TIDMARBB

RNS Number : 3046L

Arbuthnot Banking Group PLC

18 July 2017

18 July 2017

For immediate release

ARBUTHNOT BANKING GROUP ("Arbuthnot", "the Group" or "ABG")

Results for the six months to 30 June 2017

"Diversification continues"

Arbuthnot Banking Group announces a half yearly profit before

tax of GBP2.5m, compared with a loss in the prior year of

GBP2.4m.

Included in the profit figure for the six months ended 30 June

is an estimated* income of GBP2.1m for Secure Trust Bank PLC

("STB") being an associated undertaking.

Arbuthnot Banking Group PLC is the holding company for Arbuthnot

Latham & Co., Limited and Secure Trust Bank PLC is an

associated company.

FINANCIAL HIGHLIGHTS

-- Profit before tax GBP2.5m (H1 2016: loss GBP2.4m)

-- Underlying profit before tax GBP2.7m (H1 2016: GBP2.0m)

-- Earnings per share GBP0.17 (H1 2016: GBP11.11)*

-- Interim dividend per share 14p (H1 2016: 13p)

-- Net assets GBP234m (H1 2016: GBP282m)**

-- Net assets per share GBP15.33 (H1 2016: GBP18.52)

OPERATIONAL HIGHLIGHTS

-- Customer loans GBP879m (H1 2016: GBP657m), increased by 34%

-- Customer deposits GBP1,229m (H1 2016: GBP940m), growth of 31%

-- Assets Under Management GBP1,001m (H1 2016: GBP797m), up by 26%

-- Completion of acquisition of Renaissance Asset Finance

Commenting on the results, Sir Henry Angest, Chairman and Chief

Executive of Arbuthnot, said: "The Group has made good progress in

its plans to diversify, the Renaissance Asset Finance acquisition

has been completed and the Commercial Banking business is gaining

momentum. It is also pleasing to see customer deposits and assets

under management pass the significant milestone of GBP1 billion for

the first time. However, with uncertain economic and political

times ahead we remain cautious in our decision making."

The interim results are available at

http://www.arbuthnotgroup.com.

*The estimate for associate income is based on our 18.6% share

of the after tax earnings of Secure Trust calculated using the full

year market consensus of the equity research performed on STB, with

an assumed straight-line growth in profits over the first half of

the year. STB is scheduled to announce its interim results on 22

August 2017. For the avoidance of doubt, ABG's estimate for the

income from STB is not an estimate being made on its behalf. The

Group's profit before tax, profit after tax and earnings per share

therefore include this estimated income from STB.

**The prior year includes the impact of the gains arising on the

sale of Everyday Loans and the deconsolidation of STB.

**The fall in net assets is as a result of the payment of a

GBP44m special dividend and the final dividend for 2016.

ENQUIRIES:

Arbuthnot Banking Group 0207 012 2400

Sir Henry Angest, Chairman and Chief Executive

Andrew Salmon, Group Chief Operating Officer

James Cobb, Group Finance Director

Stifel Nicolaus Europe Ltd trading as KBW (Nomad and Joint

Broker) 0207 710 7600

Robin Mann

Gareth Hunt

Stewart Wallace

Numis Securities Ltd (Joint Broker) 0207 260 1000

Chris Wilkinson

Andrew Holloway

Bell Pottinger (Financial PR) 0203 772 2566

Ben Woodford

Dan de Belder

Sam Cartwright

Chairman's Statement

Arbuthnot Banking Group PLC

I am pleased to report that Arbuthnot Banking Group ("ABG") has

delivered a profit before tax of GBP2.5m for the first six months

of 2017, which includes an estimated profit from our associate,

Secure Trust Bank PLC ("STB"), who will publish its interim results

on 22 August. This compares to a loss of GBP2.4m for the same

period of 2016.

On 28 April, the Group successfully completed the acquisition of

Renaissance Asset Finance, a lender of specialist assets including

vintage and high value cars and business assets. The impact of its

earnings has only been included in the last two months of the first

half. This acquisition is a clear demonstration of the Group's long

held strategy of diversification of income streams that should

provide some protection from either an economic slow-down or short

term turbulence, and also from increased competition. It has been

clear from the number of new start-up banks and non bank lenders

that the market place is becoming more competitive. However, we

believe that the Group has two significant advantages that should

ensure its long term prosperity. Firstly, it has a long standing

heritage and market knowledge. This experience is required to run a

bank properly and has to be earned over time, it cannot always

simply be bought by hiring a few individuals, but it has to be

embedded in the DNA of the organisation. Secondly, our ability to

attract long term low cost deposits provides a competitive

advantage.

Given this long term confident view, the Board has decided to

increase the interim dividend by 1p to 14p, which will be paid on

29 September 2017 to shareholders on the register on 1

September.

