ArcelorMittal Eyes Better Value From Share Issue Than Asset Sales

February 05 2016 - 4:08AM

Dow Jones News

By Alex MacDonald

LONDON--Shareholders of steel giant ArcelorMittal (MT) will

derive better value from a rights issue than if the company sold

assets as the supply and demand dynamics in the global steel market

begin to improve, said the company's Chief Financial Officer Aditya

Mittal.

"We have to make sure we don't destroy value" through asset

sales, Mr. Mittal told reporters. "The best value decision [is] a

rights issue," he said.

ArcelorMittal on Friday announced plans to raise $3 billion

through an equity issue plus another $1 billion from the sale of

its 35% stake in Spain's automotive steel component firm Gestamp.

This should reduce net debt to less than $12 billion compared with

its previous medium-term net debt target of $15 billion and net

debt of $15.7 billion at the end of December.

Mr. Mittal said "the most difficult period of the steel prices

and costs were reached towards the end of 2015." He expects steel

prices to rise, buoyed by trade action in the U.S. Europe and

elsewhere against a surge in steel imports from China. Global steel

demand should remain broadly flat compared with its 2.2%

contraction last year, the company said.

-Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

February 05, 2016 03:53 ET (08:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

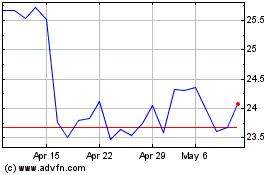

ArcelorMittal (EU:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

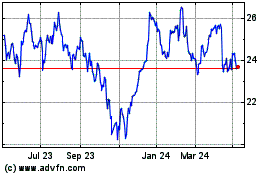

ArcelorMittal (EU:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024