-- Operating Margins Expand Over Prior Year

--

-- Cash Flow from Operations of $461 Million

--

Arrow Electronics, Inc. (NYSE:ARW) today reported second-quarter

2015 net income of $123.9 million, or $1.28 per share on a diluted

basis, compared with net income of $127.9 million, or $1.27 per

share on a diluted basis, in the second quarter of 2014. Excluding

certain items1 in the second quarters of 2015 and 2014, net income

would have been $148.9 million, or $1.54 per share on a diluted

basis, in the second quarter of 2015, compared with net income of

$144.3 million, or $1.43 per share on a diluted basis, in the

second quarter of 2014. Second-quarter sales of $5.83 billion

increased 3 percent from sales of $5.68 billion in the prior year.

Second-quarter sales, adjusted for the impact of acquisitions and

changes in foreign currencies, also increased 3 percent year over

year. In the second quarter of 2015, changes in foreign currencies

had negative impacts on growth of $350 million on sales and $.10 or

7 percent on earnings per share on a diluted basis compared to the

second quarter of 2014.

“Second-quarter sales exceeded the midpoint of our expectations.

Excluding the impacts from changes in foreign currencies, EPS

advanced nearly 16 percent year over year, with both our global

components and enterprise computing solutions segments delivering

sales growth and expanded operating margins. Both businesses

continued to experience strong demand in Europe. Our focus on

selling comprehensive solutions resulted in record second-quarter

operating income and operating margin for our enterprise computing

solutions business,” said Michael J. Long, chairman, president, and

chief executive officer.

Global components second-quarter sales of $3.7 billion grew 4

percent year over year. Second-quarter sales, adjusted for

acquisitions and changes in foreign currencies, grew 3 percent year

over year. Americas components sales were flat year over year. Core

components sales in the Americas grew 3 percent year over year.

Europe components sales were flat year over year. Sales in the

region, as adjusted, grew 11 percent year over year. Asia-Pacific

components sales grew 11 percent year over year. Sales in the

region, as adjusted, grew 4 percent year over year.

Global enterprise computing solutions second-quarter sales of

$2.13 billion grew 2 percent year over year, adjusted for

acquisitions and changes in foreign currencies. Sales, as reported,

grew 1 percent year over year. Americas sales grew 9 percent year

over year. Sales in the region, as adjusted, declined 1 percent

year over year. Core enterprise computing solutions sales in the

Americas region were flat year over year. Europe sales grew 8

percent on an as-adjusted basis. Sales in the region, as reported,

declined 13 percent year over year. Both Americas and Europe

experienced strong software growth.

“With $461 million in cash flow from operations in the second

quarter, we again meaningfully exceeded our cash flow target,” said

Paul J. Reilly, executive vice president, finance and operations,

and chief financial officer. “The highly effective management of

our balance sheet and related strong cash flow provided us with the

opportunity to both deploy capital toward our strategic initiatives

and return approximately $78 million to shareholders through our

stock repurchase program.”

SIX-MONTH RESULTS

Arrow’s net income for the first six months of 2015 was $230.0

million, or $2.37 per share on a diluted basis, compared with net

income of $235.0 million, or $2.33 per share on a diluted basis in

the first six months of 2014. Excluding certain items1 in both the

first six months of 2015 and 2014, net income would have been

$276.7 million, or $2.86 per share on a diluted basis, in the first

six months of 2015 compared with net income of $268.3 million, or

$2.66 per share on a diluted basis, in the first six months of

2014. In the first six months of 2015, sales of $10.83 billion

increased 1 percent from sales of $10.76 billion in the first six

months of 2014. Six-month sales, adjusted for acquisitions and

changes in foreign currencies, increased 3 percent year over

year.