Arbuthnot Latham & Co., Limited

Arbuthnot Latham ("AL") has reported a profit before tax for the

first half of the year of GBP4.9m (H1 2016: GBP4.5m). When the

impact of the gain of GBP1.7m that was realised on the sale of Visa

shares in 2016 is removed, it shows an increase of 75%.

The forward looking indicators of the bank suggest that AL is

continuing to grow at a respectable rate. Customer deposits at

GBP1.2bn (H1 2016: GBP0.94bn) and Assets under Management of GBP1bn

(H1 2016: GBP0.8bn), have passed the significant milestones of one

billion each during the first six months. With loans rapidly

approaching GBP0.9bn at GBP0.88bn (H1 2016: GBP0.66bn), the

business is growing at over 25% in all measures of these lead

indicators. The business hopes to end the year with all three

measures having grown through the billion mark.

The Private Bank has led the way mainly in attracting new

customers to the deposit and investment products of the bank. It

has also been able to write record volumes of new loans in the

period, with new originations reaching GBP76m in the first half, an

increase of 27% on the prior year. However, the Private Bank has

experienced a significant level of loan repayments, which resulted

in the Private Banking loan book remaining at the same level as the

prior year.

The Commercial Bank has continued to invest in new staff and now

has 44 employees. At a direct contribution level, the Commercial

Bank has broken even during the first half of the year. Its

customer balances have continued to grow at healthy rates and at

the end of June its loan book was GBP147m (H1 2016: GBP16m) and

deposit book was GBP160m (H1 2016: GBP23m). The business is now

showing signs of good momentum and has a strong pipeline of

business for the remaining months of the year.

Renaissance Asset Finance has shown that its distribution

networks remain strong and more importantly loyal. Prior to AL

acquiring the business its certainty of funding was not clear and

as a consequence, its balance sheet reduced in size as it was not

able to meet all broker enquiries. At the time of the completion of

the acquisition, the loan book had fallen to GBP57m. During its

first two months as part of the Group it has rebounded well and

returned to growth and closed the period at GBP60m, an increase of

5% in its first two months.

Overall impairments remain low and consistent with the prior

year. This is in line with the expectations of the business,

especially given the secured nature of the lending and the fact

that the Bank refuses to chase volumes at the expense of relaxing

loan to value lending covenants.

The business continues to work through its IFRS 9 work plan and

is currently not expecting it to have a material impact on the

capital resources of either the bank or ABG. The only real change

will be the need to recognise the future twelve months' expected

losses from the current performing loans.

Secure Trust Bank PLC

We have recorded GBP2.1m of income related to STB. This

represents an estimate of our 18.6% share of the after tax earnings

of the investment in our associate undertaking. In calculating this

estimate, the Company has used the full year market consensus of

the equity research performed on STB with an assumed straight-line

growth in profits over the first half, noting the trading statement

made by STB on 3 May 2017 in relation to STB's first quarter

trading being in-line with STB's management's expectations.

Outlook

The short term geopolitical and macro economic environment seems

more uncertain than it has for a number of years. However, the

Group remains focused on developing new areas of growth to

diversify its income streams and thus deploying profitably its

sizeable capital surplus. As a result of this, the Group remains

confident that it is well placed to take advantage of any

opportunities that may arise as a result of it being well

capitalised and funded.

Consolidated Statement of Comprehensive Income

Six Six

months months

ended ended

30 June 30 June

2017 2016

Note GBP000 GBP000

-------------------------------------------- ----- --------- ---------

Interest income 22,106 15,988

Interest expense (2,839) (4,105)

-------------------------------------------- ----- --------- ---------

Net interest income 19,267 11,883

-------------------------------------------- ----- --------- ---------

Fee and commission income 6,183 7,708

Fee and commission expense (322) (376)

-------------------------------------------- ----- --------- ---------

Net fee and commission income 5,861 7,332

-------------------------------------------- ----- --------- ---------

Operating income 25,128 19,215

-------------------------------------------- ----- --------- ---------

Net impairment loss on financial assets (343) (388)

Other income 2 1,104 1,665

Profit from associates 1 2,145 265

Operating expenses 3 (25,499) (23,121)

-------------------------------------------- ----- --------- ---------

Profit / (loss) before income tax 2,535 (2,364)

Income tax expense (90) (539)

-------------------------------------------- ----- --------- ---------

Profit / (loss) after income tax from

continuing operations 2,445 (2,903)

Profit from discontinued operations after

tax 6 - 228,110

-------------------------------------------- ----- --------- ---------

Profit for the period 2,445 225,207

-------------------------------------------- ----- --------- ---------

Other comprehensive income

Items that are or may be reclassified

to profit or loss

Available-for-sale reserve - (2,321)

Available-for-sale reserve - Associate 389 (209)

Tax on other comprehensive income (78) 262

-------------------------------------------- ----- --------- ---------

Other comprehensive income for the period,

net of tax 311 (2,268)

