-- Record Full-Year Sales and Earnings Per

Share --

-- Fourth-Quarter Earnings Per Share of

$1.81; Non-GAAP Earnings Per Share of $2.00 --

Arrow Electronics, Inc. (NYSE:ARW) today reported fourth-quarter

2016 net income of $165 million, or $1.81 per share on a diluted

basis, compared with net income of $158 million, or $1.69 per share

on a diluted basis, in the fourth quarter of 2015. Excluding

certain items1, net income would have been $182 million, or $2.00

per share on a diluted basis, in the fourth quarter of 2016,

compared with net income of $182 million, or $1.94 per share on a

diluted basis, in the fourth quarter of 2015. Fourth-quarter sales

of $6.44 billion decreased 5 percent from sales of $6.75 billion in

the prior year. In the fourth quarter of 2016, changes in foreign

currencies had negative impacts on growth of approximately $91

million or 1 percent on sales and $.04 or 2 percent on earnings per

share on a diluted basis compared to the fourth quarter of

2015.

“Our digital transformation and IoT solutions spanning from

sensor to sunset helped drive record full-year sales and earnings

per share,” said Michael J. Long, chairman, president, and chief

executive officer. “Our customers value our comprehensive portfolio

of electronic components and embedded computing, datacenter, cloud,

and reverse logistics solutions.”

Global components fourth-quarter sales of $4 billion grew 9

percent year over year. Fourth-quarter sales, as adjusted, grew 10

percent year over year. Americas components sales grew 4 percent

year over year. Asia-Pacific components sales grew 22 percent year

over year. Europe components sales declined 1 percent year over

year. Sales in the region, as adjusted, grew 2 percent year over

year. “Global components sales exceeded the high end of our

expectations and were propelled by our investments in

customer-facing sales and engineering resources,” said Mr.

Long.

Global enterprise computing solutions fourth-quarter sales of

$2.45 billion declined 21 percent year over year. Sales when

compared to the fourth quarter of 2015 were unfavorably impacted by

approximately $250 million due to a later calendar start to the

fourth quarter of 2016, and by approximately $250 million from a

decrease in hardware sales offset by an increase in software sales,

which are recognized on a net basis. “Full-year 2016 global

enterprise computing solutions operating income grew 4 percent year

over year, and we believe this is the best measure of our

business,” added Mr. Long.

FULL-YEAR RESULTS

Arrow’s net income for 2016 was $523 million, or $5.68 per share

on a diluted basis, compared with net income of $498 million, or

$5.20 per share on a diluted basis, in 2015. Excluding certain

items1, net income would have been $610 million, or $6.63 per share

on a diluted basis, in 2016 compared with net income of $592

million, or $6.19 per share on a diluted basis, in 2015. In 2016,

sales of $23.83 billion increased 2 percent from sales of $23.28

billion in 2015. In 2016, changes in foreign currencies had

negative impacts on growth of approximately $202 million, or 1

percent on sales, and $.08, or 1 percent, on earnings per share on

a diluted basis compared to 2015.

“We delivered record results in 2016, and our business is

increasingly differentiated from the competition. We have a built a

solid foundation for 2017 and into the future,” said Mr. Long.

“Cash flow from operations was $356 million in 2016

approximating our cash flow target,” said Chris Stansbury, senior

vice president and chief financial officer. “In the fourth quarter

we reduced net leverage and we returned approximately $49 million

to shareholders through our stock repurchase program. In 2016 we

returned approximately $200 million to shareholders through our

stock repurchase program. We had approximately $520 million of

remaining authorization under our share repurchase programs at the

end of the year.”

1 A reconciliation of non-GAAP adjusted financial measures,

including sales, as adjusted, operating income, as adjusted, net

income attributable to shareholders, as adjusted, and net income

per share, as adjusted, to GAAP financial measures is presented in

the reconciliation tables included herein.

GUIDANCE

“As we look to the first quarter, we believe that total sales

will be between $5.375 billion and $5.775 billion, with global

components sales between $3.775 billion and $3.975 billion, and

global enterprise computing solutions sales between $1.6 billion

and $1.8 billion. As a result of this outlook, we expect earnings

per share on a diluted basis, to be in the range of $1.18 to $1.30,

and earnings per share on a diluted basis, excluding any charges,

to be in the range of $1.37 to $1.49 per share. Our guidance

assumes an average tax rate in the range of 27 to 29 percent and

average diluted shares outstanding are expected to be 91 million.

