TIDMARBB TIDMSTB

RNS Number : 5676T

Arbuthnot Banking Group PLC

21 July 2015

ARBUTHNOT BANKING GROUP ("Arbuthnot", "the Group" or "ABG")

Results for the six months to 30 June 2015

"Profitable Growth"

Arbuthnot Banking Group is pleased to announce a half yearly

profit before tax of GBP15.7m, an increase of 65% compared to the

same period last year.

Both banks have continued to grow well and invest for the

future.

Arbuthnot Banking Group PLC is the holding company for Arbuthnot

Latham & Co., Limited and Secure Trust Bank PLC.

FINANCIAL HIGHLIGHTS

-- Profit before tax an increase of 65% to GBP15.7m (H1 2014: GBP9.5m)

-- Underlying profit before tax an increase of 30% to GBP17.1m (H1 2014: GBP13.2m)

-- Customer loans GBP1.4bn (H1 2014: GBP842m)

-- Customer deposits GBP1.6bn (H1 2014: GBP1.1bn)

-- Interim dividend per share 12p (H1 2014: 11p)

OPERATIONAL HIGHLIGHTS

Private Banking - Arbuthnot Latham

-- Profit before tax an increase of 111% to GBP3.7m (H1 2014: GBP1.7m)

-- Customer loans GBP584m (H1 2014: GBP394m)

-- Customer deposits GBP770m (H1 2014: GBP589m)

-- Assets Under Management GBP701m (H1 2014: GBP566m)

Retail Banking - Secure Trust Bank

-- Profit before tax an increase of 40% to GBP16.1m (H1 2014: GBP11.5m)

-- Customer loans GBP852m (H1 2014: GBP448m)

-- Customer deposits GBP835m (H1 2014: GBP477m)

Commenting on the results, Sir Henry Angest, Chairman and Chief

Executive of Arbuthnot, said: "The Group has continued its

profitable growth and as a result the Board has decided to increase

the interim dividend. Both banks have detected an improvement in

customer sentiment following the decisive result of the general

election."

The interim results and presentation are available at

http://www.arbuthnotgroup.com.

Secure Trust Bank PLC is today releasing its interim statement

and it should be read in conjunction with these results.

Footnote - Underlying Profit before tax, adjusted for Secure

Trust Bank share option scheme costs of GBP0.3m and acquisition

accounting adjustments of GBP1m and Arbuthnot Latham transformation

project costs of GBP0.2m.

ENQUIRIES:

Arbuthnot Banking Group 020 7012 2400

Sir Henry Angest, Chairman and Chief Executive

Andrew Salmon, Group Chief Operating Officer

James Cobb, Group Finance Director

David Marshall, Director of Communications

Canaccord Genuity Ltd (Nominated Advisor) 020 7665 4500

Sunil Duggal

Philippa Underwood

Numis Securities Ltd (Broker) 020 7260 1000

Chris Wilkinson

Mark Lander

Bell Pottinger (Financial PR) 020 3772 2563

Ben Woodford

Zoe Pocock

Chairman's Statement

Arbuthnot Banking Group PLC

I am pleased to report that Arbuthnot Banking Group has

continued its profitable growth throughout the first half of 2015.

The Group has recorded a profit before tax of GBP15.7m (H1 2014:

GBP9.5m), which is an increase of 65% compared to the same period

last year. Customer loan balances continue to grow and now stand at

GBP1.4bn and customer deposits have exceeded GBP1.5bn for the first

time.

As a result of the growth in profits the Board has decided to

increase the interim dividend by 1p to 12p which will be paid on 2

October 2015 to shareholders on the register at 4 September

2015.

Private banking subsidiary - Arbuthnot Latham & Co.,

Limited

Arbuthnot Latham has reported a profit before tax for the half

year of GBP3.7m (H1 2014: GBP1.7m), an increase of nearly 111%.

This is a result of the bank's investment by hiring additional

private bankers over the past two years, which has now led to a

substantial increase in new clients opening accounts.