GUIDANCE

“As we look to the third quarter, we believe that total sales

will be between $5.55 billion and $5.95 billion, with global

components sales between $3.65 billion and $3.85 billion, and

global enterprise computing solutions sales between $1.9 billion

and $2.1 billion. As a result of this outlook, we expect earnings

per share on a diluted basis, excluding any charges, to be in the

range of $1.40 to $1.52 per share. Our guidance assumes an average

tax rate in the range of 27 to 29 percent and average diluted

shares outstanding are expected to be 95.5 million. We are

expecting the average USD to Euro exchange rate for the third

quarter to be approximately $1.08 to €1. Based on this assumption,

the weaker Euro will have a negative impact of $280 million or 5

percent on sales and $.08 or 6 percent on earnings per share on a

diluted basis, respectively, when compared with the third quarter

of 2014, and a negative impact of $40 million or 1 percent on sales

and $.01 or 1 percent on earnings per share on a diluted basis,

respectively, when compared with the second quarter of 2015,” said

Mr. Reilly.

“Included in our guidance for the third quarter 2015 are $435

million of sales and $.11 of earnings per share on a diluted basis

when compared with the third quarter of 2014, and $25 million of

sales and no additional contribution to earnings per share on a

diluted basis when compared with the second quarter of 2015,

related to our closed acquisitions,” added Mr. Reilly.

Please refer to the CFO commentary, which can be found at

www.arrow.com/investor, as a supplement to the company’s earnings

release.

Arrow Electronics (www.arrow.com) is a global provider of

products, services and solutions to industrial and commercial users

of electronic components and enterprise computing solutions. Arrow

serves as a supply channel partner for more than 100,000 original

equipment manufacturers, contract manufacturers and commercial

customers through a global network of more than 460 locations in 56

countries.

Information Relating to Forward-Looking

Statements

This press release includes forward-looking statements that are

subject to numerous assumptions, risks, and uncertainties, which

could cause actual results or facts to differ materially from such

statements for a variety of reasons, including, but not limited to:

industry conditions, the company's implementation of its new

enterprise resource planning system, changes in product supply,

pricing and customer demand, competition, other vagaries in the

global components and global enterprise computing solutions

markets, changes in relationships with key suppliers, increased

profit margin pressure, the effects of additional actions taken to

become more efficient or lower costs, risks related to the

integration of acquired businesses, changes in legal and regulatory

matters, and the company’s ability to generate additional cash

flow. Forward-looking statements are those statements which are not

statements of historical fact. These forward-looking statements can

be identified by forward-looking words such as "expects,"

"anticipates," "intends," "plans," "may," "will," "believes,"

"seeks," "estimates," and similar expressions. Shareholders and

other readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date on

which they are made. The company undertakes no obligation to update

publicly or revise any of the forward-looking statements.

For a further discussion of factors to consider in connection

with these forward-looking statements, investors should refer to

Item 1A Risk Factors of the company’s Annual Report on Form 10-K

for the year ended December 31, 2014.

Certain Non-GAAP Financial

Information

In addition to disclosing financial results that are determined

in accordance with accounting principles generally accepted in the

United States (“GAAP”), the company also provides certain non-GAAP

financial information relating to sales, operating income, net

income attributable to shareholders, and net income per basic and

diluted share. The company provides sales on a non-GAAP basis

adjusted for the impact of changes in foreign currencies and the

impact of acquisitions by adjusting the company's prior periods to

include the sales of businesses acquired as if the acquisitions had

occurred at the beginning of the earliest period presented

(referred to as "impact of acquisitions"). Operating income, net

income attributable to shareholders, and net income per basic and

diluted share are adjusted for certain charges, credits, gains, and

losses that the company believes impact the comparability of its

results of operations. These charges, credits, gains, and losses

arise out of the company’s efficiency enhancement initiatives,

acquisitions (including intangible assets amortization expense),

loss on prepayment of debt, and (gain)/loss on investments. A

reconciliation of the company’s non-GAAP financial information to

GAAP is set forth in the tables below.

The company believes that such non-GAAP financial information is

useful to investors to assist in assessing and understanding the

company’s operating performance and underlying trends in the

company’s business because management considers these items

referred to above to be outside the company’s core operating

results. This non-GAAP financial information is among the primary

indicators management uses as a basis for evaluating the company’s

financial and operating performance. In addition, the company’s

Board of Directors may use this non-GAAP financial information in

evaluating management performance and setting management

compensation.

The presentation of this additional non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for, or alternative to, sales, operating income, net

income and net income per basic and diluted share determined in

accordance with GAAP. Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in conjunction with,

data presented in accordance with GAAP.