We are expecting the average USD-to-Euro exchange rate for the

first quarter to be approximately $1.07 to €1. We estimate changes

in foreign currencies will have negative impacts on growth of

approximately $70 million, or 1 percent on sales, and $.03, or 2

percent, on earnings per share on a diluted basis compared to the

first quarter of 2016,” said Mr. Stansbury.

Please refer to the CFO commentary, which can be found at

investor.arrow.com, as a supplement to the company’s earnings

release.

Arrow Electronics (www.arrow.com)

is a global provider of products, services and solutions to

industrial and commercial users of electronic components and

enterprise computing solutions. Arrow serves as a supply channel

partner for more than 125,000 original equipment manufacturers,

contract manufacturers and commercial customers through a global

network of more than 465 locations serving over 90 countries.

Information Relating to Forward-Looking

Statements

This press release includes forward-looking statements that are

subject to numerous assumptions, risks, and uncertainties, which

could cause actual results or facts to differ materially from such

statements for a variety of reasons, including, but not limited to:

industry conditions, the company's implementation of its new

enterprise resource planning system, changes in product supply,

pricing and customer demand, competition, other vagaries in the

global components and global enterprise computing solutions

markets, changes in relationships with key suppliers, increased

profit margin pressure, the effects of additional actions taken to

become more efficient or lower costs, risks related to the

integration of acquired businesses, changes in legal and regulatory

matters, and the company’s ability to generate additional cash

flow. Forward-looking statements are those statements which are not

statements of historical fact. These forward-looking statements can

be identified by forward-looking words such as "expects,"

"anticipates," "intends," "plans," "may," "will," "believes,"

"seeks," "estimates," and similar expressions. Shareholders and

other readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date on

which they are made. The company undertakes no obligation to update

publicly or revise any of the forward-looking statements.

For a further discussion of factors to consider in connection

with these forward-looking statements, investors should refer to

Item 1A Risk Factors of the company’s Annual Report on Form 10-K

for the year ended Dec. 31, 2016.

Certain Non-GAAP Financial

Information

In addition to disclosing financial results that are determined

in accordance with accounting principles generally accepted in the

United States (“GAAP”), the company also provides certain non-GAAP

financial information relating to sales, operating income, net

income attributable to shareholders, and net income per basic and

diluted share. The company provides sales on a non-GAAP basis

adjusted for the impact of changes in foreign currencies and the

impact of acquisitions by adjusting the company's operating results

for businesses acquired, including the amortization expense related

to acquired intangible assets, as if the acquisitions had occurred

at the beginning of the earliest period presented (referred to as

"impact of acquisitions"). Operating income, net income

attributable to shareholders, and net income per basic and diluted

share are adjusted for certain charges, credits, gains, and losses

that the company believes impact the comparability of its results

of operations. These charges, credits, gains, and losses arise out

of the company’s efficiency enhancement initiatives, acquisitions

(including intangible assets amortization expense), loss on

prepayment of debt, and (gain)/loss on investments. A

reconciliation of the company’s non-GAAP financial information to

GAAP is set forth in the tables below.

The company believes that such non-GAAP financial information is

useful to investors to assist in assessing and understanding the

company’s operating performance and underlying trends in the

company’s business because management considers these items

referred to above to be outside the company’s core operating

results. This non-GAAP financial information is among the primary

indicators management uses as a basis for evaluating the company’s

financial and operating performance. In addition, the company’s

Board of Directors may use this non-GAAP financial information in

evaluating management performance and setting management

compensation.

The presentation of this additional non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for, or alternative to, sales, operating income, net

income and net income per basic and diluted share determined in

accordance with GAAP. Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in conjunction with,

data presented in accordance with GAAP.

