Ariana Resources PLC Ariana Resources Plc : Excellent Results From Tavsan Scoping Study

November 10 2016 - 2:01AM

UK Regulatory

TIDMAAU

10 November 2016

AIM: AAU

EXCELLENT RESULTS FROM TAVSAN SCOPING STUDY

Ariana Resources plc ("Ariana" or "the Company"), the exploration and

development company operating in Turkey, is pleased to announce the

completion of a scoping-level assessment for the Tavsan Project*

("Tavsan" or "the Project") undertaken by independent geological,

metallurgical and mining consultants. Tavsan is part of the Red Rabbit

Joint Venture with Proccea Construction Co. and will be 50% owned by

Ariana once mine construction at the Kiziltepe Sector is completed in

Q416.

Highlights

-- Results show potential for strong financial returns, with NPV (8%) at

US$41.9M, with payback secured within 1.1 years over the Life of Mine

("LoM") at a gold price of US$1,250/oz.

-- LoM C1 gold equivalent cash-cost of US$559-630/oz, across model range

with a pre-tax IRR of 80% at a gold price of US$1,250/oz.

-- Average LoM production of approximately 30,000 ounces of gold per annum

over approximately 4 years; potential to increase the resource with

drilling.

-- Capital expenditure estimated at US$20 million, which would involve

development of a very low strip ratio open-pit mine and heap-leach.

-- Planned as a semi- stand-alone operation to Kiziltepe, potentially

sharing much of the same infrastructure including the gold stripping and

carbon regeneration facility, and gold room.

-- Additional drilling and metallurgical test-work being planned on the

Project as part of a Pre-Feasibility Study ("PFS") scheduled for 2017.

Dr. Kerim Sener, Managing Director, commented:

"This is an excellent result which reinforces our view that the Tavsan

Sector will become a valuable additional source of revenue within the

context of the Red Rabbit Joint Venture with Proccea Construction Co.

The addition of Tavsan to our mining schedule will enable the Company

the opportunity to increase production from approximately 20,000 oz pa

to 50,000 oz pa between two operations.

We are investigating options for the fast-tracking of further

exploration and development work at Tavsan, targeting completion of a

PFS in 2017. As part of this programme of work we are currently

planning and budgeting for a dedicated drilling programme at Tavsan and

further metallurgical test-work."

Scoping Summary

Ariana and its consultants have completed a scoping-level assessment for

the development of the Company's JV project at Tavsan, in Kutahya

Province, western Turkey. The scoping study provides initial estimates

for costs and financial returns, based on the current Mineral Resource,

which includes JORC 2004 classified Indicated and Inferred material as

per the SRK Consulting (UK) Ltd Mineral Resource estimate, completed in

2008 (Table 1).

Table 1: SRK Mineral Resource statement (2008) for Tavsan.

Tonnage

Classification Zone (Mt) Grade Metal

Au (g/t) Ag (g/t) Oz Au Oz Ag

Indicated Main 1.7 1.6 4.2 87,000 229,000

Main +

Inferred Satellites 3.2 1.1 3.7 117,000 380,000

Project scoping was conducted independently by mining consultancy

Auralia Mining Consulting Pty. Ltd. ("Auralia"), which has extensive

experience in gold mining project development and assessment worldwide.

For more information visit www.auralia.net.au.

Whittle Optimisation

Major parameters for the scoping study were derived from previous work

undertaken for the Company, completed in 2008, by SRK and SGS on Mineral

Resource estimation and metallurgical test-work respectively. For the

purposes of the Whittle optimisations, a revised block model was

prepared independently for a sub-set of the original Mineral Resource by

Odessa Resources Pty. Ltd. New topographic data and certain corrections

to drill hole collar coordinates were also taken in to account for the

revised block model. A base-case and set of range runs were carried out

on the Tavsan project utilising the Whittle optimisation software

package. The base-case inputs applied in Whittle are outlined in Table

2 below.

Table 2: Summary inputs of the Whittle base case optimisation.

Whittle Input Parameter Value Units

Overall Slope Angle 50 Degrees

Reference Mining Cost 1.0 US$/t

Mining Dilution 10%

Mining Recovery 95%

Processing Cost 12.0 US$/t

G & A Cost 11.0 US$/t

Processing Recovery (Au) 80%

Processing Recovery (Ag) 24%

Sell Price Gold 1,060 US$/oz

Sell Price Silver 15 US$/oz

Sell Costs Royalties as required US$/oz

Discount Rate 8%

Processing Constraint 0.75 Mtpa

The physical parameters of the base-case Whittle Revenue Factor (RF) 1

shell is summarised in Table 3 below.

