TIDMAAU

25 April 2016

AIM: AAU

SUBSTANTIAL INCREASE IN KIZILTEPE RESOURCE

Ariana Resources plc ("Ariana" or "the Company"), is pleased to announce

an increase and update of its JORC compliant Mineral Resource estimate

for the Kiziltepe Project following its recent drilling programme in

Turkey. Kiziltepe is part of the Red Rabbit Joint Venture with Proccea

Construction Co. and will be 50% owned by Ariana once mine construction

is completed in H2 2016.

Highlights:

-- Overall increase in Mineral Resource estimate of c. 44,500 oz Au and

886,000 oz Ag to a total of 195,200 oz Au and 3.15Moz Ag contained metal

on four main veins, excluding existing resources on several subsidiary

veins such as Kepez.*

-- Substantial increase in tonnage (to c. 2.5Mt) with a corresponding

reduction of grade (to c. 2.5 g/t Au and 40.3 g/t Ag) as a result of

adoption of revised geological model.

-- Large increase (approx. 45%) in volume of new Whittle-generated pit

shells in comparison to designed pits, notably Arzu North and Derya.

-- Whittle base case optimisation demonstrates a potential increase in mine

life from c. 8 years to c. 10 years at a designed throughput rate of

150,000 tonnes per annum.

Dr. Kerim Sener, Managing Director, commented:

"Following the completion of an extensive review of our geological model

and the addition of new drilling data, this result is a very pleasing

update on our resource estimate for the Kiziltepe Mine. Importantly,

the discovery cost of these additional ounces is approximately US$5 per

ounce, which demonstrates the very cost-efficient exploration we are

able to conduct on this project.

The resource update, in addition to Whittle optimisation work,

demonstrates the potential for Kiziltepe to provide for a mine life of

about 10 years at the designed throughput rate of 150,000 tonnes per

annum. This also excludes several subsidiary veins on which we have

already established resources, which with further work may add further

to mine life.

With the enlarged resource and with expectations of further resource

growth, we are now reviewing our options to potentially increase the

mine throughput rate up to 200,000 tonnes per annum with our partners,

Proccea. Meanwhile, construction at the mine is proceeding well, with

delivery of the ball-mill to site occurring a few days ago."

* All Mineral Resource figures in the announcement are quoted gross with

respect to the Red Rabbit Joint Venture. Ariana will own 50% of the

production from the JV when the Kiziltepe Mine is operational.

Resource Estimate

Following the completion of a 1,208m Reverse Circulation ("RC") drilling

programme in December 2015 (see 31 January 2016 Announcement),

geological consultants Odessa Resources Pty. Ltd. undertook a resource

estimate for Kiziltepe. The recent RC drilling coupled with certain

diamond drilling completed in late 2011 and early 2012, totalling 1,290m,

was used in the new estimation.

The new Kiziltepe JORC 2012 compliant Mineral Resource estimate has been

defined by 213 drill holes and 125 rock-saw channels on 212

cross-sections with typically 10m section spacing (see JORC Table 1

below). Wireframes were constructed using sectional polylines defined

by a cut-off of 0.5 g/t gold. Several lodes were created from the

sectional interpretations, which are orientated NW and WNW and typically

dip steeply at up to 85 degrees towards the northeast (Figure 1)

comprising four main areas, Arzu South, Arzu North, Banu and Derya. Top

cuts of 15 g/t Au and 200 g/t Ag were used and a variable bulk density

ranging between 2.50 and 2.65 g/cm(3) were assigned to the appropriate

solids and used for the resource estimation. Grade interpolation was by

the Inverse Distance Squared ("ID2") method.

The previous estimate, completed in 2013 by Tetra Tech, identified a

JORC 2004 compliant Mineral Resource of 1,502,000 tonnes at 3.12g/t gold

and 46.97g/t silver on four main veins (excluding separate estimates on

subsidiary veins and alteration halo mineralisation), based on drilling

completed until 2011. The addition of 16 diamond holes and 19 RC holes

undertaken for infill and extension drilling at Kiziltepe completed

since late 2011, in addition to corresponding modifications of the

geological model, has increased the Mineral Resource on these four main

veins to 2,436,315 tonnes at 2.49g/t gold + 40.27g/t silver and has

confirmed the potential extension of the Arzu structure under cover

between Arzu South and Arzu North. This estimate specifically excludes

several subsidiary veins on which Inferred resources have previously

been established (for an additional 18,555 oz Au equivalent), such as

Kepez, Derya West, Aybor, Ceylan and Arzu Far North, in addition to a

potential 28,230 oz Au equivalent, referred to as "Alteration Halo" in

the Tetra Tech estimate. Further drilling, modelling and economic

assessments will be required on these subsidiary veins and alteration

halo mineralisation to determine their potential to be included as Ore

Reserves.

