Key Highlights

-

As reported sales of $351.9 million, up 5.1%

versus the prior year quarter, with all segments contributing to

growth

-

Operating income from continuing operations of

$69.0 million, down 2.8%. Excluding a settlement accounting charge

for the U.S pension plan, operating income increased 27%.

-

Adjusted EBITDA up 12% to $107 million, a new

quarterly record

-

Increasing full year adjusted EBITDA guidance

due to an environmental insurance settlement in the fourth quarter.

Excluding the net settlement benefit, guidance range remains

unchanged.

-

Share repurchase program authorization

increased by $250 million

LANCASTER, Pa., October 30, 2017

-- Armstrong World Industries, Inc. (NYSE:AWI), a global leader in

the design, innovation and manufacture of commercial and

residential ceiling, wall and suspension system solutions, today

reported financial results for the third quarter.

Third Quarter Results from

Continuing Operations

| (Dollar amounts in millions except per-share

data) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

|

|

Change |

|

| Net sales |

|

$ |

351.9 |

|

|

$ |

334.9 |

|

|

|

5.1 |

% |

| Operating income |

|

$ |

69.0 |

|

|

$ |

71.0 |

|

|

|

(2.8 |

)% |

| Earnings from continuing operations |

|

$ |

43.5 |

|

|

$ |

55.9 |

|

|

|

(22.2 |

)% |

| Diluted earnings per share |

|

$ |

0.81 |

|

|

$ |

0.99 |

|

|

|

(18.2 |

)% |

Excluding the favorable impact

from foreign exchange of $5 million, consolidated adjusted net

sales increased 3.7% compared to the prior year quarter, driven by

higher volumes internationally and higher average unit values

("AUV") in which both positive mix and positive like for like

pricing contributed.

As reported operating income

declined over the prior year quarter, driven by a $20.8 million

accounting charge from the partial settlement of the U.S. pension

plan due to lump sum distributions from favorable participant

elections, lower equity earnings from our WAVE joint venture and

higher manufacturing and input costs, partially offset by the

margin impact of better AUV performance, lower SG&A expenses

and the margin impact of higher volumes.

"We delivered a solid quarter with

constant currency sales growth of 4% and adjusted EBITDA growth of

12%, overcoming one less business day and the impact of the

hurricanes," said Vic Grizzle, CEO. "I'm pleased with our

acceleration of AUV achievement over the prior year and with the

continued traction from our growth initiatives."

Additional (non-GAAP*) Financial

Metrics from Continuing Operations

| (Dollar amounts in millions except per-share

data) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

|

|

Change |

|

| Adjusted net sales |

|

$ |

346 |

|

|

$ |

334 |

|

|

|

3.7 |

% |

| Adjusted operating income |

|

$ |

83 |

|

|

$ |

76 |

|

|

|

9.4 |

% |

| Adjusted net income |

|

$ |

46 |

|

|

$ |

42 |

|

|

|

8.5 |

% |

| Adjusted diluted earnings per share |

|

$ |

0.86 |

|

|

$ |

0.75 |

|

|

|

13.6 |

% |

| Adjusted free cash flow |

|

$ |

62 |

|

|

$ |

55 |

|

|

|

11.9 |

% |

| (Dollar amounts in millions) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

|

|

Change |

|

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

| Americas |

|

$ |

96 |

|

|

$ |

85 |

|

|

|

12.5 |

% |

| EMEA |

|

|

8 |

|

|

|

8 |

|

|

|

2.6 |

% |

| Pacific Rim |

|

|

3 |

|

|

|

3 |

|

|

|

(7.4 |

)% |

| Unallocated Corporate |

|

|

- |

|

|

|

(1 |

) |

|

|

100.0 |

% |

| Consolidated Adjusted EBITDA |

|

$ |

107 |

|

|

$ |

95 |

|

|

|

11.9 |

% |

* The Company

uses the above non-GAAP adjusted measures, as well as other

non-GAAP measures mentioned below, in managing the business and

believes the adjustments provide meaningful comparisons of

operating performance between periods. Adjusted operating income,

adjusted EBITDA, adjusted net income, and adjusted EPS exclude the

impact of foreign exchange, restructuring charges and related

costs, impairments, U.S. pension plan expense, AFI separation costs

and certain other gains and losses. The Company excludes U.S.

pension expense in the non-GAAP results as it represents the

actuarial net periodic benefit cost expected to be recorded as a

component of operating income and for all periods presented, the

Company was not required and did not make cash contributions to the

U.S. Retirement Income Plan based on guidelines established by the

Pension Benefit Guaranty Corporation, nor does the Company expect

to make cash contributions to the plan in 2017. Adjusted free cash

flow is defined as cash from operations and dividends received from

the WAVE joint venture, less expenditures for property and

equipment, and is adjusted to remove the impact of cash used or

proceeds received for acquisitions and divestitures. The Company

believes adjusted free cash flow is useful because it provides

insight into the amount of cash that the Company has available for

discretionary uses, after expenditures for capital commitments and

adjustments for acquisitions and divestitures. Adjusted figures are

reported in comparable dollars using the budgeted exchange rate for

2017, and are reconciled to the most comparable GAAP measures in

tables at the end of this release.

