based on on-going

discussions with interested banks, believes that suitable project

finance should be available to fund construction of infrastructure

and pipelines, as described above. Ascent management's expectation

is that, in line with stated government timelines, the IPPC permit

will be put to public consultation early in Q1 2015 and is expected

to take several weeks from that time.

In July 2014 we reached mutual agreement with Plinovodi d.o.o.,

on the contract for the upstream pipeline connection to the natural

gas transmission system and associated metering system. This is

being reviewed by the market regulator (the Energy Agency).

However, as mentioned above the decision by the state-owned

electricity company to route a major high voltage power line close

to the existing gas treatment plant created another hurdle for us

to overcome. Although conflicting professional opinions were

expressed by various parties, it was considered prudent, for safety

reasons, not to construct a new gas processing facility in close

proximity to the proposed power line, especially as the plant will

require expansion as more wells come on stream in Phase 2 of the

field development. The partners accordingly agreed to seek a new

location for the gas processing plant, negotiations with various

landowners were duly entered into and commercially satisfactory

terms agreed. This process took approximately six months and we are

pleased that final contracts for the purchase of the land are

expected to be signed in Q4 2014.

Further delays have been caused by the considerable uncertainty

and conflicting legal advice on the applicability of new EU

regulations regarding competitive tendering for all parts of the

construction phase. However certain rules on public procurement in

Slovenia have recently been relaxed, which should lead to shorter

lead times when issuing tenders for construction contracts.

Methanol plant

At the start of the period under review we expected the rapid

re-commissioning of the adjacent but mothballed methanol plant,

which was a potential outlet for our untreated gas.

The plant was acquired by an Austrian company that wishes to use

our untreated gas in the production of methanol. Discussions with

them in relation to the terms of an offtake agreement to supply gas

from our wells have reached an advanced stage.

The methanol plant continues to offer the potential for early

revenue in advance of the construction of infrastructure required

for the sale of gas into the national grid. However the Austrian

company's transaction with Nafta Lendava, the Slovenian seller of

the methanol plant, includes various outstanding preconditions that

need to be satisfied before it will start to re-commission the

plant and until these conditions are satisfied, we are not able to

sell our untreated gas to the methanol plant.

Funding

Background

Ascent requires funding until the Petišovci project becomes

operational.

GPS

In May 2014 we announced the conditional subscription for

ordinary shares by GPS of an initial sum of GBP11.7 million at a

price of 0.8p per share (the "Initial Subscription"). Also

announced was an additional subscription by GPS of a further GBP3.3

million subject to the performance of the Petišovci project and the

adjacent methanol plant before 31 December 2014.

The new shares to be issued as part of the Initial Subscription,

together with the shares GPS already owned would have taken GPS's

holding to some 47.9% of the enlarged share capital of Ascent and

to some 53.1% of the enlarged total should the additional

subscription have been made.

GPS planned to fund this investment principally through a

back-to-back arrangement with WRS.

Eidos Partners s.r.l. ("Eidos Partners"), an independent

advisory firm with offices in Milan and London, as financial

adviser to GPS, confirmed in writing to the Ascent board the

availability of the funds to make the Initial Subscription and that

these funds would not be used for any other purpose but to complete

the Initial Subscription.

Additionally, WRS separately confirmed in writing to Ascent that

in the event GPS did not pay for the Initial Subscription by 30

June 2014, WRS would provide Ascent with collateral pending receipt

of the Initial Subscription funds from GPS.

Current position

The obligations of GPS under the above agreement remain unmet

and GPS is clearly in default.

It remains the position that we have received no adequate

explanation as to why the funds identified to make the Initial

Subscription have not been transferred to Ascent or why WRS has

failed to honour its agreement with GPS.

Additionally, WRS has failed to fulfil a direct undertaking to

Ascent to provide adequate security to Ascent in the event that GPS

did not transfer the Initial Subscription monies by 30 June

2014.

Disappointingly, to date, Eidos Partners, have shown little

interest in securing the payment that they confirmed would be

made.

Current position

Since it became clear that completion of the GPS deal was not

certain Ascent has been in discussions with several alternative

providers of funds. We have also continued working with GPS to make

sure they fulfil their commitments.

To date none of these discussions have resulted in new funding

for Ascent. Accordingly on 8 September 2014, Ascent negotiated a

variation to the 2014 Henderson Loan Note agreement, whereby a

further GBP2 million was subscribed by Henderson at an effective

conversion price of 0.2p per share. A condition of the variation

was that the total amount available under the 2014 Loan Note

agreement has been reduced from GBP5 million to GBP4 million.

