-- Margins Expand Over Prior Year --

-- Earnings Per Share of $1.45; Non-GAAP

Earnings Per Share of $1.65 --

Arrow Electronics, Inc. (NYSE:ARW) today reported second-quarter

2016 net income of $134.3 million, or $1.45 per share on a diluted

basis, compared with net income of $123.9 million, or $1.28 per

share on a diluted basis, in the second quarter of 2015. Excluding

certain items1, net income would have been $152.7 million, or $1.65

per share on a diluted basis, in the second quarter of 2016,

compared with net income of $148.9 million, or $1.54 per share on a

diluted basis, in the second quarter of 2015. Second-quarter sales

of $5.97 billion increased 2 percent from sales of $5.83 billion in

the prior year. Second-quarter sales, adjusted for the impact of

acquisitions, were flat year over year.

“By increasingly delivering more complex solutions, we capture a

greater reward. That was evidenced by our margin performance,” said

Michael J. Long, chairman, president, and chief executive officer.

“Our core businesses remain healthy, and we made significant

progress in the quarter with respect to our digital transformation,

expanding our cloud solutions, and capturing the opportunities

afforded by IoT to sell the capabilities of our entire

enterprise.”

Global components second-quarter sales of $3.83 billion grew 4

percent year over year. Second-quarter sales, as adjusted, grew 1

percent year over year. Americas components sales were flat year

over year. Europe components sales grew 7 percent year over year.

Sales in the region, as adjusted, grew 3 percent year over year.

Asia-Pacific components sales grew 5 percent year over year. Sales

in the region, as adjusted, were flat year over year.

Global enterprise computing solutions second-quarter sales of

$2.14 billion were flat year over year. Americas sales declined 2

percent year over year. Sales in the region, as adjusted, declined

6 percent year over year. Europe sales grew 6 percent year over

year. Sales in the region, as adjusted, grew 4 percent year over

year. “Our software-led solutions drove enterprise computing

solutions operating income up 10 percent year over year, and we

believe this is the best measure of the momentum in our business,”

added Mr. Long.

“Cash flow from operations was $148 million in the second

quarter as we continue to exceed our cash flow target,” said Chris

Stansbury, senior vice president and chief financial officer.

“During the quarter, we returned approximately $31 million to

shareholders through our stock repurchase program. We had

approximately $286 million of remaining authorization under our

share repurchase programs at the end of the second quarter.”

SIX-MONTH RESULTS

Arrow’s net income for the first six months of 2016 was $240.5

million, or $2.59 per share on a diluted basis, compared with net

income of $230 million, or $2.37 per share on a diluted basis in

the first six months of 2015. Excluding certain items1, net income

would have been $285 million, or $3.07 per share on a diluted

basis, in the first six months of 2016 compared with net income of

$276.7 million, or $2.86 per share on a diluted basis, in the first

six months of 2015. In the first six months of 2016, sales of

$11.45 billion increased 6 percent from sales of $10.83 billion in

the first six months of 2015.

___________________________1 A reconciliation of non-GAAP

adjusted financial measures, including sales, as adjusted,

operating income, as adjusted, net income attributable to

shareholders, as adjusted, and net income per share, as adjusted,

to GAAP financial measures is presented in the reconciliation

tables included herein.

GUIDANCE

“As we look to the third quarter, we believe that total sales

will be between $5.65 billion and $6.05 billion, with global

components sales between $3.725 billion and $3.925 billion, and

global enterprise computing solutions sales between $1.925 billion

and $2.125 billion. As a result of this outlook, we expect earnings

per share on a diluted basis, to be in the range of $1.23 to $1.35,

and earnings per share on a diluted basis, excluding any charges,

to be in the range of $1.45 to $1.57 per share. Our guidance

assumes an average tax rate in the range of 27 to 29 percent and

average diluted shares outstanding are expected to be 92.5 million.

We are expecting the average USD-to-Euro exchange rate for the

third quarter to be approximately $1.11 to €1,” said Mr.

