Arbuthnot Banking Group PLC Pre-Close Trading Update (8038L)

January 14 2016 - 2:00AM

UK Regulatory

TIDMARBB TIDMSTB

RNS Number : 8038L

Arbuthnot Banking Group PLC

14 January 2016

PRESS RELEASE

For Immediate release

14 January 2016

ARBUTHNOT BANKING GROUP PLC

PRE-CLOSE TRADING UPDATE

Arbuthnot Banking Group PLC ("Arbuthnot" or "the Group") today

issues a pre-close trading update ahead of its preliminary results

announcement for the year ended 31 December 2015 which is scheduled

for 17 March 2016.

The Group continued to trade well in the fourth quarter and as a

result expects to report a pre-tax profit in line with market

expectations.

The sale of Everyday Loans is still expected to complete in the

first quarter of 2016 and it is anticipated this will increase the

regulatory capital base of the Group by 74%, before deducting the

surplus minority interest.

Retail Banking

Secure Trust Bank PLC ("STB") saw strong overall growth in its

lending portfolios, which resulted in the total loan book closing

in excess of GBP1BN, a growth rate of over 70%. Its consumer

lending was led by Retail Finance and Motor, with new volumes

materially higher than the prior year. STB has continued to make

progress in the development of its SME lending activities in 2015.

The Bank has seen strong demand for Asset Finance, Invoice Finance

and Real Estate Finance. New lending volumes are 65% higher than in

2014.

Conditions in the savings market remain favourable as the bank

continues to see good inflows of deposits across its product

offerings.

STB remains strongly capitalised and well-funded.

Private Banking

In the third quarter update on 15 October 2015 Arbuthnot Latham

and Co., Ltd. ("AL") noted that it had established a strong

pipeline of lending. As anticipated this lending was drawn down

during the fourth quarter and as a result the customer lending

balances have ended the year in line with market expectations.

The other lines of business in the Private Bank continue to make

good progress while the Commercial Banking division remains on

track with its developments.

During the fourth quarter, AL was in exclusive negotiations to

purchase a second portfolio of residential mortgages. This process

was nearing a successful conclusion when the Bank of International

Settlements ("BIS") published its second consultative document on

its proposed revision to the standardised approach for credit risk

on 10 December 2015.

While it is unclear how those proposals will eventually be

implemented, the management view was that the direction of travel

indicated would result in the anticipated return on capital from

the mortgage portfolio falling below the desired levels being

targeted by the Bank. As a result AL withdrew its offer and the

resultant one off transaction costs of approximately GBP450,000

will be recorded in December 2015.

Once again the Group has made significant progress during 2015,

finishing the year with customer lending in excess of GBP1.6BN, its

highest ever level.

Note: STB is also making a pre-close statement today which

should be read in conjunction with this statement.

-ENDS-

Enquiries:

Arbuthnot Banking Group

Sir Henry Angest, Chairman

and Chief Executive

Andrew Salmon, Group Chief

Operating Officer

James Cobb, Group Finance

Director

David Marshall, Director

of Communications 020 7012 2400

Canaccord Genuity Ltd

(Nominated Advisor)

Sunil Duggal 020 7665 4500

Numis Securities Ltd (Broker)

Chris Wilkinson

Mark Lander 020 7260 1000

Bell Pottinger (Financial

PR)

Ben Woodford

Zoë Pocock 020 3772 2566

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTUOABRNUAAAAR

(END) Dow Jones Newswires

January 14, 2016 02:00 ET (07:00 GMT)

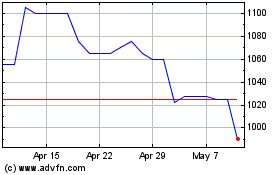

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Apr 2023 to Apr 2024