Ariana Resources PLC Ariana Resources Plc : Kiziltepe Quarterly Operational Update

July 31 2017 - 2:00AM

UK Regulatory

TIDMAAU

31 July 2017

AIM: AAU

KIZILTEPE QUARTERLY OPERATIONAL UPDATE

Ariana Resources plc ("Ariana" or "the Company"), the exploration and

development company operating in Turkey, is pleased to announce its

results for the ramp-up period ended 30 June 2017 and to provide the

following operational update for July 2017 from the Kiziltepe Mine

("Kiziltepe" or "the Project"). Kiziltepe is part of the Red Rabbit

Joint Venture with Proccea Construction Co. and is 50% owned by Ariana.

Operational Highlights:

-- Production of c.1,370 oz gold and c.6,780 oz silver during July 2017 has

exceeded forecast, with total production since start-up of c.3,300 oz

gold and c.21,300 oz silver.

-- Operation has successfully transitioned in to commercial production

during July, as expected (see announcement dated 30 June 2017).

-- Gold and silver production during ramp-up period (ending 30 June 2017)

totalled 1,929 oz and 14,519 oz respectively.

-- Processing plant operating to design specifications, with mill

availability increasing to c.97% and utilisation increasing to c.96% by

June.

-- Process recoveries of gold and silver remain significantly higher than

expected; average recoveries were 94% for gold and 79% for silver, while

feasibility expectations were 86% and 64% respectively.

-- 38,886 tonnes ore milled during the period ending 30 June 2017, with May

and June tonnage exceeding feasibility expectations.

Current Developments:

-- Grade of ore mined in July is c.4g/t Au and c.40 g/t Ag which is higher

than forecast; grades expected to be maintained at this level over the

next 6 months.

-- Production of ore from the open-pit is being increased to 17,000 tonnes

per month, with a further increase to 22,000 tonnes per month planned by

late summer.

-- Doré pour of c.450 oz gold and c.2,000 oz silver expected today

(included in July figure quoted above and Table 1 below); gold and silver

in circuit after this pour is estimated to be 300 oz and 3,000 oz

respectively.

-- Loan repayments to Turkiye Katilim Finans Bankasi A.S. have been made on

their scheduled basis and have amounted to over US$4.2 million as at the

end of July 2017.

-- Calendar year 2017 production guidance lies within a range 10,100 to

11,900 oz gold and 103,500 to 106,500 oz silver.

Dr. Kerim Sener, Managing Director, commented:

"We are very pleased to provide our first quarterly operational update

for the Kiziltepe Mine, encompassing the period of ramp-up from

mid-March through to the end of June 2017. We remain very encouraged by

the performance of all aspects of the operation, especially during July

when doré output considerably exceeded forecast. Following

sustained high-rate mill throughput, we have now achieved a production

rate above our feasibility plan and the transition in to commercial

production is complete.

Our confidence in the ability for the operation to increase output,

particularly during the dry summer months is significantly improved.

Ore movement from the pit will be increased to 22,000 tonnes per month,

which will represent an increase of over 75% above the feasibility plan.

We are also continuing to consider strategies to increase mill

throughput which may enable production to be eventually increased to

c.200,000 tonnes of ore per annum, representing an increase of one third

over the feasibility plan. Notably these strategies will not involve

any significant additional capital expenditure and relate to alternative

crusher scheduling, screening and milling approaches."

Table 1: Production statistics for the period reported, mid-March to

end-June 2017 and production to date up to the end of July 2017.

End-July production includes a doré pour, occurring on the 31 July

2017, which will yield c.450 oz gold and c.2,000 oz silver.

2017 Production to Date

Measure Unit Q2 2017 March to End-July

Gold produced Troy Ounces 1,929 c.3,300

Gold sold Troy Ounces 1,929 2,861

Silver produced Troy Ounces 14,519 c.21,300

Silver sold Troy Ounces 14,519 19,372

Cash cost of production US$/oz n/a(*) n/a(*)

Average realised gold price US$/oz 1,258.20 1,247.75

Average realised silver price US$/oz 17.40 17.04

(*) Cash costs are not provided for the purposes of this report due to

the operation having been in ramp-up. Costs incurred during the period

are not reflective of estimated operating costs over the longer term.