In the absence of additional funding this is expected to be

sufficient to cover the period to the end of Q1 2015. Beyond that,

additional funding would be required to continue with the Petišovci

project and to repay the 2013 and 2014 Loan Notes. The 2014 notes

are due for redemption on 23 December 2014, while the 2013 notes

are due on 31 January 2015.

New funding strategy

Until recently the financial strategy of the Group was to raise

sufficient funding to cover the permitting, construction and

commissioning phases of the Petišovci project. Following repeated

permitting delays it is clear that none of the banks identified for

the construction phase will advance material funding until the

permitting phase is completed. Therefore the revised financial

strategy is now to fund the Company solely for permitting and to

minimize all other costs. Inevitably this will result in waiting

for the long lead-time capital items when construction is set to

commence.

Bank funding

We are in advanced discussions with a major international

funding institution for a project loan for phase one of the

project. This is subject to their due diligence, which we

understand is progressing well.

Longer-term outlook

The Slovenian economy has suffered from the recent European

economic crisis and levels of foreign direct investment have been

disappointing, with national gas consumption being entirely reliant

on imported gas. The Petišovci project would be the largest gas

field within Slovenia and at full production could supply the

majority of the country's needs. The field should be advantageous

to the national energy strategy.

The Ascent board believes that Petišovci remains a project with

significant potential. Despite the issues referred to above,

progress continues to be made, together with our partners in

Slovenia, to bring the asset into production.

Once the project is fully permitted and with workable project

loans in place, Ascent is expected to move steadily towards

production and income. Management's estimate of the NPV10 of

Ascent's share of the asset is in excess of EUR150m. The Ascent

board expects that the project will provide material cash flows to

the Company from Q1 2016.

Yours faithfully

Clive Carver

Chairman

Consolidated Income Statement

for the Period ended 30 June 2014

Six months Six months

ended ended

30 June 30 June

2014 2013

Unaudited Unaudited

Notes GBP '000s GBP '000s

Continuing Operations

Administrative expenses 3 (1,105) (1,114)

----------- -----------

Loss from operating activities (1,105) (1,114)

Finance income 2 305

Finance cost (783) (514)

----------- -----------

Net finance costs 4 (781) (209)

Loss before taxation (1,886) (1,323)

Income tax expense - -

----------- -----------

Loss for the period from

continuing operations (1,886) (1,323)

Loss net of tax from discontinued

operations - (32)

----------- -----------

Loss for the period attributable

to owners of the parent (1,886) (1,355)

Basic & fully diluted loss

per share

Loss per share from continuing

operations (0.12)p (0.13)p

Loss per share from discontinued

operations - (0.00)p

----------- -----------

Total loss per share 5 (0.12)p (0.13)p

Consolidated Statement of Comprehensive Income

for the Period ended 30 June 2014

Six months Six months

ended ended

30 June 30 June

2014 2013

Unaudited Unaudited

GBP '000s GBP '000s

Loss for the year (1,886) (1,355)

Other comprehensive income

Currency translation differences

on foreign operations * (752) (544)

----------- -----------

Total comprehensive loss

for the year (2,638) (1,899)

Total comprehensive loss

attributable to:

Owners of the Company (2,638) (1,899)

Non-controlling interest - -

----------- -----------

Total comprehensive loss

for the year (2,638) (1,899)

----------- -----------

* Foreign currency translation differences from foreign

operations may be recycled through the income statement in the

future if certain conditions arise

Consolidated Statement of Changes in Equity

for the Period ended 30 June 2014

Share Equity Share Shares Share Translation Retained Total

Capital reserve Premium to based Reserve Earnings

be payment

issued reserve

Balance at 1 January

2013 1,026 - 52,198 - 1,901 2,102 (30,679) 26,548

Comprehensive income

Loss for the year - - - - - - (1,360) (1,360)

Other comprehensive

income

Currency translation

differences - - - - - 539 - 539

FX differences

recycled on foreign

ops - - - - - (379) 135 (244)

Total comprehensive

income - - - - - 160 (1,225) (1,065)

Transactions with

owners

Shares issued 125 - 459 - - - - 584

Convertible Loan - 518 - - - - - 518

Share-based payments - - - - 43 - 99 142

--------- --------- --------- -------- --------- ------------ ---------- --------

Balance at 30 June

2013 1,151 518 52,657 - 1,944 2,262 (31,805) 26,727

Balance at 1 January

2013 1,026 - 52,198 - 1,901 2,102 (30,679) 26,548

Comprehensive income

Loss for the year - - - - - - (3,592) (3,592)

