TIDMATS

RNS Number : 9322Z

Artemis Alpha Trust PLC

16 December 2014

ARTEMIS ALPHA TRUST PLC (the "Company")

Half-Yearly Financial Report for the six months ended 31 October

2014

This announcement contains regulated information

Chairman's Statement

I am pleased to present my first half-yearly report to

shareholders, following my appointment as Chairman on 2 October

2014. Simon Miller retired at this time, and my fellow directors

and I would like to thank him for his outstanding stewardship of,

and contribution to, the Company over his eleven year tenure as

chairman and director.

Performance

Although markets had been quiet for much of the summer, concerns

over deflation in Europe, coupled with the end of quantitative

easing in the US and slowing growth in China, took hold in

mid-September, prompting a rise in volatility. Geopolitical issues

didn't help either. The market initially fell by about 10 per cent

but recovered much of the loss before the end of the review period.

The Company continues to have a significant part of its portfolio

invested in small-cap and AIM-listed companies. These areas of the

market performed particularly poorly, with the FTSE Small Cap Index

falling by 6.0 per cent and the FTSE AIM All-Share Index falling by

11.9 per cent. Against this background, the Company's net asset

value per ordinary share increased by 1.8 per cent. This compares

favourably with a 1.6 per cent fall in the FTSE All-Share

Index.

Performance benefitted from positive contributions from two of

our unquoted investments: Lynton Holding Asia, which sold its

investment in an aviation business, and The Hut Group, where part

of the Company's investment was sold to a private equity group. It

is expected that Lynton will return proceeds from its sale to

shareholders in the near future, so we can look forward to a

significant cash inflow. The proceeds from The Hut Group,

meanwhile, were used to reduce the Company's gearing level.

Borrowings were reduced from GBP26.5 million at 30 April to GBP12.5

million as at 31 October.

More details on performance are included in the Investment

Manager's Review.

Earnings & dividends

Revenue earnings for the six months to 31 October 2014 were

1.87p (2013: 2.29p). The Board has declared a first interim

dividend of 1.25p per ordinary share. This is an increase of 4.1

per cent over the equivalent dividend last year (2013: 1.20p). This

will be paid on 30 January 2015 to shareholders on the register as

at 5 January 2015.

Share capital

During the period, the Company bought back 118,200 ordinary

shares at an average discount of 12.4 per cent. 1,258 subscription

shares were exercised and the same number of ordinary shares issued

in respect of these.

Regulatory changes

The Company became subject to the Alternative Investment Fund

Managers Directive ("AIFMD") on 21 July 2014. As indicated in the

Annual Report, Artemis Fund Managers Limited was appointed as

Investment Manager and Alternative Investment Fund Manager to the

Company, while J.P. Morgan Europe Limited was appointed as

depositary.

Outlook

The UK continues to be one of the better performing economies in

the developed world. The wider global environment, however, is

mixed, with increasing tensions in Ukraine and Syria. Combine this

with the forthcoming general election in the UK and the associated

uncertainty over the UK's future relationship with the European

Union, and the backdrop for investing is challenging. That said,

where there is uncertainty there is opportunity. I expect that the

Investment Manager's stock-picking approach will identify

investment opportunities and thereby continue to produce long-term

returns for the Company's shareholders.

Communication with shareholders

The Board is always interested to hear the views of

shareholders, and it was pleasing to see many of you at the annual

general meeting in October 2014. The Company's contact details are

set out in the Half-Yearly Financial Report, and further

information can be found on the website of the Investment Manager -

artemis.co.uk - which is updated monthly.

Duncan Budge

Chairman

16 December 2014

Investment Manager's Review

Performance

During the reporting period, investors braced themselves for an

end to quantitative easing in the US and for a slowdown in some of

the world's largest economies. In the UK, meanwhile, fears that

Scotland might break away from the United Kingdom led to a brief

period of uncertainty, sending share prices - and sterling - lower.

It was, then, a challenging six months for equity markets. Despite

this, the Company's net asset value rose by 1.8 per cent on a

total-return basis. This compares favourably with a loss of 1.6 per

cent from the FTSE All-Share Index.