Consolidated adjusted operating

income improved 9% and adjusted EBITDA improved 12% in the third

quarter, when compared to the prior year quarter. Adjusted

operating income and adjusted EBITDA both grew driven by solid AUV

fall-through to profit, lower SG&A expenses, an environmental

insurance settlement in the quarter net of legal expenses and other

consulting fees and higher volumes internationally, which offset

lower equity earnings from WAVE. Adjusted earnings per share

reflects a 39% adjusted tax rate in both the current and prior year

periods. Adjusted free cash flow improvement was driven primarily

by higher cash earnings and lower capital expenditures.

Third Quarter Segment

Highlights

Effective April 1, 2016, the

former Building Products operating segment was disaggregated

into the following three distinct geographical segments: Americas;

Europe (including Russia), Middle East and Africa ("EMEA"); and

Pacific Rim. The Unallocated Corporate segment historically

included assets, liabilities, income and expenses that had not been

allocated to the geographical segments, including AFI separation

costs.

| Americas |

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollar amounts in millions) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

|

|

Change |

|

| Total segment net sales (as reported) |

|

$ |

233.8 |

|

|

$ |

226.0 |

|

|

|

3.5 |

% |

| Operating income (as reported) |

|

$ |

67.6 |

|

|

$ |

68.6 |

|

|

|

(1.5 |

)% |

| Adjusted net sales |

|

$ |

233 |

|

|

$ |

226 |

|

|

|

3.2 |

% |

| Adjusted EBITDA |

|

$ |

96 |

|

|

$ |

85 |

|

|

|

12.5 |

% |

Excluding the favorable impact of

foreign exchange of approximately $1 million, adjusted net sales in

the Americas increased 3.2%, driven by mid-single digit AUV

expansion with contributions from both positive mix and positive

like for like pricing offsetting lower core volumes versus the

prior year quarter. The U.S. Commercial channel saw positive volume

growth, driven primarily by the Tectum acquisition. Continued

double digit growth in Architectural Specialties partially offset

volume declines in the overall segment.

On an as reported basis, operating

income decreased $1 million, driven by an approximately $11 million

increase in U.S. pension plan expense as a result of the partial

settlement, lower equity earnings and the margin impact of lower

volumes, which were partially offset by the margin impact of

favorable AUV, an environmental insurance settlement in the quarter

net of legal expenses and other consulting fees and an increase in

certain selling, promotional and administrative processing expense

reimbursements from WAVE. Equity earnings from WAVE decreased

versus the prior year quarter resulting from the expense

reimbursements, along with higher input costs mainly related to

steel pricing. Adjusted EBITDA margins expanded 340 bps driven

primarily by the environmental insurance settlement, WAVE expense

reimbursements and solid AUV fall-through to profit.

| EMEA |

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollar amounts in millions) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

|

|

Change |

|

| Total segment net sales (as reported) |

|

$ |

76.5 |

|

|

$ |

74.2 |

|

|

|

3.1 |

% |

| Operating income (as reported) |

|

$ |

3.8 |

|

|

$ |

4.1 |

|

|

|

(7.3 |

)% |

| Adjusted net sales |

|

$ |

73 |

|

|

$ |

74 |

|

|

|

(1.0 |

)% |

| Adjusted EBITDA |

|

$ |

8 |

|

|

$ |

8 |

|

|

|

2.6 |

% |

Excluding the favorable impact of

foreign exchange of approximately $3 million, adjusted net sales in

EMEA decreased 1.0%, driven by lower sales in predominantly the UK

and unfavorable AUV. On an as reported basis, operating income

decreased driven by lower equity earnings partially offset by the

margin impact of higher volumes.

| Pacific Rim |

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollar amounts in millions) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

|

|

Change |

|

| Total segment net sales (as reported) |

|

$ |

41.6 |

|

|

$ |

34.7 |

|

|

|

19.9 |

% |

| Operating (loss) income (as reported) |

|

$ |

(2.4 |

) |

|

$ |

1.0 |

|

|

Unfavorable |

|

| Adjusted net sales |

|

$ |

40 |

|

|

$ |

34 |

|

|

|

17.5 |

% |

| Adjusted EBITDA |

|

$ |

3 |

|

|

$ |

3 |

|

|

|

(7.4 |

)% |

Excluding the favorable impact of

foreign exchange of approximately $1 million, adjusted net sales in

the Pacific Rim increased 17.5%, driven by higher sales across the

region particularly in China. On an as reported basis, operating

loss increased, driven by an accelerated depreciation charge

related to the closure of the previously idled QingPu, China plant

and the margin impact of unfavorable AUV, which was partially

offset by the margin impact of higher volumes.

Unallocated Corporate

As a result of the AFI separation

on April 1, 2016, the majority of corporate support functions were

incorporated into the Americas segment, resulting in the

discontinuation of the Unallocated Corporate reportable segment

from a P&L perspective in 2017.

On an as reported basis,

Unallocated Corporate had zero expenses in the third quarter,

representing a decrease of $2.7 million from the prior year

quarter.