-------------------------------------------- ----- --------- ---------

Total comprehensive income for the period 2,756 222,939

-------------------------------------------- ----- --------- ---------

Profit attributable to:

Equity holders of the Company 2,445 163,781

Non-controlling interests - 61,426

-------------------------------------------- ----- --------- ---------

2,445 225,207

-------------------------------------------- ----- --------- ---------

Total comprehensive income attributable

to:

Equity holders of the Company 2,756 161,513

Non-controlling interests - 61,426

-------------------------------------------- ----- --------- ---------

2,756 222,939

-------------------------------------------- ----- --------- ---------

Earnings per share for profit attributable

to the equity holders of the Company

during the period

(expressed in pence per share):

- basic 5 16.5 1,111.2

- diluted 5 16.5 1,107.5

Consolidated Statement of Financial Position

At 30 June

2017 2016

GBP000 GBP000

ASSETS

Cash and balances at central banks 253,309 293,348

Loans and advances to banks 35,898 33,499

Debt securities held-to-maturity 158,515 103,131

Derivative financial instruments 1,816 1,228

Loans and advances to customers 879,348 657,122

Other assets 20,101 14,403

Financial investments 2,173 2,469

Deferred tax asset 1,689 1,714

Investment in associate 82,132 87,114

Intangible assets 16,954 7,004

Property, plant and equipment 4,490 5,216

Investment property 53,339 50,200

---------------------------------------- ---------- ----------

Total assets 1,509,764 1,256,448

---------------------------------------- ---------- ----------

EQUITY AND LIABILITIES

Equity attributable to owners of the

parent

Share capital 153 153

Retained earnings 235,178 283,079

Other reserves (1,051) (1,320)

---------------------------------------- ---------- ----------

Total equity 234,280 281,912

---------------------------------------- ---------- ----------

LIABILITIES

Deposits from banks 6,579 1,986

Deposits from customers 1,234,445 939,539

Current tax liability 450 488

Other liabilities 21,042 20,335

Debt securities in issue 12,968 12,188

---------------------------------------- ---------- ----------

Total liabilities 1,275,484 974,536

---------------------------------------- ---------- ----------

Total equity and liabilities 1,509,764 1,256,448

---------------------------------------- ---------- ----------

Consolidated Statement of Changes in Equity

Attributable to equity

holders of the Group

-------------------------------------------------------------------------------

Capital

Share Revaluation redemption Available-for-sale Treasury Retained Non-controlling

capital reserve reserve reserve shares earnings interests Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- --------

Balance at 1

January 2017 153 - 20 (251) (1,131) 235,567 - 234,358

Total comprehensive

income

for the period

Profit for the six

months

ended 30 June 2017 - - - - - 2,445 - 2,445

Other comprehensive

income,

net of income tax

Available-for-sale

reserve - - - 389 - - - 389

Available-for-sale

reserve

- Associate - - - (78) - - - (78)

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- --------

Total other

comprehensive

income - - - 311 - - - 311

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- --------

Total comprehensive

income

for the period - - - 311 - 2,445 - 2,756

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- --------

Transactions with

owners,

recorded directly

in equity

Contributions by

and distributions

to owners

Equity settled

share based

payment

transactions - - - - - (154) - (154)

Final dividend

relating

to 2016 - - - - - (2,680) - (2,680)

Total contributions

by

and distributions

to owners - - - - - (2,834) - (2,834)

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- --------

Balance at 30 June

2017 153 - 20 60 (1,131) 235,178 - 234,280

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- --------

Attributable to equity

holders of the Group

-------------------------------------------------------------------------------

Capital

Share Revaluation redemption Available-for-sale Treasury Retained Non-controlling

capital reserve reserve reserve shares earnings interests Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- ----------

Balance at 1

January 2016 153 98 20 1,047 (1,131) 123,330 67,887 191,404

Total comprehensive

income

for the period

Profit for the six

months

ended 30 June 2016 - - - - - 163,781 61,426 225,207

Other comprehensive

income,

net of income tax

Available-for-sale

reserve - - - (1,572) - - (487) (2,059)

Available-for-sale

reserve

- Associate - - - (209) - - - (209)

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- ----------

Total other

comprehensive

income - - - (1,781) - - (487) (2,268)

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- ----------

Total comprehensive

income

for the period - - - (1,781) - 163,781 60,939 222,939

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- ----------

Transactions with

owners,

recorded directly

in equity

Contributions by

and distributions

to owners

STB loss of control - (98) - 525 - (427) (124,046) (124,046)

Equity settled

share based

payment

transactions - - - - - (1,074) 31 (1,043)

Final dividend

relating

to 2015 - - - - - (2,531) (4,811) (7,342)

Total contributions

by

and distributions

to owners - (98) - 525 - (4,032) (128,826) (132,431)

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- ----------

Balance at 30 June

2016 153 - 20 (209) (1,131) 283,079 - 281,912

-------------------- -------- ------------ ----------- ------------------- --------- ---------- ---------------- ----------

