Ardian Raises $14 Billion To Back Private-Equity Funds

April 19 2016 - 3:29AM

Dow Jones News

By Laura Kreutzer

PARIS -- French private-equity firm Ardian raised $10.8 billion

to purchase private fund stakes, part of a growing pool of capital

that enables investors to sell their private-equity holdings to

secondhand buyers.

Separately, the French firm, which was spun off in 2013 from

French insurer AXA SA, raised an additional $3.2 billion across

several investment vehicles to back commitments to newly formed

private-equity funds.

Purchases of secondhand stakes in private-equity funds, termed

secondary deals, reached between $30 billion and $40 billion in

2015, according to various estimates from several intermediaries

that track such deals. That is up from an estimated $20 billion to

$30 billion in volume in 2013, those intermediaries estimated.

"Secondaries have come of age," said Vincent Gombault, who leads

Ardian's secondary activities, among other leadership roles. "It's

no longer a market for distressed sellers or those that need to

sell for regulatory [reasons]. We are offering liquidity to many

large institutions."

Ardian, which wrapped up its newest secondary fund, ASF VII, two

years after closing the fund's predecessor, said it has amassed a

total of more than $27 billion to invest in secondary deals since

2011. It joins a small group of elite investors, including pension

investor Canada Pension Plan Investment Board and fellow secondary

firm Lexington Partners, with the financial firepower to underwrite

$1 billion-plus deals on their own.

Capital available to invest in secondary transactions has

ballooned in recent years, creating a competitive environment and

driving up pricing for certain deals. Secondary firms in the U.S.

and Europe raised $16.07 billion for new funds in 2015, on top of

$25.27 billion raised for new funds in 2014, according to Dow Jones

LP Source, a data provider owned by Dow Jones & Co.

Higher prices for assets combined with strong returns have

helped attract to the market sellers that might not otherwise sell,

according to Mr. Gombault.

"We want to offer liquidity to the seller, but our pricing has

to match their assumptions," he said. "If you want to price a $1

billion portfolio at a discount of 20%, you will have no

sellers."

Public market volatility during the latter part of 2015,

however, put a slight damper on deal flow early this year and has

only recently started to recover, according to intermediaries and

sellers.

"You had buyers and sellers both sitting on the sidelines during

the first quarter," said Shawn R. Schestag, managing director and

head of secondary advisory and co-investment at Sixpoint Partners,

a global investment bank focused on the middle market. "But we

think the second half [of 2016] could be very strong, because

there's a lot of pent-up demand."

Ardian has invested or committed about 25% of the money it

raised for its latest secondary effort to six deals, using capital

raised early in the fundraising process, Mr. Gombault said. In late

2015, for example, U.K.-based pension manager Universities

Superannuation Scheme said it sold a roughly $940 million portfolio

of 13 private-equity funds to Ardian as part of a shift in the

pension system's strategy toward direct investments.

Mr. Gombault added that the insight his firm has gained through

backing new private-equity funds provides a window into how

managers invest, as well as valuable information for pricing

secondary transactions. The firm said it has backed about 1,200

funds representing about 10,000 underlying portfolio companies.

"Of course, we don't want to pay too much, but if you pay huge

discounts on bad assets, your discounts will never be enough," he

added.

Write to Laura Kreutzer at laura.kreutzer@wsj.com

(END) Dow Jones Newswires

April 19, 2016 03:14 ET (07:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

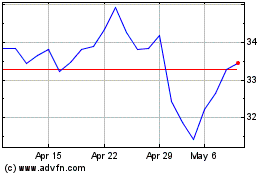

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024