Review

The diversity of the Company's portfolio reflects its bottom-up,

stock-picking style. At the same time, however, it retains some

concentration in two core themes: online businesses and other

financials. As we noted in the annual report, we took a decision

some months ago to reduce our exposure to the oil & gas sector

substantially; it now represents just 11.9 per cent of the

Company's portfolio. In hindsight, this decision was well-timed.

The sector has subsequently struggled as the oil price

weakened.

The main positive contributor to returns was an unquoted holding

in The Hut Group. After a period of strong trading, it attracted

private equity group KKR as a new investor. This enabled some of

the company's existing shareholders to realise part of their

investments. We realised 60 per cent of the Company's shareholding

at roughly double its previous carrying value and three times its

cost. This added 4.9 per cent to the Company's NAV and brought in

GBP9 million of cash.

The other major positive among the Company's unquoted holdings

was Lynton Holding Asia, which became a cash shell following the

sale of its stake in Hawker Pacific. This added 2.5 per cent to the

Company's NAV and will, in due course, lead to a sizeable cash

realisation.

Five largest stock contributors

Contribution

%

The Hut Group 4.9

Lynton Holding Asia 2.5

Skyepharma 1.5

Telford Homes 0.8

New Britain Palm Oil 0.8

Five largest stock detractors

Contribution

%

Africa Oil (1.7)

Gresham Computing (1.0)

Providence Resources (1.0)

Eland Oil & Gas (0.7)

Liontrust Asset Management (0.6)

Successes in the quoted portfolio included Skyepharma, which

successfully raised equity to pay off expensive debt, and New

Britain Palm Oil, which was bought by Sime Darby at a substantial

premium. After a period of prolonged weakness in the underlying

commodity price, the palm oil sector has seen a spate of

consolidation. Another of our palm-oil holdings, Asian Plantations,

was also acquired during the review period. Elsewhere, Gaming

Realms, an online bingo business, performed particularly well as it

continued its strategy of selective acquisitions.

As mentioned above, the oil & gas sector struggled and the

main negatives for the Company were the holdings in Africa Oil,

Providence Resources and Eland Oil & Gas. The declines in the

share prices of all three companies can, at least in part, be

explained by the weakness in the oil price. In two of these cases,

however (Africa Oil and Providence Resources), there is a need for

new funding to take forward their substantial exploration

programmes. Hurricane Energy also needs further funding following

the success of test drilling off the west coast of Scotland. All

three companies have made large discoveries but are struggling to

access capital to exploit them due to the depressed price of crude

oil.

The Company's other strugglers were Gresham Computing and

Liontrust Asset Management. Gresham, which supplies software to

financial services companies, issued a profit warning following

contract delays. Liontrust, meanwhile, succumbed to profit-taking

following a strong run. We remain supportive of both

businesses.

In terms of transactions, our largest purchase was Booker Group,

an operator of cash-and-carry outlets and an internet-enabled

grocery wholesaler to independent retailers. This is a business we

have known for a long time and it is managed by the excellent

Charles Wilson, formerly of Marks & Spencer. In a highly

fragmented market there is huge potential for Booker to grow. Other

new investments over the period included Fox Marble, the owner of a

number of marble quarries, and Essenden, which operates a number of

ten-pin bowling centres in the UK.

We sold the entirety of our holdings in Salamander Energy, an

oil & gas company, and Real Estate Investors, a Midlands-based

property company. There were partial sales in City of London

Investment Group and Summit Corp, following strong share price

appreciation.

Outlook

Given that there has been a great deal for markets to worry

about, and that any pockets of cheer have been isolated, the

resilience of most equities over the period was welcome. Will that

continue? From geopolitical concerns to the end of quantitative

easing in the US, worries are plentiful. Moreover, on the whole the

valuations of equities have risen more rapidly than their

cashflows, and so could be especially vulnerable to any sudden

shock.

Yet investors may take comfort from the fact that interest rates

look set to remain low for the foreseeable future. In general,

corporate results have been positive, and in the last few weeks

there has been a pick up in takeover activity.

In any case, this remains a stock-picking Company. We feel

confident that the two main themes we are investing in - online

businesses and other financials - have enormous potential over the

medium and longer term, even if there are short-term set-backs. And

so we continue to concentrate on stock selection, believing that

this, rather than analysing macro-economic or geopolitical issues,

will reward our shareholders.