Other comprehensive

income

Currency translation

differences - - - - - (1,276) - (1,276)

FX differences

recycled on foreign

ops - - - - - (1,324) - (1,324)

Total comprehensive

income - - - - - (2,600) (3,592) (6,192)

Transactions with

owners

Shares issued 425 - 3,635 84 - - - 4,144

Convertible Loan - 518 - - - - - 518

Share-based payments - - - - (5) - 100 95

Balance at 31 December

2013 1,451 518 55,833 84 1,896 (498) (34,171) 25,113

Balance at 1 January

2014 1,451 518 55,833 84 1,896 (498) (34,171) 25,113

Comprehensive income

Loss for the year - - - - - - (1,886) (1,886)

Other comprehensive

income

Currency translation

differences - - - - - (752) - (752)

Total comprehensive

income - - - - - (752) (1,886) (2,638)

Transactions with

owners

Shares issued 7 - 77 (84) - - - -

Convertible Loan - 91 - - - - - 91

Share-based payments - - - - (1,040) - 1,113 73

--------- --------- --------- -------- --------- ------------ ---------- --------

Balance at 30 June

2014 1,458 609 55,910 - 856 (1,250) (34,944) 22,639

--------- --------- --------- -------- --------- ------------ ---------- --------

Consolidated Statement of Financial Position

As at 30 June 2014

30 June 31 December

2014 2013

Unaudited Audited

Notes GBP '000s GBP

'000s

Assets

Non-current assets

Property, plant and equipment 2 3

Exploration and evaluation

costs 6 33,221 33,628

----------- ------------

Total non-current assets 33,223 33,631

Current assets

Trade and other receivables 88 110

Cash and cash equivalents 937 184

----------- ------------

Total current assets 1,025 294

Total assets 34,248 33,925

=========== ============

Equity and liabilities

Share capital 1,458 1,451

Equity reserve 609 518

Share premium account 55,910 55,833

Shares to be issued - 84

Share-based payment reserve 856 1,896

Translation reserves (1,250) (498)

Retained earnings (34,944) (34,171)

Total equity 22,639 25,113

----------- ------------

Non-current liabilities

Borrowings 7 - 4,957

Provisions 420 437

Other non-current liabilities 8 2,417 2,255

----------- ------------

Total non-current liabilities 2,836 7,649

Current liabilities

Trade and other payables 458 409

Borrowings 7 8,315 754

----------- ------------

Total current liabilities 8,773 1,163

Total liabilities 11,609 8,812

Total equity and liabilities 34,248 33,925

=========== ============

Consolidated Statement of Cash Flows

for the six months ended 30 June 2014

Six months Six months

ended ended

30 June 30 June

2014 2013

Unaudited Unaudited

GBP '000s GBP '000s

Cash flows from operations

Loss before tax for

the year (1,886) (1,355)

DD&A charge 1 177

Decrease in receivables 22 428

Increase / (decrease)

in payables 49 (603)

Decrease in inventories - 8

Impairment of exploration

expenditure - 81

Share-based payment

charge 73 142

Exchange differences 6 (522)

Finance income (2) (243)

Finance cost 783 514

----------- -----------

Net cash flows from

operating activities (954) (1,373)

Cash flows from investing

activities

Interest received 2 38

Payments for investing

in exploration (389) (322)

----------- -----------

Net cash used in investing

activities (387) (284)

Cash flows from financing

activities

Interest paid and other

finance fees (55) (90)

Proceeds from loans 2,150 1,895

Loans repaid - (2,024)

Loan issue costs - (15)

Proceeds from issue

of shares - 627

Share issue costs - (38)

----------- -----------

Net cash generated from

financing activities 2,095 355

Net increase in cash

and cash equivalents

for the period 754 (1,302)

Effect of foreign exchange

differences (1) (2)

Cash and cash equivalents

at beginning of the

period 184 3,452

----------- -----------

Cash and cash equivalents

at end of the period 937 2,148

=========== ===========

Notes to the Financial Statements

For the Period ended 30 June 2013

1. Accounting Policies

Reporting entity

Ascent Resources plc ('the Company') is a company domiciled in

England. The address of the Company's registered office is 5 New

Street Square, London EC4A 3TW. The unaudited consolidated interim

financial statements of the Company as at 30 June 2014 comprise the

Company and its subsidiaries (together referred to as the 'Group')

and the Group's interest in associates.

