-- Record First-Quarter Sales and Earnings

Per Share --

-- First-Quarter Earnings Per Share of

$1.26; Non-GAAP Earnings Per Share of $1.46 --

Arrow Electronics, Inc. (NYSE:ARW) today reported first-quarter

2017 net income of $114 million, or $1.26 per share on a diluted

basis, compared with net income of $106 million, or $1.14 per share

on a diluted basis, in the first quarter of 2016. Excluding certain

items1, net income would have been $132 million in the first

quarter of 2017, unchanged from the first quarter of 2016.

Excluding certain items1, net income would have been $1.46 per

share on a diluted basis, in the first quarter of 2017, compared

with $1.43 per share on a diluted basis, in the first quarter of

2016. First-quarter sales of $5.76 billion increased 5 percent from

sales of $5.47 billion in the prior year. In the first quarter of

2017, changes in foreign currencies had negative impacts on growth

of approximately $73 million or 1 percent on sales and $.03 or 2

percent on earnings per share on a diluted basis compared to the

first quarter of 2016.

“Customers and suppliers are migrating to our platform of online

and offline component distribution, on-premise and off-premise

software-led solutions, and our sustainable technology solutions,”

said Michael J. Long, chairman, president, and chief executive

officer. “Our unique approach drove record first-quarter earnings

per share and record first-quarter sales that were at the high end

of our expectation.”

Global components first-quarter sales of $4.06 billion grew 10

percent year over year. First-quarter sales, as adjusted, grew 12

percent year over year. Americas components sales grew 9 percent

year over year. Asia-Pacific components sales grew 17 percent year

over year. Europe components sales grew 6 percent year over year.

Sales in the region, as adjusted, grew 10 percent year over year.

Global components first-quarter operating income grew 1 percent

year over year. “Global components sales exceeded the high end of

our expectation for the second quarter in a row driven by our

differentiated value proposition,” said Mr. Long.

Global enterprise computing solutions first-quarter sales of

$1.7 billion declined 5 percent year over year. Global enterprise

computing solutions first-quarter operating income grew 3 percent

year over year and grew 4 percent year over year excluding

amortization of intangibles expense. “ECS’ growth was driven by our

industry-leading software solutions, and we continue to believe

operating income is the best measure of this business,” added Mr.

Long.

“First-quarter cash flow from operations was negative $21

million. While seasonally negative, cash flow from operations

improved compared to the prior-year first quarter despite

substantial working capital investments to support our growth,”

said Chris Stansbury, senior vice president and chief financial

officer. “We remain committed to returning excess cash to

shareholders. During the first quarter we returned approximately

$56 million to shareholders through our stock repurchase program.

We had approximately $464 million of remaining authorization under

our share repurchase programs at the end of the first quarter.”

1 A reconciliation of non-GAAP adjusted financial measures,

including sales, as adjusted, operating income, as adjusted, net

income attributable to shareholders, as adjusted, and net income

per share, as adjusted, to GAAP financial measures is presented in

the reconciliation tables included herein.

GUIDANCE

“As we look to the second quarter, we believe that total sales

will be between $5.975 billion and $6.375 billion, with global

components sales between $4.05 billion and $4.25 billion, and

global enterprise computing solutions sales between $1.925 billion

and $2.125 billion. As a result of this outlook, we expect earnings

per share on a diluted basis, to be in the range of $1.50 to $1.62,

and earnings per share on a diluted basis, excluding any charges,

to be in the range of $1.70 to $1.82 per share. Our guidance

assumes an average tax rate toward the higher end of our longer

term range of 27 to 29 percent and average diluted shares

outstanding are expected to be 90 million. We are expecting the

average USD-to-Euro exchange rate for the second quarter to be

approximately $1.07 to €1. We estimate changes in foreign

currencies will have negative impacts on growth of approximately

$110 million, or 2 percent on sales, and $.05, or 3 percent, on

earnings per share on a diluted basis compared to the second

quarter of 2016,” said Mr. Stansbury. “Based on our strong growth

and disciplined operating expense management, we expect

second-quarter earnings per share, at the midpoint, to grow 10

percent year over year adjusted for acquisitions and changes in

foreign currencies,” added Mr. Stansbury.

Please refer to the CFO commentary, which can be found at

investor.arrow.com, as a supplement to the company’s earnings

release.