ARROW ELECTRONICS, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands except per share data) (Unaudited)

Quarter Ended Year Ended December 31, 2016

December 31, 2015 December 31, 2016

December 31, 2015 Sales $ 6,442,891 $ 6,751,342 $ 23,825,261

$ 23,282,020 Costs and expenses: Cost of sales 5,619,543 5,912,376

20,681,062 20,246,770 Selling, general, and administrative expenses

518,329 529,089 2,052,863 1,986,249 Depreciation and amortization

37,679 37,900 159,195 155,754 Restructuring, integration, and other

charges 12,441 17,666 73,602 68,765

6,187,992 6,497,031 22,966,722

22,457,538 Operating income 254,899 254,311 858,539 824,482 Equity

in earnings of affiliated companies 2,179 2,147 7,573 7,037 Gain on

sale of investment — — — 2,008 Loss on prepayment of debt — — —

2,943 Interest and other financing expense, net 38,887 34,442

150,715 135,401 Other expense, net — 1,500 —

3,000 Income before income taxes 218,191 220,516 715,397

692,183 Provision for income taxes 53,233 61,108

190,674 191,697 Consolidated net income 164,958

159,408 524,723 500,486 Noncontrolling interests 440

916 1,973 2,760 Net income attributable to

shareholders $ 164,518 $ 158,492 $ 522,750 $ 497,726 Net

income per share: Basic 1.84 1.71 5.75 5.26 Diluted 1.81 1.69 5.68

5.20 Weighted average shares outstanding: Basic 89,596

92,731 90,960 94,608 Diluted 90,692 94,039 92,033 95,686

ARROW ELECTRONICS, INC. CONSOLIDATED BALANCE SHEETS (In

thousands except par value) December

31, 2016 December 31, 2015 ASSETS Current assets: Cash and cash

equivalents $ 534,320 $ 273,090 Accounts receivable, net 6,746,687

6,161,418 Inventories, net 2,855,645 2,466,490 Other current assets

180,069 285,473 Total current assets

10,316,721 9,186,471 Property, plant,

and equipment, at cost: Land 23,456 23,547 Buildings and

improvements 175,141 162,011 Machinery and equipment

1,297,657 1,250,115 1,496,254 1,435,673 Less:

Accumulated depreciation and amortization (739,955 )

(735,495 ) Property, plant, and equipment, net 756,299

700,178 Investments in affiliated companies

88,401 73,376 Intangible assets, net 336,882 389,326 Goodwill

2,392,220 2,368,832 Other assets 315,843

303,747 Total assets $ 14,206,366 $ 13,021,930

LIABILITIES AND EQUITY Current liabilities: Accounts payable $

5,774,151 $ 5,192,665 Accrued expenses 821,244 819,463 Short-term

borrowings, including current portion of long-term debt

93,827 44,024 Total current liabilities

6,689,222 6,056,152 Long-term debt 2,696,334

2,380,575 Other liabilities 355,190 390,392 Equity: Shareholders'

equity: Common stock, par value $1: Authorized – 160,000 shares in

both 2016 and 2015 Issued – 125,424 shares in both 2016 and 2015

125,424 125,424 Capital in excess of par value 1,112,114 1,107,314

Treasury stock (36,511 and 34,501 shares in 2016 and 2015,

respectively), at cost (1,637,476 ) (1,480,069 ) Retained earnings

5,197,230 4,674,480 Accumulated other comprehensive loss

(383,854 ) (284,706 ) Total shareholders' equity 4,413,438

4,142,443 Noncontrolling interests 52,182

52,368 Total equity 4,465,620 4,194,811

Total liabilities and equity $ 14,206,366 $

13,021,930 ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited)

Quarter Ended December 31, 2016

December 31, 2015 Cash flows from operating activities:

Consolidated net income $ 164,958 $ 159,408 Adjustments to

reconcile consolidated net income to net cash provided by

operations: Depreciation and amortization 37,679 37,900

Amortization of stock-based compensation 10,042 13,491 Equity in

earnings of affiliated companies (2,179 ) (2,147 ) Deferred income

taxes (2,061 ) (21,048 ) Excess tax benefits from stock-based

compensation arrangements (96 )

(48

) Other 1,508 2,837 Change in assets and liabilities, net of

effects of acquired businesses: Accounts receivable (972,399 )

(1,125,272 ) Inventories (286,306 ) 2,100 Accounts payable

1,095,530 1,352,100 Accrued expenses 149,935 128,867 Other assets

and liabilities 23,443 (4,053 ) Net cash

provided by operating activities 220,054

544,135 Cash flows from investing activities:

Purchase price adjustment (cash consideration paid for acquired

businesses) 4,195 (1,821 ) Acquisition of property, plant, and

equipment (38,354 ) (41,744 ) Proceeds from sale of facilities

— 3,496 Net cash used for investing

activities (34,159 ) (40,069 ) Cash flows from

financing activities: Change in short-term and other borrowings

16,743 (42,576 ) Repayment of long-term bank borrowings, net (7,000

) (366,700 ) Proceeds from exercise of stock options 2,281 178

Excess tax benefits from stock-based compensation arrangements 96

48 Repurchases of common stock (49,268 ) (149,833 ) Other

(190 ) (1,937 ) Net cash used for financing activities

(37,338 ) (560,820 ) Effect of exchange rate changes

on cash 1,348 (6,900 ) Net increase (decrease)

in cash and cash equivalents 149,905 (63,654 ) Cash and cash

equivalents at beginning of period 384,415

336,744 Cash and cash equivalents at end of period $ 534,320

$ 273,090 ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands)

Year Ended December 31, 2016 December 31, 2015

Cash flows from operating activities: Consolidated net income $

524,723 $ 500,486 Adjustments to reconcile consolidated net income

to net cash provided by operations: Depreciation and amortization

159,195 155,754 Amortization of stock-based compensation 39,825

47,274 Equity in earnings of affiliated companies (7,573 ) (7,037 )

Deferred income taxes 28,130 5,833 Gain on sale of investment —

(2,008 ) Excess tax benefits from stock-based compensation

arrangements (5,049 ) (5,911 ) Other 5,972 10,894 Change in assets

and liabilities, net of effects of acquired businesses: Accounts

receivable (636,944 ) (68,990 ) Inventories (403,980 ) (42,790 )

Accounts payable 582,165 33,398 Accrued expenses 47,020 56,139

Other assets and liabilities 22,322 (27,963 )

Net cash provided by operating activities 355,806

655,079 Cash flows from investing activities:

Cash consideration paid for acquired businesses (64,751 ) (514,731

) Acquisition of property, plant, and equipment (164,695 ) (154,800

) Proceeds from sale of facilities — 3,496 Proceeds from sale of

investment — 2,008 Other (12,000 ) — Net cash

used for investing activities (241,446 ) (664,027 )

Cash flows from financing activities: Change in short-term

and other borrowings 48,684 (46,645 ) Proceeds from (repayment of)

long-term bank borrowings, net 313,000 (128,000 ) Net proceeds from

note offering — 688,162 Redemption of notes — (254,313 ) Proceeds

from exercise of stock options 18,967 14,900 Excess tax benefits

from stock-based compensation arrangements 5,049 5,911 Repurchases

of common stock (216,446 ) (356,434 ) Other (3,190 )

(7,768 ) Net cash provided by (used for) financing activities

166,064 (84,187 ) Effect of exchange rate

changes on cash (19,194 ) (34,130 ) Net increase

(decrease) in cash and cash equivalents 261,230 (127,265 ) Cash and

cash equivalents at beginning of period 273,090

400,355 Cash and cash equivalents at end of period $

534,320 $ 273,090 ARROW ELECTRONICS,

INC. NON-GAAP SALES RECONCILIATION (In thousands) (Unaudited)

Quarter Ended December 31, 2016

December 31, 2015 % Change Consolidated sales, as

reported $ 6,442,891 $ 6,751,342 (4.6

)

%

Impact of changes in foreign currencies — (91,058 ) Impact of

acquisitions — 66,777 Consolidated sales, as

adjusted $ 6,442,891 $ 6,727,061 (4.2

)

%

Global components sales, as reported $ 3,995,491 $ 3,668,804

8.9

%

Impact of changes in foreign currencies — (26,949 ) Impact of

acquisitions — 4,850 Global components sales,

as adjusted $ 3,995,491 $ 3,646,705 9.6

%

Europe components sales, as reported $ 963,349 $ 972,125

(0.9

)

%

Impact of changes in foreign currencies — (28,341 ) Impact of

acquisitions — 143 Europe components sales, as

adjusted $ 963,349 $ 943,927 2.1

%

Asia components sales, as reported $ 1,487,816 $ 1,215,242

22.4

%

Impact of changes in foreign currencies — 786 Impact of

acquisitions — — Asia components sales, as

adjusted $ 1,487,816 $ 1,216,028 22.4

%

Global ECS sales, as reported $ 2,447,400 $ 3,082,538 (20.6

)

