TIDMARBB TIDMSTB

RNS Number : 9757H

Arbuthnot Banking Group PLC

04 December 2015

Arbuthnot Banking Group PLC

Proposed disposal of Everyday Loans Group by Secure Trust Bank

PLC

Arbuthnot Banking Group PLC ("ABG", the "Group") today announces

that its Retail Bank, Secure Trust Bank PLC ("STB"), has agreed on

the conditional sale of its branch based non-standard consumer

lending business, Everyday Loans Holdings Limited ("ELG"), to Non

Standard Finance plc ("NSF") (the "Disposal").

ABG is the holding company for Arbuthnot Latham & Co.,

Limited and STB PLC, in which it owns a 51.9% shareholding.

Highlights

-- Consideration comprises GBP107 million in cash and GBP20 million in NSF ordinary shares(1)

-- On completion, NSF will repay c. GBP108 million intercompany debt to STB

-- Expected post tax profit on disposal of not less than GBP115 million

-- On a proforma basis as at 31 October 2015, ABG estimates a 52% enhancement in the Group's CET1 ratio to 16.4% as

a result of the Disposal(2)

-- Since 30 June 2015, STB customer lending balances have continued to grow and now exceed GBP1 billion (30 June

2015: GBP852m)

-- Continued exposure to ELG through STB's shareholding in NSF and GBP30m loan to NSF

-- STB will retain its Moneyway personal lending business which is not part of the Disposal

-- The Disposal is conditional on NSF shareholder approval of its equity fundraising, admission of the new NSF

shares to the main market of the London Stock Exchange, regulatory approval and satisfaction of the conditions to

the NSF financing

-- Completion expected in first quarter of 2016

Commenting on the Disposal, Sir Henry Angest, Chairman and Chief

Executive of Arbuthnot Banking Group, said: "This disposal allows

Secure Trust Bank PLC and Arbuthnot Banking Group PLC to capitalise

future profits and thus strengthen the business and support further

growth."

Paul Lynam, Chief Executive Officer of Secure Trust Bank PLC,

said:

"The unsolicited approach from Non Standard Finance PLC for the

Everyday Loans Group presented an attractive option to accelerate

our strategy of proportionately reducing our exposure to personal

unsecured loan products whilst we invest in our strongly growing

Motor, Retail and SME lending activities. By monetising substantial

levels of future potential profit we are creating material tangible

shareholder value now. This transaction, when completed, broadens

the range of strategic options available to us which we will

consider in more depth and update the market in due course. I

believe today's announcement demonstrates the Board's commitment to

the robust control of the growth of the bank through changes to the

composition of the lending portfolio."

Notes:

(1) Subject to a net asset adjustment mechanism

(2) Proforma basis, as if the Disposal had occurred on 31

October 2015, based on expected capital gain and reduction in Total

Risk Exposure

Note: STB and NSF also today issued separate announcements,

providing further details on the Disposal.

Enquiries:

Arbuthnot Banking Group

PLC

Sir Henry Angest, Chairman Tel: 020 7012 2400

and Chief Executive

Andrew Salmon, Group

Chief Operating Officer

James Cobb, Group Finance

Director

David Marshall, Director

of Communications Tel: 020 7012 2400

Secure Trust Bank PLC

Paul Lynam, Chief Executive

Officer

Neeraj Kapur, Chief

Financial Officer

----------------------------- ---------------------

Canaccord Genuity Limited Tel: 020 7665 4500

(Nominated Adviser and

Broker)

Sunil Duggal

Roger Lambert

----------------------------- ---------------------

Numis Securities Ltd Tel: 020 7260 1000

(Broker)

Chris Wilkinson

Mark Lander

----------------------------- ---------------------

Bell Pottinger Tel: 020 3772 2566

(Financial PR)

Ben Woodford

Zoe Pocock

----------------------------- ---------------------

Introduction

Arbuthnot Banking Group's (ABG) subsidiary, Secure Trust Bank

PLC (STB) has agreed on the conditional sale of its non-standard

consumer lending business, Everyday Loans Group (ELG), to Non

Standard Finance (NSF) for GBP107 million in cash (subject to a net

asset adjustment) and GBP20 million in NSF ordinary shares. On

completion, NSF will repay the current intercompany debt of GBP108

million to STB.

Background on Everyday Loans Group

As at 30 June 2015 ELG provided unsecured loans to more than

37,000 customers, predominantly in lower income groups. It operates

through a national network of 36 branches where loans are

originated, serviced and collected. ELG forms part of STB's

consumer finance division, alongside Moneyway, STB's direct online

and telephone lending business which is being retained.