Consolidated Statement of Cash Flows

Six Six

months months

ended ended

30 June 30 June

2017 2016

GBP000 GBP000

------------------------------------------------- ---------- ----------

Cash flows from operating activities

Interest received 20,004 87,027

Interest paid (3,347) (16,490)

Fees and commissions received 4,966 12,987

Net trading and other income 1,104 -

Cash payments to employees and suppliers (16,392) (63,503)

Taxation paid - (6,053)

--------------------------------------------------- ---------- ----------

Cash flows from operating profits before

changes in operating assets and liabilities 6,335 13,968

Changes in operating assets and liabilities:

- net decrease in derivative financial

instruments (527) 127

- net (increase)/decrease in loans and

advances to customers (121,290) 956,385

- net (increase)/decrease in other assets (7,720) 22,212

- net increase/(decrease) in deposits

from banks 3,379 (53,319)

- net increase/(decrease) in amounts

due to customers 236,796 (990,299)

- net increase/(decrease) in other liabilities 3,960 (20,342)

--------------------------------------------------- ---------- ----------

Net cash inflow/(outflow) from operating

activities 120,933 (71,268)

--------------------------------------------------- ---------- ----------

Cash flows from investing activities

Purchase of financial investments - (462)

Disposal of financial investments - 837

Purchase of computer software (8,797) (5,071)

Proceeds from sale of software - 8,062

Purchase of investment property - (50,200)

Purchase of property, plant and equipment (361) (939)

Proceeds from sale of property, plant

and equipment - 8,815

Disposal of subsidiaries, net of cash

and cash equivalents disposed - 65,695

Purchases of debt securities (108,363) (59,893)

Proceeds from redemption of debt securities 55,772 41,424

--------------------------------------------------- ---------- ----------

Net cash (outflow)/inflow from investing

activities (61,749) 8,268

--------------------------------------------------- ---------- ----------

Cash flows from financing activities

Dividends paid (2,680) (7,342)

--------------------------------------------------- ---------- ----------

Net cash used in financing activities (2,680) (7,342)

--------------------------------------------------- ---------- ----------

Net increase/(decrease) in cash and cash

equivalents 56,504 (70,342)

Cash and cash equivalents at 1 January 232,703 397,189

--------------------------------------------------- ---------- ----------

Cash and cash equivalents at 30 June 289,207 326,847

--------------------------------------------------- ---------- ----------

1. Operating segments

The Group is organised into three main operating segments as

disclosed below:

1) Retail banking (associate) - incorporating household cash

management, personal lending and banking and insurance

services.

2) UK Private banking - incorporating private banking, wealth

management and commercial banking.

3) Group Centre - ABG Group Centre management.

Transactions between the operating segments are on normal

commercial terms. Centrally incurred expenses are charged to

operating segments on an appropriate pro-rata basis. Segment assets

and liabilities comprise operating assets and liabilities, being

the majority of the balance sheet.

In calculating the Income from associates, the Company has used

an estimate based on the full year market consensus of the equity

research performed on STB with an assumed straight-line growth in

profits over the first half, noting the trading statement made by

STB on 3 May 2017 in relation to STB's first quarter trading being

in-line with STB's management's expectations. The Group's profit

before tax, profit after tax and earnings per share therefore

include this estimated income from STB..

Continuing operations

Retail

Bank

Associate UK Private Group

Income banking Centre Total

Six months ended 30 June 2017 GBP000 GBP000 GBP000 GBP000

------------------------------------------ ----------- ----------- --------- ----------

Interest revenue - 22,184 117 22,301

Inter-segment revenue - (78) (117) (195)

------------------------------------------ ----------- ----------- --------- ----------

Interest revenue from external customers - 22,106 - 22,106

------------------------------------------ ----------- ----------- --------- ----------

Fee and commission income - 6,183 - 6,183

------------------------------------------ ----------- ----------- --------- ----------

Revenue from external customers - 28,289 - 28,289

------------------------------------------ ----------- ----------- --------- ----------

Interest expense - (2,782) 117 (2,665)

Add back inter-segment revenue - 78 (78) -

Subordinated loan note interest - - (174) (174)

Fee and commission expense - (322) - (322)

------------------------------------------ ----------- ----------- --------- ----------

Segment operating income - 25,263 (135) 25,128

------------------------------------------ ----------- ----------- --------- ----------

Impairment losses - (343) - (343)

Other income - 1,588 (484) 1,104

Income from associates 2,145 - - 2,145

Operating expenses - (21,632) (3,867) (25,499)

------------------------------------------ ----------- ----------- --------- ----------

Segment profit / (loss) before tax 2,145 4,876 (4,486) 2,535

------------------------------------------ ----------- ----------- --------- ----------

Income tax (expense) / income - (90) - (90)

------------------------------------------ ----------- ----------- --------- ----------