Stansbury.

Please refer to the CFO commentary, which can be found at

investor.arrow.com, as a supplement to the company’s earnings

release.

Arrow Electronics (www.arrow.com) is a global provider of

products, services and solutions to industrial and commercial users

of electronic components and enterprise computing solutions. Arrow

serves as a supply channel partner for more than 100,000 original

equipment manufacturers, contract manufacturers and commercial

customers through a global network of more than 460 locations

serving over 85 countries.

Information Relating to Forward-Looking

Statements

This press release includes forward-looking statements that are

subject to numerous assumptions, risks, and uncertainties, which

could cause actual results or facts to differ materially from such

statements for a variety of reasons, including, but not limited to:

industry conditions, the company's implementation of its new

enterprise resource planning system, changes in product supply,

pricing and customer demand, competition, other vagaries in the

global components and global enterprise computing solutions

markets, changes in relationships with key suppliers, increased

profit margin pressure, the effects of additional actions taken to

become more efficient or lower costs, risks related to the

integration of acquired businesses, changes in legal and regulatory

matters, and the company’s ability to generate additional cash

flow. Forward-looking statements are those statements which are not

statements of historical fact. These forward-looking statements can

be identified by forward-looking words such as "expects,"

"anticipates," "intends," "plans," "may," "will," "believes,"

"seeks," "estimates," and similar expressions. Shareholders and

other readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date on

which they are made. The company undertakes no obligation to update

publicly or revise any of the forward-looking statements.

For a further discussion of factors to consider in connection

with these forward-looking statements, investors should refer to

Item 1A Risk Factors of the company’s Annual Report on Form 10-K

for the year ended December 31, 2015.

Certain Non-GAAP Financial

Information

In addition to disclosing financial results that are determined

in accordance with accounting principles generally accepted in the

United States (“GAAP”), the company also provides certain non-GAAP

financial information relating to sales, operating income, net

income attributable to shareholders, and net income per basic and

diluted share. The company provides sales on a non-GAAP basis

adjusted for the impact of changes in foreign currencies and the

impact of acquisitions by adjusting the company's operating results

for businesses acquired, including the amortization expense related

to acquired intangible assets, as if the acquisitions had occurred

at the beginning of the earliest period presented (referred to as

"impact of acquisitions"). Operating income, net income

attributable to shareholders, and net income per basic and diluted

share are adjusted for certain charges, credits, gains, and losses

that the company believes impact the comparability of its results

of operations. These charges, credits, gains, and losses arise out

of the company’s efficiency enhancement initiatives, acquisitions

(including intangible assets amortization expense), loss on

prepayment of debt, and (gain)/loss on investments. A

reconciliation of the company’s non-GAAP financial information to

GAAP is set forth in the tables below.

The company believes that such non-GAAP financial information is

useful to investors to assist in assessing and understanding the

company’s operating performance and underlying trends in the

company’s business because management considers these items

referred to above to be outside the company’s core operating

results. This non-GAAP financial information is among the primary

indicators management uses as a basis for evaluating the company’s

financial and operating performance. In addition, the company’s

Board of Directors may use this non-GAAP financial information in

evaluating management performance and setting management

compensation.

The presentation of this additional non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for, or alternative to, sales, operating income, net

income and net income per basic and diluted share determined in

accordance with GAAP. Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in conjunction with,

data presented in accordance with GAAP.

