Ariana Resources PLC Ariana Resources Plc : Positive Drilling Results From Arzu Central

October 12 2016 - 2:00AM

UK Regulatory

TIDMAAU

12 October 2016

AIM: AAU

POSITIVE DRILLING RESULTS FROM ARZU CENTRAL

Ariana Resources plc ("Ariana" or "the Company"), the gold exploration

and development company operating in Turkey, is pleased to announce

further results for its Phase One drilling programme of 2016, completed

during early September at the Kiziltepe Project. The results reported

here relate to drilling within the Arzu Central target area at

Kiziltepe. Kiziltepe is part of the Red Rabbit Joint Venture with

Proccea Construction Co. and will be 50% owned by Ariana once mine

construction is completed in Q416.

Highlights:

-- Drilling intercepts the widest zone of sulphidic quartz vein

mineralisation ever encountered on the Kiziltepe Project, with at least

20m of true width, ending in mineralised quartz.

-- Best intercepts overall include 10m @ 2.4g/t gold + 28.3g/t silver, 15m @

1.5g/t gold + 16.4g/t silver, 6m @ 2.3g/t gold + 55.2g/t silver and 5m @

1.2g/t gold + 34.5g/t silver.

-- 1,086m of Reverse Circulation ("RC") drilling for six initial holes was

completed in Arzu Central, in order to improve understanding of the

geometry of the mineralisation ahead of Phase Two drilling.

-- New mineralisation identified in the footwall of the Arzu North vein

system, which appears to extend beneath the cap rock sequence and remains

otherwise untested.

-- Preparations for Phase Two of the 2016 drilling programme are complete,

with at least 3,500m currently planned.

Dr. Kerim Sener, Managing Director, commented:

"We are exceptionally pleased with these drilling results, as they

collectively and unequivocally demonstrate the continuity of

mineralisation within the Arzu Central target area. The results confirm

that the mineralised structure remains consistent for at least a further

200m beyond the northern end of the current Arzu South pit and, most

significantly, that the vein system appears to be increasing in width.

Meanwhile, zones of stockwork mineralisation and alteration have been

identified in three further holes along strike, which potentially

narrowly missed the vein due to targeting that was based on the original

model. We now know that the vein is likely to be positioned 10-20

metres to the south of the original target.

Following a revision of our drill targeting based on these results, we

are now well-positioned to execute Phase Two of our drilling programme

in late October for at least 3,500m. There is clearly potential for us

to start the work on converting the Exploration Target established for

Arzu Central in to a JORC Inferred resource with substantial new

drilling, some of which will be completed as part of the current

programme."

Drilling Programme

Final results have now been received for the drilling completed within

the Arzu Central target area as part of Phase One of the 2016 drilling

programme. These results include the assay data for six initial holes

drilled into the Arzu Central (or Gap Zone) target. A total of 3,002m

of Reverse Circulation ("RC") drilling has now been completed as part of

Phase One, with 1,086m located in the Arzu Central area. A further

3,500 meters of RC drilling has been planned for Phase Two of the 2016

programme, scheduled to start in late October.

Drilling in the Arzu Central area during the 2016 campaign required a

two-phase approach. Before a full exploration drilling programme could

be designed to extensively test the potential for significant

mineralisation within Arzu Central, the geological team planned several

"pilot" holes to generate detailed information on: 1) the geometry of

non-outcropping mineralisation along the NW end of Arzu South and; 2)

the morphology of the overlying pumice ignimbrite cap rock, which

obscures any surface indications of mineralisation across Arzu Central.

The results received for Phase One drilling at Arzu Central has

indicated that the orientation of mineralisation between Arzu South and

Arzu North is orientated at 315 degrees, differing by approximately 7

degrees from the previous interpretation (322 degrees). This was

identified by the drilling of two holes (KTP-RC19-16 and KTP-RC21-16),

which were positioned to target mineralisation from the northern most

extents of known vein intercepts at the NW end of Arzu South. Both holes

intercepted significant and wide mineralised quartz and stockwork zones,

with best results returning 10m @ 2.4g/t Au + 28.3g/t Ag, 6m @ 2.3g/t Au

+ 55.2g/t Ag and 5m @ 1.2g/t Au + 34.5g/t Ag. The latter two intercepts

were identified within a 50m (downhole) quartz vein and sulphidic

stockwork zone ending in mineralisation, which due to the oblique nature

of drilling in to this target, is estimated to be at least 20m wide

(true width). This is the widest continuous zone of mineralisation ever

encountered at Kiziltepe and is highly significant to future

exploration.

A further four holes were drilled directly into the original Arzu

Central target. Two were situated on the Arzu South side of Arzu Central,

and the remaining two were drilled on the Arzu North side of Arzu

Central. Three of these holes (KTP-RC09-16, KTP-RC10-16 and KTP-RC11-16),

were positioned to test the original Arzu Central target which was

developed by extrapolating the structure between Arzu South and Arzu

North (Figure 1). Instead, these holes confirmed the presence of a

greater thickness of pumice ignimbrite cap rock than originally modelled

(by up to 40m). Also towards the north-east the cap rock unit dips at

30 degrees to the north, which is significantly steeper than expected.

Some stock-work and narrow vein mineralisation, typical of that seen in

the Arzu North footwall, was intercepted towards the end of hole

KTP-RC11-16, suggesting that it may have just missed the main structure.

Meanwhile KTP-RC25-16 intercepted significant mineralisation in the

immediate footwall of Arzu North, for 15m @ 1.5g/t Au + 16.4g/t Ag,

indicating that a completely untested additional vein is located in this

position. Importantly, this hole identified the potential for other

mineralised structures occurring between Arzu North and Derya.