Segment profit / (loss) after tax 2,145 4,786 (4,486) 2,445

------------------------------------------ ----------- ----------- --------- ----------

Segment profit / (loss) after tax 2,145 4,786 (4,486) 2,445

------------------------------------------ ----------- ----------- --------- ----------

Loans and advances to customers - 879,348 - 879,348

Other assets - 551,239 79,177 630,416

------------------------------------------ ----------- ----------- --------- ----------

Segment total assets - 1,430,587 79,177 1,509,764

------------------------------------------ ----------- ----------- --------- ----------

Customer deposits - 1,234,445 - 1,234,445

Other liabilities - 111,199 (70,160) 41,039

------------------------------------------ ----------- ----------- --------- ----------

Segment total liabilities - 1,345,644 (70,160) 1,275,484

------------------------------------------ ----------- ----------- --------- ----------

Other segment items:

Capital expenditure - (2,658) - (2,658)

Depreciation and amortisation - (1,046) (1) (1,047)

------------------------------------------ ----------- ----------- --------- ----------

The "Group Centre" segment above includes the parent entity and

all intercompany eliminations. Segment profit is shown prior to any

intra-group eliminations. The UK private bank opened a branch in

Dubai in 2013. Other than the Dubai branch, all other operations of

the Group are conducted wholly within the United Kingdom and

therefore geographical information is not presented.

Discontinued

operations (Retail

Banking) Continuing operations

Retail

Bank

Associate UK Private Group Group

ELL STB Total Income banking Centre Total Total

Six months ended GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

30 June 2016

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Interest revenue 11,137 57,498 68,635 - 16,112 68 16,180

Inter-segment revenue - - - - (128) (64) (192)

------------------------ -------- --------- --------- ----------- ----------- ---------- ----------

Interest revenue

from external

customers 11,137 57,498 68,635 - 15,984 4 15,988

------------------------ -------- --------- --------- ----------- ----------- ---------- ----------

Fee and commission

income 147 7,981 8,128 - 7,708 - 7,708

------------------------ -------- --------- --------- ----------- ----------- ---------- ----------

Revenue from external

customers 11,284 65,479 76,763 - 23,692 4 23,696

------------------------ -------- --------- --------- ----------- ----------- ---------- ----------

Interest expense - (12,107) (12,107) - (3,996) 64 (3,932)

Add back inter-segment

revenue - - - - 128 (128) -

Subordinated loan

note interest - - - - - (173) (173)

Fee and commission

expense (124) (779) (903) - (376) - (376)

------------------------ -------- --------- --------- ----------- ----------- ---------- ----------

Segment operating

income 11,160 52,593 63,753 - 19,448 (233) 19,215

------------------------ -------- --------- --------- ----------- ----------- ---------- ----------

Impairment losses (2,610) (12,172) (14,782) - (388) - (388)

Other income - - - - 2,209 (544) 1,665

Income from associates - - - 265 - - 265

Operating expenses (6,016) (29,073) (35,089) - (16,762) (6,359) (23,121)

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Segment profit

/ (loss) before

tax 2,534 11,348 13,882 265 4,507 (7,136) (2,364) 11,518

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Income tax (expense)

/ income (507) (2,199) (2,706) - (48) (491) (539) (3,245)

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Segment profit

/ (loss) after

tax 2,027 9,149 11,176 265 4,459 (7,627) (2,903) 8,273

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Profit on sale

of discontinued

operations 116,754 100,180 216,934 - - - - -

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Segment profit

/ (loss) after

tax 118,781 109,329 228,110 265 4,459 (7,627) (2,903) 225,207

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Loans and advances

to customers - 657,122 - 657,122 657,122

Other assets - 515,489 83,837 599,326 599,326

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Segment total assets - 1,172,611 83,837 1,256,448 1,256,448

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Customer deposits - 939,539 - 939,539 939,539

Other liabilities - 179,577 (144,580) 34,997 34,997

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Segment total

liabilities - 1,119,116 (144,580) 974,536 974,536

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

Other segment items:

Capital expenditure - (53,721) - (53,721) (53,721)

Depreciation and

amortisation - (753) (1) (754) (754)

------------------------ -------- --------- --------- ----------- ----------- ---------- ---------- ----------

2. Other income

Other income of GBP1.1m in 2017 mainly consist out of rental

income received from the investment property, while 2016 included a

GBP1.6m gain realised as a result of the completion of the Visa

Europe transaction.

3. Operating expenses

In 2016 operating expenses included Group bonuses paid relating

to the sale of the Everyday Loans Group amounting to GBP2.3m.

4. Underlying profit reconciliation

The profit before tax from continuing operations as reported in

the operating segments can be reconciled to the underlying profit

from continuing operations for the year as disclosed in the tables

below.

