TIDMAST

RNS Number : 1351K

Ascent Resources PLC

19 September 2016

Ascent Resources plc / Epic: AST / Index: AIM / Sector: Oil and

Gas

Ascent Resources plc

("Ascent" or "the Company")

Interim results for the period ended 30 June 2016

Ascent Resources plc, the AIM quoted European oil and gas

exploration and production company is pleased to report its interim

results for the six months ended 30 June 2016.

Highlights:

-- Raised GBP1.5million in new equity through three placings.

-- Loan note conversions have reduced the cash owed on

convertible loan notes by GBP2.8 million in six months.

-- Administrative expenses reduced by (33%) to GBP676k compared with the same period in 2015.

-- Preliminary approach from Cadogan Petroleum plc highlighting

the potential value of the asset.

-- Colin Hutchinson appointed as permanent CEO.

Post Period Highlights:

-- Gas sales agreement signed with INA-Industrija Nafte d.d.

giving a confirmed route to market independent of the IPPC

Permit.

-- Alternative route agreements implemented - cheaper and

quicker than the construction of a new gas treatment facility.

-- Acquisition of Trameta d.o.o guaranteeing access to key

pipeline infrastructure required for the alternative route.

-- Export pipeline has been successfully tested to the proposed operating pressure.

-- First gas sales revenue expected by early 2017.

Colin Hutchinson, CEO of Ascent, commented:

"Progress to date has made 2016 one of the most significant

years in the history of the Company. Following the signing of the

INA gas sales agreement we can look forward to delivering gas

revenue in early 2017".

Enquiries:

Ascent Resources plc

Clive Carver, Chairman

Colin Hutchinson, CEO 0207 251 4905

Stockdale Securities Limited,

Nominated Adviser

Richard Johnson

Edward Thomas 0207 601 6100

Northland Capital Partners

Limited (Joint Broker)

Tom Price 020 3861 6625

IFC Advisory Ltd, Financial

PR and IR

Graham Herring

Tim Metcalfe

Heather Armstrong 0203 053 8671

Chairman's statement

Ascent presents its unaudited results for the six months ended

30 June 2016.

I am pleased to be able to issue our first report where we have

a clear, short route to first gas production and income. On

commencement of commercial production of gas from the Petišovci

field Ascent will retain 90% of revenues from hydrocarbons until

the full EUR42 million costs expended to date have been

recovered.

First gas

In July 2016 we announced an agreement between the Petišovci

project partners and INA. Under this agreement natural gas with

excess water removed but otherwise untreated will be sold to INA at

the Croatian border, some 5 kilometres from the Petišovci field.

This was made possible by the re-commissioning of existing

pipelines in Slovenia and the construction of 75 kilometres of new

pipelines in Croatia to connect the Petišovci field with a Croatian

treatment facility in Molve.

We also entered an agreement with the owner of Trameta to

acquire the company and its rights over the first section of the

Slovenian pipeline. Following the acquisition of Trameta, the

existing Slovenian section of gas pipeline has been successfully

tested to the optimal operating pressure without the need for any

rectification work. The documentation to recertify the line has

been submitted to the Ministry of Infrastructure in Ljubljana.

The remaining work required to commence production primarily

consists of completing a short pipeline connecting the export

pipeline to the pipeline from the CPP, the refurbishment of an

existing gas separation facility (CPP) and working over the

existing wells to ready them for production.

We hope to carry out the first test production in late Q4 2016

with commercial production commencing in Q1 2017.

In anticipation of the agreement with INA, Ascent has in the

past few months raised GBP1.5 million by way of new shares issues.

Additionally, some GBP2.8 million of Loan Notes have been converted

into shares, thereby reducing the indebtedness of the Company.

There remains GBP8.2 million due on the 2013 & 2014

Convertible Loan Notes which are due for redemption on 19 November

2016. The Company has entered into discussions with the majority

note holder with a view to extending their term.

To assist the Company with its future plans we have appointed

Northland Capital Partners as joint broker with immediate

effect.