Table 1: Summary 2016 Kiziltepe JORC 2012 compliant Mineral Resource

estimate, based on 125 diamond and 76 RC drill holes. This estimate

excludes several subsidiary veins such as Kepez, which were a part of

the previous resource estimate. Gold equivalent is the sum of the gold

ounces and the gold equivalent ounces of silver based on a price ratio

of 60:1. Reporting at a 1/g/t Au cut off, excluding Banu which is

included in these figures at a 0.5 g/t Au cut-off. All figures are

quoted gross with respect to the Red Rabbit Joint Venture.

Tonnage Grade Au Grade Ag Au equiv.

Classification (t) (g/t) (g/t) Au (oz) Ag (oz) (oz)

MEASURED 1,051,491 3.19 43.7 108,009 1,476,700 132,621

INDICATED 512,422 2.16 40.6 35,650 668,490 46,792

INFERRED 872,402 1.84 36.0 51,545 1,008,906 68,360

GLOBAL 2,436,315 2.49 40.3 195,205 3,154,096 247,773

Figure 1, which can be accessed by clicking on or pasting the following

link into your web browser:

http://hugin.info/138153/R/2006265/741269.pdf, is the three-dimensional

model of the Kiziltepe vein system (in yellow) looking north, showing

the modelled ore zones and current drilling. The Arzu Central target

area is shown in grey.

Whittle Optimisation

Whittle Pit Optimisation Software was used by Auralia Mining Consulting

Pty. Ltd. to define pit shells on all-materials that contained grade

within the resource block model. The optimisation work generated four

pit shells at Arzu South, Arzu North, Banu and Derya respectively

(Figure 2: http://hugin.info/138153/R/2006265/741270.pdf ). The Whittle

base case optimisation work was run using the parameters provided in

Table 2. The Arzu South pit shell is the largest with dimensions of 860

x 145 x 90m, followed by the Arzu North (530 x 175 x 85m), Derya (545 x

150 x 80m) and Banu (485 x 90 x 50m) pit shells. The output of the

Whittle optimisations is provided in Table 3. It is important to note

that actual pit designs may vary from these optimised pit shells based

on a variety of modifying factors that will result from an increase in

the accuracy and definition of future work, notably additional

confirmatory and grade control drilling, geotechnical analysis and mine

planning. The bulk of the Mineral Resource sits within these four pit

shells and therefore has a high probability of being converted into Ore

Reserve classification once these modifying factors are fully taken in

to account.

Figure 2, which can be accessed by clicking on or pasting the following

link into your web browser:

http://hugin.info/138153/R/2006265/741270.pdf, is the three-dimensional

model of the four main veins on Kiziltepe comprising the current

resource estimate, showing new Whittle optimised base case pit shells

(in red), the designed pits from the Definitive Feasibility Study (in

light blue) and the new vein model (in yellow).

Table 2: Whittle optimisation parameters used for the Kiziltepe base

case. Cut-off grades were calculated as per the formula: ECOG = (Mining

Dilution x Processing Cost)/Processing Recovery x (Sell Price - Sell

Costs). Note that a gold equivalent cut-off grade was not implemented

in the base case Whittle optimisations.

Whittle Input Parameter Value Unit

Overall Pit Slope 50 Degrees

Mining Cost (ore and Waste) 1 US$/t

Mining Dilution 10%

Mining Recovery 95%

Processing Cost 23 US$/t

Processing Recovery (Au) 87%

Processing Recovery (Ag) 64%

Discount Rate 8%

G&A Cost (haulage at $8.40/t plus G&A at $1.60/t) 11 US$/t

Metal Price Gold 1,060 US$/oz

Metal Price Silver 15 US$/oz

Total Selling Cost Au (NSR 2%) 34.84 US$/oz

Total Selling Cost Ag (NSR 2%) 0.69 US$/oz

The Whittle base case optimisations were conducted on the basis that all

JORC classified material, including Inferred and Unclassified, was

included to be considered for processing.

