Asahi Offers AB InBev $2.9 Billion For Brands

February 11 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 2/11/16)

By Tripp Mickle and Atsuko Fukase

Anheuser-Busch InBev NV is moving toward selling the Peroni and

Grolsch brands to Asahi Group Holdings Ltd. in a deal designed to

help the Belgian brewer close its takeover of SABMiller PLC.

The company said Wednesday it received a binding offer from

Japan's Asahi valued at about $2.9 billion in cash. The potential

sale of Peroni, Grolsch and U.K. craft brewer Meantime, which are

owned by SABMiller, is aimed at helping AB InBev secure European

regulatory approval for its roughly $108 billion acquisition of

SABMiller.

If AB InBev accepts Asahi's bid, the deal would close after the

SABMiller takeover is completed this year, as expected. The

SABMiller agreement, announced in November, would create a brewing

behemoth with about 30% of the global beer market. It requires

regulatory approval in a host of markets, including Europe, the

U.S., China and South Africa.

The deal would be Asahi's biggest overseas acquisition and

largest acquisition in Japan's beverage and liquor industry since

Suntory Holdings Ltd. bought Beam Inc., owner of Jim Beam, for

about $13.6 billion in 2014.

Asahi's binding was offer presented to AB InBev in a strategic

effort to outflank competitors and private-equity firms vying for

Italy's Peroni and the Netherlands' Grolsch in an auction process

that began early this year, a person familiar with the process

said.

The deal would increase Asahi's global market share by volume to

1.9% from 1.5% and make it the world's ninth-largest brewer,

according to industry research firm Plato Logic.

Acquiring the brands would give the Japanese brewer a bigger

footprint outside its home country, where a shrinking and aging

population and tough competition have cut into sales.

The company sees an opportunity to bundle Asahi Super Dry, its

signature brand, with Peroni, Grolsch and Meantime to create a

stable of high-end beers. Peroni, Grolsch and Meantime combine for

operating profit in Italy, the Netherlands and the U.K. of more

than $80 million, according to Asahi.

Heineken NV and Carlsberg A/S, the world's third and fourth

largest brewers by volume, respectively, on Wednesday brought some

cheer to shareholders.

Heineken raised its dividend by 18% and reported a 25% increase

in net profit in 2015 to $2.1 billion behind strong sales in Asia,

Mexico and Brazil.

Carlsberg reported a surprise profit for the fourth quarter of

about $12 million, down from around $25 million during the same

period a year earlier, but better than the loss of roughly $38

million that analysts expected.

(END) Dow Jones Newswires

February 11, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

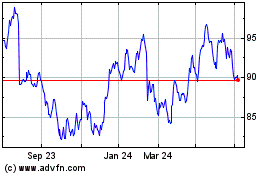

Heineken (EU:HEIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

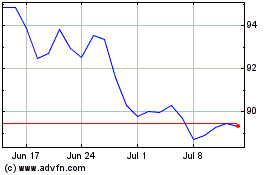

Heineken (EU:HEIA)

Historical Stock Chart

From Apr 2023 to Apr 2024