1 A reconciliation of non-GAAP adjusted financial measures,

including sales, as adjusted, operating income, as adjusted, net

income attributable to shareholders, as adjusted, and net income

per share, as adjusted, to GAAP financial measures is presented in

the reconciliation tables included herein.

ARROW ELECTRONICS, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands except per share data) (Unaudited)

Quarter Ended Six Months Ended

June 27, 2015 June 28, 2014 June 27, 2015

June 28, 2014 Sales $ 5,829,989 $ 5,676,539 $

10,832,374 $ 10,758,579 Costs and expenses: Cost of sales 5,061,394

4,929,018 9,378,457 9,307,230 Selling, general, and administrative

expenses 504,754 489,908 959,284 967,811 Depreciation and

amortization 39,751 39,712 76,913 76,283 Restructuring,

integration, and other charges 17,147 9,632

33,343 21,246 5,623,046 5,468,270

10,447,997 10,372,570 Operating income 206,943 208,269

384,377 386,009 Equity in earnings of affiliated companies 1,903

1,181 3,216 2,598 Interest and other financing expense, net 34,696

28,920 65,550 58,557 Other 1,500 - 2,435

- Income before income taxes 172,650 180,530 319,608 330,050

Provision for income taxes 47,967 52,470

88,834 94,798 Consolidated net income 124,683 128,060

230,774 235,252 Noncontrolling interests 751 176

784 248 Net income attributable to shareholders $

123,932 $ 127,884 $ 229,990 $ 235,004 Net income per share: Basic $

1.30 $ 1.29 $ 2.40 $ 2.36 Diluted $ 1.28 $ 1.27 $ 2.37 $ 2.33

Weighted average shares outstanding: Basic 95,638 99,449 95,776

99,695 Diluted 96,649 100,562 96,874 100,980 ARROW

ELECTRONICS, INC.

CONSOLIDATED BALANCE

SHEETS

(In thousands except par value)

June 27, 2015 December 31, 2014

(Unaudited)

ASSETS

Current assets: Cash and cash equivalents $ 399,721 $ 400,355

Accounts receivable, net 5,084,531 6,043,850 Inventories 2,517,815

2,335,257 Other current assets 301,066 253,145

Total current assets 8,303,133

9,032,607 Property, plant, and equipment, at cost:

Land 23,590 23,770 Buildings and improvements 159,470 144,530

Machinery and equipment 1,202,214 1,146,045

1,385,274 1,314,345 Less: Accumulated depreciation and

amortization (713,826 ) (678,046 ) Property, plant,

and equipment, net 671,448 636,299

Investments in affiliated companies

72,774

69,124

Intangible assets, net 438,670 335,711 Cost in excess of net assets

of companies acquired 2,327,572 2,069,209 Other assets

298,217 292,351 Total assets $

12,111,814 $ 12,435,301 LIABILITIES AND EQUITY

Current liabilities: Accounts payable $ 4,171,131 $ 5,027,103

Accrued expenses 719,232 797,464

Short-term borrowings, including current

portion of long-term debt

86,806 13,454 Total current

liabilities 4,977,169 5,838,021

Long-term debt 2,544,388 2,067,898 Other liabilities 410,333

370,471 Equity: Shareholders' equity: Common stock, par

value $1: Authorized – 160,000 shares in both 2015 and 2014 Issued

– 125,424 shares in both 2015 and 2014 125,424 125,424 Capital in

excess of par value 1,083,885 1,086,082

Treasury stock (31,008 and 29,529 shares

in 2015 and 2014, respectively), at cost

(1,281,456 ) (1,169,673 ) Retained earnings 4,406,744 4,176,754

Accumulated other comprehensive loss (210,567 )

(64,617 ) Total shareholders' equity 4,124,030 4,153,970

Noncontrolling interests 55,894 4,941

Total equity 4,179,924 4,158,911

Total liabilities and equity $ 12,111,814 $ 12,435,301

ARROW ELECTRONICS, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited)

Quarter Ended June 27, June 28,

2015 2014 Cash flows from operating activities: Consolidated net

income $ 124,683 $ 128,060

Adjustments to reconcile consolidated net

income to net cash provided by (used for) operations:

Depreciation and amortization 39,751 39,712 Amortization of

stock-based compensation 12,086 10,371 Equity in earnings of

affiliated companies (1,903 ) (1,181 ) Deferred income taxes 14,115

5,338 Restructuring, integration, and other charges 12,894 7,526

Excess tax benefits from stock-based compensation arrangements (185

) (386 ) Other 2,844 (120 )

Change in assets and liabilities, net of

effects of acquired businesses:

Accounts receivable 143,882 (306,793 ) Inventories (131,399 )

(202,670 ) Accounts payable 259,287 449,225 Accrued expenses (3,104

) 19,289 Other assets and liabilities (11,917 )

11,064 Net cash provided by (used for) operating activities

461,034 159,435 Cash flows from

investing activities: Cash consideration paid for acquired

businesses (337,585 ) - Acquisition of property, plant, and

equipment (37,670 ) (29,160 ) Other

-

- Net cash used for investing activities

(375,255 ) (29,160 ) Cash flows from financing

activities: Change in short-term and other borrowings (5,051 )

(2,566 ) Proceeds from (repayment of) long-term bank borrowings,

net 82,800 (35,000 ) Proceeds from exercise of stock options 1,898

2,179

Excess tax benefits from stock-based

compensation arrangements

185 386 Repurchases of common stock (77,863 ) (50,310 ) Other

- - Net cash provided by (used for)

financing activities 1,969 (85,311 )

Effect of exchange rate changes on cash 6,680

5,689 Net increase in cash and cash equivalents 94,428

50,653 Cash and cash equivalents at beginning of period

305,293 258,283 Cash and cash equivalents at

end of period $ 399,721 $ 308,936 ARROW

ELECTRONICS, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited) Six Months

Ended June 27, June 28, 2015 2014 Cash flows from

operating activities: Consolidated net income $ 230,774 $ 235,252

Adjustments to reconcile consolidated net

income to net cash provided by operations:

Depreciation and amortization 76,913 76,283 Amortization of

stock-based compensation 22,006 20,167 Equity in earnings of

affiliated companies (3,216 ) (2,598 ) Deferred income taxes 26,506

15,979 Restructuring, integration, and other charges 25,463 15,546

Excess tax benefits from stock-based compensation arrangements

(5,842 ) (6,248 ) Other 4,574 1,372

Change in assets and liabilities, net of

effects of acquired businesses:

Accounts receivable 1,079,153 597,926 Inventories (82,825 )

(130,669 ) Accounts payable (1,020,150 ) (410,063 ) Accrued

expenses (124,829 ) (107,937 ) Other assets and liabilities

(9,089 ) (21,538 ) Net cash provided by operating activities

219,438 283,472 Cash flows from

investing activities: Cash consideration paid for acquired

businesses (470,674 ) (60,224 ) Acquisition of property, plant, and

equipment (68,820 ) (62,003 ) Other 2,008 -

Net cash used for investing activities (537,486 )

(122,227 ) Cash flows from financing activities:

Change in short-term and other borrowings (3,817 ) (9,904 )

Proceeds from (repayment of) long-term bank borrowings, net 34,400

(120,000 ) Net proceeds from note offering 688,162 - Redemption of

notes (254,313 ) - Proceeds from exercise of stock options 14,474

18,321

Excess tax benefits from stock-based

compensation arrangements

5,842 6,248 Repurchases of common stock (156,424 ) (138,811 ) Other

(3,000 ) - Net cash provided by (used for)

financing activities 325,324 (244,146 )

Effect of exchange rate changes on cash (7,910 )

1,235 Net decrease in cash and cash equivalents (634 )

(81,666 ) Cash and cash equivalents at beginning of period

400,355 390,602 Cash and cash equivalents at

end of period $ 399,721 $ 308,936 ARROW

ELECTRONICS, INC. (In thousands except per share data) (Unaudited)