Table 3: Output of Whittle base case optimisation, showing key

parameters. Numbers are rounded to one decimal place.

Ore t input to mill 1,520,000

Au grade input to mill 2.8 g/t

Ag grade input to mill 38.8 g/t

Waste t 21.8 Mt

Strip Ratio 14.3

(MORE TO FOLLOW) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

Mine life @150ktpa mill throughput 10.2 years

Product Au 119,000 oz

Product Ag 1,214,000 oz

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628 3396

Roland Cornish / Felicity Geidt

Beaufort Securities Limited Tel: +44 (0) 20 7382 8300

Jon Belliss

Loeb Aron & Company Ltd. Tel: +44 (0) 20 7628 1128

John Beresford-Peirse

Editor's Notes

Competent Person:

The information in this report that relates to Mineral Resources is

based on information compiled by Mr. Alfred Gillman of Odessa Resources

Pty. Ltd., who is a fellow of the Australasian Institute of Mining and

Metallurgy. Mr. Gillman is a consultant to Ariana Resources plc and has

sufficient experience relevant to the styles of mineralisation and type

of deposit under consideration and to the subject matter of the report

to qualify as Competent Person and defined in the 2012 edition of the

Australasian Code for the Reporting of Exploration Results Mineral

Resources and Ore Reserves (JORC Code). Mr. Gillman consents to the

inclusion in the report of the matters based on his information in the

form and context in which it appears.

Dr Kerim Sener, BSc (Hons), MSc, PhD, is the Managing Director of Ariana

Resources plc. A graduate of the University of Southampton in Geology,

he also holds a Master's degree from the Royal School of Mines (Imperial

College, London) in Mineral Exploration and a doctorate from the

University of Western Australia. He is a Fellow of The Geological

Society of London and has worked in geological research and mineral

consultancy in Africa, Australia and Europe. He has read and approved

the technical disclosure in this regulatory announcement.

About Ariana Resources:

Ariana is an exploration and development company focused on epithermal

gold-silver and porphyry copper-gold deposits in Turkey. The Company is

developing a portfolio of prospective licences selected on the basis of

its in-house geological and remote-sensing database, on its own in

western Turkey and in Joint Venture with Eldorado Gold Corporation in

north-eastern Turkey. Eldorado owns 51% of this joint venture and are

fully funding all exploration work on the JV properties, while Ariana

owns 49%. The total resource inventory within this JV is 1.09 million

ounces of gold.

The Company's flagship assets are its Kiziltepe and Tavsan gold projects

which form the Red Rabbit Gold Project. Both contain a series of

prospects, within two prolific mineralised districts in the Western

Anatolian Volcanic and Extensional (WAVE) Province in western Turkey.

This Province hosts the largest operating gold mines in Turkey and

remains highly prospective for new porphyry and epithermal deposits.

These core projects, which are separated by a distance of 75km, are

presently being assessed as to their economic merits and now form part

of a Joint Venture with Proccea Construction Co. The total resource

inventory at the Red Rabbit Project stands at 475,000 ounces of gold

equivalent.

Beaufort Securities Limited and Loeb Aron & Company Ltd. are joint

brokers to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana you are invited to visit the Company's

website at www.arianaresources.com.

JORC Table 1

Ariana Resources Kiziltepe Project

The table below is a description of the assessment and reporting

criteria used in the Kiziltepe Project Mineral estimation that reflects

those presented in Table 1 of The Australasian Code for the Reporting of

Exploration Results, Mineral Resources and Ore Reserves (The JORC Code,

2012). The Mineral Resource statement was prepared for the Kiziltepe

Project.

Sampling techniques and Data

Sampling techniques

-- Reverse circulation (RC) chips were collected at 1m intervals and in some

cases over 0.5m intervals over the mineralised zone. The chips were

collected into plastic sample bags from a cyclone to ensure maximum

recovery. The samples were split using a standard riffle-splitter to

around 0.25 to 0.5 kg per sample and sent to an ISO-accredited laboratory

in Romania for Au and Ag analysis by fire assay.