Table 3: Summary outputs of the modified Whittle base-case optimisation

(rounded figures with mining recovery and dilution applied) at

US$1,060/oz Au.

Parameter Output

Total rock 8.1 Mt

Ore 2.7 Mt

Strip ratio 2:1

Average gold grade 1.6 g/t

Average silver grade 3.0 g/t

Gold ounces recovered 109,000 oz

For the purposes of determining mining inputs into the Whittle base-case

run, the study assumed conventional drill, blast, load and haul methods

with excavation planned to be carried out by 30t excavator and 25-35

tonne rigid body truck fleets. Due to the geometry of the

mineralisation in relation to the topography, a flat US$/t unit rate

mining cost was applied, based on Ariana's Red Rabbit Gold Project.

Whittle range runs were carried out as part of the study. They

displayed standard expected linear movement and sensitivities to

altering input parameters. Although only at a scoping level, the

resulting runs indicate the project is most sensitive to sell price

fluctuations, but is physically robust to change on variance away from

key base-case parameters. This can be seen in Table 4 below.

http://hugin.info/138153/R/2055817/769953.pdf

Table 4: Whittle range run outputs, RF 1 worst-case shells used for

comparison purposes. All figures are rounded.

Mine Design

The topography at the Tavsan Project is dominated by a gently rolling

hills. Much of the Mineral Resource lies within the Main Zone, referred

to here as the 100 Zone and several satellite zones, referred to as the

200, 300 and 600 zones (Figure 1). As much of the mineralisation occurs

within a gently dipping and largely outcropping unit of mineralised

jasperoid, the bulk of the current Mineral Resource varies in depth from

0m to 30m below the surface.

This physiography would potentially enable the development of several

open-pits which would be initiated from the lowest point, with mining

progressing sequentially up the hill-side with side-casting or dumping

of waste behind the working face (Figure 1). The open-pit could

essentially be back-filled as mining progresses, minimising

environmental impact and eliminating the requirement for a large

permanent waste rock dump, which would also keep capital costs to a

minimum. Based on the high level scoping study Whittle shells, the

overall strip ratio for the project is likely to be approximately 2:1,

so little waste will need to moved within the pits.

http://hugin.info/138153/R/2055817/769947.pdf

Figure 1: which can be accessed from the link above shows a plan view of

conceptual open-pit design for all pits at Tavsan (left) with the Main

(100) Zone at Tavsan (right). The mineralised zone is shown in yellow

(left), sitting within the conceptual pit designs shown in brown. The

conceptual designs were based upon the side casting and back-filling

premise as discussed above. For the Main (100) Zone, Mineral Resources

at >0.5g/t gold are displayed in pink in the diagram on the right,

looking north-east, with topography shown in green.

Mine Schedule

A conceptual mining schedule was completed for the life of the project

using the RF1 Whittle shells for each ore zone (Figure 2). As the

deposit has a low strip ratio with ore at or close to the surface, very

little pre-strip is required and therefore for the purposes of

conceptual scheduling it is reasonable to use averaged ore delivery

figures for the life of the project. More detailed future studies will

provide an opportunity to further optimise pit designs and scheduling so

as to deliver the best overall cash flow for the project.

http://hugin.info/138153/R/2055817/769949.pdf

Figure 2: which can be accessed from the link above shows high level

mining schedule including tonnes processed and input gold grades.

Process Route

Preliminary metallurgical test-work conducted in 2008 by SGS Lakefield

Research Limited confirmed that processing using heap-leach methods

would be suitable for the Tavsan mineralisation. Recovery rates on

average grade gold mineralisation (1.4 g/t Au) of 80% for gold and 26%

for silver are expected based on column-leach test-work, although

further test work is required, particularly for higher than average

grade gold mineralisation (4.2 g/t Au). Initial test-work showed that

higher grade mineralisation demonstrated lower recoveries (67% for gold

and 22% for silver), though the limited distribution of such

mineralisation is not considered extensive enough to be a metallurgical

concern at this stage.

A four-year processing schedule is expected based on an all-materials

schedule. The silver contained with the mineralisation is not economic

on its own, but adds credits as an output given the requirement to mine

and process it along with the gold recovered (where the gold grade

exceeds the economic cut-off). Of approximately 136,000 ounces of gold

input to the heap leach, approximately 109,000 ounces of gold is

recovered at an 80% gold recovery rate. A cut-off grade of

approximately 0.96 g/t Au was established for the base case at

US$1,060/oz Au.

It is envisaged that processing would commence on a small starter pad

developed outside of the Main Zone. After mining had progressed

sufficiently within this zone, part of the pit could be converted to

heap leach pads for the remaining mine life. This would substantially

reduce the environmental footprint of the operation, as the pads and

much of the waste could be recycled back in to the pits, the operation

would be largely self-rehabilitating.

