ArcelorMittal CFO Calls for 'More Comprehensive' Fight Against China Exports

November 08 2016 - 5:56AM

Dow Jones News

By Alex MacDonald

LONDON--ArcelorMittal (MT) wants national governments and

international governments to do more to counteract sustained

Chinese steel exports, according to the chief financial Officer of

the world's largest steelmaker by shipments.

Aditya Mittal told reporters that Chinese steel exports remain

at very high levels despite signs of better-than-expected steel

demand growth in the country, the world's largest consumer and

producer of the metal used in skyscrapers, bridges and fridges.

Mr. Mittal called upon countries to find ways to make sure that

China isn't able to circumvent steel tariffs by shipping steel

through other countries. "We see that [Chinese steelmakers are]

using Vietnam to continue to export steel into the United States.

We need a resolution to make Vietnam a part of these trade cases"

too, he said. "We need a comprehensive trade solution."

U.S. officials on Monday launched two new investigations into

whether Chinese steelmakers are shipping metal to the U.S. through

Vietnam to evade U.S. import tariffs.

Mr. Mittal also said tariffs need to be applied to more steel

products since China has demonstrated agility in tweaking

production to focus on steel products that don't have steel

tariffs.

Lastly, governments should consider raising existing tariffs

even more to make sure they remain relevant, given emerging trends

in Chinese steel production, he said.

For instance, China limited coking coal production to only 276

days a year, thereby spurring a surge in coking coal prices. It

also imposed a ban on coking coal exports. This resulted in cheaper

domestic coking coal prices for Chinese steelmakers than for

international steelmakers, he said.

Nevertheless, Mr. Mittal said he felt "comfortable" that his

company would be able to pass along the recent rise in coking coal

prices to customers, although it would likely impact its profit

margin in the fourth quarter as the steel industry adjusts to

higher production costs.

In ArcelorMittal's case, the company consumes about 35 million

tons of coking coal a year and produces about 6 million to 7

million tons from its mines annually. Mr. Mittal wouldn't comment

on whether current coking coal prices are unsustainable, a view

buttressed by coal producer BHP Billiton Ltd (BHP) last week. "What

we're focused on is passing on this cost increase to our end

markets. We did that by leading a price increase a few weeks ago,"

Mr. Mittal said.

He also noted that the company has pushed for a steel price rise

in the U.S. even as it warned of lower profitability at its U.S

operations in the current quarter due to lower steel prices in the

third quarter from the second quarter. "We have a lag effect in our

revenue... The orders we booked in the second quarter, some of that

gets shipped in the third quarter." The same applies to the third

and fourth quarters, he said.

Looking at the U.S. presidential elections, Mr. Mittal said both

U.S. presidential candidates, Hillary Clinton and Donald Trump,

would be good for buttressing North American steel demand.

"The good thing is that both candidates have talked about

[increasing] infrastructure spending and working on creating a fair

level playing field in terms of trade."

-Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

November 08, 2016 05:41 ET (10:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

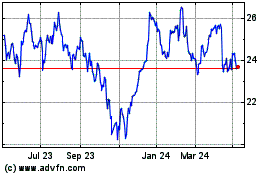

ArcelorMittal (EU:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

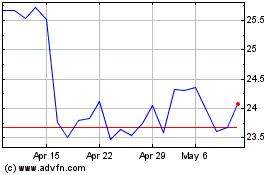

ArcelorMittal (EU:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024