-- Full core was split using a rock saw and half-core samples were taken at

variable intervals. Core recovery was recorded into the database.

Drilling techniques

-- Percussion

-- Reverse Circulation (130mm diameter)

-- Diamond coring - NQ diameter

Drill sample recovery

-- Core recoveries were monitored and were generally good (>95%).

-- RC recoveries were routinely monitored.

Logging

-- All RC and core holes were logged lithologically using a coded logging

system for rock type, grain size, colour, alteration and any other

relevant observations.

-- Mineralised zones were identified from the gamma logging as well as

handheld XRF.

Subsampling techniques and sample preparation

-- Samples from diamond drilling were collected as sawn half-core or in some

cases full-core.

-- A combination of cyclone and riffle splitter to produce 0.25-0.5 kg

subsamples of RC chips was used. Wet intervals were sub-sampled with

scoop or spear. Samples were oven-dried at the laboratory if necessary.

Quality of assay data and laboratory tests

-- QC procedures employed in all recent drill programs included the

insertion of certified reference standards (1:22), blank samples (1:22),

pulp and crush duplicates (2:22) to monitor the accuracy and precision of

laboratory data.

-- The overall quality of QAQC is considered adequate to ensure the validity

of the data used for resource estimation purposes.

Verification of sampling and assaying

-- Samples collected by Ariana were submitted to ALS Global preparation

facilities in Izmir and analysis in Romania, Canada or Australia (ISO

9001 accredited).

Location of data points

-- All collar positions were located initially by hand-held GPS and later

surveyed by a professional surveyor using DGPS equipment.

-- Downhole deviation surveys were not routinely carried out in holes of

less than 100m depth. Deeper holes were surveyed using a standard

electromagnetic deviation tool.

Data spacing and distribution

-- At Kiziltepe drill section spacing is typically 10 to 12.5m with several

holes often being collared from a single site.

Orientation of data in relation to geological structure

-- The dip of the mineralisation for most of the deposit is 75-85o towards

the northeast.

-- Local grade continuity follows the dip of the mineralisation for the

entire deposit. All drilling is angled, thus intersecting the

mineralisation obliquely.

-- No biases are expected from the drilling direction.

Sample security

-- Samples are stored at a secure company facility (Sindirgi Depot) in a

clean area free of any contamination. During an active drilling programme,

samples are delivered to the laboratory once a week by Aras Cargo,

Sindirgi.

-- Chain of custody is demonstrated by both the company and ALS Global in

the delivery and receipt of sample materials. Upon receipt of samples,

ALS Global delivers by email to the company's designated QC Manager,

confirmation that each batch of 22 samples has arrived, with its

tamper-proof seal intact, at the Izmir sample preparation facility.

-- Any damage to or loss of samples within each batch (e.g. total loss,

spillage or obvious contamination), must also be reported to the company

in the form of a list of samples affected and detailing the nature of the

problem(s).

Audits and reviews of sampling and assaying

-- Ariana has implemented QA/QC programs covering all aspects of sample

location and collection that meets or exceeds the currently accepted

industry standards. Ariana implemented a QA/QC programme based on

international best practice during the initial exploration work and

subsequent drilling programmes. The company has continued to review and

refine the QA/QC programme as these exploration campaigns have

progressed.

Estimation and reporting of Kiziltepe Mineral Resources

Database integrity

-- The Kiziltepe resource data is stored in a MS Access database and is

managed using MS Access and Excel software.

-- Data was logged onto field sheets which were then entered into the data

system by data capture technicians.

-- Data was validated on entry into the database, or on upload from the

earlier MS Access databases, by a variety of means including the

enforcement of coding standards, constraints and triggers. These are

features built into the data model that ensure data meets essential

standards of validity and consistency.

-- Laboratory data has been received in digital format and uploaded directly

to the database.

-- Original data sheets and files have been retained and are used to

validate the contents of the database against the original logging.

-- Independent consultants Odessa Resources Pty Ltd performed a visual

validation by reviewing drillholes on section and by subjecting drillhole

data to data auditing processes in specialised mining software (e.g.

checks for sample overlaps etc.).

Site visits

-- Two site visits have been undertaken by Odessa Resources Pty Ltd.

