Ark Restaurants Corp. (NASDAQ:ARKR) today reported financial

results for the first quarter ended December 27, 2014.

Total revenues for the three-month period ended December 27,

2014 were $33,359,000 versus $32,138,000 for the three months ended

December 28, 2013. The three-month period ended December 27, 2014

includes revenues of $3,192,000 related to The Rustic Inn in Dania

Beach, Florida, which was acquired on February 24, 2014. The

three-month period ended December 28, 2013 includes revenues of

$1,564,000 related to four properties closed subsequent to the

three-month period ended December 28, 2013 due to lease

expirations.

Company-wide same store sales decreased 1.8% for the three-month

period ended December 27, 2014 compared to the same three month

period last year. This decrease resulted primarily from a decrease

in the usage of complimentaries by the ownership of the casinos at

our Florida properties.

The Company’s EBITDA, adjusted for non-cash stock option expense

and non-controlling interests, for the three-month period December

27, 2014 was $2,331,000 versus $2,201,000 during the same

three-month period last year. Net income for the three-month period

ended December 27, 2014 was $722,000, or $0.21, per basic and

diluted share as compared to $563,000, or $0.17 per basic and

diluted share, for the same three-month period last year. Included

in net income for the three-month period ended December 27, 2014

are pre-opening losses of $200,000 related to the new Rustic Inn in

Jupiter, Florida, which opened on January 26, 2015.

As of December 27, 2014 the Company had cash and cash

equivalents totaling $8,285,000. The Company has a bank note for

the purchase of membership interests in Ark Hollywood/Tampa

Investment, LLC and the purchase of The Rustic Inn in Dania Beach,

Florida with an outstanding balance of $6,872,000 at December 27,

2014.

Ark Restaurants owns and operates 21 restaurants and bars, 19

fast food concepts and catering operations primarily in New York

City, Florida, Washington, D.C. and Las Vegas, NV. Five restaurants

are located in New York City, three are located in Washington,

D.C., six are located in Las Vegas, Nevada, three are located in

Atlantic City, New Jersey, one is located at the Foxwoods Resort

Casino in Ledyard, Connecticut, one is located in Boston,

Massachusetts and one is located in Dania Beach, Florida. The Las

Vegas operations include four restaurants within the New York-New

York Hotel & Casino Resort and operation of the hotel's room

service, banquet facilities, employee dining room and six food

court concepts; one bar within the Venetian Casino Resort and one

restaurant within the Planet Hollywood Resort and Casino. In

Atlantic City, New Jersey, the Company operates a restaurant and a

bar in the Resorts Atlantic City Hotel and Casino and a restaurant

in the Tropicana Hotel and Casino. The operations at the Foxwoods

Resort Casino include one fast food concept and one restaurant. In

Boston, Massachusetts, the Company operates a restaurant in the

Faneuil Hall Marketplace. The Florida operations include two Rustic

Inn’s, one in Dania Beach, Florida and one in Jupiter, Florida and

the operation of five fast food facilities in Tampa, Florida and

seven fast food facilities in Hollywood, Florida, each at a Hard

Rock Hotel and Casino operated by the Seminole Indian Tribe at

these locations.

Except for historical information, this news release contains

forward-looking statements, within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These statements involve unknown risks, and

uncertainties that may cause the Company's actual results or

outcomes to be materially different from those anticipated and

discussed herein. Important factors that might cause such

differences are discussed in the Company's filings with the

Securities and Exchange Commission. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Actual results could differ materially from those

anticipated in these forward-looking statements, if new information

becomes available in the future.

ARK RESTAURANTS CORP.

Consolidated Statements of

Income For the 13 week periods ended December 27, 2014 and

December 28, 2013

(In Thousands,

Except per share amounts)

13 weeks ended 13 weeks ended December 27, December

28,

2014

2013

TOTAL REVENUES

$ 33,359

$ 32,138 COST AND EXPENSES:

Food and beverage cost of sales 8,747 7,854 Payroll expenses

10,855 10,478 Occupancy expenses 4,193 4,401 Other operating costs

and expenses 4,240 4,207 General and administrative expenses 3,000

2,850 Depreciation and amortization

1,105

1,147 Total costs and

expenses

32,140

30,937 OPERATING INCOME

1,219 1,201

OTHER (INCOME) EXPENSE: Interest (income) expense, net 57 12

Other (income) expense, net

(57 )

(66 ) Total other income, net

- (54 )

INCOME BEFORE PROVISION FOR INCOME TAXES 1,219 1,255

Provision for income taxes

342

399 CONSOLIDATED NET INCOME 877 856

Net income attributable to non-controlling interests

(155 ) (293

) NET INCOME ATTRIBUTABLE TO ARK RESTAURANTS

CORP.

$ 722 $

563 NET INCOME PER ARK RESTAURANTS CORP.

COMMON SHARE: Basic

$ 0.21

$ 0.17 Diluted

$

0.21 $ 0.17

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: Basic

3,378 3,256

Diluted

3,481 3,400

EBITDA Reconciliation: Pre tax income $ 1,219 $ 1,255

Depreciation and amortization 1,105 1,147 Interest expense, net

57 12 EBITDA

(a)

$ 2,381 $

2,414 EBITDA adjusted for non-cash stock

option expense, and non-controlling interests: EBITDA (as defined)

(a) $ 2,381 $ 2,414 Net income attributable to non-controlling

interests (155 ) (293 ) Non-cash stock option expense

105 80 EBITDA, as

adjusted

$ 2,331 $

2,201

(a)

EBITDA is defined as earnings before

interest, taxes, depreciation and amortization and cumulative

effect of changes in accounting principle. Although EBITDA is not a

measure of performance or liquidity calculated in accordance with

generally accepted accounting principles (GAAP), the Company

believes the use of this non-GAAP financial measure enhances an

overall understanding of the Company's past financial performance

as well as providing useful information to the investor because of

its historical use by the Company as both a performance measure and

measure of liquidity, and the use of EBITDA by virtually all

companies in the restaurant sector as a measure of both performance

and liquidity. However, investors should not consider this measure

in isolation or as a substitute for net income (loss), operating

income (loss), cash flows from operating activities or any other

measure for determining the Company's operating performance or

liquidity that is calculated in accordance with GAAP, it may not

necessarily be comparable to similarly titled measures employed by

other companies. A reconciliation of EBITDA to the most comparable

GAAP financial measure, pre-tax income, is included above.

Ark Restaurants Corp.Robert Stewart, (212)

206-8800bstewart@arkrestaurants.com

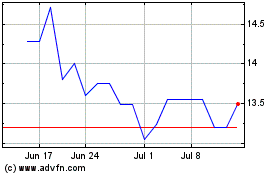

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Apr 2023 to Apr 2024