John Dodd & Adrian Paterson

Fund managers

Artemis Fund Managers Limited

16 December 2014

Responsibility Statement of the Directors in respect of the

Half-Yearly Financial Report

We confirm that to the best of our knowledge, in respect of the

Half-Yearly Financial Report for thesix months ended 31 October

2014:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' issued by

the International Accounting Standards Board as adopted by the

EU;

-- the interim management report includes a fair review of the

information required by:

(a) Disclosure and Transparency Rule 4.2.7R (indication of

important events during the first six months; and a description of

the principal risks and uncertainties for the remaining six months

of the year); and

(b) Disclosure and Transparency Rule 4.2.8R (related party

transactions).

For and on behalf of the Board

Duncan Budge

Chairman

16 December 2014

Condensed Consolidated Income Statement

For the six months ended 31 October 2014

Six months ended Six months ended Year ended

31 October 2014 31 October 2013 30 April 2014

(unaudited) (unaudited) (audited)

Note Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment

income 1,174 - 1,174 935 - 935 2,280 - 2,280

Other income (109) - (109) 12 - 12 710 - 710

Total revenue 1,065 - 1,065 947 - 947 2,990 - 2,990

Gains on

investments - 3,126 3,126 - 15,897 15,897 - 15,054 15,054

Gains on

current asset

investments 28 - 28 366 - 366 392 - 392

Currency

(losses)/gains - (2) (2) - 2 2 (4) (3) (7)

Total income 1,093 3,124 4,217 1,313 15,899 17,212 3,378 15,051 18,429

Expenses

Investment

management

fee (49) (436) (485) (47) (426) (473) (96) (864) (960)

Other expenses (207) (10) (217) (206) (6) (212) (403) (29) (432)

Profit before

finance costs

and tax 837 2,678 3,515 1,060 15,467 16,527 2,879 14,158 17,037

Finance costs (28) (252) (280) (26) (220) (246) (59) (511) (570)

Profit before

tax 809 2,426 3,235 1,034 15,247 16,281 2,820 13,647 16,467

Tax (3) - (3) (7) - (7) (98) - (98)

Profit for

the period 806 2,426 3,232 1,027 15,247 16,274 2,722 13,647 16,369

Earnings

per ordinary

share (pence) 2 1.87p 5.62p 7.49p 2.29p 34.10p 36.39p 6.16p 30.90p 37.06p

The total column of this statement represents the Statement of

Comprehensive Income of the Group, prepared in accordance with

International Financial Reporting Standards. The supplementary

revenue and capital columns are both prepared under guidance

published by the Association of Investment Companies. All items in

the above statement derive from continuing operations.

All income is attributable to the equity shareholders of Artemis

Alpha Trust plc. There are no minority interests.

Condensed Consolidated Balance Sheet

As at 31 October 2014

31 October 31 October

2014 2013 30 April 2014

(unaudited) (unaudited) (audited)

Note GBP'000 GBP'000 GBP'000

Non-current assets

Investments 156,492 168,508 167,207

Current assets

Investments held by

subsidiary 813 1,014 1,263

Other receivables 286 287 551

Cash and cash equivalents 1,050 3,044 1,437

2,149 4,345 3,251

Total assets 158,641 172,853 170,458

Current liabilities

Other payables (444) (543) (274)

Bank loan (12,500) (26,500) (26,500)

(12,944) (27,043) (26,774)

Net assets 145,697 145,810 143,684

Equity attributable

to equity holders

Share capital 520 543 539

Share premium 640 636 636

Special reserve 55,290 57,345 55,649

Capital redemption reserve 70 47 51

Retained earnings -

revenue 2,936 1,824 2,994

Retained earnings -

capital 5 86,241 85,415 83,815

Total equity 145,697 145,810 143,684

Net asset value per

ordinary share (pence) 3 338.12p 333.16p 332.55p

Condensed Consolidated Statement of Changes in Equity

For the six months ended 31 October 2014

Six months ended 31 October 2014 (unaudited)

Capital

Share Share Special redemption Retained earnings

capital premium reserve reserve Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May

