As Hartford Mulls Bankruptcy, Bond Insurer Offers to Help Postpone Payments -- Update

September 25 2017 - 3:47PM

Dow Jones News

By Heather Gillers

Hartford's biggest bond insurer said it had offered to help the

city postpone payments on as much as $300 million in outstanding

debt, in a move designed to help prevent a bankruptcy filing for

Connecticut's capital.

The insurer, Assured Guaranty Ltd., made the announcement before

a Monday conference call between Hartford and its bondholders.

During the call Hartford Mayor Luke Bronin said postponement of

the city's debt would be inadequate without other fixes such as

more revenue from the state, according to a statement released by

the city after the call.

"I appreciate Assured's willingness to have constructive

discussions," the mayor said, according to the statement, but "this

administration is not interested in pushing off this challenge for

another mayor or another generation to fix."

Under Assured Guaranty's proposal, debt payments due in the next

15 years would instead be spread out over the next 30 years without

bankruptcy or default. The city would issue new longer-dated bonds

and use the proceeds to make the near-term debt payments.

Assured Guaranty and another insurer, Build America Mutual,

would insure the new bonds, said an Assured Guaranty spokesman.

Assured Guaranty backs 57% of Hartford's roughly $550 million in

outstanding general obligation debt and would be on the hook for

any shortfall in payments should the city enter bankruptcy. Build

America Mutual backs $103 million in Hartford debt. About $163

million in Hartford bonds are held by U.S. mutual funds.

Hartford is in the middle of a fiscal emergency because of a

weak tax base and a budget deficit of nearly $50 million. It also

has one of the lowest credit ratings in the nation. Making matters

worse, Connecticut lawmakers have been unable to reach agreement on

a state budget more than two months into the fiscal year, leaving

Hartford short of state funding.

City officials have warned that the city would likely file for

bankruptcy this fall unless the state provides more help. Mayor

Luke Bronin has said the city cannot afford to make its bond

payments on time and will need to restructure its debt even if

Hartford does receive state assistance.

The offer from Assured Guaranty would provide Hartford with

short-term budgetary relief but wouldn't reduce the city's total

liabilities. In fact, it would add to them because delaying when

the debt comes due would increase interest costs.

The city's debt payments are scheduled to jump from $6.6 million

to $56 million in the next four years, according to city financial

disclosures. Assured Guaranty's plan would lower those payments by

pushing some of the debt out as far as 2047.

It is common for states to issue bonds as a way of refunding old

debt, both to take advantage of low interest rates and to put off

debt payments. But Hartford, which is rated deep in junk status and

has hired restructuring advisers, would likely be unable to

complete such a deal without insurance.

"Once you hire restructuring advisers, investors steer clear,"

said Matt Fabian, partner at Municipal Market Analytics, a

municipal bond research firm.

Of cities rated by Moody's Investors Service, only Stockton,

Calif., which emerged from bankruptcy protection two years ago, and

Atlantic City, N.J., which narrowly avoided it, have lower ratings

than Hartford.

Assured Guaranty's proposal takes advantage of state legislation

passed in July that for the next five years allows cities to

refinance debt with 30-year bonds instead of restricting them to

20-year bonds.

Hartford could receive more than $40 million in aid under one

version of Connecticut's fiscal 2018 budget, which state lawmakers

are still debating. But that alone wouldn't be enough to keep

Hartford out of bankruptcy, the city said in a notice about

Monday's conference call.

Assured Guaranty's proposal wouldn't help Hartford solve all its

problems. A continued delay in the budget could strain the city's

ability to make payment on a $20 million short-term loan due on

Oct. 31.

The insurer's proposal could be "a part of the solution," said

the Assured Guaranty spokesman. "It's not the solution in

itself."

Write to Heather Gillers at heather.gillers@wsj.com

(END) Dow Jones Newswires

September 25, 2017 15:32 ET (19:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

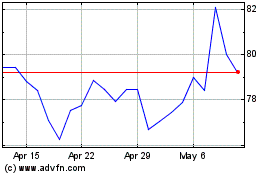

Assured Guaranty Municipal (NYSE:AGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

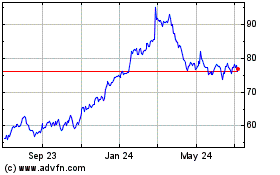

Assured Guaranty Municipal (NYSE:AGO)

Historical Stock Chart

From Apr 2023 to Apr 2024