TIDMARC

RNS Number : 7151G

Arcontech Group PLC

10 August 2016

ARCONTECH GROUP PLC

("Arcontech", the "Company" or the "Group")

Final Results for the Year Ended 30 June 2016

Arcontech (AIM: ARC), the provider of products and services for

real-time financial market data processing and trading, is pleased

to announce its final audited results for the year ended 30 June

2016.

Financial highlights

-- Profit before tax of GBP302,329 (2015: GBP243,660)

-- Cash balance of GBP1,633,159 (2015: GBP1,069,755)

-- Basic earnings per share of 0.027p (2015: 0.023p)

Operational highlights

-- 'Soft launch' of a new Desktop product

-- Good cost control (costs lowered by 2%)

-- Continued investment in R&D to develop new solutions for existing and new clients

-- Pipeline currently unaffected by Brexit

Distributable reserves and Proposed Share Consolidation

In March 2016 Arcontech obtained court approval to cancel its

share premium account, creating positive distributable reserves.

This will enable the directors to recommend the payment of

dividends out of retained profits in the future, should the Board

feel this is appropriate.

Due to the large number of shares in issue and to avoid

fractional entitlements to any future dividend, it is the Board's

intention to consolidate the number of shares prior to announcing a

dividend. Further details of the proposed share consolidation will

be provided to shareholders in the Notice of Annual General

Meeting.

Commenting on the results, Richard Last, Chairman of Arcontech

said:

"We believe, as a result of continued product investment and

from listening to our customers, we have a good product set that is

suitable for our markets. Our focus is now fundamentally on winning

new business and whilst we believe the opportunities for increased

sales exist, the sales cycle remains longer than we would like. We

also need to fully compensate for the reduction in revenue during

the year from the Asian focused bank. Our prospects, however,

whilst positive need to be tempered against uncertainties in the

banking sector as a result of the low interest rate environment and

potential issues following Brexit."

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

Enquiries:

Arcontech Group plc

Richard Last, Chairman and

Non-Executive Director 07713 214484

020 7256

Matthew Jeffs, Chief Executive 2300

finnCap Ltd (Nomad & Broker)

020 7220

Carl Holmes/Simon Hicks 0500

To access more information on the Group please visit:

www.arcontech.com

Chairman's Statement

Arcontech Group plc ("Arcontech" or the "Company") is pleased to

report a profit before taxation for the year ended 30 June 2016 of

GBP302,329 compared to GBP243,660 for the year ended 30 June 2015.

After taking the benefit of the Research and Development tax credit

of GBP105,813 (2015: GBP109,378) which the company receives due to

the amount it has invested in qualifying product design and

development, Arcontech achieved a profit after tax of GBP408,142

(2015: GBP353,038).

Turnover for the year increased modestly by 0.5% to GBP2,141,630

(2015: GBP2,129,958) reflecting the situation that new business

predominantly from existing customers only marginally exceeded the

impact of the loss in revenue from the Asian focused bank,

previously reported, from the start of the second half. With the

"soft launch" of our new Desktop product we would expect to see

increased sales momentum in the coming year.

Throughout the year ended 30 June 2016 we maintained tight

control of costs which has helped improve our profitability. We

have continued to invest in new product development which we expect

to maintain going forward as we believe product development and

innovation is key to our future success. Further investment in

sales and marketing resources is expected but this will be

dependent on new sales wins.

Financing

As at 30 June 2016 Arcontech had no debt and cash balances of

GBP1,633,159 (2015: GBP1,069,755), reflecting increased

profitability. This leaves the business well financed for the

future.

Employees

Once again I would like to thank our employees who are the core

of the business and whose support and dedication is greatly

appreciated.

Outlook

We believe, as a result of continued product investment and from

listening to our customers, we have a good product set that is

suitable for our markets. Our focus is now fundamentally on winning

new business and whilst we believe the opportunities for increased

sales exist, the sales cycle remains longer than we would like. We

also need to fully compensate for the reduction in revenue during

the year from the Asian focused bank. Our prospects, however,

whilst positive need to be tempered against uncertainties in the

banking sector as a result of the low interest rate environment and

potential issues following Brexit.

Richard Last

Chairman

Chief Executive's Review

I am pleased to report that during the year our continued

attention to managing costs whilst bringing the sales pipeline

forward, has resulted in an increase in profit before tax of 24%

compared to the previous year.