Arbuthnot Arbuthnot

Latham Banking

Underlying profit reconciliation & Co. Group

Six months ended 30 June 2017 GBP000 GBP000

---------------------------------------------- ---------- ----------

Profit before tax from continuing operations 4,876 2,535

Investment in operating systems 97 97

Acquisition costs 67 67

---------------------------------------------- ---------- ----------

Underlying profit 5,040 2,699

---------------------------------------------- ---------- ----------

Arbuthnot Arbuthnot

Latham Banking

Underlying profit reconciliation & Co. Group

Six months ended 30 June 2016 GBP000 GBP000

--------------------------------------------- ---------- ----------

Profit / (loss) before tax from continuing

operations 4,507 (2,364)

ABG Group bonuses relating to sale of ELL - 2,304

STB full year equivalent associate income* - 2,261

AL realised profit on AFS investment (Visa) (1,665) (1,665)

Investment in operating systems 260 260

AL commercial banking investment 567 567

AL incremental office space 650 650

--------------------------------------------- ---------- ----------

Underlying profit 4,319 2,013

--------------------------------------------- ---------- ----------

* - STB associate income adjustment (excl. ELL & bonuses

relating to ELL sale) as if received from 1 January

2016.

5. Earnings per ordinary share

Basic

Basic earnings per ordinary share are calculated by dividing the

profit after tax attributable to equity holders of the Company by

the weighted average number of ordinary shares 14,815,045 (2016:

14,738,548) in issue during the period. On 30 March 2017, Sir Henry

Angest bought 150,500 shares previously held in an ESOP trust.

Diluted

Diluted earnings per ordinary share are calculated by dividing

the dilutive profit after tax attributable to equity holders of the

Company by the weighted average number of ordinary shares in issue

during the period, as well as the number of dilutive share options

in issue during the period. There were no dilutive share options in

issue at the end of June (2016: 50,000).

Six Six

months months

ended ended

30 June 30 June

2017 2016

Profit attributable GBP000 GBP000

------------------------------------------------ --------- ---------

Total profit after tax attributable to equity

holders of the Company 2,445 163,781

Profit / (loss) after tax from continuing

operations attributable to equity holders

of the Company 2,445 (2,903)

Profit after tax from discontinuing operations

(ELL) attributable to equity holders of the

Company - 61,667

Profit after tax from discontinuing operations

(STB) attributable to equity holders of the

Company - 105,017

------------------------------------------------ --------- ---------

Six Six

months months

ended ended

30 June 30 June

2017 2016

Dilutive profit attributable GBP000 GBP000

------------------------------------------------ --------- ---------

Total profit after tax attributable to equity

holders of the Company 2,445 163,781

Profit after tax from continuing operations

attributable to equity holders of the Company 2,445 (2,903)

Profit after tax from discontinuing operations

(ELL) attributable to equity holders of the

Company - 61,667

Profit after tax from discontinuing operations

(STB) attributable to equity holders of the

Company - 105,017

------------------------------------------------ --------- ---------

Six Six

months months

ended ended

30 June 30 June

2017 2016

Basic Earnings per share p p

------------------------------------------------ --------- ---------

Total Basic Earnings per share 16.5 1,111.2

Basic Earnings per share from continuing

operations 16.5 (19.7)

Basic Earnings per share from discontinuing

operations - ELL - 418.4

Basic Earnings per share from discontinuing

operations - STB - 712.5

------------------------------------------------ --------- ---------

Six Six

months months

ended ended

30 June 30 June

2017 2016

Diluted Earnings per share p p

------------------------------------------------ --------- ---------

Total Diluted Earnings per share 16.5 1,107.5

Diluted Earnings per share from continuing

operations 16.5 (19.6)

Diluted Earnings per share from discontinuing

operations - ELL - 417.0

Diluted Earnings per share from discontinuing

operations - STB - 710.1

------------------------------------------------ --------- ---------

6. Discontinued operations

The profit after tax from discontinued operations is made up as

follows:

Six Six

months months

ended ended

30 June 30 June

2017 2016

Discontinued operations GBP000 GBP000

----------------------------------------------- ---------- ---------

Profit after tax from discontinued operations

- ELL (up to 13 April 2016) - 2,027

Profit after tax on sale of discontinued

operations - ELL - 116,754

Profit after tax from discontinued operations

- STB (up to 15 June 2016) - 9,149

Profit after tax on sale of discontinued

operations - STB - 100,180

------------------------------------------------- -------- ---------

Profit after tax from discontinued operations - 228,110

------------------------------------------------- -------- ---------

On 4 December 2015, the Bank agreed to the conditional sale of

its non-standard consumer lending business, ELL, which comprised

Everyday Loans Holdings Limited and subsidiary companies Everyday

Lending Limited and Everyday Loans Limited, to Non Standard Finance

PLC (NSF) for GBP106.9 million in cash subject to a net asset

adjustment and GBP16.3 million in NSF ordinary shares. The Disposal

completed on 13 April 2016, and on completion, NSF repaid

intercompany debt of GBP108.1 million to STB. After selling costs

of GBP2.8m, this resulted in a gain recognised on disposal of

GBP116.8m.