In addition to recruitment in London, the bank has also

developed in its other markets. The South West regional office in

Exeter has agreed a lease and will move into its new offices in the

second half of 2015. The North West regional office in Manchester

has completed further recruitment of both private bankers and a

wealth planner. The Dubai office will break even in July 2015, as

expected, just two years after opening for business.

The bank has shown good growth, with customer loans increasing

to GBP584m (H1 2014: GBP394m), deposits up by 31% to GBP770m (H1

2014: GBP589m) and assets under management growing to GBP701m (H1

2014: GBP566m).

Included in customer loans is GBP101m of the residential

mortgage portfolio that was purchased in December 2014. As planned

at the time of acquisition, the bank successfully transferred

ownership of the loans into its own name in June and at the same

time entered into a servicing agreement with Exact Mortgages.

As the momentum within the business has grown, the bank has

embarked on three significant investment initiatives to support its

future growth. Firstly, the bank has begun a transformational

upgrade of its operations. The programme includes paperless

workflow, standardised customer interaction and the implementation

of a new banking platform. The work is expected to be completed by

the end of 2016. Secondly, Arbuthnot Latham has agreed heads of

terms to secure 10,000 square feet of additional office space in

the City on a short term lease to be occupied in the second half of

2015. Finally, the bank is embarking on its expansion into

Commercial Banking. Initially, the focus will be on providing

business banking services to its entrepreneurial private banking

clients. Recruitment for the new business stream is already

underway with several new bankers expected to join in the remaining

months of 2015. This proposition is not expected to launch until

2016.

Retail banking subsidiary - Secure Trust Bank PLC

The retail bank has reported a record level of first half

profits at GBP16.1m (H1 2014: GBP11.5m), which represents an

increase of 40% on the prior year.

The business has continued to implement its strategic plan

following the significant capital raising it carried out in 2014.

As a result it has seen continued positive trends in its customer

lending balances, which overall have grown by 90% compared to the

prior year period to stand at GBP852m (H1 2014: GBP448m).

Of the more established Consumer Finance businesses, Motor

Finance and Retail Finance have performed well. The Motor Finance

book has increased to GBP152m from GBP128m a year ago, an increase

of 19%. The Retail Finance lending has grown to GBP163m from GBP91m

driven by good lending volumes generated from the sport and leisure

and cycle businesses.

The SME Lending growth has exceeded expectations, largely due to

the Real Estate and Asset Finance products. The Real Estate Finance

loan balances have increased to GBP266m from GBP13m at 30 June

2014, which was shortly after we had started this line of business.

The Asset Finance portfolio has risen to GBP30m and invoice finance

now stands at GBP16m, both of which commenced business within the

last year and are now fully established.

The growth in the portfolios continues to be controlled

according to our strict lending criteria, with impairments at

levels well below our expectations at the time the loans were

originated.

Secure Trust Bank remains funded from the retail deposit

markets. During the first six months of 2015 the bank continued to

see a good flow of deposits and has grown the customer deposit

balances to GBP835m (H1 2014: GBP 477m), an increase of 75%.

Outlook

The economic environment remains favourable, which should allow

both banks to continue their growth. With a business friendly

government in office for the next five years, we expect the banks

will maintain their momentum and continue their long term

investment plans. As ever, we remain vigilant as to the political

and economic events that are developing in Europe, and

elsewhere.

Consolidated Statement of Comprehensive Income

Six Six

months months

ended ended

30 June 30 June

2015 2014

Note GBP000 GBP000

-------------------------------------------- ----- --------- ---------

Interest income 77,374 50,909

Interest expense (12,925) (9,844)

-------------------------------------------- ----- --------- ---------

Net interest income 64,449 41,065

-------------------------------------------- ----- --------- ---------

Fee and commission income 16,373 18,240

Fee and commission expense (1,815) (2,123)

-------------------------------------------- ----- --------- ---------

Net fee and commission income 14,558 16,117

-------------------------------------------- ----- --------- ---------

Operating income 79,007 57,182

-------------------------------------------- ----- --------- ---------

Net impairment loss on financial assets (11,926) (7,502)

Operating expenses (51,345) (40,155)