Year to Date Results from

Continuing Operations

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollar amounts in millions) |

|

For the Nine Months Ended September 30, |

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

|

|

Change |

|

| Net sales (as reported) |

|

$ |

998.1 |

|

|

$ |

936.6 |

|

|

|

6.6 |

% |

| Operating income (as reported) |

|

$ |

210.4 |

|

|

$ |

144.3 |

|

|

|

45.8 |

% |

| Adjusted net sales |

|

$ |

993 |

|

|

$ |

932 |

|

|

|

6.6 |

% |

| Adjusted EBITDA |

|

$ |

274 |

|

|

$ |

247 |

|

|

|

11.0 |

% |

Excluding the impact from foreign

exchange, consolidated adjusted net sales increased 6.6% compared

to the prior year period, driven by higher volumes globally and

higher AUV in which both positive mix and positive like for like

pricing contributed.

As reported operating income

improved over the prior year period, driven by lower separation

costs, the margin impact of higher volume, AUV improvement and a

decrease in U.S. pension plan expense due to a longer amortization

period for actuarial losses as a result of the separation of AFI,

which partially offset higher input costs and lower WAVE equity

earnings.

Share Repurchase

Program

The AWI Board of Directors

authorized an expansion of the Company's existing stock repurchase

program under which it may repurchase up to an additional $250

million of its outstanding common stock. This additional

repurchase authorization extends through October of 2020.

Repurchases under the program may

be made through open market, block and privately-negotiated

transactions, including Rule 10b5-1 plans, at times and in such

amounts as management deems appropriate, subject to market and

business conditions, regulatory requirements and other

factors. The share repurchase program does not obligate the

Company to repurchase any particular amount of common stock and may

be suspended or discontinued at any time without notice. The

Company had approximately 52.8 million shares of common stock

outstanding as of September 30, 2017.

Market Outlook and 2017 Guidance

(1)

"We are increasing our 2017

adjusted EBITDA guidance due solely to the subsequent event

disclosed in our 10-Q relating to an environmental insurance

settlement in October of $20 million," said Brian MacNeal, CFO.

"Net of the additional costs associated with this settlement, we

now expect our adjusted EBITDA to grow 15% to 18% and range between

$365 million and $375 million. Excluding the net impact of this

settlement, our guidance range remains unchanged."

Adjusted earnings per share

guidance is increasing to $2.80 to $2.90 per diluted share, also

reflecting the net benefit of the environmental insurance

settlement in October.

(1)

Guidance metrics are presented using 2017 budgeted foreign exchange

rates. Adjusted EPS guidance for 2017 is calculated based on

an adjusted effective tax rate of 39%.

Earnings Webcast

Management will host a live

Internet broadcast beginning at 11:00 a.m. Eastern time today, to

discuss third quarter results. This event will be broadcast live on

the Company's website. To access the call and accompanying slide

presentation, go to www.armstrongceilings.com and click Investors.

The replay of this event will also be available on the Company's

website for up to one year after the date of the call.

Uncertainties Affecting

Forward-Looking Statements

Disclosures in this release,

including without limitation, those relating to future financial

results, market conditions and guidance, and in our other public

documents and comments, contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Those statements provide our future expectations or forecasts

and can be identified by our use of words such as "anticipate,"

"estimate," "expect," "project," "intend," "plan," "believe,"

"outlook," "target," "predict," "may," "will," "would," "could,"

"should," "seek," and other words or phrases of similar meaning in

connection with any discussion of future operating or financial

performance. Forward-looking statements, by their nature, address

matters that are uncertain and involve risks because they relate to

events and depend on circumstances that may or may not occur in the

future. As a result, our actual results may differ materially from

our expected results and from those expressed in our

forward-looking statements. A more detailed discussion of the risks

and uncertainties that could cause our actual results to differ

materially from those projected, anticipated or implied is included

in the "Risk Factors" and "Management's Discussion and Analysis"

section of our report on Forms 10-K and 10-Q filed with the U.S.

Securities and Exchange Commission ("SEC"). Forward-looking

statements speak only as of the date they are made. We undertake no

obligation to update any forward-looking statements beyond what is

required under applicable securities law.

About Armstrong and Additional

Information

More details on the Company's

performance can be found in its quarterly report on Form 10-Q for

the quarter ended September 30, 2017 that the Company expects

to file with the SEC today.

Armstrong World Industries, Inc.

(AWI) is a global leader in the design, innovation and manufacture

of commercial and residential ceiling, wall and suspension system

solutions. With over 3,900 employees and fiscal 2016 revenues

from continuing operations in excess of $1.2 billion, AWI has a

global manufacturing network of 26 facilities, including 9 plants

dedicated to its WAVE joint venture. On April 1, 2016, AWI

completed the separation of its legacy flooring business that now

operates as Armstrong Flooring, Inc., an independent,

publicly-traded company. For more information, visit

www.armstrongceilings.com.

Additional forward looking

non-GAAP metrics are available on the Company's website at

www.armstrongceilings.com under the Investors tab. The website is

not part of this release and references to our website address in

this release are intended to be inactive textual references

only.