ARROW ELECTRONICS, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands except per share

data)(Unaudited)

Quarter Ended Six Months Ended July 2,

2016

June 27,

2015

July 2,

2016

June 27,

2015

Sales $ 5,972,101 $ 5,829,989 $ 11,446,278 $ 10,832,374

Costs and expenses: Cost of sales 5,173,310 5,061,394 9,898,589

9,378,457 Selling, general, and administrative expenses 518,704

504,754 1,024,517 959,284 Depreciation and amortization 40,389

39,751 81,322 76,913 Restructuring, integration, and other charges

16,106 17,147 36,894 33,343

5,748,509 5,623,046 11,041,322 10,447,997

Operating income 223,592 206,943 404,956 384,377 Equity in earnings

of affiliated companies 2,227 1,903 4,083 3,216 Interest and other

financing expense, net 39,024 34,696 74,599 65,550 Other expense,

net - 1,500 - 2,435 Income before

income taxes 186,795 172,650 334,440 319,608 Provision for income

taxes 51,457 47,967 92,510 88,834

Consolidated net income 135,338 124,683 241,930 230,774

Noncontrolling interests 1,068 751 1,425

784 Net income attributable to shareholders $ 134,270 $

123,932 $ 240,505 $ 229,990 Net income per share:

Basic

$ 1.46 $ 1.30 $ 2.62 $ 2.40 Diluted $ 1.45 $ 1.28 $ 2.59 $ 2.37

Weighted average shares outstanding: Basic 91,782 95,638

91,647 95,776 Diluted 92,693 96,649 92,771 96,874

ARROW ELECTRONICS, INC.CONSOLIDATED

BALANCE SHEETS(In thousands except par value)

July 2,

2016

December 31,

2015

(Unaudited) ASSETS Current assets: Cash and cash equivalents $

495,771 $ 273,090 Accounts receivable, net 5,704,633 6,161,418

Inventories, net 2,504,121 2,466,490 Other current assets

331,159 285,473 Total current assets

9,035,684 9,186,471 Property, plant, and

equipment, at cost: Land 23,723 23,547 Buildings and improvements

171,125 162,011 Machinery and equipment 1,322,470

1,250,115 1,517,318 1,435,673 Less: Accumulated

depreciation and amortization (779,767 ) (735,495 )

Property, plant, and equipment, net 737,551

700,178 Investments in affiliated companies 75,985 73,376

Intangible assets, net 365,603 389,326 Cost in excess of net assets

of companies acquired 2,418,958 2,368,832 Other assets

313,025 303,747 Total assets $ 12,946,806

$ 13,021,930 LIABILITIES AND EQUITY Current

liabilities: Accounts payable $ 4,644,655 $ 5,192,665 Accrued

expenses 701,960 819,463 Short-term borrowings, including current

portion of long-term debt 111,259 44,024

Total current liabilities 5,457,874

6,056,152 Long-term debt 2,619,003 2,380,575 Other

liabilities 421,048 390,392 Equity: Shareholders' equity: Common

stock, par value $1: Authorized – 160,000 shares in both 2016 and

2015 Issued – 125,424 shares in both 2016 and 2015 125,424 125,424

Capital in excess of par value 1,092,323 1,107,314 Treasury stock

(34,073 and 34,501 shares in 2016 and 2015, respectively), at cost

(1,475,671 ) (1,480,069 ) Retained earnings 4,914,985 4,674,480

Accumulated other comprehensive loss (262,560 )

(284,706 ) Total shareholders' equity 4,394,501 4,142,443

Noncontrolling interests 54,380 52,368

Total equity 4,448,881 4,194,811 Total

liabilities and equity $ 12,946,806 $ 13,021,930

ARROW ELECTRONICS, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(In thousands)(Unaudited)

Quarter Ended July 2,

2016

June 27,

2015

Cash flows from operating activities: Consolidated net income $

135,338 $ 124,683 Adjustments to reconcile consolidated net income

to net cash used for operations: Depreciation and amortization

40,389 39,751 Amortization of stock-based compensation 10,398

12,086 Equity in earnings of affiliated companies (2,227 ) (1,903 )

Deferred income taxes 5,114 14,115 Excess tax benefits from

stock-based compensation arrangements (807 ) (185 ) Other 1,492

2,844 Change in assets and liabilities, net of effects of acquired

businesses: Accounts receivable (467,492 ) 143,882 Inventories

(67,101 ) (131,399 ) Accounts payable 429,416 259,287 Accrued

expenses 45,952 9,790 Other assets and liabilities 17,448

(11,917 ) Net cash provided by operating activities

147,920 461,034 Cash flows from

investing activities: Cash consideration paid for acquired

businesses 1,017 (337,585 ) Acquisition of property, plant, and

equipment (39,075 ) (37,670 ) Other (12,000 ) -

Net cash used for investing activities (50,058 )