-------------------------------------------- ----- --------- ---------

Profit before income tax 15,736 9,525

Income tax expense (3,038) (2,862)

-------------------------------------------- ----- --------- ---------

Profit for the period 12,698 6,663

-------------------------------------------- ----- --------- ---------

Revaluation reserve

- Amount transferred to profit and loss - (2)

Cash flow hedging reserve

- Effective portion of changes in fair

value - 378

Other comprehensive income for the period,

net of income tax - 376

-------------------------------------------- ----- --------- ---------

Total comprehensive income for the period 12,698 7,039

-------------------------------------------- ----- --------- ---------

Profit attributable to:

Equity holders of the Company 6,507 3,873

Non-controlling interests 6,191 2,790

-------------------------------------------- ----- --------- ---------

12,698 6,663

-------------------------------------------- ----- --------- ---------

Total comprehensive income attributable

to:

Equity holders of the Company 6,507 4,249

Non-controlling interests 6,191 2,790

-------------------------------------------- ----- --------- ---------

12,698 7,039

-------------------------------------------- ----- --------- ---------

Earnings per share for profit attributable

to the equity holders of the Company

during the period

(expressed in pence per share):

- basic 3 42.6 25.3

- diluted 3 42.4 25.3

Consolidated Statement of Financial Position

At 30 June

2015 2014

GBP000 GBP000

ASSETS

Cash 224,678 172,402

Loans and advances to banks 35,865 98,474

Debt securities held-to-maturity 98,143 49,980

Derivative financial instruments 1,634 101

Loans and advances to customers 1,436,381 841,602

Other assets 17,269 18,573

Financial investments 1,108 1,622

Deferred tax asset 1,770 3,080

Investment in associate 943 943

Intangible assets 11,100 12,235

Property, plant and equipment 13,475 5,617

---------------------------------------- ---------- ----------

Total assets 1,842,366 1,204,629

---------------------------------------- ---------- ----------

EQUITY AND LIABILITIES

Equity attributable to owners of the

parent

Share capital 153 153

Retained earnings 118,822 69,739

Other reserves (1,263) (1,091)

---------------------------------------- ---------- ----------

Non-controlling interests 61,716 20,777

---------------------------------------- ---------- ----------

Total equity 179,428 89,578

---------------------------------------- ---------- ----------

LIABILITIES

Deposits from banks 10,871 1,619

Deposits from customers 1,604,929 1,065,678

Current tax liability 5,487 1,145

Other liabilities 31,256 33,123

Deferred tax liability - 1,720

Debt securities in issue 10,395 11,766

---------------------------------------- ---------- ----------

Total liabilities 1,662,938 1,115,051

---------------------------------------- ---------- ----------

Total equity and liabilities 1,842,366 1,204,629

---------------------------------------- ---------- ----------

Consolidated Statement of Changes in Equity

Attributable to equity holders

of the Group

-----------------------------------------------------------------------------------------

Cash

Capital flow

Share Revaluation redemption Available-for-sale hedging Treasury Retained Non-controlling

capital reserve reserve reserve reserve shares earnings interests Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Balance at 1

January

2015 153 98 20 (250) - (1,131) 114,641 60,038 173,569

Total

comprehensive

income for the

period

Profit for the

six

months ended

30 June

2015 - - - - - - 6,507 6,191 12,698

Other

comprehensive

income, net of

income

tax

Revaluation

reserve

Cash flow

hedging

reserve

Total

comprehensive

income for

the period - - - - - - 6,507 6,191 12,698

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Transactions

with owners,

recorded

directly in

equity

Contributions

by and

distributions

to owners

Equity settled

share

based payment

transactions - - - - - - 56 36 92

Final dividend

relating

to 2014 - - - - - - (2,382) (4,549) (6,931)

Total

contributions

by and

distributions

to owners - - - - - - (2,326) (4,513) (6,839)

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Balance at 30

June

2015 153 98 20 (250) - (1,131) 118,822 61,716 179,428

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Attributable to equity holders

of the Group

-----------------------------------------------------------------------------------------

Cash

Capital flow

Share Revaluation redemption Available-for-sale hedging Treasury Retained Non-controlling

capital reserve reserve reserve reserve shares earnings interests Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Balance at 1

