Ark Restaurants Corp. (NASDAQ:ARKR) today reported financial

results for the second quarter ended April 1, 2017.

Total revenues for the three-month period ended April 1, 2017

were $34,478,000 versus $34,272,000 for the three months ended

April 2, 2016. The three-month period ended April 1, 2017 includes

revenues of $2,832,000 related to the Oyster House properties in

Gulf Shores and Spanish Fort, AL which were acquired on November

30, 2016. The three-month period ended April 2, 2016 includes

revenues of $1,205,000 related to Sequoia DC which was closed for

renovation on January 1, 2017 and remained closed throughout the

quarter.

Total revenues for the six-month period ended April 1, 2017 were

$72,870,000 versus $71,264,000 for the six months ended April 2,

2016. Sequoia DC was opened for the first three months of the

six–month period and generated revenue of $1,989,000. During the

six–month period ended April 2, 2016 Sequoia generated revenue of

$3,292,000. The six-month period ended April 1, 2017 includes

revenues of $3,539,000 related to the Oyster House properties in

Gulf Sores and Spanish Fort, AL which were acquired on November 30,

2016. Also, during the same six-month period ended April 2, 2016

revenue included $931,000 related to two properties, the V-Bar in

Las Vegas and Center Café in Washington DC, that were closed during

the period due to lease expirations.

Company-wide same store sales decreased 3.0% for the three-month

period ended April 1, 2017 compared to the same three month period

last year.

Restaurant operating loss was ($415,000) for the three-month

period ended April 1, 2017 versus ($623,000) for the three months

ended April 2, 2016.

The Company’s EBITDA, adjusted for non-cash stock option expense

and non-controlling interests, for the three-month period ended

April 1, 2017 was $694,000 versus $589,000 during the same

three-month period last year. Net loss for the three-month period

ended April 1, 2017, after a tax benefit, was ($393,000), or

($0.11) per basic and diluted share compared to ($646,000) after a

tax benefit, or ($0.19) per basic share and diluted share, for the

same three-month period last year.

The Company’s EBITDA, adjusted for non-cash stock option expense

and non-controlling interests, for the six-month period ended April

1, 2017 was $4,794,000 versus $2,370,000 during the same six-month

period last year. Of the increase in EBITDA, adjusted for non-cash

stock option expense and non-controlling interests, $1,637,000

resulted from the recognition of a gain (discussed below) in

connection with the sale of the real estate underlying our Rustic

Inn, Jupiter, FL property. Without the gain related to the sale of

real estate, EBITDA as adjusted for non-cash stock option expense

and non-controlling interests would have been $3,157,000 for the

six-month period ended April 1, 2017.

Net income for the six-month period ended April 1, 2017 was

$1,341,000, or $0.39 per basic share , $0.38 per diluted share,

after taxes compared to a net loss of ($324,000), or ($0.09) per

basic share and diluted share, for the same six-month period last

year.

On November 18, 2016, Ark Jupiter RI, LLC a wholly-owned

subsidiary of the Company, entered into a Purchase Agreement for

$5,200,000 to purchase the land and building in which the Company

operates its Rustic Inn location in Jupiter, Florida. Concurrent

with the execution of the purchase, Ark Jupiter RI, LLC entered

into a Sale Agreement to sell this same property for $8,250,000. In

connection with the sale, Ark Jupiter continues to operate the

Rustic in under a temporary lease and 1065 A1A, LLC have entered

into a temporary lease which expires on July 18, 2017.

On November 30, 2016, the Company, through newly formed,

wholly-owned subsidiaries, acquired the assets of the Original

Oyster House, Inc., a restaurant and bar located in the City of

Gulf Shores, Baldwin County, Alabama and the related real estate

and an adjacent retail shopping plaza and the Original Oyster House

II, Inc., a restaurant and bar located in the City of Spanish Fort,

Baldwin County, Alabama and the related real estate. The total

purchase price was for $10,750,000 plus inventory. The acquisition

is accounted for as a business combination and was financed with a

bank loan from the Company’s existing lender in the amount of

$8,000,000 and cash from operations.

The Company is currently renovating its Sequoia restaurant in

Washington DC. The interior of the restaurant seats approximately

400 with a separate event space for an additional 180 people. The

interior will be operational the last week in May 2017. The

exterior space has a seating capacity for 550 patrons and will be

operational in early July of 2017. In addition, the Company is in

the early stages of adding capacity to its Rustic Inn Fort

Lauderdale property. The expansion of that property will not

interfere with ongoing operations and will be completed in late

spring or early summer of 2018. We have posted renderings of these

two projects that can be viewed

https://goo.gl/photos/xx45vRBJ4WvADJ8P8.

Ark Restaurants owns and operates 20 restaurants and bars, 19

fast food concepts and catering operations primarily in New York

City, Florida, Washington, D.C, Las Vegas, NV and the gulf coast of

Alabama. Five restaurants are located in New York City, two are

located in Washington, D.C., five are located in Las Vegas, Nevada,

three are located in Atlantic City, New Jersey, one is located in

Boston, Massachusetts, three are located in Florida and two are

located on the Gulf Coast of Alabama. The Las Vegas operations

include four restaurants within the New York-New York Hotel &

Casino Resort and operation of the hotel's room service, banquet

facilities, employee dining room and six food court concepts; and

one restaurant within the Planet Hollywood Resort and Casino. In

Atlantic City, New Jersey, the Company operates a restaurant and a

bar in the Resorts Atlantic City Hotel and Casino and a restaurant

in the Tropicana Hotel and Casino. The operations at the Foxwoods

Resort Casino consist of one fast food concept. In Boston,

Massachusetts, the Company operates a restaurant in the Faneuil

Hall Marketplace. The Florida operations include two Rustic Inn’s,

one in Dania Beach, Florida and one in Jupiter, Florida, a

restaurant, Shuckers, located in Jensen Beach and the operation of

five fast food facilities in Tampa, Florida and seven fast food

facilities in Hollywood, Florida, each at a Hard Rock Hotel and

Casino operated by the Seminole Indian Tribe at these locations. In

Alabama, the Company operates two Original Oyster Houses, one in

Gulf Shores, Alabama and one in Spanish Fort, Alabama.