It is expected that loaded carbon could be potentially trucked to the

Kiziltepe processing plant for carbon elution and recovery of gold. In

this case, there would be no requirement at Tavsan for gold stripping

involving carbon elution and regeneration, electro-winning or a gold

room, which would substantially reduce the capital cost. Further work

is required to determine the potential for such infrastructure to be

shared in this manner.

Infrastructure

The Tavsan project benefits from well-developed infrastructure and an

established mining culture in the vicinity of the proposed mine. A

combination of sealed and un-sealed roads provide access to the project

from the nearby town of Balikoy (8.5km away). Nearby towns and villages

provide a source of both skilled and un-skilled labour for the project.

Labour costs are significantly lower in Turkey than in comparable

jurisdictions. Power would be supplied from the grid for which costs

are expected to be approximately 11 c/kWh. A 31KV power line runs

adjacent to the property and water would be derived from nearby sources.

Project Costs

Capital costs have been estimated by Auralia for the mining and

processing components of the operation based on cost estimates that have

been compiled based on metrics demonstrated by similar mining operations

in Turkey and elsewhere. The capital cost for the process plant,

heap-leach pads and ancillary infrastructure is US$20 million at an

estimated accuracy of +/-30%.

Operating costs for the heap-leach plant are estimated at US$10.00/t,

based on quoted pricing received by Ariana for the company's Salinbas

project. It should be noted that the mine optimisation work utilised a

processing cost of US$12/t ore, based upon a 0.5Mtpa initial case, but

this was subsequently revised for the modified base-case to US$10.00/t

based on an enhanced production rate of 0.75Mtpa.

Across the model range, C1 gold equivalent cash costs are expected at

approximately US$559-630/oz for the (averaged) LoM, based on the scoping

study level Whittle shells.

Financial Model

A high level indicative pre-tax financial evaluation showing sensitivity

to gold price (Table 5) was prepared on the basis of the Whittle outputs

for the NPV (8%) scenario and the modelled NPV (10%) based on the RF1

Whittle shell derived at NPV (8%). Total capital expenditure on the

project has been deducted from the NPV figures. All values were derived

pre-tax due to the complexity and variability of tax on mining projects

in Turkey, which are subject to investment incentives provided by the

Government of Turkey.

It is important to note that for the high level financial analysis, the

G&A parameters used in Whittle were amended from the original base-case

to better reflect the economics of the project and the fact that Tavsan

is likely to function as a satellite operation to the established

Kiziltepe project, which will absorb the majority of the company's

corporate overheads. The G&A figure was revised down to a still

conservative US$9/t for the financial analysis.

Table 5: Summary high level indicative financial model and sensitivity

of the project to gold price. The NPV at 8% and 10% discount rates are

shown after deduction of the total capital expenditure. Estimated C1

cash costs are inclusive of royalty costs and calculated using the

following formula: (Au Sell Price x Rec oz Au + Au equiv Rec oz Ag) -

Undisc Cash Flow)/(Rec oz Au + Au equiv Rec oz Ag). All figures shown

are rounded.

Approx.

Ave. Est. C1

Gold Price NPV (US$M) Pre-Tax inc. IRR% Payback Cash Cost*

(US$/oz) CAPEX (Pre Tax) (Years) (US$/oz)

8% D/R 10% D/R

1250 41.9 39.1 80 1.1 630

1150 32.6 30.2 67 1.3 619

1060 24.4 22.5 55 1.5 606

950 14.6 13.1 39 1.8 586

850 6.1 5.1 23 2.2 559

Approvals and Incentives

The Joint Venture holds the relevant mining licences for the project

through Zenit Madencilik San. ve Tic. A.S., but would require an

Environmental Impact Assessment ("EIA") to be completed, in addition to

other permits required for mining, in order for the project to be

developed. Preliminary EIAs are already in place for additional

exploration and trial mining.

Turkey has adopted policies aimed at encouraging development of the

mining sector through specific incentives. Corporate tax rates are

competitive, with a headline rate of 20% but with various tax incentives

potentially reducing effective rates to 4% or less for initial periods

of production.

This announcement contains inside information for the purposes of

Article 7 of EU Regulation 596/2014.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628 3396

Roland Cornish / Felicity Geidt

Beaufort Securities Limited Tel: +44 (0) 20 7382 8300

Jon Belliss

Panmure Gordon (UK) Limited Tel: +44 (0) 20 7886 2500

Adam James / Tom Salvesen

Editors' note:

The information in this report that relates to Mineral Resources is

based on information compiled by Mr. Alfred Gillman of Odessa Resources

Pty. Ltd., who is a fellow of the Australasian Institute of Mining and

Metallurgy. Mr. Gillman is a consultant to Ariana Resources plc and has

sufficient experience relevant to the styles of mineralisation and type

of deposit under consideration and to the subject matter of the report

to qualify as Competent Person and defined in the 2012 edition of the

Australasian Code for the Reporting of Exploration Results Mineral

Resources and Ore Reserves (JORC Code). Mr. Gillman consents to the

inclusion in the report of the matters based on his information in the

form and context in which it appears.