IPPC Permit

In May 2016 the Company received the unexpected decision of the

Administrative Court to revoke the IPPC Permit to allow the Joint

Venture to construct its own processing plant in Slovenia. The

Company remains of the view that constructing a processing plant in

Slovenia remains the most economic solution for both the Company

and the Country and will continue to work to resolve this issue. If

this issue cannot be resolved through dialogue the Company reserves

the right to progress the issue through the Slovenian and European

Courts.

Outlook

The opportunity at Petišovci remains as strong as ever. Despite

the prolonged delays Ascent still has a 75% economic interest in

the Petišovci field, which has a net present value, including Phase

2 of some EUR200 million based on management estimates.

With 90% of revenues coming preferentially to Ascent to cover

historic costs to date of some EUR42 million and without the

immediate obligation to construct a new Slovenian treatment works

the cash flows of the company should materially strengthen during

2017.

The performance of the Phase 1 wells during 2017 will also be

important in assessing the terms of project financing when we come

to develop the much larger Phase 2 of the Petišovci project.

I would like to take this opportunity to thank shareholders for

their patience and understanding during the past few years and look

forward to bringing the first two wells on stream from Petišovci in

the near future.

Clive Carver

Non-executive Chairman

Consolidated Income Statement

for the Period ended 30 June 2016

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

Notes GBP '000s GBP '000s GBP '000s

Administrative expenses 2 (676) (1,011) (1,888)

Loss from operating activities (676) (1,011) (1,888)

Finance income 3 153 1 745

Finance cost 3 (821) (1,674) (2,501)

----------- ----------- ------------

Net finance costs (668) (1,673) (1,756)

Loss before taxation (1,344) (2,684) (3,644)

Income tax expense - - -

----------- ----------- ------------

Loss for the period (1,344) (2,684) (3,644)

Loss per share

Basic & fully diluted

loss per share (Pence)

* 4 0.52 3.48 4.13

* as restated for the capital reorganisation in November 2015

which effectively reduced shares in issue by a factor of 20.

Consolidated Statement of Comprehensive Income

for the Period ended 30 June 2016

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Loss for the period (1,344) (2,684) (3,644)

Other comprehensive income

Foreign currency translation

differences for foreign

operations 2,293 (1,809) (1,059)

Total comprehensive gain

/ (loss) for the period 949 (4,493) (4,703)

Consolidated Statement of Changes in Equity

for the Period ended 30 June 2016

Share Share Equity Share Translation Retained Total

capital premium reserve based reserve earnings

payment

reserve

GBP '000s GBP '000s GBP '000s GBP '000s GBP '000s GBP '000s GBP '000s

Balance at 1 January 2015 1,459 55,911 2,576 861 (1,746) (38,613) 20,448

Loss for the period - - - - - (2,684) (2,684)

Currency translation

differences - - - - (1,809) - (1,809)

Total comprehensive income - - - - (1,809) (2,684) (4,493)

Issue of shares during

the period net of costs 275 250 - - - - 525

Extinguishment of convertible

loan notes - - (2,576) - - 2,576 -

Extension of convertible

loan notes - - 1,910 - - - 1,910

Share-based payments and

expiry of options - - - 73 - - 73

Balance at 30 June 2015 1,734 56,161 1,910 934 (3,555) (38,721) 18,463

------------------------------ ---------- ---------- ---------- ---------- ------------ ---------- ----------

Balance at 1 January 2015 1,459 55,911 2,576 861 (1,746) (38,613) 20,448

Loss for the period - - - - - (3,644) (3,644)

Currency translation

differences - - - - (1,059) - (1,059)

Total comprehensive income - - - - (1,059) (3,644) (4,703)

Extinguishment of convertible

loan notes - - (4,586) - - 4,586 -

Extension of convertible

loan notes - - 3,582 - - - 3,582

Conversion of loan notes 4 1 - - - - 5

Issue of shares during

the period net of costs 415 781 - - - - 1,196

Share-based payments and

expiry of options - - - (378) - 524 146

Balance at 31 December

2015 1,878 56,693 1,572 483 (2,805) (37,147) 20,674

------------------------------ ---------- ---------- ---------- ---------- ------------ ---------- ----------