Details of the profits of discontinued operations, net assets

disposed of and consequential gain recognised on disposal and cash

flow from discontinued operations are set out below.

Six From

months 1 January

ended to 13

30 June April

2017 2016

Note GBP000 GBP000

------------------------------------------ ----- --------- -----------

Interest income - 11,137

Net interest income - 11,137

------------------------------------------ ----- --------- -----------

Fee and commission income - 147

Fee and commission expense - (124)

------------------------------------------ ----- --------- -----------

Net fee and commission income - 23

------------------------------------------ ----- --------- -----------

Operating income - 11,160

------------------------------------------ ----- --------- -----------

Net impairment loss on financial assets - (2,610)

Operating expenses - (6,016)

------------------------------------------ ----- --------- -----------

Profit before tax - 2,534

Tax expense - (507)

------------------------------------------ ----- --------- -----------

Profit after tax - 2,027

------------------------------------------ ----- --------- -----------

Profit on sale of business - 116,754

------------------------------------------ ----- --------- -----------

Total profit from discontinued operation - 118,781

------------------------------------------ ----- --------- -----------

Profit attributable to:

Equity holders of the Company - 61,667

Non-controlling interests - 57,114

------------------------------------------ ----- --------- -----------

Profit after tax - 118,781

------------------------------------------ ----- --------- -----------

Earnings per share for profit attributable to the equity

holders of the Company from discontinued operations during

the year

(expressed in pence per share):

- basic 5 - 418.4

- diluted 5 - 417.0

6. Discontinued operations - continued

The following unaudited assets were sold as part of

the sale of ELL:

Recognised

values

on sale

2016

GBP000

----------------------------------------------- -----------

Loans and advances to banks 457

Loans and advances to customers 116,744

Property, plant and equipment 452

Intangible assets 1,258

Deferred tax assets 371

Prepayments and accrued income 451

Other assets 11

----------------------------------------------- -----------

Total assets 119,744

Intercompany funding 108,088

Current tax liability 3,212

Other liabilities 4,748

----------------------------------------------- -----------

Total liabilities 116,048

Net identifiable assets 3,696

----------------------------------------------- -----------

Consideration 123,206

Costs (2,756)

Profit on sale of ELL 116,754

----------------------------------------------- -----------

The intercompany funding was repaid by NSF at

the time of completion.

6. Discontinued operations - continued

Six From

months 1 January

Cash flow from discontinued operations ended to 13

- ELL 30 June April

2017 2016

GBP000 GBP000

---------------------------------------------- ---------- -----------

Cash flows from operating activities

Interest received - 11,137

Fees and commissions received - 23

Cash payments to employees and suppliers - (8,626)

Taxation paid - (507)

------------------------------------------------ -------- -----------

Cash flows from operating profits before

changes in operating assets and liabilities - 2,027

Changes in operating assets and liabilities:

- net increase in loans and advances

to customers - (3,618)

- net increase in other assets - (249)

- net increase in other liabilities - 2,621

------------------------------------------------ -------- -----------

Net cash inflow from operating activities - 781

------------------------------------------------ -------- -----------

Cash flows from investing activities

Purchase of property, plant and equipment - (9)

Net cash outflow from investing activities - (9)

------------------------------------------------ -------- -----------

Cash flows from financing activities

Increase in borrowings

Dividends paid

Net increase in cash and cash equivalents - 772

Cash and cash equivalents at 1 January - 1,661

------------------------------------------------ -------- -----------

Cash and cash equivalents at 13 April - 2,433

------------------------------------------------ -------- -----------

6. Discontinued operations - continued

On 15 June 2016 Arbuthnot Banking Group ('ABG') sold 6 million

shares in Secure Trust Bank PLC ('STB'), which reduced its

shareholding in STB from 51.92% to 18.93%. From this date the Group

accounted for its remaining shareholding in STB as an associate.

After the sale of the 6 million shares, the Group retained Board

representation and as such is seen to have significant influence

over STB. The profit and cash flow from discontinued operations

relating to ELL have been shown in the tables above. The ELL

entities were subsidiaries of STB and therefore formed part of the

STB number reported in the operating segments of ABG. The tables

below therefore reflect the profit and cash flow from the STB group

excluding ELL. The combined impact can be seen in the operating

segments (see note 1 - Retail banking).

