Arrow Electronics Upsizes Asset Securitization Program

March 25 2014 - 8:00AM

Business Wire

-- Maturity Extended to 2017 –-

Arrow Electronics, Inc. (NYSE:ARW) announced that the company

has amended its asset securitization program, extending maturity to

March 2017 and increasing capacity to $900 million. The program

previously matured in December 2014 and totaled $775 million. The

program is led by Bank of America, as administrative agent.

"We are pleased to have extended and expanded our

securitization," said Paul J. Reilly, executive vice president,

finance and operations, and chief financial officer. "Our strong

balance sheet, excellent cash flows, and enhanced liquidity

facilities, such as the asset securitization program, give us the

financial flexibility to continue to drive strategic growth."

Arrow Electronics (www.arrow.com) is a global provider of

products, services and solutions to industrial and commercial users

of electronic components and enterprise computing solutions. Arrow

serves as a supply channel partner for more than 100,000 original

equipment manufacturers, contract manufacturers and commercial

customers through a global network of more than 460 locations in 58

countries.

Safe Harbor

The Private Securities Litigation Reform Act of 1995 provides a

“safe harbor” for forward-looking statements. This press release

includes forward-looking statements that are subject to numerous

assumptions and a number of risks and uncertainties that could

cause actual results or facts to differ materially from such

statements for a variety of reasons including, but not limited to:

industry conditions, the company’s implementation of its new

enterprise resource planning system, changes in product supply,

pricing and customer demand, competition, other vagaries in the

global components and global ECS markets, changes in relationships

with key suppliers, increased profit margin pressure, the effects

of additional actions taken to become more efficient or lower

costs, risks related to the integration of acquired businesses,

change in legal and regulatory matters, the company’s ability to

generate additional cash flow and the other risks described from

time to time in the company’s reports to the Securities and

Exchange Commission (including the company’s Annual Report on Form

10-K and Quarterly Reports on Form 10-Q). Forward-looking

statements are those statements, which are not statements of

historical fact. These forward-looking statements can be identified

by forward-looking words such as “expects,” “anticipates,”

“intends,” “plans,” “may,” “will,” “believes,” “seeks,”“estimates,”

and similar expressions. Shareholders and other readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date on which they are made.

The company undertakes no obligation to update publicly or revise

any of the forward-looking statements.

Arrow ElectronicsGreg Hanson, 303-824-4537Vice President

and TreasurerorPaul J. Reilly, 631-847-1872Executive Vice

President, Finance and Operations, &Chief Financial

OfficerorMedia Contact:John Hourigan, 303-824-4586Vice

President, Corporate Communications

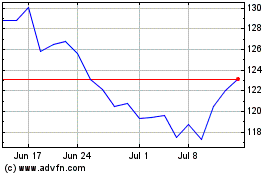

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

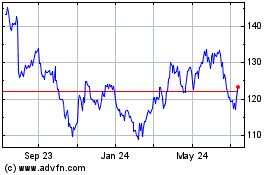

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024