Balance at 1 January 2016 1,878 56,693 1,572 483 (2,805) (37,147) 20,674

Loss for the period - - - - - (1,344) (1,344)

Currency translation

differences - - - - 2,293 - 2,293

Total comprehensive income - - - - 2,293 (1,344) 949

Conversion of loan notes 565 2,260 (369) - - 369 2,825

Issue of shares during

the period net of costs 405 1,010 - - - - 1,415

Share-based payments and

expiry of options - - - 83 - - 83

Balance at 30 June 2016 2,848 59,963 1,203 566 (512) (38,122) 25,946

------------------------------ ---------- ---------- ---------- ---------- ------------ ---------- ----------

Consolidated Statement of Financial Position

As at 30 June 2016

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

Assets Notes GBP '000s GBP '000s GBP '000s

Non-current assets

Property, plant and equipment 4 2 3

Exploration and evaluation

costs 5 35,214 31,455 32,711

----------- ----------- ------------

Total non-current assets 35,218 31,457 32,714

Current assets

Trade and other receivables 23 142 61

Cash and cash equivalents 860 239 32

----------- ----------- ------------

Total current assets 883 381 93

Total assets 36,101 31,838 32,807

=========== =========== ============

Equity and liabilities

Attributable to the equity

holders of the Parent

Company

Share capital 7 2,848 1,734 1,878

Share premium account 59,963 56,161 56,693

Equity reserve 1,203 1,910 1,572

Share-based payment reserve 566 934 483

Translation reserves (512) (3,555) (2,805)

Retained earnings (38,122) (38,721) (37,147)

----------- ----------- ------------

Total equity 25,946 18,463 20,674

----------- ----------- ------------

Non-current liabilities

Provisions 434 370 386

Total non-current liabilities 434 370 386

Current liabilities

Trade and other payables 297 535 508

Borrowings 6 9,424 9,691 11,239

Other current liabilities - 2,779 -

----------- ------------

Total current liabilities 9,721 13,005 11,747

Total liabilities 10,155 13,375 12,133

----------- ----------- ------------

Total equity and liabilities 36,101 31,838 32,807

=========== =========== ============

Consolidated Statement of Cash Flows

for the six months ended 30 June 2016

6 months 6 months Year ended

ended ended 31 December

30 June 30 June

2016 2015 2015

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Cash flows from operations

Loss after tax for the

period (1,344) (2,684) (3,644)

DD&A charge - - (1)

Decrease/ (increase)

in receivables 38 (44) 37

(Decrease in payables (211) (112) (222)

Increase in share based

payments 83 73 146

Exchange differences (8) 30 36

Finance income (153) (1) (745)

Finance cost 821 1,674 2,501

Net cash used in operating

activities (774) (1,064) (1,892)

----------- ----------- -------------

Cash flows from investing

activities

Interest received - 1 1

Payments for investing

in exploration 5 (158) (174) (661)

Purchase of property, (1) - -

plant and equipment

Net cash used in investing

activities (159) (173) (660)

----------- ----------- -------------

Cash flows from financing

activities

Interest paid and other

finance fees - (1) (18)

Proceeds from loans 350 500 950

Loan issue costs (6) (1) -

Proceeds from issue

of shares 1,455 550 1,252

Share issue costs (40) (25) (56)

Net cash generated from

financing activities 1,759 1,023 2,128

----------- ----------- -------------

Net increase in cash

and cash equivalents

for the period 826 (214) (424)

Effect of foreign exchange

differences 2 (3) -

Cash and cash equivalents

at beginning of the

period 32 456 456

Cash and cash equivalents

at end of the period 860 239 32

=========== =========== =============

1. Accounting Policies

Reporting entity

Ascent Resources plc ('the Company') is a company domiciled in

England. The address of the Company's registered office is 5 New

Street Square, London EC4A 3TW. The unaudited consolidated interim

financial statements of the Company as at 30 June 2015 comprise the

Company and its subsidiaries (together referred to as the

'Group').