(375,255 ) Cash flows from financing activities: Change in

short-term and other borrowings 67,141 (5,051 ) Proceeds from

(repayment of)long-term bank borrowings, net (32,000 ) 82,800

Proceeds from exercise of stock options 9,139 1,898 Excess tax

benefits from stock-based compensation arrangements 807 185

Repurchases of common stock (28,149 ) (77,863 ) Net

cash provided by financing activities 16,938

1,969 Effect of exchange rate changes on cash (13,684

) 6,680 Net increase in cash and cash equivalents

101,116 94,428 Cash and cash equivalents at beginning of period

394,655 305,293 Cash and cash

equivalents at end of period $ 495,771 $ 399,721

ARROW ELECTRONICS, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(In thousands)(Unaudited)

Six Months Ended July 2,

2016

June 27,

2015

Cash flows from operating activities: Consolidated net income $

241,930 $ 230,774 Adjustments to reconcile consolidated net income

to net cash provided by operations: Depreciation and amortization

81,322 76,913 Amortization of stock-based compensation 19,275

22,006 Equity in earnings of affiliated companies (4,083 ) (3,216 )

Deferred income taxes 27,669 26,506 Excess tax benefits from

stock-based compensation arrangements (4,939 ) (5,842 ) Other 2,954

4,574 Change in assets and liabilities, net of effects of acquired

businesses: Accounts receivable 529,246 1,079,153 Inventories

(22,490 ) (82,825 ) Accounts payable (606,678 ) (1,020,150 )

Accrued expenses (114,741 ) (99,366 ) Other assets and liabilities

(38,137 ) (9,089 ) Net cash provided by operating

activities 111,328 219,438 Cash

flows from investing activities: Cash consideration paid for

acquired businesses (45,473 ) (470,674 ) Acquisition of property,

plant, and equipment (88,336 ) (68,820 ) Other (12,000 )

2,008 Net cash used for investing activities

(145,809 ) (537,486 ) Cash flows from financing activities:

Change in short-term and other borrowings 67,611 (3,817 ) Proceeds

from long-term bank borrowings, net 233,000 34,400 Net proceeds

from note offering - 688,162 Redemption of notes - (254,313 )

Proceeds from exercise of stock options 14,844 14,474 Excess tax

benefits from stock-based compensation arrangements 4,939 5,842

Repurchases of common stock (46,833 ) (156,424 ) Other

(3,000 ) (3,000 ) Net cash provided by financing activities

270,561 325,324 Effect of exchange rate

changes on cash (13,399 ) (7,910 ) Net increase

(decrease) in cash and cash equivalents 222,681 (634 ) Cash and

cash equivalents at beginning of year 273,090

400,355 Cash and cash equivalents at end of year $ 495,771

$ 399,721

ARROW ELECTRONICS, INC.NON-GAAP SALES

RECONCILIATION(In thousands)(Unaudited)

Quarter Ended July 2,

2016

June 27,

2015

% Change Consolidated sales, as reported $ 5,972,101 $

5,829,989 2.4 % Impact of changes in foreign currencies - (1,309 )

Impact of acquisitions - 163,354 Consolidated

sales, as adjusted $ 5,972,101 $ 5,992,034 (0.3 %)