ELG represents approximately GBP102 million of the GBP189

million receivables of STB's personal lending consumer division as

at 30 June 2015, and generated revenues in FY14 of GBP40.0 million,

compared with GBP49.4 million for the division. ELG generated

pre-exceptional profit before tax of GBP12.9 million in FY14. As at

30 June 2015, ELG had gross assets of GBP107 million and net assets

of GBP7 million.

Further information in relation to ELG, including its

consolidated historic financial statements, is contained in NSF's

announcement today and in the related prospectus to be issued in

due course.

Transaction terms

STB has agreed to sell ELG to NSF for GBP107 million in cash and

GBP20 million in NSF ordinary shares, subject to a net asset

adjustment based on a 30 November 2015 balance sheet. On

completion, NSF will repay current intercompany debt of GBP108

million to STB. The transaction has been structured such that the

economic risk and reward of the ELG business from 30 November 2015

will pass to NSF on completion.

The transaction is being funded by NSF by way of a fully

underwritten placing and open offer and debt facilities of GBP85

million (of which GBP65 million will be drawn down to fund the

Disposal)(the "Facilities"). STB has agreed to provide a proportion

of the funding for the Facilities with a GBP30 million three year

term loan. The loan is secured on ELG's assets.

If the net asset adjustment mechanism referred to above is more

than a material amount, then the Disposal may not proceed. The

determination of the net asset value as at 30 November 2015 is

expected to be completed before the NSF general meeting.

The NSF ordinary shares to be issued to STB will be retained and

subject to a six month lock-up.

STB has also agreed to provide certain services to ELG for a

transitional period post completion.

The Disposal is conditional on NSF shareholder approval of its

equity fundraising, admission of the new NSF shares to the main

market of the London Stock Exchange, regulatory approval and

satisfaction of the conditions to the NSF financing but does not

require shareholder approval by STB or ABG. NSF has agreed to a

break fee of GBP1 million, payable to STB under certain

circumstances, including should the NSF directors change their

recommendation of the acquisition or completion does not occur

(other than as a result of a material breach by STB).

Reasons for and financial effects of the Disposal

Under STB's ownership, ELG has achieved impressive growth,

within the constraints imposed upon it as part of a highly

regulated banking group. An unsolicited approach revealed that NSF,

headed by John Van Kuffeler (former CEO and Chairman of Provident

Financial Group PLC), was prepared to pay an attractive valuation

for ELG.

ELG is expected to target a broader customer base and offer a

wider range of products under NSF's ownership. The greater

opportunity for ELG under NSF's ownership is a reason why STB is

providing funding of GBP30 million to NSF and is accepting NSF

equity as part of the Disposal consideration. The other finance

providers to NSF are Royal Bank of Scotland and Shawbrook Bank.

After repayment of debt, transaction costs and management

incentives, STB expects to book a post-tax profit on the Disposal

of not less than GBP115 million and for the equity base of STB to

almost double to c. GBP250 million.

ABG estimates that the Group's CET1 ratio will grow by 52% to

16.4% as a result of the Disposal.

While in the short term the Disposal is expected to be dilutive

to earnings, given the disposal of ELG's profit streams, the Board

of STB is confident that the proceeds can be reinvested to

accelerate STB's growth prospects and secure new income

streams.

STB is continuing to see strong growth in its Motor, Retail and

SME lending activities. The capital generated by the Disposal will

support the ongoing increase in customer lending balances which now

exceed GBP1 billion for the first time.

STB will provide further commentary in respect of its strategy

when it presents its 2015 final results on 17 March 2016. ABG will

also announce their full year results on 17 March 2016.

STB has reiterated that it anticipates its 2015 full year

results will be in line with market expectations, after taking into

account certain of the deal costs already incurred which are not

dependent on completion of the Disposal.

The Board therefore believes that the Disposal is in the

interests of the Group and represents an excellent opportunity to

realise value for shareholders for reinvestment into STB's existing

profitable consumer and business lending divisions, in line with

STB's stated ambition to shift, over time, the majority of STB's

balance sheet lending into secured lending assets.

Expected timetable

Expected posting of NSF's 7 December 2015

prospectus

---------------------------- --------------------------

NSF general meeting 6 January 2016

---------------------------- --------------------------

FCA approval and completion Decision expected Q1 2016

---------------------------- --------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

(MORE TO FOLLOW) Dow Jones Newswires

December 04, 2015 02:01 ET (07:01 GMT)

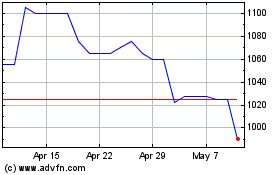

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Apr 2023 to Apr 2024