As Reported Financial

Highlights

FINANCIAL HIGHLIGHTS

Armstrong World Industries, Inc. and Subsidiaries

(Amounts in millions, except for per-share amounts, quarterly data

is unaudited)

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Net sales |

|

$ |

351.9 |

|

|

$ |

334.9 |

|

|

$ |

998.1 |

|

|

$ |

936.6 |

|

| Cost of goods sold |

|

|

241.0 |

|

|

|

225.2 |

|

|

|

676.8 |

|

|

|

651.1 |

|

| Selling, general and administrative expenses |

|

|

55.8 |

|

|

|

55.7 |

|

|

|

162.8 |

|

|

|

165.2 |

|

| Separation costs |

|

|

- |

|

|

|

2.0 |

|

|

|

- |

|

|

|

33.0 |

|

| Equity earnings from joint venture |

|

|

(13.9 |

) |

|

|

(19.0 |

) |

|

|

(51.9 |

) |

|

|

(57.0 |

) |

| Operating income |

|

|

69.0 |

|

|

|

71.0 |

|

|

|

210.4 |

|

|

|

144.3 |

|

| Interest expense |

|

|

9.1 |

|

|

|

9.0 |

|

|

|

27.5 |

|

|

|

43.4 |

|

| Other non-operating expense |

|

|

1.7 |

|

|

|

- |

|

|

|

3.6 |

|

|

|

- |

|

| Other non-operating (income) |

|

|

(3.0 |

) |

|

|

(1.6 |

) |

|

|

(7.4 |

) |

|

|

(8.9 |

) |

| Earnings from continuing operations before income

taxes |

|

|

61.2 |

|

|

|

63.6 |

|

|

|

186.7 |

|

|

|

109.8 |

|

| Income tax expense |

|

|

17.7 |

|

|

|

7.7 |

|

|

|

70.9 |

|

|

|

44.4 |

|

| Earnings from continuing operations |

|

$ |

43.5 |

|

|

$ |

55.9 |

|

|

$ |

115.8 |

|

|

$ |

65.4 |

|

Net (loss) from discontinued operations, net of tax

expense

of $ -, $-, $- and $ 0.1 |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(4.5 |

) |

Gain from disposal of discontinued business, net of

tax

(benefit) of ($5.9), ($14.7), ($5.4) and ($16.6) |

|

|

5.9 |

|

|

|

14.7 |

|

|

|

5.3 |

|

|

|

16.7 |

|

| Net gain from discontinued operations |

|

|

5.9 |

|

|

|

14.7 |

|

|

|

5.3 |

|

|

|

12.2 |

|

| Net earnings |

|

$ |

49.4 |

|

|

$ |

70.6 |

|

|

$ |

121.1 |

|

|

$ |

77.6 |

|

| Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

|

7.0 |

|

|

|

(2.0 |

) |

|

|

20.9 |

|

|

|

(13.8 |

) |

| Derivative (loss) gain |

|

|

(0.3 |

) |

|

|

1.7 |

|

|

|

(2.0 |

) |

|

|

1.2 |

|

| Pension and postretirement adjustments |

|

|

14.3 |

|

|

|

6.9 |

|

|

|

18.8 |

|

|

|

23.9 |

|

| Total other comprehensive income |

|

|

21.0 |

|

|

|

6.6 |

|

|

|

37.7 |

|

|

|

11.3 |

|

| Total comprehensive income |

|

$ |

70.4 |

|

|

$ |

77.2 |

|

|

$ |

158.8 |

|

|

$ |

88.9 |

|

| Earnings per share of common stock, continuing

operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.82 |

|

|

$ |

1.00 |

|

|

$ |

2.16 |

|

|

$ |

1.17 |

|

| Diluted |

|

$ |

0.81 |

|

|

$ |

0.99 |

|

|

$ |

2.14 |

|

|

$ |

1.16 |

|

| Earnings per share of common stock, discontinued

operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.11 |

|

|

$ |

0.26 |

|

|

$ |

0.10 |

|

|

$ |

0.22 |

|

| Diluted |

|

$ |

0.11 |

|

|

$ |

0.26 |

|

|

$ |

0.10 |

|

|

$ |

0.22 |

|

| Net earnings per share of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.93 |

|

|

$ |

1.27 |

|

|

$ |

2.26 |

|

|

$ |

1.39 |

|

| Diluted |

|

$ |

0.92 |

|

|

$ |

1.26 |

|

|

$ |

2.24 |

|

|

$ |

1.38 |

|

| Average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

53.0 |

|

|

|

55.5 |

|

|

|

53.5 |

|

|

|

55.6 |

|

| Diluted |

|

|

53.5 |

|

|

|

56.0 |

|

|

|

53.9 |

|

|

|

56.0 |

|

SEGMENT RESULTS

Armstrong World Industries, Inc. and Subsidiaries

(Amounts in millions)

(Unaudited)