%

Impact of changes in foreign currencies — (64,108 ) Impact of

acquisitions — 61,927 Global ECS sales, as

adjusted $ 2,447,400 $ 3,080,357 (20.5

)

%

Europe ECS sales, as reported $ 818,363 $ 1,054,926 (22.4

)

%

Impact of changes in foreign currencies — (70,254 ) Impact of

acquisitions — — Europe ECS sales, as adjusted

$ 818,363 $ 984,672 (16.9

)

%

Americas ECS sales, as reported $ 1,629,037 $ 2,027,612

(19.7

)

%

Impact of changes in foreign currencies — 6,145 Impact of

acquisitions — 61,927 Americas ECS sales, as

adjusted $ 1,629,037 $ 2,095,684 (22.3

)

%

ARROW ELECTRONICS, INC. NON-GAAP SALES RECONCILIATION

(In thousands) (Unaudited) Year Ended

December 31, 2016 December 31, 2015 % Change

Consolidated sales, as reported $ 23,825,261 $ 23,282,020 2.3

%

Impact of changes in foreign currencies — (201,764 ) Impact of

acquisitions 48,148 680,798 Consolidated

sales, as adjusted $ 23,873,409 $ 23,761,054 0.5

%

Global components sales, as reported $ 15,408,839 $

14,405,793 7.0

%

Impact of changes in foreign currencies — (79,175 ) Impact of

acquisitions 9,711 338,553 Global components

sales, as adjusted $ 15,418,550 $ 14,665,171 5.1

%

Europe components sales, as reported $ 4,086,607 $ 3,874,744

5.5

%

Impact of changes in foreign currencies — (52,718 ) Impact of

acquisitions — 104,634 Europe components

sales, as adjusted $ 4,086,607 $ 3,926,660 4.1

%

Asia components sales, as reported $ 5,400,429 $ 4,720,210

14.4

%

Impact of changes in foreign currencies — (22,458 ) Impact of

acquisitions — 211,745 Asia components sales,

as adjusted $ 5,400,429 $ 4,909,497 10.0

%

Global ECS sales, as reported $ 8,416,422 $ 8,876,227 (5.2

)% Impact of changes in foreign currencies — (122,589 ) Impact of

acquisitions 38,437 342,245 Global ECS sales,

as adjusted $ 8,454,859 $ 9,095,883 (7.0

)

%

Europe ECS sales, as reported $ 2,686,078 $ 2,913,995 (7.8

)

%

Impact of changes in foreign currencies — (111,522 ) Impact of

acquisitions — — Europe ECS sales, as adjusted

$ 2,686,078 $ 2,802,473

(4.2

)

%

Americas ECS sales, as reported $ 5,730,344 $ 5,962,232 (3.9

)

%

Impact of changes in foreign currencies — (11,067 ) Impact of

acquisitions 38,437 342,245 Americas ECS

sales, as adjusted $ 5,768,781 $ 6,293,410 (8.3

)

%

ARROW ELECTRONICS, INC. NON-GAAP EARNINGS

RECONCILIATION (In thousands except per share data) (Unaudited)