Our endeavours resulted in revenue growth of 0.5% and a

reduction in costs of 2%. This had a significant and positive

impact to our bottom line to generate a profit before tax of

GBP302,329.

As well as progressing the sales pipeline, this year has also

seen us improve our product offering by adding functionality to

existing products as well as building out the product portfolio

with a new Desktop component. This is currently in trials with

several Tier 1 clients with whom prospects for commercial

deployment are looking very promising.

More generally, the outlook for the business remains positive

and as yet has been unaffected by the wider uncertainties

surrounding Brexit. What does continue to affect revenues, however,

is the length of the sales cycle. This is largely attributable to

the fact that our traditional offerings invariably need to displace

an incumbent for which the existing contract terms can affect our

prospects. As has been stated previously, however, once a

commercial relationship has been established, we inevitably find

many opportunities to grow the relationship both through

displacement and development of new solutions. We also look forward

to securing cornerstone clients for our newly developed Desktop

component in order to generate new and additional revenues outside

of our traditional target market due to the broad appeal of its

value proposition.

Having maintained momentum and grown profitability over the

previous year, we have reconfirmed the value of our products to the

market whilst strengthening our position. We are now working to

capitalise on this by increasing revenues. Sales growth remains our

clear priority.

Matthew Jeffs

Chief Executive

Group Income Statement and Statement of Comprehensive Income

For the year ended 30 June 2016

2016 2015

GBP GBP

Revenue 2,141,630 2,129,958

Administrative costs (1,849,257) (1,890,242)

Operating profit 292,373 239,716

Finance income 9,956 3,944

------------------------------------------ ------------- ------------------

Profit before taxation 302,329 243,660

Taxation 105,813 109,378

Profit for the year after tax 408,142 353,038

------------------------------------------ ------------- ------------------

Total comprehensive income for the year 408,142 353,038

------------------------------------------ ------------- ------------------

Earnings per share (basic) 0.027p 0.023p

------------------------------------------ ------------- ------------------

Earnings per share (diluted) 0.026p 0.023p

------------------------------------------ ------------- ------------------

All of the results relate to continuing operations.

Statement of Changes in Equity

For the year ended 30 June 2016

Group:

Share Share Retained Total

capital premium Share option reserve earnings equity

GBP GBP GBP GBP GBP

Balance at 30 June 2014 1,536,672 9,430,312 72,562 (9,622,661) 1,416,885

Profit for the year - - - 353,038 353,038

Total comprehensive income for the year - - - 353,038 353,038

Share-based payments - - 20,199 - 20,199

Balance at 30 June 2015 1,536,672 9,430,312 92,761 (9,269,623) 1,790,122

Profit for the year - - - 408,142 408,142

Total comprehensive income for the year - - - 408,142 408,142

Cancellation of share premium account - (9,430,312) - 9,430,312 -

Issue of shares 5,060 2,024 - - 7,084

Share-based payments - - 26,931 - 26,931

Balance at 30 June 2016 1,541,732 2,024 119,692 568,831 2,232,279

------------------------------------------ ---------- ------------ --------------------- ------------ ----------

Balance Sheet

As at 30 June 2016

Group Group

2016 2015

GBP GBP

Non-current assets

Goodwill 1,715,153 1,715,153

Property, plant

and equipment 44,785 41,605

Trade and other

receivables 141,750 141,750

Total non-current

assets 1,901,688 1,898,508

---------------------------------- ------------ ------------

Current assets

Trade and other

receivables 265,360 478,402

Cash and cash equivalents 1,633,159 1,069,755

---------------------------------- ------------ ------------

Total current assets 1,898,519 1,548,157

---------------------------------- ------------ ------------

Current liabilities

Trade and other

payables (1,567,928) (1,656,543)

---------------------------------- ------------ ------------

Total current liabilities (1,567,928) (1,656,543)

---------------------------------- ------------ ------------

Net current assets/(liabilities) 330,591 (108,386)

---------------------------------- ------------ ------------

Net assets 2,232,279 1,790,122

---------------------------------- ------------ ------------

Equity

Called up share

capital 1,541,732 1,536,672

Share premium account 2,024 9,430,312

Share option reserve 119,692 92,761

Retained earnings 568,831 (9,269,623)

---------------------------------- ------------ ------------

2,232,279 1,790,122

---------------------------------- ------------ ------------

Group Cash Flow Statement

For the year ended 30 June 2016

2016 2015

GBP GBP

Net cash generated from operating activities 567,420 369,982

------------------------------------------------ ---------- ----------

Investing activities

Interest received 9,956 3,944

Purchases of plant and equipment (21,056) (38,014)