Basis of preparation

The interim financial statements have been prepared using

measurement and recognition criteria based on International

Financial Reporting Standards (IFRS and IFRIC interpretations)

issued by the International Accounting Standards Board (IASB) as

adopted for use in the EU. The interim financial information has

been prepared using the accounting policies which will be applied

in the Group's statutory financial statements for the year ended 31

December 2014 and were applied in the Group's statutory financial

statements for the year ended 31 December 2013.

All amounts have been prepared in British Pounds, this being the

Group's presentational currency.

The interim financial information to 30 June 2014 and 30 June

2013 is unaudited and does not constitute statutory financial

information. The information given for the year ended 31 December

2013 does not constitute statutory accounts within the meaning of

Section 19 of the Companies (Amendment) Act 1986. The statutory

accounts for the year ended 31 December 2013 have been filed with

the Registrar and are available on the Company's web site

www.ascentresources.co.uk.

Going Concern

The financial statements of the Group are prepared on a going

concern basis.

On 5 June 2014 the shareholders approved a proposed subscription

for ordinary shares in the Company by Global Power Sources S.r.l

("GPS"). Global Power Sources S.r.l ("GPS") and their partners,

Salomon Werner HAB Privee Limited, formerly known as Salomon

Partners WRS Werner Rothschild & CIE Limited ("WRS"), failed to

make payment to Ascent of the GBP11.7m required to fund GPS's

investment in Ascent as approved by shareholders in a general

meeting held on 5 June 2014.

As a result, the board of Ascent was obliged to explore

alternative sources of funds, including maintaining an on-going

dialogue with GPS in this respect. Whilst positive discussions

continue, the Company has not yet concluded a replacement funding

transaction and therefore approached Henderson to agree the basis

for further drawdowns of up to GBP2 million under an Amended and

Restated Instrument.

Of the additional GBP2 million to be subscribed by Henderson

under the Amended and Restated Instrument, GBP0.3 million will be

used to repay the outstanding balance under the short term loan

facility from Darwin Strategic Limited, which was due for repayment

at the beginning of June 2014. The remaining GBP1.7 million is

expected to provide the Company with sufficient funds to complete

the permitting process and issue tender documentation for key

infrastructure necessary for full field development.

Liquidity and Capital Resources:

The Company continues to be an emerging business and currently

has no production cash flows; consequently, it manages its working

capital and liquidity position by balancing the timing of critical

expenditure with available funds. Further information on future

funding arrangements and the Directors' assessment of the Group's

going concern position is set out in note 1 of these Interim

Financial Statements.

Principal Risks and Uncertainties:

The principal risks and uncertainties affecting the business

activities of the Group remain those detailed on pages 56-58 of the

Annual Review 2013, a copy of which is available on the Company's

website at www.ascentresources.co.uk.

2. Financial Reporting Period

The interim financial information for the period 1 January 2014

to 30 June 2014 is unaudited. In the opinion of the Directors the

interim financial information for the period presents fairly the

financial position, and the results from operations and cash flows

for the period are in conformity with generally accepted accounting

principles consistently applied. The financial information is

prepared using the accounting policies which will be applied in the

Group's statutory financial statements for the year ending 31

December 2013. The financial statements incorporate unaudited

comparative figures for the interim period 1 January 2013 to 30

June 2013 and the audited financial year to 31 December 2013.

The financial information contained in this interim report does

not constitute statutory accounts as defined by section 435 of the

Companies Act 2006.

The comparatives for the full year ended 31 December 2013 are

not the Group's full statutory accounts for that year. A copy of

the statutory accounts for that year has been delivered to the

Registrar of Companies. The auditors' report on those accounts was

unqualified and included an emphasis of matter drawing attention to

the importance of disclosures made in the annual report regarding

going concern. It did not contain a statement under section

498(2)-(3) of the Companies Act 2006.

3. Administrative Expenses

Six months Six months

ended ended

30 June 30 June

2014 2013

Unaudited Unaudited

GBP '000s GBP '000s

Employee costs 382 540

Share based payments

charge 73 142

Legal & Professional 128 110

Audit, Accountancy &

Tax 66 82

Consultancy costs 209 111

Listing related costs 191 75

Other office costs 56 53

----------- -----------

1,105 1,114

4. Finance income and costs recognised in loss

Six months Six months

ended ended

30 June 30 June

2014 2013

Unaudited Unaudited

GBP '000s GBP '000s

Finance income

Income on bank deposits 2 4

Foreign exchange movements

realised - 301

2 305

Finance cost

Interest payable on

borrowings (564) (719)

Bank Charges (1) -

Unwinding of discount

/ adjustment to provision

(EnQuest) (162) 205

Foreign exchange movements (57) -

realised

----------- -----------

(783) (514)