2014 539 636 55,649 51 2,994 83,815 143,684

Total comprehensive

income:

Profit for

the period - - - - 806 2,426 3,232

Transactions

with owners

recorded

directly

to equity:

Repurchase

of ordinary

shares into

treasury - - (359) - - - (359)

Cancellation

of ordinary

shares from

treasury (19) - - 19 - - -

Conversion

of subscription

shares - 4 - - - - 4

Dividends

paid - - - - (864) - (864)

At 31 October

2014 520 640 55,290 70 2,936 86,241 145,697

Six months ended 31 October 2013 (unaudited)

Capital

Share Share Special redemption Retained earnings

capital premium reserve reserve Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May

2013 554 635 65,334 36 1,621 70,168 138,348

Total comprehensive

income:

Profit for

the period - - - - 1,027 15,247 16,274

Transactions

with owners

recorded

directly

to equity:

Repurchase

of ordinary

shares into

treasury - - (7,989) - - - (7,989)

Cancellation

of ordinary

shares from

treasury (11) - - 11 - - -

Conversion

of subscription

shares - 1 - - - - 1

Dividends

paid - - - - (824) - (824)

At 31 October

2013 543 636 57,345 47 1,824 85,415 145,810

Year ended 30 April 2014 (audited)

Capital

Share Share Special redemption Retained earnings

capital premium reserve reserve Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May

2013 554 635 65,334 36 1,621 70,168 138,348

Total comprehensive

income:

Profit for

the year - - - - 2,722 13,647 16,369

Transactions

with owners

recorded

directly

to equity:

Repurchase

of ordinary

shares into

treasury - - (9,685) - - - (9,685)

Cancellation

of ordinary

shares from

treasury (15) - - 15 - - -

Conversion

of subscription

shares - 1 - - - - 1

Dividends

paid - - - - (1,349) - (1,349)

At 30 April

2014 539 636 55,649 51 2,994 83,815 143,684

Condensed Consolidated Cash Flow Statement

For the six months ended 31 October 2014

Six months Six months

ended ended

31 October 31 October Year ended

2014 2013 30 April

(unaudited) (unaudited) 2014 (audited)

GBP'000 GBP'000 GBP'000

Operating activities

Profit before tax 3,235 16,281 16,467

Interest payable 280 246 705

Gains on investments (3,126) (15,897) (15,054)

Gains on current asset investments (28) (366) (392)

Currency losses/(gains) 2 (2) 3

Decrease/(increase) in other receivables 14 55 (136)

Increase/(decrease) in other payables 268 (29) (311)

Net cash inflow from operating activities before interest and tax 645 288 1,282

Interest paid (280) (246) (705)

Irrecoverable overseas tax suffered (3) (7) (98)

Net cash inflow from operating activities 362 35 479

Investing activities

Purchases of investments (12,580) (16,518) (39,556)

Sales of investments 27,150 25,807 48,922

Net cash inflow from investing activities 14,570 9,289 9,366

Financing activities

Repurchase of ordinary shares into treasury (457) (7,989) (9,587)

Conversion of subscription shares 4 1 1

Dividends paid (864) (824) (1,349)

Net cash outflow from financing activities (1,317) (8,812) (10,935)

Net increase/(decrease) in

cash and cash equivalents 13,615 512 (1,090)

Cash and cash equivalents at the start of the period (25,063) (23,970) (23,970)

Effect of foreign exchange rate changes (2) 2 (3)

Cash and cash equivalents at the end of the period (11,450) (23,456) (25,063)

Bank loan (12,500) (26,500) (26,500)

Cash 1,050 3,044 1,437

(11,450) (23,456) (25,063)

Notes

1. Accounting policies

The Group's Half-Yearly Financial Report has been prepared in

accordance with International Accounting Standard 34, 'Interim

Financial Reporting', the provisions of the Companies Act 2006 and

with the guidance set out in the Statement of Recommended Practice

for Investment Trust Companies and Venture Capital Trusts issued by

the Association of Investment Companies in January 2009.

The Half-Yearly Financial Report has been prepared under the

same accounting policies as the Annual Financial Statements for the

year ended 30 April 2014.