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Americas |

|

$ |

233.8 |

|

|

$ |

226.0 |

|

|

$ |

679.2 |

|

|

$ |

640.9 |

|

| EMEA |

|

|

76.5 |

|

|

|

74.2 |

|

|

|

211.8 |

|

|

|

199.4 |

|

| Pacific Rim |

|

|

41.6 |

|

|

|

34.7 |

|

|

|

107.1 |

|

|

|

96.3 |

|

| Total net sales |

|

$ |

351.9 |

|

|

$ |

334.9 |

|

|

$ |

998.1 |

|

|

$ |

936.6 |

|

| Operating Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Americas |

|

$ |

67.6 |

|

|

$ |

68.6 |

|

|

$ |

214.7 |

|

|

$ |

189.0 |

|

| EMEA |

|

|

3.8 |

|

|

|

4.1 |

|

|

|

(1.1 |

) |

|

|

(5.2 |

) |

| Pacific Rim |

|

|

(2.4 |

) |

|

|

1.0 |

|

|

|

(3.2 |

) |

|

|

(2.4 |

) |

| Unallocated Corporate (expense) |

|

|

- |

|

|

|

(2.7 |

) |

|

|

- |

|

|

|

(37.1 |

) |

| Total operating income |

|

$ |

69.0 |

|

|

$ |

71.0 |

|

|

$ |

210.4 |

|

|

$ |

144.3 |

|

Selected Balance Sheet

Information

(Amounts in millions)

(Unaudited)

| |

|

September 30, 2017 |

|

|

December 31, 2016 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

$ |

407.8 |

|

|

$ |

406.2 |

|

| Property, plant and equipment, net |

|

|

699.0 |

|

|

|

669.6 |

|

| Other noncurrent assets |

|

|

722.9 |

|

|

|

682.2 |

|

| Total assets |

|

$ |

1,829.7 |

|

|

$ |

1,758.0 |

|

| Liabilities and shareholders' equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

$ |

205.9 |

|

|

$ |

224.1 |

|

| Noncurrent liabilities |

|

|

1,257.6 |

|

|

|

1,267.5 |

|

| Equity |

|

|

366.2 |

|

|

|

266.4 |

|

| Total liabilities and shareholders' equity |

|

$ |

1,829.7 |

|

|

$ |

1,758.0 |

|

Selected Cash Flow

Information

(Amounts in millions)

(Unaudited)

| |

|

Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

| Net earnings |

|

$ |

121.1 |

|

|

$ |

77.6 |

|

| Other adjustments to reconcile net earnings to net

cash provided by operating activities |

|

|

73.6 |

|

|

|

97.3 |

|

| Changes in operating assets and liabilities, net |

|

|

(89.8 |

) |

|

|

(177.5 |

) |

| Net cash provided by (used for) operating

activities |

|

|

104.9 |

|

|

|

(2.6 |

) |

| Net cash (used for) investing activities |

|

|

(41.3 |

) |

|

|

(6.9 |

) |

| Net cash (used for) financing activities |

|

|

(92.2 |

) |

|

|

(88.2 |

) |

| Effect of exchange rate changes on cash and cash

equivalents |

|

|

3.2 |

|

|

|

(4.6 |

) |

| Net (decrease) in cash and cash equivalents |

|

|

(25.4 |

) |

|

|

(102.3 |

) |

| Cash and cash equivalents at beginning of year |

|

|

141.9 |

|

|

|

244.8 |

|

| Cash and cash equivalents at end of period |

|

$ |

116.5 |

|

|

$ |

142.5 |

|

Supplemental Reconciliations of

GAAP to non-GAAP Results (unaudited)

(Amounts in millions, except per share data)

To supplement its consolidated

financial statements presented in accordance with accounting

principles generally accepted in the United States ("GAAP"), the

Company provides additional measures of performance adjusted to

exclude the impact of foreign exchange, restructuring charges and

related costs, impairments, U.S. pension plan expense, separation

costs and certain other gains and losses. The Company excludes U.S.

pension expense in the non-GAAP results as it represents the

actuarial net periodic benefit cost recorded as a component of

operating income and for all periods presented, the Company was not

required and did not make cash contributions to the U.S. Retirement

Income Plan based on guidelines established by the Pension Benefit

Guaranty Corporation, nor does the Company expect to make cash

contributions to the plan in 2017. Adjusted free cash flow is

defined as cash from operations and dividends received from the

WAVE joint venture, less expenditures for property and equipment,

and is adjusted to remove the impact of cash used or proceeds

received for acquisitions and divestitures. The Company believes

adjusted free cash flow is useful because it provides insight into

the amount of cash that the Company has available for discretionary

uses, after expenditures for capital commitments and adjustments

for acquisitions and divestitures. Adjusted figures are reported in

comparable dollars using the budgeted exchange rate for 2017. The

Company uses these adjusted performance measures in managing the

business, including communications with its Board of Directors and

employees, and believes that they provide users of this financial

information with meaningful comparisons of operating performance

between current results and results in prior periods. The Company

believes that these non-GAAP financial measures are appropriate to

enhance understanding of its past performance, as well as prospects

for its future performance. A reconciliation of these adjustments

to the most directly comparable GAAP measures is included in this

release and on the Company's website. These non-GAAP measures

should not be considered in isolation or as a substitute for the

most comparable GAAP measures. Non-GAAP financial measures utilized

by the Company may not be comparable to non-GAAP financial measures

used by other companies.