NON-GAAP SALES

RECONCILIATION

Quarter

Ended

June 27, June 28, % 2015 2014 Change

Consolidated sales, as reported $ 5,829,989 $ 5,676,539 2.7 %

Impact of changes in foreign currencies - (348,234 ) Impact of

acquisitions 47,722 390,897 Consolidated

sales, as adjusted $ 5,877,711 $ 5,719,202 2.8 %

Global components sales, as reported $ 3,698,175 $ 3,569,344 3.6 %

Impact of changes in foreign currencies - (190,880 ) Impact of

acquisitions 47,722 242,595 Global components

sales, as adjusted $ 3,745,897 $ 3,621,059 3.4 %

Europe components sales, as reported $ 986,735 $ 984,927 0.2 %

Impact of changes in foreign currencies - (180,658 ) Impact of

acquisitions - 83,512 Europe components sales,

as adjusted $ 986,735 $ 887,781 11.1 % Asia

components sales, as reported $ 1,237,865 $ 1,111,953 11.3 % Impact

of changes in foreign currencies - (6,703 ) Impact of acquisitions

47,722 125,878 Asia components sales, as

adjusted $ 1,285,587 $ 1,231,128 4.4 % Global ECS

sales, as reported $ 2,131,814 $ 2,107,195 1.2 % Impact of changes

in foreign currencies - (157,354 ) Impact of acquisitions -

148,302 Global ECS sales, as adjusted $ 2,131,814 $

2,098,143 1.6 % Europe ECS sales, as reported $

678,278 $ 777,033 (12.7 )% Impact of changes in foreign currencies

- (147,505 ) Impact of acquisitions - - Europe

ECS sales, as adjusted $ 678,278 $ 629,528 7.7 %

Americas ECS sales, as reported $ 1,453,536 $ 1,330,161 9.3 %

Impact of changes in foreign currencies - (9,849 ) Impact of

acquisitions - 148,302 Americas ECS sales, as

adjusted $ 1,453,536 $ 1,468,614 (1.0 )% ARROW

ELECTRONICS, INC. (In thousands except per share data) (Unaudited)

NON-GAAP SALES

RECONCILIATION

Six Months

Ended

June 27, June 28, % 2015 2014 Change

Consolidated sales, as reported $ 10,832,374 $ 10,758,579 0.7 %

Impact of changes in foreign currencies - (670,373 ) Impact of

acquisitions 340,392 743,729 Consolidated

sales, as adjusted $ 11,172,766 $ 10,831,935 3.1 %

Global components sales, as reported $ 7,044,938 $ 6,990,525 0.8 %

Impact of changes in foreign currencies - (374,710 ) Impact of

acquisitions 248,406 478,492 Global components

sales, as adjusted $ 7,293,344 $ 7,094,307 2.8 %

Europe components sales, as reported $ 1,909,996 $ 1,973,861 (3.2

)% Impact of changes in foreign currencies - (352,999 ) Impact of

acquisitions 57,361 164,637 Europe components

sales, as adjusted $ 1,967,357 $ 1,785,499 10.2 %

Asia components sales, as reported $ 2,263,779 $ 2,142,648 5.7 %

Impact of changes in foreign currencies - (15,591 ) Impact of

acquisitions 187,699 251,099 Asia components

sales, as adjusted $ 2,451,478 $ 2,378,156 3.1 %

Global ECS sales, as reported $ 3,787,436 $ 3,768,054 0.5 % Impact

of changes in foreign currencies - (295,663 ) Impact of

acquisitions 91,986 265,237 Global ECS sales,

as adjusted $ 3,879,422 $ 3,737,628 3.8 % Europe ECS

sales, as reported $ 1,259,941 $ 1,442,012 (12.6 )% Impact of

changes in foreign currencies - (272,229 ) Impact of acquisitions

- - Europe ECS sales, as adjusted $ 1,259,941

$ 1,169,783 7.7 %

Americas ECS sales, as reported $ 2,527,495 $ 2,326,042 8.7 %

Impact of changes in foreign currencies - (23,434 ) Impact of

acquisitions 91,986 265,237 Americas ECS

sales, as adjusted $ 2,619,481 $ 2,567,845 2.0 %

ARROW ELECTRONICS, INC. (In thousands except per share data)

(Unaudited)