January

2014 153 191 20 (169) (378) (1,131) 67,901 20,327 86,914

Total

comprehensive

income for the

period

Profit for the

six

months ended

30 June

2014 - - - - - - 3,873 2,790 6,663

Other

comprehensive

income, net of

income

tax

Cash flow

hedging

reserve

- Adjustment - (2) - - - - 2 - -

- Effective

portion

of changes

in fair

value - - - - 378 - - - 378

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Total other

comprehensive

income - (2) - - 378 - 2 - 378

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Total

comprehensive

income for

the period - (2) - - 378 - 3,875 2,790 7,041

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Transactions

with owners,

recorded

directly in

equity

Contributions

by and

distributions

to owners

Equity settled

share

based payment

transactions - - - - - - 196 86 282

Final dividend

relating

to 2013 - - - - - - (2,233) (2,426) (4,659)

Total

contributions

by and

distributions

to owners - - - - - - (2,037) (2,340) (4,377)

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Balance at 30

June

2014 153 189 20 (169) - (1,131) 69,739 20,777 89,578

--------------- -------- ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Consolidated Statement of Cash Flows

Six Six

months months

ended ended

30 June 30 June

2015 2014

GBP000 GBP000

------------------------------------------------- ---------- ----------

Cash flows from operating activities

Interest received 73,555 53,775

Interest paid (12,512) (11,240)

Fees and commissions received 11,482 16,117

Cash payments to employees and suppliers (49,020) (54,804)

Taxation paid (1,163) (3,144)

--------------------------------------------------- ---------- ----------

Cash flows from operating profits before

changes in operating assets and liabilities 22,342 704

Changes in operating assets and liabilities:

- net decrease in derivative financial

instruments 6 36

- net increase in loans and advances

to customers (283,097) (100,072)

- net increase in other assets (403) (1,306)

- net decrease in deposits from banks (16,786) (384)

- net increase in amounts due to customers 410,644 107,887

- net (decrease)/increase in other liabilities (3,728) 2,106

--------------------------------------------------- ---------- ----------

Net cash inflow from operating activities 128,978 8,971

--------------------------------------------------- ---------- ----------

Cash flows from investing activities

Purchase of financial investments (1,580) -

Disposal of financial investments 1,602 -

Purchase of computer software (1,200) (765)

Purchase of property, plant and equipment (1,648) (306)

Proceeds from sale of property, plant

and equipment - 42

Purchases of debt securities (152,243) (37,766)

Proceeds from redemption of debt securities 145,783 7,252

--------------------------------------------------- ---------- ----------

Net cash outflow from investing activities (9,286) (31,543)

--------------------------------------------------- ---------- ----------

Cash flows from financing activities

Dividends paid (6,931) (4,659)

--------------------------------------------------- ---------- ----------

Net cash used in financing activities (6,931) (4,659)

--------------------------------------------------- ---------- ----------

Net increase/(decrease) in cash and cash

equivalents 112,761 (27,231)

Cash and cash equivalents at 1 January 147,782 298,107

--------------------------------------------------- ---------- ----------

Cash and cash equivalents at 30 June 260,543 270,876

--------------------------------------------------- ---------- ----------

1. Operating segments

The Group is organised into three main operating segments as

disclosed below:

1) Retail banking - incorporating household cash management,

personal lending and banking and insurance services.

2) UK Private banking - incorporating private banking and wealth

management.

3) Group Centre - ABG Group Centre management.

Transactions between the operating segments are on normal

commercial terms. Centrally incurred expenses are charged to

operating segments on an appropriate pro-rata basis. Segment assets

and liabilities comprise operating assets and liabilities, being

the majority of the balance sheet.