Arrow Electronics (www.arrow.com) is a global provider of

products, services and solutions to industrial and commercial users

of electronic components and enterprise computing solutions. Arrow

serves as a supply channel partner for more than 125,000 original

equipment manufacturers, contract manufacturers and commercial

customers through a global network of more than 465 locations

serving over 90 countries.

Information Relating to Forward-Looking

Statements

This press release includes forward-looking statements that are

subject to numerous assumptions, risks, and uncertainties, which

could cause actual results or facts to differ materially from such

statements for a variety of reasons, including, but not limited to:

industry conditions, the company's implementation of its new

enterprise resource planning system, changes in product supply,

pricing and customer demand, competition, other vagaries in the

global components and global enterprise computing solutions

markets, changes in relationships with key suppliers, increased

profit margin pressure, the effects of additional actions taken to

become more efficient or lower costs, risks related to the

integration of acquired businesses, changes in legal and regulatory

matters, and the company’s ability to generate additional cash

flow. Forward-looking statements are those statements which are not

statements of historical fact. These forward-looking statements can

be identified by forward-looking words such as "expects,"

"anticipates," "intends," "plans," "may," "will," "believes,"

"seeks," "estimates," and similar expressions. Shareholders and

other readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date on

which they are made. The company undertakes no obligation to update

publicly or revise any of the forward-looking statements.

For a further discussion of factors to consider in connection

with these forward-looking statements, investors should refer to

Item 1A Risk Factors of the company’s Annual Report on Form 10-K

for the year ended Dec. 31, 2016.

Certain Non-GAAP Financial

Information

In addition to disclosing financial results that are determined

in accordance with accounting principles generally accepted in the

United States (“GAAP”), the company also provides certain non-GAAP

financial information relating to sales, operating income, net

income attributable to shareholders, and net income per basic and

diluted share. The company provides sales, income, or expense on a

non-GAAP basis adjusted for the impact of changes in foreign

currencies and the impact of acquisitions by adjusting the

company's operating results for businesses acquired, including the

amortization expense related to acquired intangible assets, as if

the acquisitions had occurred at the beginning of the earliest

period presented (referred to as "impact of acquisitions").

Operating income, net income attributable to shareholders, and net

income per basic and diluted share are adjusted to exclude

identifiable intangible amortization, restructuring, integration,

and other charges, and certain charges, credits, gains, and losses

that the company believes impact the comparability of its results

of operations. These charges, credits, gains, and losses arise out

of the company’s efficiency enhancement initiatives and

acquisitions (including intangible assets amortization expense). A

reconciliation of the company’s non-GAAP financial information to

GAAP is set forth in the tables below.

The company believes that such non-GAAP financial information is

useful to investors to assist in assessing and understanding the

company’s operating performance and underlying trends in the

company’s business because management considers these items

referred to above to be outside the company’s core operating

results. This non-GAAP financial information is among the primary

indicators management uses as a basis for evaluating the company’s

financial and operating performance. In addition, the company’s

Board of Directors may use this non-GAAP financial information in

evaluating management performance and setting management

compensation.

The presentation of this additional non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for, or alternative to, sales, operating income, net

income and net income per basic and diluted share determined in

accordance with GAAP. Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in conjunction with,

data presented in accordance with GAAP.

ARROW ELECTRONICS, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands except per share data) (Unaudited)

