Arrow Electronics Prices $700 Million Notes Offering

February 23 2015 - 5:06PM

Business Wire

Arrow Electronics, Inc. (NYSE:ARW) announced today the pricing

of two series of the company’s senior unsecured notes in an

aggregate principal amount of $700 million. Of these, $350 million

will mature on April 1, 2022 and will bear interest at an annual

rate of 3.5 percent (the “2022 Notes”), and $350 million will

mature on April 1, 2025 and will bear interest at an annual rate of

4.0 percent (the “2025 Notes” and, together with the 2022 Notes,

the “Notes”). The offering is expected to close on March 2, 2015.

Net proceeds from this offering are expected to be used to repay

the company's outstanding 3.375 percent notes due November 1, 2015

at or before maturity and for other general corporate purposes,

which may include acquisitions or the repayment of other

indebtedness including amounts outstanding under the company’s

revolving credit facility or securitization program.

The Notes are being offered under an automatic shelf

registration statement previously filed with the Securities and

Exchange Commission, and which became effective upon filing. The

offering is being led by Merrill Lynch, Pierce, Fenner & Smith

Incorporated, J.P. Morgan Securities LLC, and Morgan Stanley &

Co. LLC.

This press release is neither an offer to sell nor the

solicitation of an offer to buy the Notes. In addition, there shall

be no sale of these securities in any jurisdiction in which the

offer, solicitation, or sale would be unlawful.

Arrow Electronics is a global provider of products, services and

solutions to industrial and commercial users of electronic

components and enterprise computing solutions. Arrow serves as a

supply channel partner for more than 100,000 original equipment

manufacturers, contract manufacturers and commercial customers

through a global network of more than 460 locations in 56

countries.

Information Relating to Forward-Looking

Statements

This press release includes forward-looking statements that are

subject to numerous assumptions, risks, and uncertainties, which

could cause actual results or facts to differ materially from such

statements for a variety of reasons, including, but not limited to:

industry conditions, the company’s implementation of its new

enterprise resource planning system, changes in product supply,

pricing and customer demand, competition, other vagaries in the

global components and global ECS markets, changes in relationships

with key suppliers, increased profit margin pressure, the effects

of additional actions taken to become more efficient or lower

costs, risks related to the integration of acquired businesses,

changes in legal and regulatory matters, and the company’s ability

to generate additional cash flow. Forward-looking statements are

those statements which are not statements of historical fact. These

forward-looking statements can be identified by forward-looking

words such as “expects,” “anticipates,” “intends,” “plans,” “may,”

“will,” “believes,” “seeks,” “estimates,” and similar expressions.

Shareholders and other readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date on which they are made. The company undertakes no

obligation to update publicly or revise any of the forward-looking

statements.

For a further discussion of factors to consider in connection

with these forward-looking statements, investors should refer to

Item 1A Risk Factors of the company’s Annual Report on Form 10-K

for the year ended December 31, 2014.

Arrow ElectronicsSteven O’Brien, 303-824-4544Director,

Investor RelationsorPaul J. Reilly, 631-847-1872Executive Vice

President, Finance and Operations, andChief Financial

OfficerorMedia Contact:John Hourigan, 303-824-4586Vice

President, Global Communications

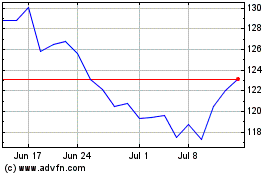

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

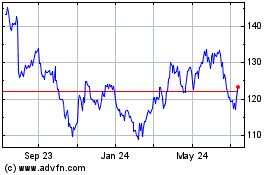

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024