Retail UK Private Group

banking banking Centre Total

Six months ended 30 June 2015 GBP000 GBP000 GBP000 GBP000

--------------------------------- ---------- ----------- ------------ ----------

Interest revenue 64,162 13,460 60 77,682

Inter-segment revenue (159) (89) (60) (308)

--------------------------------- ---------- ----------- ------------ ----------

Interest revenue from external

customers 64,003 13,371 - 77,374

--------------------------------- ---------- ----------- ------------ ----------

Fee and commission income 9,482 6,891 - 16,373

--------------------------------- ---------- ----------- ------------ ----------

Revenue from external customers 73,485 20,262 - 93,747

--------------------------------- ---------- ----------- ------------ ----------

Interest expense (9,769) (3,162) 172 (12,759)

Subordinated loan note interest - - (166) (166)

Fee and commission expense (1,635) (180) - (1,815)

Add back inter-segment revenue 159 89 (248) -

--------------------------------- ---------- ----------- ------------ ----------

Segment operating income 62,240 17,009 (242) 79,007

--------------------------------- ---------- ----------- ------------ ----------

Impairment losses (11,218) (708) - (11,926)

Operating expenses (34,873) (12,640) (3,832) (51,345)

Segment profit / (loss) before

tax 16,149 3,661 (4,074) 15,736

--------------------------------- ---------- ----------- ------------ ----------

Income tax (expense) / income (3,132) - 94 (3,038)

--------------------------------- ---------- ----------- ------------ ----------

Segment profit / (loss) after

tax 13,017 3,661 (3,980) 12,698

--------------------------------- ---------- ----------- ------------ ----------

Loans and advances to customers 852,291 584,090 - 1,436,381

Other assets 149,701 281,135 (24,851) 405,985

--------------------------------- ---------- ----------- ------------ ----------

Segment total assets 1,001,992 865,225 (24,851) 1,842,366

--------------------------------- ---------- ----------- ------------ ----------

Customer deposits 835,083 769,846 - 1,604,929

Other liabilities 38,555 52,495 (33,041) 58,009

--------------------------------- ---------- ----------- ------------ ----------

Segment total liabilities 873,638 822,341 (33,041) 1,662,938

--------------------------------- ---------- ----------- ------------ ----------

Other segment items:

Capital expenditure (1,435) (1,313) - (2,748)

Depreciation and amortisation (799) (587) (5) (1,391)

--------------------------------- ---------- ----------- ------------ ----------

The "Group Centre" segment above includes the parent entity and

all intercompany eliminations. Segment profit is shown prior to any

intra-group eliminations. The UK private bank opened a branch in

Dubai in 2013, which generated GBP807k (2014: GBP225k) fee income

and had operating costs of GBP873k (2014: GBP745k). Other than the

Dubai branch, all other operations of the Group are conducted

wholly within the United Kingdom and therefore geographical

information is not presented.

Retail UK Private Group

banking banking Centre Total

Six months ended 30 June 2014 GBP000 GBP000 GBP000 GBP000

--------------------------------- --------- ----------- --------- ----------

Interest revenue 41,576 9,454 58 51,088

Inter-segment revenue (31) (87) (61) (179)

--------------------------------- --------- ----------- --------- ----------

Interest revenue from external

customers 41,545 9,367 (3) 50,909

--------------------------------- --------- ----------- --------- ----------

Fee and commission income 11,227 7,013 - 18,240

--------------------------------- --------- ----------- --------- ----------

Revenue from external customers 52,772 16,380 (3) 69,149

--------------------------------- --------- ----------- --------- ----------

Interest expense (7,213) (2,460) 29 (9,644)

Subordinated loan note interest - - (200) (200)

Fee and commission expense (1,825) (298) - (2,123)

Add back inter-segment revenue 31 87 (118) -

--------------------------------- --------- ----------- --------- ----------

Segment operating income 43,765 13,709 (292) 57,182

--------------------------------- --------- ----------- --------- ----------

Impairment losses (6,352) (1,150) - (7,502)

Operating expenses (25,899) (10,822) (3,434) (40,155)

Segment profit / (loss) before

tax 11,514 1,737 (3,726) 9,525

--------------------------------- --------- ----------- --------- ----------

Income tax (expense) / income (3,057) (88) 283 (2,862)