Summary of Project

The Kiziltepe operation is currently expected to deliver approximately

20,000 oz gold equivalent per annum over eight years of initial mine

life, for a total of up to 160,000 oz gold equivalent based on current

resources. The operating company, Zenit Madencilik San. ve Tic. A.S.

(50:50 JV between Ariana and Proccea) will continue to make repayments

against its loan from Turkiye Finans Katilim Bankasi A.S. based on a

pre-determined schedule. Major loan repayments will have been completed

by April 2020 and, during this time, excess cash-flow from the operation

will be used to make repayments of loans provided by Ariana and Proccea

jointly to the JV for exploration and development respectively. After

the repayment of all loans, profits from the operation will be shared on

a 51:49 basis between Ariana and Proccea respectively.

Ramp-up to full production capacity at Kiziltepe has been concluded and

formal quarterly production reporting is commencing. The Company has

also completed a new resource estimate for the project based on recent

drilling and geological interpretation. Detailed technical and economic

assessments will be completed on several satellite vein systems which

are not currently in the mining plan, in anticipation of these being

developed in future years. The Company is currently targeting a minimum

ten-year mine life, which will require the addition of a further 40,000

oz gold equivalent in reserves outside of the four main veins (Arzu

South, Arzu North, Banu and Derya) that are currently scheduled to be

mined.

This announcement contains inside information for the purposes of

Article 7 of EU Regulation 596/2014.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628 3396

Roland Cornish / Felicity Geidt

Beaufort Securities Limited Tel: +44 (0) 20 7382 8300

Jon Belliss

Panmure Gordon (UK) Limited Tel: +44 (0) 20 7886 2500

Adam James / Tom Salvesen

Editors' Note

About Ariana Resources:

Ariana is an exploration and development company focused on epithermal

gold-silver and porphyry copper-gold deposits in Turkey. The Company is

developing a portfolio of prospective licences originally selected on

the basis of its in-house geological and remote-sensing database.

The Company's flagship assets are its Kiziltepe and Tavsan gold projects

which form the Red Rabbit Gold Project. Both contain a series of

prospects, within two prolific mineralised districts in the Western

Anatolian Volcanic and Extensional (WAVE) Province in western Turkey.

This Province hosts the largest operating gold mines in Turkey and

remains highly prospective for new porphyry and epithermal deposits.

These core projects, which are separated by a distance of 75km, form

part of a 50:50 Joint Venture with Proccea Construction Co. The

Kiziltepe Sector of the Red Rabbit Project is fully-permitted and is

currently in production. The total resource inventory at the Red Rabbit

Project and wider project area stands at c. 605,000 ounces of gold

equivalent. At Kiziltepe a Net Smelter Return ("NSR") royalty of up to

2.5% on production is payable to Franco-Nevada Corporation. At Tavsan

an NSR royalty of up to 2% on future production is payable to Sandstorm

Gold.

In north-eastern Turkey, Ariana owns 100% of the Salinbas Gold Project,

comprising the Salinbas gold-silver deposit and the Ardala

copper-gold-molybdenum porphyry among other prospects. The total

resource inventory of the Salinbas project area is c. 1 million ounces

of gold equivalent. A NSR royalty of up to 2% on future production is

payable to Eldorado Gold Corporation.

Beaufort Securities Limited and Panmure Gordon (UK) Limited are joint

brokers to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana you are invited to visit the Company's

website at www.arianaresources.com.

Glossary of Technical Terms:

"doré" semi-pure alloy of gold and silver;

"g/t" grams per tonne;

"kg" Kilograms;

"oz" Ounces;

"tpa" tonnes per annum;

"tpm" tonnes per month.

Ends

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Ariana Resources plc via Globenewswire

http://www.arianaresources.com/s/Home.asp

(END) Dow Jones Newswires

July 31, 2017 02:00 ET (06:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

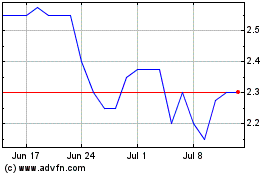

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024