From this initial round of drilling, it is clear that significant

mineralisation occurs within the Arzu Central target zone (Figure 1 and

2). Importantly, this mineralisation trends in a manner different to

that originally modelled and so planned holes for Phase Two of the 2016

programme have been reviewed and revised in the light of the new data.

Table 1: Significant RC drilling results from the 2016 programme,

arranged in order of the gram x metre intercepts (down-hole gold

equivalent grade multiplied by intercept thickness). The intercepts

reported in this table are the down-hole lengths. Intercept grades have

been calculated using a 0.5 g/t Au minimum cut-off with up to 2m

internal waste allowed.

Grade Au

Interval Grade Au Grade Ag Equiv.

Hole ID From (m) To (m) (m) (g/t) (g/t) (g/t)

KTP-RC21-16 72 82 10 2.4 28.3 2.9

KTP-RC25-16 12 27 15 1.5 16.4 1.7

KTP-RC19-16 125 131 6 2.3 55.2 3.2

KTP-RC19-16 154 159 5 1.2 34.5 1.7

KTP-RC11-16 114 117 3 0.8 15.0 1.0

FIGURE 1 IS ATTACHED http://hugin.info/138153/R/2048379/765861.pdf

Figure 1 shows a three dimensional image looking down on the Arzu

Central area, showing the current Whittle pit shells. The positions of

all new and historic drill holes are shown, with drill traces and

intercept locations. Several new holes were located to intercept the

mineralisation beneath the pumice ignimbrite cap rock sequence and are

representative of part of the Arzu Central target area. Several new

vein trends were identified and these will be tested as part of the

Phase Two programme.

FIGURE 2 IS ATTACHED http://hugin.info/138153/R/2048379/765862.pdf

Figure 2 shows a long-section through the Arzu structure showing the

position of new drilling. The contours show the gram x metre

intercepts. The approximate outlines of the open-pits at Arzu South and

North are also shown and these give an indication of the limits of

previous resource modelling. The continued identification of

mineralisation beyond these areas in to Arzu Central is encouraging and

provides further resource upside. Note that the upper ignimbrite is not

flat-lying and that it thickens towards the centre of the Arzu Central

target.

Sampling and Assaying Procedures

269 samples were selected based on geological logging of RC chips during

drilling and sent for assay. All samples from the drilling programme

undertaken by Ariana Resources plc, were prepared and assayed by 30g

fire assay, and ICP-MS multi-element analysis, at the ALS Global

laboratory in Izmir. Routine re-assaying of all samples assaying

greater than 10 g/t of gold and 100 g/t of silver has also been

completed by ALS Global. Standard, blank and duplicate samples are

being used in the sample batches, which is in line with the Company's

quality control procedures. Laboratory sample preparation, assaying

procedures and chain of custody are appropriately controlled. The

Company maintains an archive of reference RC chip samples, in addition

to all sample pulps and splits.

This announcement contains inside information for the purposes of

Article 7 of EU Regulation 596/2014.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628 3396

Roland Cornish / Felicity Geidt

Beaufort Securities Limited Tel: +44 (0) 20 7382 8300

Jon Belliss

Panmure Gordon (UK) Limited Tel: +44 (0) 20 7886 2500

Adam James / Tom Salvesen

Editor's Notes:

Dr Kerim Sener, BSc (Hons), MSc, PhD, is the Managing Director of Ariana

Resources plc. A graduate of the University of Southampton in Geology,

he also holds a Master's degree from the Royal School of Mines (Imperial

College, London) in Mineral Exploration and a doctorate from the

University of Western Australia. He is a Fellow of The Geological

Society of London and has worked in geological research and mineral

consultancy in Africa, Australia and Europe. He has read and approved

the technical disclosure in this regulatory announcement.

About Ariana Resources:

Ariana is an exploration and development company focused on epithermal

gold-silver and porphyry copper-gold deposits in Turkey. The Company is

developing a portfolio of prospective licences selected on the basis of

its in-house geological and remote-sensing database, on its own in

western Turkey and in Joint Venture with Eldorado Gold Corporation in

north-eastern Turkey. Eldorado owns 51% of this joint venture and are

fully funding all exploration work on the JV properties, while Ariana

owns 49%. The total resource inventory within this JV is 1.09 million

ounces of gold.

The Company's flagship assets are its Kiziltepe and Tavsan gold projects

which form the Red Rabbit Gold Project. Both contain a series of

prospects, within two prolific mineralised districts in the Western

Anatolian Volcanic and Extensional (WAVE) Province in western Turkey.

This Province hosts the largest operating gold mines in Turkey and

remains highly prospective for new porphyry and epithermal deposits.

These core projects, which are separated by a distance of 75km, are

presently being assessed as to their economic merits and now form part

of a Joint Venture with Proccea Construction Co. The total resource

inventory at the Red Rabbit Project stands at c. 525,000 ounces of gold

equivalent.

Beaufort Securities Limited and Panmure Gordon (UK) Limited are joint

brokers to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana you are invited to visit the Company's

website at www.arianaresources.com.

Glossary of Technical Terms:

"Ag" Silver

"Au" Gold

"g/t" grams per tonne

"m" Metres

"oz" Ounces

Ends

FIGURE 1: http://hugin.info/138153/R/2048379/765861.pdf

FIGURE 2: http://hugin.info/138153/R/2048379/765862.pdf

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Ariana Resources plc via Globenewswire

http://www.arianaresources.com/s/Home.asp

(END) Dow Jones Newswires

October 12, 2016 02:00 ET (06:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

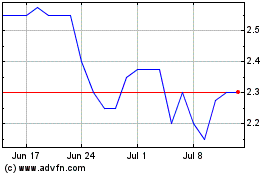

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024