2. Earnings per ordinary share

Six months Six months

ended ended

31 October 31 October Year ended

2014 2013 30 April 2014

Earnings per ordinary share

is based on:

Revenue earnings (GBP'000) 806 1,027 2,722

Capital earnings (GBP'000) 2,426 15,247 13,647

Total earnings (GBP'000) 3,232 16,274 16,369

Weighted average number

of ordinary shares in issue

during the period (basic) 43,164,248 44,719,128 44,162,066

Weighted average number

of ordinary shares in issue

during the period (diluted) 43,164,248 44,719,128 44,162,066

3. Net asset value per ordinary share

As at

As at 31 October As at

31 October 2014 2013 30 April 2014

Net asset value per ordinary

share is based on:

Net assets (GBP'000) 145,697 145,810 143,684

Number of ordinary shares

in issue at the end of the

period (basic) 43,089,843 43,765,162 43,206,785

Number of ordinary shares

in issue at the end of the

period (diluted) 43,089,843 43,765,162 43,206,785

During the period the Company bought back 118,200 ordinary

shares into treasury. 1,258 subscription shares were exercised and

the same number of ordinary shares were issued in respect of

these.

4. Dividends

Six months

ended

Six months ended 31 October Year ended

31 October 2014 2013 30 April 2014

GBP'000 GBP'000 GBP'000

Second interim dividend

for the

year ended 30 April 2013

- 1.85p - 824 824

First interim dividend for

the

year ended 30 April 2014

- 1.20p - - 525

Second interim dividend

for the

year ended 30 April 2014

- 2.00p 864 - -

864 824 1,349

A first interim dividend for the year ending 30 April 2015 of

GBP540,000 (1.25p per ordinary share) has been declared. This will

be paid on 30 January 2015 to those shareholders on the register at

close of business on 5 January 2015.

5. Analysis of retained earnings - capital

31 October 31 October

2014 2013 30 April 2014

GBP'000 GBP'000 GBP'000

Retained earnings - capital

(realised) 76,830 65,123 68,835

Retained earnings - capital

(unrealised) 9,411 20,292 14,980

86,241 85,415 83,815

6. Comparative information

The financial information for the six months ended 31 October

2014 and 31 October 2013 has not been audited and does not

constitute statutory financial statements as defined in Section 234

of the Companies Act 2006.

The information for the year ended 30 April 2014 has been

extracted from the Audited Financial Statements for the year ended

30 April 2014. These financial statements contained an unqualified

auditor's report and have been lodged with the Registrar of

Companies and did not contain a statement required under Section

498 of the Companies Act 2006.

7. Principal risks and uncertainties

Pursuant to DTR 4.2.7R of the Disclosure and Transparency Rules,

the principal risks faced by the Company include general market

price risk, liquidity risk, regulatory, and financial risks.

These risks, which have not materially changed since the Annual

Report for the year ended 30 April 2014, and the way in which they

are managed, are described in more detail in the Annual Report for

the year ended 30 April 2014 which is available on the Investment

Manager's website at artemis.co.uk.

8. Related party transactions

There were no related party transactions during the period. The

existence of an independent Board of Directors demonstrates that

the Company is free to pursue its own financial and operating

policies and therefore, under IAS 24: Related Party Disclosures,

the Investment Manager is not considered to be a related party.

Copies of the Half-Yearly Financial Report for the six months

ended 31 October 2014 will be sent to shareholders shortly and will

be available from the registered office at Cassini House, 57 St

James's Street, London SW1A 1LD as well as on the investment

manager's website, artemis.co.uk.

Artemis Fund Managers Limited

Company Secretary

For further information, please contact:

Billy Aitken at Artemis Fund Managers Limited

Telephone: 0131 225 7300

16 December 2014

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZQLFFZLFZFBZ

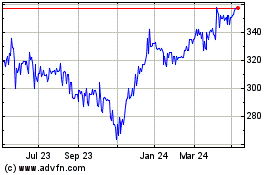

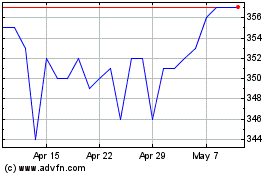

Artemis Alpha (LSE:ATS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Artemis Alpha (LSE:ATS)

Historical Stock Chart

From Apr 2023 to Apr 2024