Proceeds of sales of plant and equipment - 167

Net cash invested in investing activities (11,100) (33,903)

------------------------------------------------ ---------- ----------

Financing activities

Issue of shares 7,084 -

------------------------------------------------ ---------- ----------

Net cash generated from financing activities 7,084 -

------------------------------------------------ ---------- ----------

Net increase in cash and cash equivalents 563,404 336,079

Cash and cash equivalents at beginning of year 1,069,755 733,676

------------------------------------------------ ---------- ----------

Cash and cash equivalents at end of year 1,633,159 1,069,755

------------------------------------------------ ---------- ----------

Notes to the Financial Information

For the year ended 30 June 2016

1. Status of financial information

Arcontech Group plc is a public limited company incorporated in

England and Wales whose ordinary shares of 0.1p each are traded on

the AIM Market of the London Stock Exchange. The Company's

registered office is 1st Floor, 11-21 Paul Street, London, EC2A

4JU.

The Board of Directors approved this preliminary announcement on

9 August 2016. Whilst the financial information included in this

preliminary announcement has been prepared in accordance with

International Financial Reporting Standards ("IFRS") as endorsed by

the European Union, this announcement does not itself contain

sufficient information to comply with all the disclosure

requirements of IFRS and does not constitute statutory accounts of

the Company for the years ended 30 June 2016 or 30 June 2015.

The financial information has been extracted from the statutory

accounts of the Company for the years ended 30 June 2016 and 30

June 2015. The auditors reported on those accounts; their reports

were unqualified and did not contain a statement under either

Section 498 (2) or Section 498 (3) of the Companies Act 2006 and

did not include references to any matters to which the auditor drew

attention by way of emphasis.

The statutory accounts for the year ended 30 June 2015 have been

delivered to the Registrar of Companies, whereas those for the year

ended 30 June 2016 will be delivered to the Registrar of Companies

following the Company's Annual General Meeting.

2. Basis of preparation

This financial information has been prepared in accordance with

the principles of International Financial Reporting Standards

("IFRS") as adopted by the European Union and International

Financial Reporting Interpretations Committee ("IFRIC")

recommendations and with those parts of the Companies Act 2006

applicable to companies reporting under IFRS. For the purposes of

the preparation of the consolidated financial information, the

Group has applied all standards and interpretations that are

effective for accounting periods beginning on or after 1 July 2015.

There have been no changes in accounting policies during the year.

The financial information has been prepared under the historical

cost convention unless otherwise stated.

3. Profit per share

2016 2015

GBP GBP

Earnings

Earnings for the purpose of basic and diluted earnings per share being net profit

attributable

to equity shareholders 408,142 353,038

408,142 353,038

------------------------------------------------------------------------------------------- -------- --------

No. No.

Number of shares

Weighted average number of ordinary shares for the purpose of basic earnings

per share 1,537,198,758 1,536,672,013

Number of dilutive shares under option 26,682,073 15,602,384

-------------------------------------------------------------------------------- -------------- --------------

Weighted average number of ordinary shares for the purposes of dilutive

earnings per share 1,563,880,831 1,552,274,847

-------------------------------------------------------------------------------- -------------- --------------

The calculation of diluted earnings per share assumes conversion

of all potentially dilutive ordinary shares, all of which arise

from share options. A calculation is done to determine the number

of shares that could have been acquired at fair value, based upon

the monetary value of the subscription rights attached to

outstanding share options.

4. Annual General Meeting

The Annual general meeting of Arcontech Group PLC will be held

at the Company's offices, 1st Floor, 11-21 Paul Street, London EC2A

4JU on 27 September 2016 at 10 a.m.

5. Annual report and accounts

Copies of the annual report and accounts will be sent to

shareholders shortly and will be available from the Company

Secretary at the Company's registered office at 1st Floor, 11-21

Paul Street, London, EC2A 4JU or from the Company's website at

www.arcontech.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR AKCDQQBKDOFK

(END) Dow Jones Newswires

August 10, 2016 02:00 ET (06:00 GMT)

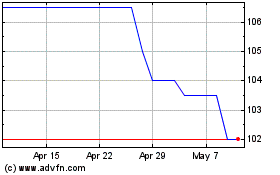

Arcontech (LSE:ARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arcontech (LSE:ARC)

Historical Stock Chart

From Apr 2023 to Apr 2024