About Ariana Resources:

Ariana is an exploration and development company focused on epithermal

gold-silver and porphyry copper-gold deposits in Turkey. The Company is

developing a portfolio of prospective licences selected on the basis of

its in-house geological and remote-sensing database, on its own in

western Turkey and in Joint Venture with Eldorado Gold Corporation in

north-eastern Turkey. Eldorado owns 51% of this joint venture and are

fully funding all exploration work on the JV properties, while Ariana

owns 49%. The total resource inventory within this JV is 1.09 million

ounces of gold.

The Company's flagship assets are its Kiziltepe and Tavsan gold projects

which form the Red Rabbit Gold Project. Both contain a series of

prospects, within two prolific mineralised districts in the Western

Anatolian Volcanic and Extensional (WAVE) Province in western Turkey.

This Province hosts the largest operating gold mines in Turkey and

remains highly prospective for new porphyry and epithermal deposits.

These core projects, which are separated by a distance of 75km, are

presently being assessed as to their economic merits and now form part

of a Joint Venture with Proccea Construction Co. The total resource

inventory at the Red Rabbit Project stands at c. 525,000 ounces of gold

equivalent.

Beaufort Securities Limited and Panmure Gordon (UK) Limited are joint

brokers to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana you are invited to visit the Company's

website at www.arianaresources.com.

Disclaimer:

The open pit mining study carried out by Auralia Mining Consulting Pty

Ltd referred to in this document is classed as high level only, and

although constitutes a scoping study it does not meet the criteria of a

pre-feasibility or feasibility study. Due to this, the subsequent

material inventories resulting from this work do not constitute or imply

Ore Reserves. The estimates and beliefs applied in undertaking the

scoping study, either stated or implied, by the Company and its

consultants are based on a combination of quoted data, industry best

practise and assumptions that may involve known and unknown risks and

uncertainties which may result in future outcomes that differ to any

expressed or implied estimates or projections derived from this scoping

study. Given the level of study, any data resulting from this scoping

study refers solely to potential and does not guarantee that future work

will result in the determination of Ore Reserves. This document

describes references to JORC classified Indicated and Inferred Mineral

Resources. Inferred Mineral Resources have a greater amount of

uncertainty as to their existence and greater uncertainty as to their

economic feasibility. It cannot be assumed that any, or all, parts of

the Inferred Resource will be upgraded to a higher Mineral Resource

category or converted to Proven or Probable Ore Reserves.

Glossary of Technical Terms:

"Ag" the chemical symbol for silver;

"Au" the chemical symbol for gold;

"g/t" grams per tonne;

"Indicated resource" a part of a mineral resource for which tonnage,

densities, shape, physical characteristics, grade and mineral content

can be estimated with a reasonable level of confidence. It is based on

exploration, sampling and testing information gathered through

appropriate techniques from locations such as outcrops, trenches, pits,

workings and drill holes. The locations are too widely or

inappropriately spaced to confirm geological and/or grade continuity but

are spaced closely enough for continuity to be assumed;

"Inferred resource" a part of a mineral resource for which tonnage,

grade and mineral content can be estimated with a low level of

confidence. It is inferred from geological evidence and has assumed, but

not verified, geological and/or grade continuity. It is based on

information gathered through appropriate techniques from locations such

as outcrops, trenches, pits, workings and drill holes that may be

limited or of uncertain quality and reliability;

"IRR" Internal Rate of Return;

"JORC" the Joint Ore Reserves Committee;

"m" Metres;

"M" million;

"Mt" million tonnes;

"Mtpa" million tonnes per annum;

"NPV" Net Present Value;

"oz" Ounces;

Ends

FIGURE 1: http://hugin.info/138153/R/2055817/769947.pdf

TABLE 4: http://hugin.info/138153/R/2055817/769953.pdf

FIGURE 2: http://hugin.info/138153/R/2055817/769949.pdf

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Ariana Resources plc via Globenewswire

http://www.arianaresources.com/s/Home.asp

(END) Dow Jones Newswires

November 10, 2016 02:01 ET (07:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

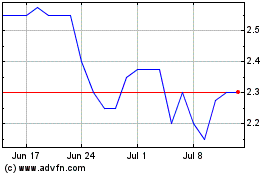

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024