Quarter Ended April 1, 2017 April 2,

2016 Sales $ 5,759,552 $ 5,474,177 Costs and

expenses: Cost of sales 4,999,665 4,725,279 Selling, general, and

administrative expenses 515,519 505,813 Depreciation and

amortization 37,141 40,933 Restructuring, integration, and other

charges 15,505 20,788 5,567,830 5,292,813 Operating

income 191,722 181,364 Equity in earnings of affiliated companies

925 1,856 Interest and other financing expense, net 38,073

35,575 Income before income taxes 154,574 147,645 Provision for

income taxes 39,224 41,053 Consolidated net income 115,350

106,592 Noncontrolling interests 1,582 357 Net income

attributable to shareholders $ 113,768 $ 106,235 Net

income per share: Basic 1.27 1.16 Diluted 1.26 1.14 Weighted

average shares outstanding: Basic 89,262 91,514 Diluted 90,541

92,787 ARROW ELECTRONICS, INC. CONSOLIDATED BALANCE SHEETS

(In thousands except par value) April 1, 2017

December 31, 2016 ASSETS Current assets: Cash and cash

equivalents $ 521,562 $ 534,320 Accounts receivable, net 5,867,182

6,746,687 Inventories, net 2,905,502 2,855,645 Other current assets

190,257 180,069 Total current assets 9,484,503

10,316,721 Property, plant, and equipment, at cost: Land

15,359 23,456 Buildings and improvements 190,179 175,141 Machinery

and equipment 1,345,427 1,297,657 1,550,965 1,496,254

Less: Accumulated depreciation and amortization (764,369 ) (739,955

) Property, plant, and equipment, net 786,596 756,299

Investments in affiliated companies 88,376 88,401 Intangible

assets, net 325,920 336,882 Goodwill 2,405,160 2,392,220 Other

assets 328,820 315,843 Total assets $ 13,419,375

$ 14,206,366 LIABILITIES AND EQUITY Current

liabilities: Accounts payable $ 4,820,086 $ 5,774,151 Accrued

expenses 741,449 821,244 Short-term borrowings, including current

portion of long-term debt 471,753 93,827 Total

current liabilities 6,033,288 6,689,222 Long-term

debt 2,459,849 2,696,334 Other liabilities 369,431 355,190 Equity:

Shareholders' equity: Common stock, par value $1: Authorized –

160,000 shares in both 2017 and 2016 Issued – 125,424 shares in

both 2017 and 2016 125,424 125,424 Capital in excess of par value

1,089,724 1,112,114 Treasury stock (36,519 and 36,511 shares in

2017 and 2016, respectively), at cost (1,664,779 ) (1,637,476 )

Retained earnings 5,310,998 5,197,230 Accumulated other

comprehensive loss (345,355 ) (383,854 ) Total shareholders' equity

4,516,012 4,413,438 Noncontrolling interests 40,795 52,182

Total equity 4,556,807 4,465,620 Total

liabilities and equity $ 13,419,375 $ 14,206,366

ARROW ELECTRONICS, INC. CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands) (Unaudited) Quarter Ended April 1, 2017

April 2, 2016 Cash flows from operating activities:

Consolidated net income $ 115,350 $ 106,592 Adjustments to

reconcile consolidated net income to net cash provided by

operations: Depreciation and amortization 37,141 40,933

Amortization of stock-based compensation 11,575 8,877 Equity in

earnings of affiliated companies (925 ) (1,856 ) Deferred income

taxes 13,938 22,555 Other 3,251 1,462 Change in assets and

liabilities, net of effects of acquired businesses: Accounts

receivable 926,901 996,738 Inventories (38,185 ) 44,611 Accounts

payable (982,355 ) (1,036,094 ) Accrued expenses (93,619 ) (160,693

) Other assets and liabilities (13,962 ) (56,768 ) Net cash used

for operating activities (20,890 ) (33,643 ) Cash flows from

investing activities: Cash consideration paid for acquired

businesses — (46,490 ) Acquisition of property, plant, and

equipment (62,118 ) (49,261 ) Proceeds from sale of property,

plant, and equipment 7,886 — Net cash used for

investing activities (54,232 ) (95,751 ) Cash flows from

financing activities: Change in short-term and other borrowings

76,402 470 Proceeds from long-term bank borrowings, net 62,500

265,000 Proceeds from exercise of stock options 17,259 5,705

Repurchases of common stock (68,847 ) (18,684 ) Purchase of shares

from noncontrolling interest (23,350 ) — Other — (1,817 )

Net cash provided by financing activities 63,964 250,674

Effect of exchange rate changes on cash (1,600 ) 285

Net increase (decrease) in cash and cash equivalents (12,758 )

121,565 Cash and cash equivalents at beginning of period 534,320

273,090 Cash and cash equivalents at end of period $

521,562 $ 394,655 ARROW ELECTRONICS, INC.

NON-GAAP SALES RECONCILIATION (In thousands) (Unaudited)