-- Ariana staff have visited the site on numerous occasions in order to

observe drilling and sampling operations in order to ensure proper QAQC

(MORE TO FOLLOW) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

and sampling protocols are maintained.

Geological interpretation

-- Veins the Kiziltepe prospect, comprise WNW-NNW trending, sub-parallel,

low-sulphidation style veins and related stockworks are hosted by dacite

and dacitic pyroclastic units.

-- At Arzu North and Banu the veins appear to bifurcate.

-- Interpretations of geological surfaces derived from 3D modelling of

drillhole lithological data.

Dimensions

Arzu South

-- In plan orientation, the deposit is approximately 750 metres long and

2-10m metres wide.

-- One primary lode trending 320 degrees and 150m northerly-trending

southern section separated from main lode by interpreted fault

-- Lodes vary from 2-10m in thickness with main lode averaging 5m thickness

-- Mineralisation has vertical extents ranging between 385 and 220mRL.

Arzu North

-- The deposit is approximately 460 metres long and comprises several

steeply-dipping parallel and partly overlapping 310 degree trending

lodes.

-- Mineralisation has vertical extents ranging between 405 and 220mRL.

Derya

-- The deposit is approximately 450 metres long and comprises several steep

north-dipping sub-parallel and partly overlapping, 290 degree trending

lodes.

-- Mineralisation has vertical extents ranging between 400 and 240 mRL

(average 90m down dip distance)

Gapz 400

-- The deposit is approximately 150 metres long and comprises a single

vertical 305 degree trending lode.

-- Mineralisation has vertical extents ranging between 410 and 300mRL.

Gapz 500

-- The deposit is approximately 80 metres long and comprises a single steep

north-dipping 300 degree trending lode.

-- Mineralisation has vertical extents ranging between 395 and 320mRL.

Banu

-- The deposit extends over a strike length of 470m and comprises a single

sub-vertical 330 degree trending lode. The lode is disrupted by possible

fault/shear zone that breaks up the lode into several sub-parallel

segments.

-- Mineralisation has vertical extents ranging between 395 and 265mRL.

Estimation and modelling techniques

-- Drillhole sample data was constrained within:

-- Kiziltepe: manually constructed wireframes defined by nominal

0.5g/t Au cut off.

-- Several <0.5g/t Au intervals were included to maintain geological

continuity.

-- Sample data was composited to a 1 metre downhole length using a

wireframe-intersection compositing method. Residual samples (those

composite intervals for which there was less than 50% of the composite

length) were not considered biased and hence were included in the

estimate.

-- An analysis of the grade distribution characteristics of the domain

composites for each deposit was undertaken. In each case one of the

following was identified: noticeable high grade inflection points on

log-probability graphs and/or significant gaps on disintegration plots.

-- The following top cuts were used:

Gold 15g/tAu

Silver 200g/tAg

-- Isotropic search ellipses and ranges were used.

-- The Arzu-Derya block model was constructed using a 15mE by 5mN by 10mRL

parent block size.

-- The Banu block model was constructed using a 5mE by 5mN by 5mRL parent

block size.

-- Estimation was carried out using inverse distance squared (ID2) at the

parent block scale using a three estimation pass using all available

composite.

-- A percentage model was used to report precisely the volume of material

within each block.

Moisture

-- Tonnes have been estimated on a dry basis.

Cut-off parameters

-- Indicated and Inferred Resources have been reported above a 1.0 Au

cut-off grade.

-- Banu 0.5g/t Au cut off.

Mining factors or assumptions

-- No mining factors (i.e. dilution, ore loss, recoverable resources at

selective mining block size) have been applied.

Metallurgical factors or assumptions

-- No metallurgical assumptions have been built into the resources. However,

metallurgical test work concludes that recoveries of up to 87% and 64%

for gold and silver respectively can be achieved (Tetra Tech DFS).

Environmental factors or assumptions

-- Statutory forestry permits have been approved by the Prime Ministry and

issued by the Department of Forestry for the Kiziltepe Sector of the Red

Rabbit Project.

Bulk density

-- Bulk density data was sourced from the Tetra Tech (2013) model.