Basis of preparation

The interim financial statements have been prepared using

measurement and recognition criteria based on International

Financial Reporting Standards (IFRS and IFRIC interpretations)

issued by the International Accounting Standards Board (IASB) as

adopted for use in the EU. The interim financial information has

been prepared using the accounting policies which will be applied

in the Group's statutory financial statements for the year ended 31

December 2016 and were applied in the Group's statutory financial

statements for the year ended 31 December 2015.

All amounts have been prepared in British pounds, this being the

Group's presentational currency.

The interim financial information for the six months to 30 June

2016 and 30 June 2015 is unaudited and does not constitute

statutory financial information. The comparatives for the full year

ended 31 December 2015 are not the Group's full statutory accounts

for that year. The information given for the year ended 31 December

2015 does not constitute statutory financial statements as defined

by Section 435 of the Companies Act. The statutory accounts for the

year ended 31 December 2015 have been filed with the Registrar and

are available on the Company's web site www.ascentresources.co.uk.

The auditors' report on those accounts was unqualified and included

an emphasis of matter drawing attention to the importance of

disclosures made in the annual report regarding going concern. It

did not contain a statement under Section 498(2)-(3) of the

Companies Act 2006.

Going Concern

The financial statements of the Group are prepared on a going

concern basis.

During June 2016 the Company raised GBP1 million (GBP977,500 net

of costs) in two separate equity placings. These funds are

sufficient to fund current trading obligations of the Company until

Q1 2017.

On 1 August 2016 the Company announced that it had signed a gas

sales agreement with INA, Croatia's leading Oil & Gas Company,

to sell joint venture gas production at the Croatian border.

Additional funds will be required to complete the capital programme

required in order to make existing wells and facilities ready for

production however there is currently no committed expenditure in

relation to this programme.

Additionally, the Company has GBP8.2million of convertible loan

notes currently due for redemption on 19 November 2016. While the

share price is currently significantly above the conversion price

there can be no guarantee that all of the notes will have converted

by the redemption date.

As such the Company will require further funding to finance the

capital programme in Slovenia and repay the loan notes as they fall

due. The Directors have a range of different options including, but

not limited to, new borrowings or new equity placings. However,

there can be no guarantee over the outcome of these options and as

a consequence there is a material uncertainty of the Group's

ability to raise the necessary finance, which may cast doubt on the

Group's ability to operate as a going concern. Further, the Group

may be unable to realise its assets and discharge its liabilities

in the normal course of business.

The Directors, however, remain confident of the Group's ability

to operate as a going concern given the signing of agreements which

give the Company a clear route through to first gas and in light of

the significant recent support from new and longer term

shareholders.

Liquidity and Capital Resources:

The Company continues to be an emerging business and currently

has no production cash flows; consequently, it manages its working

capital and liquidity position by balancing the timing of critical

expenditure with available funds. Further information on future

funding arrangements and the Directors' assessment of the Group's

going concern position is set out above.

Principal Risks and Uncertainties:

The principal risks and uncertainties affecting the business

activities of the Group remain those detailed on pages 50-52 of the

Annual Review 2015, a copy of which is available on the Company's

website at www.ascentresources.co.uk.

2. Operating loss is stated after charging

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Employee costs 277 397 702

Termination payments - - 279

Share based payment charge 83 73 147

Foreign Exchange differences (1) - 3

Included within Admin

Expenses

Audit Fees 25 26 59

Fees payable to the company's

auditor for other services - - 3

----------- ----------- ------------

25 26 62

3. Finance income and costs recognised in loss

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Finance income

Income on bank deposits - 1 1

Foreign exchange movements

realised - - 3

Other income 153 - -

Gain on EnQuest liability

restructuring - - 741

153 1 745

=========== =========== ============

Finance cost

Interest payable on borrowings (814) (624) (1,451)

Bank Charges (8) (1) (5)

Unwinding of EnQuest liability - (186) (186)

Foreign exchange movements

realised 1 (9) (3)

Loss on extinguishment

of loan notes - (854) (856)

(821) (1,674) (2,501)

=========== =========== ============

The liability written off represented a creditor dating back

more than five years which the Company no longer deems to be

payable.