Consolidated Net Sales

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Reported net sales |

|

$ |

352 |

|

|

$ |

335 |

|

|

$ |

998 |

|

|

$ |

937 |

|

| Add: Foreign exchange impact |

|

|

(6 |

) |

|

|

(1 |

) |

|

|

(5 |

) |

|

|

(5 |

) |

| Adjusted net sales |

|

$ |

346 |

|

|

$ |

334 |

|

|

$ |

993 |

|

|

$ |

932 |

|

Consolidated Results from

Continuing Operations

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Earnings from continuing operations,

Reported |

|

$ |

44 |

|

|

$ |

56 |

|

|

$ |

116 |

|

|

$ |

65 |

|

| Less: Tax expense |

|

|

(17 |

) |

|

|

(8 |

) |

|

|

(71 |

) |

|

|

(45 |

) |

| Earnings before tax,

Reported |

|

$ |

61 |

|

|

$ |

64 |

|

|

$ |

187 |

|

|

$ |

110 |

|

| Less: Interest/other income and expense,

net(1) |

|

|

(8 |

) |

|

|

(7 |

) |

|

|

(23 |

) |

|

|

(34 |

) |

| Operating Income, Reported |

|

$ |

69 |

|

|

$ |

71 |

|

|

$ |

210 |

|

|

$ |

144 |

|

| Add: U.S. pension expense(2) |

|

|

14 |

|

|

|

3 |

|

|

|

2 |

|

|

|

9 |

|

| Add: Separation expenses |

|

|

- |

|

|

|

2 |

|

|

|

- |

|

|

|

33 |

|

| Add: China plant cost reduction initiatives |

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

|

|

3 |

|

| Add: Foreign exchange impact |

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

| Operating Income, Adjusted |

|

$ |

83 |

|

|

$ |

76 |

|

|

$ |

212 |

|

|

$ |

189 |

|

| Less: D&A |

|

|

(24 |

) |

|

|

(19 |

) |

|

|

(62 |

) |

|

|

(58 |

) |

| Adjusted EBITDA(3) |

|

$ |

107 |

|

|

$ |

95 |

|

|

$ |

274 |

|

|

$ |

247 |

|

(1) Reported results include $10.7

million of interest expense recorded in the first quarter of 2016

related to the settlement of interest rate swaps incurred in

connection with the Company's refinancing of its credit

facility.

(2) U.S. pension expense represents the actuarial net periodic

benefit cost expected to be recorded as a component of operating

income. For all periods presented, we were not required and did not

make cash contributions to our U.S. Retirement Income Plan based on

guidelines established by the Pension Benefit Guaranty Corporation,

nor do we expect to make cash contributions to the plan in

2017.

(3) Includes $1 million and $4 million of Unallocated Corporate

expense related to the separation of AFI in the third quarter and

first nine months of 2016, respectively.

Americas

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Operating Income, Reported |

|

$ |

68 |

|

|

$ |

69 |

|

|

$ |

215 |

|

|

$ |

189 |

|

| Add: U.S. pension expense(1) |

|

|

14 |

|

|

|

3 |

|

|

|

2 |

|

|

|

9 |

|

| Operating Income, Adjusted |

|

$ |

82 |

|

|

$ |

72 |

|

|

$ |

217 |

|

|

$ |

198 |

|

| Less: D&A |

|

|

(14 |

) |

|

|

(13 |

) |

|

|

(41 |

) |

|

|

(40 |

) |

| Adjusted EBITDA |

|

$ |

96 |

|

|

$ |

85 |

|

|

$ |

258 |

|

|

$ |

238 |

|

(1) U.S. pension expense

represents the actuarial net periodic benefit cost expected to be

recorded as a component of operating income. For all periods

presented, we were not required and did not make cash contributions

to our U.S. Retirement Income Plan based on guidelines established

by the Pension Benefit Guaranty Corporation, nor do we expect to

make cash contributions to the plan in 2017.

EMEA

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Operating Income (Loss),

Reported |

|

$ |

4 |

|

|

$ |

4 |

|

|

$ |

(1 |

) |

|

$ |

(5 |

) |

| Add: Foreign exchange impact |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

| Operating Income (Loss),

Adjusted |

|

$ |

4 |

|

|

$ |

4 |

|

|

$ |

(1 |

) |

|

$ |

(6 |

) |

| Less: D&A |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

(12 |

) |

|

|

(12 |

) |

| Adjusted EBITDA |

|

$ |

8 |

|

|

$ |

8 |

|

|

$ |

11 |

|

|

$ |

6 |

|

Pacific Rim

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Operating (Loss) Income,

Reported |

|

$ |

(2 |

) |

|

|

1 |

|

|

$ |

(3 |

) |

|

$ |

(2 |

) |

| Add: China plant cost reduction initiatives |

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

|

|

3 |

|

| Add: Foreign exchange impact |

|

|

(1 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Operating (Loss) Income,

Adjusted |

|

$ |

(3 |

) |

|

$ |

1 |

|

|

$ |

(4 |

) |

|

$ |

1 |

|

| Less: D&A |

|

|

(6 |

) |

|

|

(2 |

) |

|

|

(9 |

) |

|

|

(6 |

) |

| Adjusted EBITDA |

|

$ |

3 |

|

|

$ |

3 |

|

|

$ |

5 |

|

|

$ |

7 |

|

Unallocated Corporate

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Operating (Loss), Reported |