Global components sales, as reported $ 3,832,972 $ 3,698,175 3.6 %

Impact of changes in foreign currencies - (6,292 ) Impact of

acquisitions - 96,352 Global components sales,

as adjusted $ 3,832,972 $ 3,788,235 1.2 % Europe

components sales, as reported $ 1,056,691 $ 986,735 7.1 % Impact of

changes in foreign currencies - 10,728 Impact of acquisitions

- 24,584 Europe components sales, as adjusted

$ 1,056,691 $ 1,022,047 3.4 % Asia components sales,

as reported $ 1,298,429 $ 1,237,865 4.9 % Impact of changes in

foreign currencies - (15,840 ) Impact of acquisitions -

71,768 Asia components sales, as adjusted $ 1,298,429

$ 1,293,793 0.4 % Global ECS sales, as reported $

2,139,129 $ 2,131,814 0.3 % Impact of changes in foreign currencies

- 4,983 Impact of acquisitions - 67,002 Global

ECS sales, as adjusted $ 2,139,129 $ 2,203,799 (2.9 %)

Europe ECS sales, as reported $ 720,335 $ 678,278 6.2 %

Impact of changes in foreign currencies - 13,608 Impact of

acquisitions - - Europe ECS sales, as adjusted

$ 720,335 $ 691,886 4.1 % Americas ECS sales, as

reported $ 1,418,794 $ 1,453,536 (2.4 %) Impact of changes in

foreign currencies - (8,624 ) Impact of acquisitions -

67,002 Americas ECS sales, as adjusted $ 1,418,794 $

1,511,914 (6.2 %) ARROW ELECTRONICS, INC.

NON-GAAP SALES RECONCILIATION (In thousands) (Unaudited)

Six Months Ended July 2,

2016

June 27,

2015

% Change Consolidated sales, as reported $ 11,446,278 $

10,832,374 5.7 % Impact of changes in foreign currencies - (61,267

) Impact of acquisitions 38,437 531,508

Consolidated sales, as adjusted $ 11,484,715 $ 11,302,615

1.6 % Global components sales, as reported $ 7,508,901 $

7,044,938 6.6 % Impact of changes in foreign currencies - (46,059 )

Impact of acquisitions - 313,757 Global

components sales, as adjusted $ 7,508,901 $ 7,312,636 2.7 %

Europe components sales, as reported $ 2,115,123 $ 1,909,996

10.7 % Impact of changes in foreign currencies - (12,803 ) Impact

of acquisitions - 98,666 Europe components

sales, as adjusted $ 2,115,123 $ 1,995,859 6.0 % Asia

components sales, as reported $ 2,476,297 $ 2,263,779 9.4 % Impact

of changes in foreign currencies - (28,218 ) Impact of acquisitions

- 211,745 Asia components sales, as adjusted $

2,476,297 $ 2,447,306 1.2 % Global ECS sales, as

reported $ 3,937,377 $ 3,787,436 4.0 % Impact of changes in foreign

currencies - (15,208 ) Impact of acquisitions 38,437

217,751 Global ECS sales, as adjusted $ 3,975,814 $

3,989,979 (0.4 %) Europe ECS sales, as reported $

1,327,783 $ 1,259,941 5.4 % Impact of changes in foreign currencies

- 6,108 Impact of acquisitions - - Europe ECS

sales, as adjusted $ 1,327,783 $ 1,266,049 4.9 %

Americas ECS sales, as reported $ 2,609,594 $ 2,527,495 3.2 %

Impact of changes in foreign currencies - (21,317 ) Impact of

acquisitions 38,437 217,751 Americas ECS

sales, as adjusted $ 2,648,031 $ 2,723,929 (2.8 %)