Quarter Ended April 1, 2017 April 2, 2016 % Change

Consolidated sales, as reported $ 5,759,552 $ 5,474,177 5.2

% Impact of changes in foreign currencies — (73,042 ) Impact of

acquisitions — 42,599 Consolidated sales, as adjusted

$ 5,759,552 $ 5,443,734 5.8 % Global

components sales, as reported $ 4,058,803 $ 3,675,929 10.4 % Impact

of changes in foreign currencies — (40,351 ) Impact of acquisitions

— 4,162 Global components sales, as adjusted $

4,058,803 $ 3,639,740 11.5 % Europe components

sales, as reported $ 1,118,279 $ 1,058,432 5.7 % Impact of changes

in foreign currencies — (45,320 ) Impact of acquisitions — —

Europe components sales, as adjusted $ 1,118,279 $

1,013,112 10.4 % Asia components sales, as reported $

1,376,979 $ 1,177,868 16.9 % Impact of changes in foreign

currencies — 3,868 Impact of acquisitions — — Asia

components sales, as adjusted $ 1,376,979 $ 1,181,736

16.5 % Global ECS sales, as reported $ 1,700,749 $ 1,798,248

(5.4 )% Impact of changes in foreign currencies — (32,691 ) Impact

of acquisitions — 38,437 Global ECS sales, as

adjusted $ 1,700,749 $ 1,803,994 (5.7 )%

Europe ECS sales, as reported $ 567,562 $ 607,448 (6.6 )% Impact of

changes in foreign currencies — (38,064 ) Impact of acquisitions —

— Europe ECS sales, as adjusted $ 567,562 $

569,384 (0.3 )% Americas ECS sales, as reported $

1,133,187 $ 1,190,800 (4.8 )% Impact of changes in foreign

currencies — 5,373 Impact of acquisitions — 38,437

Americas ECS sales, as adjusted $ 1,133,187 $ 1,234,610

(8.2 )% ARROW ELECTRONICS, INC. NON-GAAP EARNINGS

RECONCILIATION (In thousands except per share data) (Unaudited)

Three months ended April 1, 2017 ReportedGAAPmeasure

Intangibleamortizationexpense Restructuring&

Integrationcharges Non-GAAPmeasure Operating income $

191,722 $ 12,900 $ 15,505 $ 220,127 Income before income taxes

154,574 12,900 15,505 182,979 Provision for income taxes 39,224

4,561 4,997 48,782 Consolidated net income 115,350 8,339 10,508

134,197 Noncontrolling interests 1,582 251 — 1,833 Net income

attributable to shareholders $ 113,768 $ 8,088 $ 10,508 $ 132,364

Net income per diluted share 1.26 0.09 0.12 1.46 Effective tax rate

25.4 % 26.7 %

Three months ended April 2, 2016 ReportedGAAPmeasure

Intangibleamortizationexpense Restructuring& Integrationcharges

Non-GAAPmeasure Operating income $ 181,364 12,913 20,788 215,065

Income before income taxes 147,645 12,913 20,788 181,346 Provision

for income taxes 41,053 2,279 5,434 48,766 Consolidated net income

106,592 10,634 15,354 132,580 Noncontrolling interests 357 — — 357

Net income attributable to shareholders $ 106,235 10,634 15,354

132,223 Net income per diluted share 1.14 0.11 0.17 1.43 Effective

tax rate 27.8 % 26.9 % ARROW ELECTRONICS, INC. SEGMENT

INFORMATION (In thousands) (Unaudited) Quarter Ended

April 1, 2017 April 2, 2016 Sales: Global components $

4,058,803 $ 3,675,929 Global ECS 1,700,749 1,798,248

Consolidated

$ 5,759,552 $ 5,474,177 Operating income (loss):

Global components $ 173,533 $ 170,770 Global ECS 80,879 78,212

Corporate (a) (62,690 ) (67,618 ) Consolidated $ 191,722 $

181,364

(a) Includes restructuring, integration,

and other charges of $15.5 million and $20.8 million for the first

quarters of 2017 and 2016, respectively.

NON-GAAP SEGMENT RECONCILIATION Quarter Ended April

1, 2017 April 2, 2016 Global components operating income, as

reported $ 173,533 $ 170,770 Intangible assets amortization expense

7,399 7,900 Global components operating income, as

adjusted $ 180,932 $ 178,670 Global ECS operating

income, as reported $ 80,879 $ 78,212 Intangible assets

amortization expense 5,501 5,013 Global ECS operating

income, as adjusted $ 86,380 $ 83,225

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170504005438/en/

Arrow Electronics, Inc.Contact:Steven O’Brien,

303-824-4544Vice President, Investor RelationsorMedia Contact:John

Hourigan, 303-824-4586Vice President, Global Communications

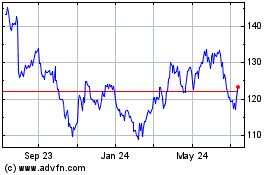

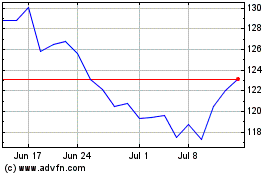

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024