Ascent Resources PLC Conversion of final 2014 convertible loan notes (5793M)

July 31 2017 - 6:13AM

UK Regulatory

TIDMAST

RNS Number : 5793M

Ascent Resources PLC

31 July 2017

Ascent Resources plc

("Ascent" or the "Company")

Conversion of the final remaining 2014 Convertible Loan

Notes

Ascent Resources plc, the AIM quoted European oil and gas

exploration and production company, has received a notice of

exercise ("the Notice") to convert 1,204,305 convertible loan notes

of GBP1 each:

- 185,185 of which were issued in May 2013 as part of an open

offer to all shareholders (the "2013 Loan Notes") and the terms of

which were amended in February 2015 and October 2016. The 2013 Loan

Notes, including rolled up interest, are convertible into new

Ordinary Shares at a rate of 100 new Ordinary Shares per GBP1 loan

note.

- 1,019,120 of which were issued to Henderson Global Investors

and EnQuest plc between February 2014 and July 2015 (the "2014 Loan

Notes") and the terms of which were amended in February 2015 and

October 2016. The 2014 Loan Notes, including rolled up interest,

are convertible into new Ordinary Shares at a rate of 100 new

Ordinary Shares per GBP1 loan note.

Consequently, a total of 121,609,758 new Ordinary Shares ("the

Conversion Shares") will be issued pursuant to the Notice.

Following the above conversion, the 2014 Loan Notes, which were

originally issued to Henderson Global Investors and EnQuest plc in

February 2014, have been fully converted. The GBP49,423 nominal

convertible loan notes (including rolled-up interest) that remain

outstanding all comprise loan notes subscribed for by shareholders

as part of the open offer in May 2013.

Admission and Settlement

Application has been made for the admission to trading on AIM of

the Conversion Shares ("Admission"). Admission is expected to occur

on 4 August 2017. Following Admission, Ascent will have

2,147,364,779 Ordinary Shares in issue. There are no shares held in

treasury. The total voting rights in the Company is therefore

2,147,364,779 and Shareholders may use this figure as the

denominator by which they are required to notify their interest in,

or change to their interest in, the Company under the Disclosure

Guidance and Transparency Rules.

Colin Hutchinson, CEO commented:

"The almost total conversion of the GBP12 million Loan Notes

reflects the entry by the Company over the past 16 months of a new

stage in its history.

While these Loan Notes were an essential part of the financial

survival plan for the Company as we struggled to reach first gas

they no longer play any significant role in the future funding

structure of the Company.

Repaying the GBP12 million Loan Note debt solely via market

conversions over the past 16 months demonstrates the strength of

interest in the Company's future prospects"

Enquiries:

Ascent Resources plc 0207 251 4905

Clive Carver, Chairman

Colin Hutchinson, CEO

Stockdale Securities Limited, Nominated Adviser and Joint Broker 0207 601 6100

Richard Johnson

Edward Thomas

Northland Capital Partners Limited, Joint Broker 0203 861

6625

Tom Price

Abchurch, Financial PR and IR 0207 398 7700

Tim Thompson

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMMGFNGMMGNZM

(END) Dow Jones Newswires

July 31, 2017 06:13 ET (10:13 GMT)

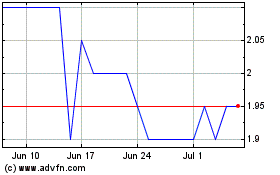

Ascent Resources (LSE:AST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Apr 2023 to Apr 2024