|

$ |

- |

|

|

$ |

(3 |

) |

|

$ |

- |

|

|

$ |

(37 |

) |

| Add: Separation expenses |

|

|

- |

|

|

|

2 |

|

|

|

- |

|

|

|

33 |

|

| Operating (Loss), Adjusted |

|

$ |

- |

|

|

$ |

(1 |

) |

|

$ |

- |

|

|

$ |

(4 |

) |

| Less: D&A |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Adjusted EBITDA |

|

$ |

- |

|

|

$ |

(1 |

) |

|

$ |

- |

|

|

$ |

(4 |

) |

Adjusted Free Cash Flow

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Net cash provided by (used for)

operations |

|

$ |

63 |

|

|

$ |

52 |

|

|

$ |

105 |

|

|

$ |

(3 |

) |

| Less: net cash (used for) investing |

|

|

- |

|

|

|

(3 |

) |

|

|

(41 |

) |

|

|

(7 |

) |

| Adjustments to reconcile free cash flow: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Acquisitions |

|

|

- |

|

|

|

- |

|

|

|

31 |

|

|

|

- |

|

| Add: Separation payments |

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

51 |

|

| Add: Cash flows attributable to AFI |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

16 |

|

| Add: Interest rate swap settlement |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

11 |

|

| Add: Other |

|

|

(1 |

) |

|

|

2 |

|

|

|

- |

|

|

|

4 |

|

| Adjusted Free Cash Flow |

|

$ |

62 |

|

|

$ |

55 |

|

|

$ |

95 |

|

|

$ |

72 |

|

Consolidated Results From

Continuing Operations - Adjusted Diluted Earnings Per Share

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| |

|

Total |

|

|

Per Diluted

Share(3) |

|

|

Total |

|

|

Per Diluted

Share(3) |

|

|

Total |

|

|

Per Diluted

Share(3) |

|

|

Total |

|

|

Per Diluted

Share(3) |

|

| Earnings from continuing operations,

As Reported |

|

$ |

44 |

|

|

$ |

0.81 |

|

|

$ |

56 |

|

|

$ |

0.99 |

|

|

$ |

116 |

|

|

$ |

2.14 |

|

|

$ |

65 |

|

|

$ |

1.16 |

|

| Add: Income taxes, as reported |

|

|

17 |

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

71 |

|

|

|

|

|

|

|

45 |

|

|

|

|

|

| Earnings from continuing operations

before income taxes, As Reported |

|

$ |

61 |

|

|

|

|

|

|

$ |

64 |

|

|

|

|

|

|

$ |

187 |

|

|

|

|

|

|

$ |

110 |

|

|

|

|

|

| Add: U.S. pension expense(1) |

|

|

14 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

9 |

|

|

|

|

|

| Add: Separation costs |

|

|

- |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

33 |

|

|

|

|

|

| Add: China plant cost reduction initiatives |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

(1 |

) |

|

|

|

|

|

|

3 |

|

|

|

|

|

| Add: Settlement of interest rate swap(2) |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

11 |

|

|

|

|

|

| Add: Foreign exchange impact |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

| Adjusted earnings from continuing

operations before income taxes |

|

$ |

75 |

|

|

|

|

|

|

$ |

69 |

|

|

|

|

|

|

$ |

189 |

|

|

|

|

|

|

$ |

166 |

|

|

|

|

|

Add: Adjusted tax (expense)

@ 39% for 2017 and 2016 |

|

|

(29 |

) |

|

|

|

|

|

|

(27 |

) |

|

|

|

|

|

|

(74 |

) |

|

|

|

|

|

|

(64 |

) |

|

|

|

|

| Adjusted net income |

|

$ |

46 |

|

|

$ |

0.86 |

|

|

$ |

42 |

|

|

$ |

0.75 |

|

|

$ |

115 |

|

|

$ |

2.13 |

|

|

$ |

102 |

|

|

$ |

1.81 |

|

(1) U.S. pension expense

represents the actuarial net periodic benefit cost expected to be

recorded as a component of operating income. For all periods

presented, we were not required and did not make cash contributions

to our U.S. Retirement Income Plan based on guidelines established

by the Pension Benefit Guaranty Corporation, nor do we expect to

make cash contributions to the plan in 2017.

(2) Adjusted results exclude $10.7 million of interest expense

recorded in the first quarter of 2016 related to the settlement of

interest rate swaps incurred in connection with the Company's

refinancing of its credit facility. Cash payments for the

settlement of this swap occurred in the second quarter of

2016.