Except for historical information, this news release contains

forward-looking statements, within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These statements involve unknown risks, and

uncertainties that may cause the Company's actual results or

outcomes to be materially different from those anticipated and

discussed herein. Important factors that might cause such

differences are discussed in the Company's filings with the

Securities and Exchange Commission. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Actual results could differ materially from those

anticipated in these forward-looking statements, if new information

becomes available in the future.

ARK RESTAURANTS CORP. Consolidated Statements of

Income For the 13 and 26-week periods ended April 1, 2017

and April 2, 2016 (In Thousands, Except per share

amounts) 13 weeks ended 13 weeks ended 26

weeks ended 26 weeks ended April 1, April 2, April 1, April

2,

2017 2016 2017

2016 TOTAL REVENUES

$

34,478 $ 34,272

$ 72,870 $

71,264 COST AND EXPENSES: Food

and beverage cost of sales 9,836 9,191 19,587 18,783 Payroll

expenses 12,670 12,895 25,626 26,088 Occupancy expenses 3,764 4,037

8,496 8,583 Other operating costs and expenses 5,126 4,924 9,992

9,486 General and administrative expenses 2,444 2,712 5,744 6,040

Depreciation and amortization

1,053

1,136 2,535

2,275 Total costs and expenses

34,893 34,895

71,980 71,255

RESTAURANT OPERATING INCOME (LOSS) (415 ) (623 ) 890 9

Gain on sale of Rustic Inn, Jupiter property

- -

1,637 -

OPERATING INCOME (LOSS)

(415 )

(623 ) 2,527

9 OTHER (INCOME) EXPENSE:

Interest (income) expense, net 161 98 165 177 Other (income)

expense, net

(162 )

(160 ) (189

) (222 ) Total other

income, net

(1 )

(62 ) (24

) (45 ) INCOME

(LOSS) BEFORE PROVISION (BENEFIT) FOR INCOME TAXES (414 ) (561 )

2,551 54 Provision (benefit) for income taxes

(127 ) (103

) 753

35 CONSOLIDATED NET INCOME (LOSS) (287 )

(458 ) 1,798 19 Net income attributable to non-controlling

interests

(106 )

(188 ) (457

) (343 ) NET

INCOME (LOSS) ATTRIBUTABLE TO ARK RESTAURANTS CORP.

$

(393 ) $ (646

) $ 1,341

$ (324 ) NET INCOME

(LOSS) PER ARK RESTAURANTS CORP. COMMON SHARE: Basic

$

(0.11 ) $ (0.19

) $ 0.39

$ (0.09 ) Diluted

$ (0.11 ) $

(0.19 ) $ 0.38

$ (0.09 )

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: Basic

3,424 3,418

3,423 3,418 Diluted

3,424 3,418

3,541 3,418

EBITDA Reconciliation: Restaurant operating income (loss) $

(415 ) $ (623 ) $ 890 $ 9 Other income (expense), net

1 62

24 45 Restaurant

income (loss) before provision (benefit) for income taxes (414 )

(561 ) 914 54 Gain on sale of Rustic Inn, Jupiter property

- -

1,637 - Pre tax

income (loss) (414 ) (561 ) 2,551 54 Depreciation and amortization

1,053 1,136 2,535 2,275 Interest expense, net

161 98

165 177 EBITDA (a)

$ 800 $

673 $ 5,251

$ 2,506 EBITDA adjusted for

non-cash stock option expense, and non-controlling interests:

EBITDA (as defined) (a) $ 800 $ 673 $ 5,251 $ 2,506 Net income

attributable to non-controlling interests (106 ) (188 ) (457 ) (343

) Non-cash stock option expense

-

104 -

207 EBITDA, as adjusted

$

694 $ 589

$ 4,794 $

2,370 (a) EBITDA is defined as

earnings before interest, taxes, depreciation and amortization and

cumulative effect of changes in accounting principle. Although

EBITDA is not a measure of performance or liquidity calculated in

accordance with generally accepted accounting principles (GAAP),

the Company believes the use of this non-GAAP financial measure

enhances an overall understanding of the Company's past financial

performance as well as providing useful information to the investor

because of its historical use by the Company as both a performance

measure and measure of liquidity, and the use of EBITDA by

virtually all companies in the restaurant sector as a measure of

both performance and liquidity. However, investors should not

consider this measure in isolation or as a substitute for net

income (loss), operating income (loss), cash flows from operating

activities or any other measure for determining the Company's

operating performance or liquidity that is calculated in accordance

with GAAP, it may not necessarily be comparable to similarly titled

measures employed by other companies. A reconciliation of EBITDA to

the most comparable GAAP financial measure, pre-tax income, is

included above.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170512005743/en/

Ark Restaurants Corp.Robert Stewart,

212-206-8800bstewart@arkrestaurants.com

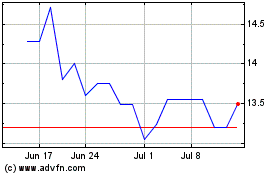

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Apr 2023 to Apr 2024