5. Loss per share

Six months Six months

ended ended

30 June 30 June

2014 2013

Unaudited Unaudited

GBP '000s GBP '000s

Loss

Loss from continuing

operations (1,886) (1,323)

Loss from discontinued

operations - (32)

-------------- --------------

Total loss for the period

attributable to equity

shareholders (1,886) (1,355)

Wight average number

of ordinary shares

For basic earnings per

share 1,451,164,395 1,067,797,847

Loss per share (pence)

Loss per share from

continuing operations (0.12) (0.13)

Loss per share from

discontinued operations - (0.00)

-------------- --------------

Total loss per share (0.12) (0.13)

6. Exploration and Evaluation Costs

Slovenia Total

Cost

At 1 January 2013 31,918 31,918

Additions 322 322

Effects of movements

in exchange rates 821 821

--------- -------

At 30 June 2013 33,061 33,061

At 1 July 2013 33,061 33,061

Additions 1,021 1,021

Effects of movements

in exchange rates (454) (454)

--------- -------

At 31 December 2013 33,628 33,628

At 1 January 2014 33,628 33,628

Additions 389 389

Effects of movements

in exchange rates (796) (796)

--------- -------

At 30 June 2014 33,221 33,221

--------- -------

Carrying value

At 30 June 2014 33,221 33,221

At 31 December 2013 33,628 33,628

At 1 July 2013 33,061 33,061

7. Borrowings

30 June 31 December

2014 2013

Unaudited Audited

GBP '000s GBP '000s

Current

Loan with financial

institution 317 150

Convertible loan note 7,998 604

----------- ------------

8,315 754

----------- ------------

Non-current

Convertible loan note - 4,957

----------- ------------

- 4,957

----------- ------------

Analysis of convertible 30 June 31 December

loan note: 2014 2013

Unaudited Audited

GBP '000s GBP '000s

Fair value of consideration

received 2,000 1,954

Equity component (91) (204)

----------- ------------

Liability component

on initial recognition 1,909 1,750

Liability brought forward 5,561 3,217

Liability on initial

recognition 1,909 1,750

Interest expense 549 920

Equity component of

GBP3m rec'd December'12

and approved Apr'13 - (314)

Exchange movements (21) 8

Deferral of set up costs - (20)

----------- ------------

Liability at the end

of the period 7,998 5,561

8. Other non-current liabilities

The other non-current liability of GBP2,417,000 (December 2013:

GBP2,255,000) relates to the grant in 2011 of a nil cost option

over 29,686,000 new Ordinary Shares of 0.1p each in the Company to

EnQuest. The options are convertible at a price of 10p each; given

the current share price the Company considers it to be likely that

the option will be settled in cash rather than through the issue of

equity. As a result this was reclassified in 2012 from equity to

non-current liabilities. This is held at a discounted rate and

repayment is due in December 2015.

The discount rate used for the purposes of calculating accretion

interest was revised to 15% (2012: 10%). The interest accreted for

the period was GBP161,831.

9. Events subsequent to the reporting date

On 8 September 2014 the Company announced that it had entered

into a variation of to the existing GBP5 million 2014 Convertible

Loan Note Instrument pursuant to which Henderson Global Investors

Limited and Henderson Alternative Investment Advisor Limited

(together, "Henderson") subscribed for GBP2 million in principal

amount of loan notes ("Convertible Loan Notes") as announced on 5

February 2014. Under the terms of the variation, Henderson has

agreed to subscribe for further Convertible Loan Notes of up to

GBP2 million in principal amount on the terms of the amended

Instrument.

DIRECTORS AND ADVISERS

Directors Clive Nathan Carver

Leonard John Reece

William Cameron Davies

Nigel Sandford Johnson Moore

Colin Hutchinson

Secretary Colin Hutchinson

Registered Office 5 New Street Square

London, EC4A 3TW

Nominated Adviser finnCap Ltd.

& Broker

60 New Broad Street

London, EC2M 1JJ

Auditors BDO LLP

55 Baker Street

London, W1U 7EU

Solicitors Taylor Wessing LLP

5 New Street Square

London, EC4A 3TW

Bankers Barclays Corporate

1 Churchill Place

London, E14 5HP

Share Registry Computershare Investors Services

plc

The Pavilions

Bridgwater Road

Bristol, BS13 8AE

Company's registered

number 05239285

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAXNSFAKLEFF

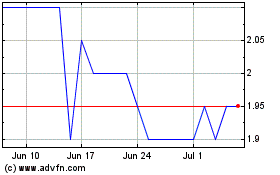

Ascent Resources (LSE:AST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Apr 2023 to Apr 2024