-- Assigned bulk density of has been applied according to the following

table:

Prospect Solid Assigned Density

Arzu North 200 2.55

Arzu North 201 2.65

Arzu North 202 2.65

Arzu North 203 2.65

Arzu North 204 2.65

Arzu South 100 2.55

Arzu South 101 2.50

Arzu South 102 2.50

Banu 100c 2.55

Banu 200c 2.55

Banu 300c 2.55

Derya 300 2.55

Gapz 400 2.50

Gapz 500 2.50

Classification criteria

-- Mineral Resources have been classified on the basis of confidence in

geological and grade continuity using the drilling density, geological

model and modelled grade continuity.

-- Measured Mineral Resources have been defined by a search radius of 5m

-- Indicated Mineral Resources have been defined by a search radius of 5-25m

-- Inferred Mineral Resources have been defined by a search radius of 25-70m

Block Model verification

-- For each deposit, the ID2 model was validated against the input drillhole

composites for each domain by visual comparisons carried out against the

composited drillhole samples for each domain against the modelled block

grade.

Audits or reviews

-- The estimated grades were validated against average Au and Ag grade

statistics for each lode.

Discussion of relative accuracy/ confidence

-- Odessa Resources Pty Ltd place a relative accuracy of +/- 20% (and 90 %

confidence level) in the Mineral Resource estimate at the global level

for the Indicated Resources based on the estimation technique and data

quality and distribution. Inferred Resources would have a lower level of

confidence outside of this range.

Criteria

Explanation

Glossary of Technical Terms:

"Ag" the chemical symbol for silver;

"Au" the chemical symbol for gold;

"cut-off grade" The lowest grade, or quality, of mineralised material

that qualifies as economically mineable and available in a given

deposit. May be defined on the basis of economic evaluation, or on

physical or chemical attributes that define an acceptable product

specification;

"g/t" grams per tonne;

"Indicated resource" a part of a mineral resource for which tonnage,

densities, shape, physical characteristics, grade and mineral content

can be estimated with a reasonable level of confidence. It is based on

exploration, sampling and testing information gathered through

appropriate techniques from locations such as outcrops, trenches, pits,

workings and drill holes. The locations are too widely or

inappropriately spaced to confirm geological and/or grade continuity but

are spaced closely enough for continuity to be assumed;

"Inferred resource" a part of a mineral resource for which tonnage,

grade and mineral content can be estimated with a low level of

confidence. It is inferred from geological evidence and has assumed, but

not verified, geological and/or grade continuity. It is based on

information gathered through appropriate techniques from locations such

as outcrops, trenches, pits, workings and drill holes that may be

limited or of uncertain quality and reliability;

"Inverse Distance Squared" a conventional mathematical method used to

calculate mineral resources. Near sample points provide a greater

weighting than samples further away for any given resource block;

"JORC" the Joint Ore Reserves Committee;

"JORC 2004" is the previous edition of the JORC Code, which was

published in 2004. It has been superseded by JORC 2012;

"JORC 2012" is the current edition of the JORC Code, which was published

in 2012. After a transition period, the 2012 Edition came into

mandatory operation in Australasia from 1 December 2013;

"m" Metres;

"Measured resource" a part of a Mineral Resource for which tonnage,

densities, shape, physical characteristics, grade and mineral content

can be estimated with a high level of confidence. It is based on

detailed and reliable exploration, sampling and testing information

gathered through appropriate techniques from locations such as outcrops,

trenches, pits, workings and drillholes. The locations are spaced

closely enough to confirm geological and grade continuity.

"oz" Ounces;

"t" Tonnes;

"Whittle" computer software that uses the Lerch-Grossman algorithm,

which is a 3-D algorithm that can be applied to the optimisation of

open-pit mine designs. The purpose of optimisation is to produce the

most cost effective and most profitable open-pit design from a resource

block model.

Ends

Figure 1: http://hugin.info/138153/R/2006265/741269.pdf

Figure 2: http://hugin.info/138153/R/2006265/741270.pdf

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

(MORE TO FOLLOW) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

Source: Ariana Resources plc via Globenewswire

HUG#2006265

http://www.arianaresources.com/s/Home.asp

(END) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

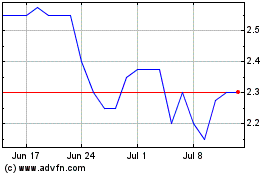

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024