Convertible loan notes were restructured during the prior

periods and a full commentary is contained within the audited

financial statements for the year ended 31 December 2015 and are

available at www.ascentresources.co.uk.

4. Loss per share

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

GBP '000s GBP '000s GBP '000s

Result for the period

Total loss for the

period attributable

to equity shareholders 1,344 2,684 3,644

Weighted average Number Number Number

number of ordinary

shares

For basic earnings

per share 258,096,858 77,060,955 88,160,768

Loss per share (Pence) 0.52 3.48 4.13

The weighted average number of shares for six months ended 30

June 2015 has been adjusted for the share consolidation. The

previously presented total was 1,514,219,096 which equated to

77,060,955 as if the share consolidation had taken place at the

start of 2015.

Potential shares to be issued are antidilutive so the basic

earnings per share is equivalent to the diluted earnings per

share.

5. Exploration and Evaluation Costs

Exploration Costs Slovenia Total

Cost

At 1 January 2015 33,166 33,166

Additions 174 174

Effects of exchange rate

movements (1,885) (1,885)

At 30 June 2015 31,455 31,455

--------- --------

At 1 July 2015 31,455 31,455

Additions 487 487

Effects of exchange rate

movements 769 769

At 31 December 2015 32,711 32,711

--------- --------

At 1 January 2016 32,711 32,711

Additions 144 144

Effects of exchange rate

movements 2,345 2,345

At 30 June 2016 35,200 35,200

--------- --------

Carrying value

At 30 June 2016 35,200 35,200

--------- --------

At 31 December 2015 32,711 32,711

--------- --------

At 30 June 2015 33,166 33,166

--------- --------

6. Borrowings

2016 2015 2015

Unaudited Unaudited Audited

GBP '000s GBP GBP

'000s '000s

Current

Short term loan facility 838 - 461

Convertible loan notes 8,586 9,691 10,778

9,424 9,691 11,239

----------- ----------- ------------

Convertible Loan Note 30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

GBP '000s GBP GBP

'000s '000s

Liability brought forward 10,778 9,624 9,624

Interest expense 786 624 1,346

Convertible loan notes drawn

in the period - 500 500

Modification to convertible loan

notes - de-recognition (Feb 2015) - (9,983) (9,983)

Modification to convertible loan

notes - recognition of amended

loan notes (Feb 2015) - 8,930 8,930

EnQuest debt restructured into

loan notes - - 1,937

Modification to convertible loan

notes - de-recognition (Nov 2015) - - (12,021)

Modification to convertible loan

notes - recognition of amended

loan notes (Nov 2015) - - 10,449

Other movements (153) - -

Conversion of 2013 & 2014 Convertible

Loan Notes (2,825) (4) (4)

Liability carried forward 8,586 9,691 10,778

----------- ----------- ------------

Conversion of loan Shares Principal Interest Total

notes during the issued

period

Number GBP GBP GBP

07 April 2016 9,199,293 81,681 10,312 91,993

14 April 2016 12,218,647 108,490 13,696 122,186

14 April 2016 28,156,159 250,000 31,562 281,562

14 April 2016 20,731,493 184,076 23,239 207,315

25 April 2016 38,533,398 342,140 43,194 385,334

04 May 2016 23,786,327 211,200 26,663 237,863

17 May 2016 22,524,931 200,000 25,249 225,249

06 June 2016 99,334 882 111 993

13 June 2016 46,176,109 410,000 51,761 461,761

13 June 2016 46,176,109 410,000 51,761 461,761

21 June 2016 5,862,153 55,112 3,510 58,622

21 June 2016 29,078,558 258,190 32,596 290,786

Total for the period

to 30 June 2016 282,542,511 2,511,771 313,654 2,825,425

7. Share Capital

# Ordinary Nominal Share

Shares Share Capital

Price GBP

(Pence)