(3) Based on ~54 million diluted shares outstanding for the three

and nine month periods ended September 30, 2017 and ~56 million

diluted shares outstanding for the three and nine month periods

ended September 30, 2016.

Adjusted Net Sales

Guidance

| |

|

For the Year Ending December 31, 2017 |

|

| |

|

Low |

|

|

High |

|

| Reported net sales |

|

$ |

1,292 |

|

to |

$ |

1,327 |

|

| Add: Foreign exchange impact |

|

|

13 |

|

|

|

13 |

|

| Adjusted net sales |

|

$ |

1,305 |

|

to |

$ |

1,340 |

|

Updated Adjusted EBITDA

Guidance

| |

|

For the Year Ending December 31, 2017 |

|

| |

|

Low |

|

|

High |

|

| Net income |

|

$ |

166 |

|

to |

$ |

172 |

|

| Add: Interest expense |

|

|

35 |

|

|

|

35 |

|

| Less: Other non-operating (income) |

|

|

(3 |

) |

|

|

(3 |

) |

| Add: Income tax expense |

|

|

90 |

|

|

|

94 |

|

| Operating income |

|

$ |

288 |

|

to |

$ |

298 |

|

| Less: U.S. pension (credit)(1) |

|

|

(3 |

) |

|

|

(3 |

) |

| Add: D&A |

|

|

80 |

|

|

|

80 |

|

| Adjusted EBITDA |

|

$ |

365 |

|

to |

$ |

375 |

|

(1) U.S. pension (credit)

represents the actuarial net periodic benefit cost expected to be

recorded as a component of operating income. For all periods

presented, we were not required and did not make cash contributions

to our U.S. Retirement Income Plan based on guidelines established

by the Pension Benefit Guaranty Corporation, nor do we expect to

make cash contributions to the plan in 2017.

Updated Adjusted Diluted Earnings

Per Share (EPS) Guidance

| |

|

For the Year Ending December 31, 2017 |

|

| |

|

Low |

|

|

Per Diluted

Share(1) |

|

|

High |

|

|

Per Diluted

Share(1) |

|

| Net income |

|

$ |

166 |

|

|

$ |

3.07 |

|

to |

$ |

172 |

|

|

$ |

3.19 |

|

| Add: Interest expense |

|

|

35 |

|

|

|

|

|

|

|

35 |

|

|

|

|

|

| Less: Other non-operating (income) |

|

|

(3 |

) |

|

|

|

|

|

|

(3 |

) |

|

|

|

|

| Add: Income tax expense |

|

|

90 |

|

|

|

|

|

|

|

94 |

|

|

|

|

|

| Operating income |

|

$ |

288 |

|

|

|

|

|

to |

$ |

298 |

|

|

|

|

|

| Less: U.S. pension (credit)(2) |

|

|

(3 |

) |

|

|

|

|

|

|

(3 |

) |

|

|

|

|

| Less: Interest expense |

|

|

(35 |

) |

|

|

|

|

|

|

(35 |

) |

|

|

|

|

| Adjusted earnings before income

taxes |

|

$ |

250 |

|

|

|

|

|

to |

$ |

260 |

|

|

|

|

|

| Less: Income tax expense |

|

|

(99 |

) |

|

|

|

|

|

|

(103 |

) |

|

|

|

|

| Adjusted net income |

|

$ |

151 |

|

|

$ |

2.80 |

|

to |

$ |

157 |

|

|

$ |

2.91 |

|

(1) Adjusted EPS guidance for 2017

is calculated based on an adjusted effective tax rate of 39% and

based on ~54 million of diluted shares outstanding.

(2) U.S. pension (credit) represents the actuarial net periodic

benefit cost expected to be recorded as a component of operating

income. For all periods presented, we were not required and did not

make cash contributions to our U.S. Retirement Income Plan based on

guidelines established by the Pension Benefit Guaranty Corporation,

nor do we expect to make cash contributions to the plan in

2017.

Adjusted Free Cash Flow

Guidance

| |

|

For the Year Ending December 31, 2017 |

|

| |

|

Low |

|

|

High |

|

| Net cash provided by operating

activities |

|

$ |

165 |

|

to |

$ |

180 |

|

| Add: Return of investment from joint venture |

|

|

70 |

|

|

|

70 |

|

| Adjusted net cash provided by

operating activities |

|

$ |

235 |

|

to |

$ |

250 |

|

| Less: Capital expenditures |

|

|

(95 |

) |

|

|

(95 |

) |

| Adjusted Free Cash Flow |

|

$ |

140 |

|

to |

$ |

155 |

|

Source: Armstrong World Industries

AWI Reports Third Quarter Results -

FINAL

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Armstrong World Industries, Inc. via

Globenewswire

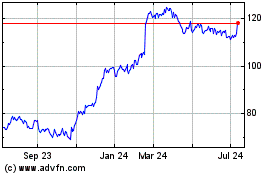

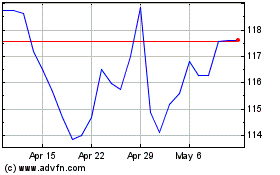

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Apr 2023 to Apr 2024