Three months ended December 31, 2016

ReportedGAAPmeasure

Intangibleamortizationexpense

Restructuring& Integrationcharges Other*

Non-GAAPmeasure Operating income $ 254,899 $ 13,634 $ 12,441

$ — $ 280,974 Income before income taxes 218,191 13,634 12,441 —

244,266 Provision for income taxes 53,233 4,870 3,733 — 61,836

Consolidated net income 164,958 8,764 8,708 — 182,430

Noncontrolling interests 440 336 — — 776 Net income attributable to

shareholders $ 164,518 $ 8,428 $ 8,708 $ — $ 181,654 Net income per

diluted share 1.81 0.09 0.10 — 2.00 Effective tax rate 24.4 % 25.3

%

Three months ended

December 31, 2015 ReportedGAAPmeasure Intangibleamortizationexpense

Restructuring& Integrationcharges Other* Non-GAAPmeasure

Operating income $ 254,311 11,743 17,666 — 283,720 Income before

income taxes 220,516 11,743 17,666 1,500 251,425 Provision for

income taxes 61,108 2,206 4,467 579 68,360 Consolidated net income

159,408 9,537 13,199 921 183,065 Noncontrolling interests 916 — — —

916 Net income attributable to shareholders $ 158,492 9,537 13,199

921 182,149 Net income per diluted share 1.69 0.10 0.14 0.01 1.94

Effective tax rate 27.7 % 27.2 %

Year Ended December 31, 2016 ReportedGAAPmeasure

Intangibleamortizationexpense Restructuring& Integrationcharges

Other* Non-GAAPmeasure Operating income $ 858,539 54,886 73,602 —

987,027 Income before income taxes 715,397 54,886 73,602 — 843,885

Provision for income taxes 190,674 17,226 22,977 — 230,877

Consolidated net income 524,723 37,660 50,625 — 613,008

Noncontrolling interests 1,973 1,275 — — 3,248 Net income

attributable to shareholders $ 522,750 36,385 50,625 — 609,760 Net

income per diluted share 5.68 0.40 0.55 — 6.63 Effective tax rate

26.7 % 27.4 %

Year

Ended December 31, 2015 ReportedGAAPmeasure

Intangibleamortizationexpense Restructuring& Integrationcharges

Other* Non-GAAPmeasure Operating income $ 824,482 51,036 68,765 —

944,283 Income before income taxes 692,183 51,036 68,765 3,935

815,919 Provision for income taxes 191,697 9,780 17,461 1,952

220,890 Consolidated net income 500,486 41,256 51,304 1,983 595,029

Noncontrolling interests 2,760 — — — 2,760 Net income attributable

to shareholders $ 497,726 41,256 51,304 1,983 592,269 Net income

per diluted share 5.20 0.43 0.54 0.02 6.19 Effective tax rate 27.7

% 27.1 %

*Other

includes gain/loss on sale of investments and loss on prepayment of

debt. ARROW ELECTRONICS, INC. SEGMENT INFORMATION (In

thousands) (Unaudited)

Quarter Ended Year Ended December 31, 2016 December

31, 2015 December 31, 2016 December 31, 2015 Sales:

Global components $ 3,995,491 $ 3,668,804 $ 15,408,839 $ 14,405,793

Global ECS 2,447,400 3,082,538

8,416,422 8,876,227 Consolidated $ 6,442,891

$ 6,751,342 $ 23,825,261 $ 23,282,020

Operating income (loss): Global components $ 161,804 $ 149,940 $

686,466 $ 649,396 Global ECS 158,011 173,919 441,803 424,063

Corporate (a) (64,916 ) (69,548 ) (269,730 )

(248,977 ) Consolidated $ 254,899 $ 254,311 $

858,539 $ 824,482 (a) Includes

restructuring, integration, and other charges of $12.4 million and

$73.6 million for the fourth quarter and Year Ended 2016 and $17.7

million and $68.8 million for the fourth quarter and Year Ended

2015, respectively. NON-GAAP SEGMENT RECONCILIATION

Quarter Ended Year Ended

December 31, 2016 December 31, 2015 December 31, 2016

December 31, 2015 Global components operating income,

as reported $161,804 $ 149,940 $ 686,466 $ 649,396 Intangible

assets amortization expense 7,497 6,657 31,621

27,125 Global components operating income, as adjusted $169,301

$ 156,597 $ 718,087 $ 676,521 Global ECS

operating income, as reported $158,011 $ 173,919 $ 441,803 $

424,063 Intangible assets amortization expense 6,137 5,086

23,265 23,911 Global ECS operating income, as

adjusted $164,148 $ 179,005 $ 465,068 $

447,974

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170207005618/en/

Arrow Electronics, Inc.Steven O’Brien,Vice President, Investor

Relations303-824-4544orMedia Contact:John Hourigan,Vice President,

Global Communications303-824-4586

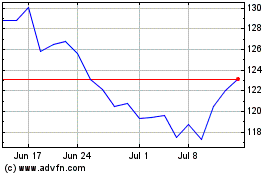

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

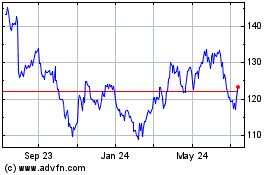

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024