NON-GAAP EARNINGS

RECONCILIATION

Quarter Ended Six Months Ended

June 27, 2015 June 28, 2014 June 27, 2015

June 28, 2014 Operating income, as reported $ 206,943

$ 208,269 $ 384,377 $ 386,009 Intangible assets amortization

expense 13,917 10,870 25,024 21,817 Restructuring, integration, and

other charges 17,147 9,632 33,343

21,246 Operating income, as adjusted $ 238,007 $ 228,771 $

442,744 $ 429,072 Net income attributable to

shareholders, as reported $ 123,932 $ 127,884 $ 229,990 $ 235,004

Intangible assets amortization expense 11,169 8,867 20,198 17,774

Restructuring, integration, and other charges 12,895 7,526 25,463

15,546 Loss on prepayment of debt - - 1,808 - (Gain)/loss on

investments 921 - (746 ) - Net income

attributable to shareholders, as adjusted $ 148,917 $ 144,277 $

276,713 $ 268,324 Net income per basic share, as

reported $ 1.30 $ 1.29 $ 2.40 $ 2.36 Intangible assets amortization

expense .12 .09 .21 .18 Restructuring, integration, and other

charges .13 .08 .27 .16 Loss on prepayment of debt - - .02 -

(Gain)/loss on investments .01 - (.01 )

- Net income per basic share, as adjusted $ 1.56 $ 1.45 $ 2.89

$ 2.69 Net income per diluted share, as reported $

1.28 $ 1.27 $ 2.37 $ 2.33 Intangible assets amortization expense

.12 .09 .21 .18 Restructuring, integration, and other charges .13

.07 .26 .15 Loss on prepayment of debt - - .02 - (Gain)/loss on

investments .01 - (.01 ) - Net income

per diluted share, as adjusted $ 1.54 $ 1.43 $ 2.86 $ 2.66

The sum of the components for basic and diluted net income

per share, as adjusted, may not agree to totals, as presented, due

to rounding. ARROW ELECTRONICS, INC. (In thousands

except per share data) (Unaudited)

SEGMENT

INFORMATION

Quarter Ended

Six Months Ended

June 27, 2015 June 28, 2014 June 27, 2015

June 28, 2014 Sales: Global components $ 3,698,175 $

3,569,344 $ 7,044,938 $ 6,990,525 Global ECS 2,131,814

2,107,195 3,787,436

3,768,054 Consolidated $ 5,829,989 $ 5,676,539

$ 10,832,374 $ 10,758,579 Operating income

(loss): Global components $ 169,817 $ 159,642 $ 334,712 $ 320,788

Global ECS 98,394 95,990 165,911 160,148 Corporate (a)

(61,268 ) (47,363 )

(116,246

)

(94,927 ) Consolidated $ 206,943 $ 208,269 $

384,377 $ 386,009

(a)

Includes restructuring, integration, and other

charges of $17.1 million and $33.3 million for the second quarter

and first six months of 2015 and $9.6 million and $21.2 million for

the second quarter and first six months of 2014, respectively.

NON-GAAP SEGMENT

RECONCILIATION

Quarter Ended

Six Months Ended

June 27, 2015 June 28, 2014 June 27, 2015

June 28, 2014 Global components operating income, as

reported $ 169,817 $ 159,642 $ 334,712 $ 320,788 Intangible assets

amortization expense 7,146 5,458 12,928

11,006 Global components operating income, as adjusted $ 176,963 $

165,100 $ 374,640 $ 331,794 Global ECS operating income, as

reported $ 98,394 $ 95,990 $ 165,911 $ 160,148 Intangible assets

amortization expense 6,771 5,412 12,096

10,811 Global ECS operating income, as adjusted $ 105,165 $ 101,402

$ 178,007 $ 170,959

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150728005614/en/

Arrow Electronics, Inc.Steven O’Brien, 303-824-4544Director,

Investor RelationsorPaul J. Reilly, 631-847-1872Executive Vice

President, Finance and Operations, and Chief Financial

OfficerorMedia:John Hourigan, 303-824-4586Vice President, Global

Communications

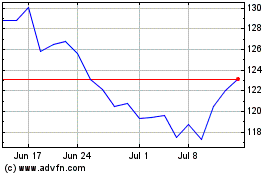

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

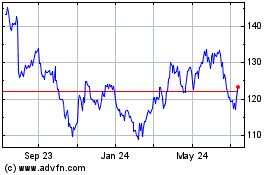

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024