--------------------------------- --------- ----------- --------- ----------

Segment profit / (loss) after

tax 8,457 1,649 (3,443) 6,663

--------------------------------- --------- ----------- --------- ----------

Loans and advances to customers 447,848 393,754 - 841,602

Other assets 122,576 290,903 (50,452) 363,027

--------------------------------- --------- ----------- --------- ----------

Segment total assets 570,424 684,657 (50,452) 1,204,629

--------------------------------- --------- ----------- --------- ----------

Customer deposits 476,783 588,895 - 1,065,678

Other liabilities 30,209 65,752 (46,588) 49,373

--------------------------------- --------- ----------- --------- ----------

Segment total liabilities 506,992 654,647 (46,588) 1,115,051

--------------------------------- --------- ----------- --------- ----------

Other segment items:

Capital expenditure (625) (445) (1) (1,071)

Depreciation and amortisation (1,488) (308) (6) (1,802)

--------------------------------- --------- ----------- --------- ----------

2. Underlying profit reconciliation

The profit before tax as reported in the operating segments can

be reconciled to the underlying profit for the year as disclosed in

the tables below.

Arbuthnot Secure Arbuthnot

Latham Trust Banking

Underlying profit reconciliation & Co. Bank Group

Six months ended 30 June 2015 GBP000 GBP000 GBP000

----------------------------------- ---------- ------- ----------

Profit before tax 3,661 16,149 15,736

ELL & V12 fair value amortisation - 950 950

STB acquisition costs - 4 4

STB share options - 271 271

AL transformation project 170 - 170

----------------------------------- ---------- ------- ----------

Underlying profit 3,831 17,374 17,131

----------------------------------- ---------- ------- ----------

Basic earnings per share (pence) 46.8

Arbuthnot Secure Arbuthnot

Latham Trust Banking

Underlying profit reconciliation & Co. Bank Group

Six months ended 30 June 2014 GBP000 GBP000 GBP000

----------------------------------- ---------- ------- ----------

Profit before tax 1,737 11,514 9,525

ELL & V12 fair value amortisation - 2,767 2,767

STB acquisition costs - 183 183

STB share options - 754 754

----------------------------------- ---------- ------- ----------

Underlying profit 1,737 15,218 13,229

----------------------------------- ---------- ------- ----------

Basic earnings per share (pence) 38.1

3. Earnings per ordinary share

Basic

Earnings per ordinary share are calculated on the net basis by

dividing the profit attributable to equity holders of the Company

of GBP6,607,000 (H1 2014: GBP3,873,000) by the weighted average

number of ordinary shares 15,279,322 (H1 2014: 15,279,322) in issue

during the year.

Diluted

Diluted earnings per ordinary share are calculated on the net

basis by dividing the profit attributable to equity holders of the

Company of GBP6,607,000 (H1 2014: GBP3,873,000) by the weighted

average number of ordinary shares 15,279,322 (H1 2014: 15,279,322)

in issue during the year, as noted above, as well as the number of

dilutive share options in issue during the year. The number of

dilutive shares in issue at the half year was 53,699 (H1 2014:

42,533), being based on the number of options granted of 200,000

(H1 2014: 200,000), the weighted exercise price of 994 pence (H1

2014: 994 pence) per option and the average share price during the

year of 1359 pence (H1 2014: 1300 pence).

4. Basis of reporting

The interim financial statements have been prepared on the basis

of accounting policies set out in the Group's 2014 statutory

accounts as amended by standards and interpretations effective

during 2015 and in accordance with IAS 34 "Interim Financial

Reporting" (except for the comparatives in the statement of

financial position). The directors do not consider the fair value

of the assets and liabilities presented in these financial

statements to be materially different from their carrying

value.

The statements were approved by the Board of Directors on 20

July 2015 and are unaudited. The interim financial statements will

be posted to shareholders and copies may be obtained from The

Company Secretary, Arbuthnot Banking Group PLC, Arbuthnot House, 7

Wilson Street, London EC2M 2SN.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PKKDDABKDQOB

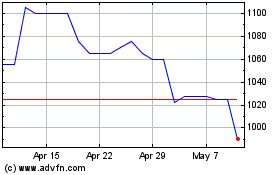

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Apr 2023 to Apr 2024