----------------------------- ---------------- --------- ----------

1st January 2015

Opening Balance 1,458,507,909 0.10 1,458,508

Conversions to 30

June 2015 611,550 0.10 612

May 2015 Placing

- PrimaryBid 275,000,000 0.10 275,000

------------------------------ ---------------- --------- ----------

Balance at 30 June

2015 1,734,119,459 0.10 1,734,119

Conversions from 1 July

2015 to 30 November 2015 2,991,304 0.10 2,991

Impact of capital

re-organisation (1,650,255,216)

November 2015 Placing 70,350,000 0.20 140,700

Conversions from 1 December

'15 to 31 December '15 101,362 0.20 203

------------------------------ ---------------- --------- ----------

Balance at 31 December

2015 157,306,909 1,878,014

Being:

Ordinary shares 157,306,909 0.20 314,614

Deferred shares 1,737,110,763 0.09 1,563,400

----------

1,878,014

Balance at 1 January

2016 157,306,909 1,878,014

April 2016 Placing

- Primary Bid 35,714,285 0.20 71,429

June 2016 Placing

- PrimaryBid 83,333,333 0.20 166,667

June 2016 Placing

- Henderson 83,333,333 0.20 166,667

Conversions in the

period 282,542,511 0.20 565,085

------------------------------ ---------------- --------- ----------

Balance at 30 June

2016 642,230,371 2,847,860

Being:

Ordinary shares 642,230,371 0.20 1,284,461

Deferred shares 1,737,110,763 0.09 1,563,400

----------

2,847,860

In total 484,923,471 new ordinary shares were issued during the

period in three equity placings and a number of loan note

conversions which are detailed in note 6 above.

On 7 April 2016 the Company raised GBP500,000 (GBP477,500 net of

costs) via the placing of 35,714,285 new ordinary shares of

0.2pence each in the Company at a price of 1.4pence per placing

share with investors using the PrimaryBid platform.

On 1 June 2016 the Company raised GBP500,000 (GBP477,500 net of

costs) via the placing of 83,333,333 new ordinary shares of

0.2pence each in the Company at a price of 0.6pence per placing

share with investors using the PrimaryBid platform.

On 7 April 2016 the Company raised GBP500,000 (GBP500,000 net of

costs) via the placing of 83,333,333 new ordinary shares of

0.2pence each in the Company at a price of 0.6pence per placing

share to Henderson Global Investors.

These funds have been used to confirm the alternative route to

market and to begin planning and ordering of equipment for the

connection of our existing wells and the refurbishment of

processing facilities.

8. Events subsequent to the end of the reporting period

On 1 August 2016 the Company reported that, together with our

Slovenian partners, it had signed the conditional agreements

necessary to allow commercial gas production to commence as early

as January 2017.

The Company and its Slovenian partners have negotiated a gas

sale and purchase agreement with INA, Croatia's leading oil &

gas company, which will enable the Joint Venture to sell untreated

gas, within our partner's production systems, at the Slovenian /

Croatian border.

The Company also announced the signing of a condition sale and

purchase agreement to acquire 100% of Trameta doo. a company which

owns access to a key section of pipeline in Slovenia in return for

the issue of up to 75 million Consideration Shares plus Options

over a further up to 7.5 million Subscription Shares.

On 22 August 2016 the resolutions necessary to approve these

agreements were approved by shareholders.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR VVLFFQKFXBBK

(END) Dow Jones Newswires

September 19, 2016 02:00 ET (06:00 GMT)

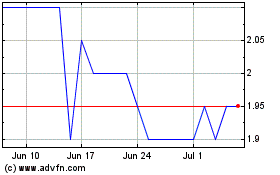

Ascent Resources (LSE:AST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Apr 2023 to Apr 2024