ARROW ELECTRONICS, INC. NON-GAAP EARNINGS RECONCILIATION (In

thousands except per share data) (Unaudited) Quarter

Ended Six Months Ended July 2,

2016

June 27,

2015

July 2,

2016

June 27,

2015

Operating income, as reported $ 223,592 $ 206,943 $ 404,956

$ 384,377 Intangible assets amortization expense 14,446 13,917

27,359 25,024 Restructuring, integration, and other charges

16,106 17,147 36,894

33,343 Operating income, as adjusted $ 254,144 $

238,007 $ 469,209 $ 442,744 Net income

attributable to shareholders, as reported $ 134,270 $ 123,932 $

240,505 $ 229,990 Intangible assets amortization expense 13,562

13,917 26,475 25,024 Restructuring, integration, and other charges

16,106 17,147 36,894 33,343 Loss on prepayment of debt - - - 2,943

(Gain)/loss on investments - 1,500 - (508 ) Tax effect

(11,197 ) (7,579 ) (18,910 ) (14,079 ) Net

income attributable to shareholders, as adjusted $ 152,741 $

148,917 $ 284,964 $ 276,713 Net income

per basic share, as reported $ 1.46 $ 1.30 $ 2.62 $ 2.40 Intangible

assets amortization expense .15 .15 .29 .26 Restructuring,

integration, and other charges .18 .18 .40 .35 Loss on prepayment

of debt - - - .03 (Gain)/loss on investments - .02 - - Tax effect

(.12 ) (.08 ) (.21 ) (.15 ) Net income

per basic share, as adjusted $ 1.66 $ 1.56 $ 3.11

$ 2.89 Net income per diluted share, as

reported $ 1.45 $ 1.28 $ 2.59 $ 2.37 Intangible assets amortization

expense .15 .14 .29 .26 Restructuring, integration, and other

charges .17 .18 .40 .34 Loss on prepayment of debt - - - .03

(Gain)/loss on investments - .02 - - Tax effect (.12 )

(.08 ) (.20 ) (.15 ) Net income per diluted

share, as adjusted $ 1.65 $ 1.54 $ 3.07 $ 2.86

The sum of the components for basic and

diluted net income per share, as adjusted, may not agree

to totals, as presented, due to

rounding.

ARROW ELECTRONICS, INC.SEGMENT

INFORMATION(In thousands)(Unaudited)

Quarter Ended Six Months Ended July 2,

2016

June 27,

2015

July 2,

2016

June 27,

2015

Sales: Global components $ 3,832,972 $ 3,698,175 $ 7,508,901 $

7,044,938 Global ECS 2,139,129 2,131,814

3,937,377 3,787,436 Consolidated

$ 5,972,101 $ 5,829,989 $ 11,446,278 $

10,832,374 Operating income (loss): Global components

$ 178,385 $ 169,817 $ 349,155 $ 334,712 Global ECS 109,399 98,394

187,611 165,911 Corporate (a) (64,192 ) (61,268 )

(131,810 ) (116,246 ) Consolidated $ 223,592 $

206,943 $ 404,956 $ 384,377

(a)

Includes restructuring, integration, and

other charges of $16.1 million and $36.9million for the second

quarter and six months ended 2016 and $17.1 million and

$33.3million for the second quarter and six months ended 2015,

respectively.

NON-GAAP SEGMENT RECONCILIATION

Quarter Ended Six Months Ended July 2,

2016

June 27,

2015

July 2,

2016

June 27,

2015

Global components operating income, as reported $ 178,385 $ 169,817

$ 349,155 $ 334,712 Intangible assets amortization expense

8,545 7,146 16,445 12,928 Global components

operating income, as adjusted $ 186,930 $ 176,963 $ 365,600 $

374,640 Global ECS operating income, as reported $ 109,399 $

98,394 $ 187,611 $ 165,911 Intangible assets amortization expense

5,901 6,771 10,914 12,096 Global ECS

operating income, as adjusted $ 115,300 $ 105,165 $ 198,525 $

178,007

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160802005580/en/

Arrow Electronics, Inc.Steven O’Brien, 303-824-4544Director,

Investor RelationsorMedia Contact:John Hourigan, 303-824-4586Vice

President, Global Communications

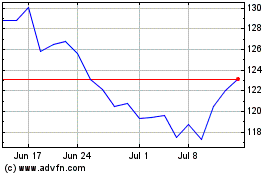

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

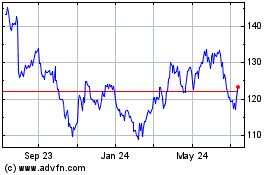

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024