Six From

months 1 January

ended to 15

30 June June

2017 2016

Note GBP000 GBP000

------------------------------------------ ----- --------- -----------

Interest income - 57,498

Interest expense - (12,107)

------------------------------------------ ----- --------- -----------

Net interest income - 45,391

------------------------------------------ ----- --------- -----------

Fee and commission income - 7,981

Fee and commission expense - (779)

------------------------------------------ ----- --------- -----------

Net fee and commission income - 7,202

------------------------------------------ ----- --------- -----------

Operating income - 52,593

------------------------------------------ ----- --------- -----------

Net impairment loss on financial assets - (12,172)

Operating expenses - (29,074)

------------------------------------------ ----- --------- -----------

Profit before tax - 11,347

Tax expense - (2,198)

------------------------------------------ ----- --------- -----------

Profit after tax - 9,149

------------------------------------------ ----- --------- -----------

Profit on sale of shares - 100,180

------------------------------------------ ----- --------- -----------

Total profit from discontinued operation - 109,329

------------------------------------------ ----- --------- -----------

Profit attributable to:

Equity holders of the Company - 105,017

Non-controlling interests - 4,312

------------------------------------------ ----- --------- -----------

Profit after tax - 109,329

------------------------------------------ ----- --------- -----------

Earnings per share for profit attributable to the equity

holders of the Company from discontinued operations during

the year

(expressed in pence per share):

- basic 5 - 712.5

- diluted 5 - 710.1

6. Discontinued operations - continued

The following unaudited assets were deconsolidated

as part of the sale of 6 million shares in STB:

Recognised

values

on sale

2016

GBP000

------------------------------------------------ -----------

Cash and balances at central banks 176,647

Loans and advances to banks 27,618

Loans and advances to customers 1,117,700

Other assets 5,805

Financial investments 15,030

Deferred tax asset 606

Intangible assets 7,017

Property, plant and equipment 8,606

------------------------------------------------ -----------

Total assets 1,359,029

Deposits from banks 25,000

Deposits from customers 1,046,009

Current tax liability 293

Other liabilities 29,748

------------------------------------------------ -----------

Total liabilities 1,101,050

Net identifiable assets 257,979

------------------------------------------------ -----------

Profit on sale of shares were calculated as follows:

2016

GBP000

------------------------------------------------ -----------

Consideration received 150,000

Less costs (2,001)

Less net identifiable assets (257,979)

Add back non-controlling interest 124,046

Add back fair value of remaining investment in

STB 86,114

Profit on sale of STB 100,180

------------------------------------------------ -----------

6. Discontinued operations - continued

Six From

months 1 January

Cash flow from discontinued operations ended to 15

- STB excluding ELL 30 June June

2017 2016

GBP000 GBP000

---------------------------------------------- ---------- -----------

Cash flows from operating activities

Interest received - 68,635

Interest paid - (12,107)

Fees and commissions received - 7,226

Cash payments to employees and suppliers - (51,552)

Taxation paid - (6,034)

------------------------------------------------ -------- -----------

Cash flows from operating profits before

changes in operating assets and liabilities - 6,168

Changes in operating assets and liabilities:

- net increase in loans and advances

to customers - (165,976)

- net decrease in other assets - 117,395

- net decrease in deposits from banks - (10,000)

- net increase in amounts due to customers - 12,936

- net decrease in other liabilities - (5,031)

------------------------------------------------ -------- -----------

Net cash outflow from operating activities - (44,508)

------------------------------------------------ -------- -----------

Cash flows from investing activities

Purchase of computer software - (1,754)

Purchase of property, plant and equipment - (531)

Disposal of property, plant and equipment - 2,179

Proceeds from disposal of businesses - 106,912

Proceeds from sale of property, plant

and equipment - 456

------------------------------------------------ -------- -----------

Net cash inflow from investing activities - 107,262

------------------------------------------------ -------- -----------

Cash flows from financing activities

Increase in borrowings

Dividends paid - (10,005)

Net cash used in financing activities - (10,005)

------------------------------------------------ -------- -----------

Net increase in cash and cash equivalents - 52,749

Cash and cash equivalents at 1 January - 141,595

------------------------------------------------ -------- -----------

Cash and cash equivalents at 15 June - 194,344

------------------------------------------------ -------- -----------

7. Basis of reporting

The interim financial statements have been prepared on the basis

of accounting policies set out in the Group's 2016 statutory

accounts as amended by standards and interpretations effective

during 2017 and in accordance with IAS 34 "Interim Financial

Reporting" (except for comparatives in the statement of financial

position). The directors do not consider the fair value of the

assets and liabilities presented in these financial statements to

be materially different from their carrying value.

The statements were approved by the Board of Directors on 17

July 2017 and are unaudited. The interim financial statements will

be posted to shareholders and copies may be obtained from The

Company Secretary, Arbuthnot Banking Group PLC, Arbuthnot House, 7

Wilson Street, London EC2M 2SN.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SFFFMWFWSELW

(END) Dow Jones Newswires

July 18, 2017 02:00 ET (06:00 GMT)

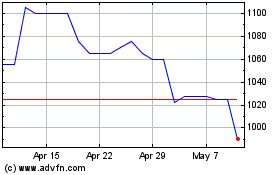

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Apr 2023 to Apr 2024