AptarGroup, Inc. (NYSE:ATR) today announced record quarterly net

income and earnings per share. The Company also announced that it

is expanding its Congers, New York facility to include elastomer

component capacity for the U.S. injectables market.

Second Quarter 2016 Summary

- Reported sales increased 4% to $620

million

- Changes in foreign currency exchange

rates had a negative impact of 2% on the sales growth

- Recently acquired Mega Airless

contributed approximately $18 million or 3% of the sales growth and

approximately $0.02 per share to reported earnings per

share

- Reported earnings per share rose to

a quarterly record of $0.91 compared to $0.90 reported in the prior

year

- Excluding the effects of a change to

the FIFO inventory valuation method ($0.08 per share), and

adjusting to a comparable foreign currency environment ($0.01),

prior year adjusted earnings per share were $0.81

- Operating margins were strong across

each business segment

- Reported pre-tax earnings of $84

million were approximately 14% of net sales

- EBITDA of $133 million was

approximately 22% of net sales

SECOND QUARTER RESULTS

For the quarter ended June 30, 2016, reported sales increased 4%

to $620 million from $594 million a year ago. Excluding the

negative impact from changes in currency exchange rates and the

positive impact from acquisitions, core sales increased by

approximately 3%.

Second Quarter Segment Sales Analysis (Change Over

Prior Year) Beauty + Food + Total Home

Pharma Beverage AptarGroup Core Sales Growth 4

% 3 % (1 %) 3 % Acquisitions 5 % 1 % -- 3 % Currency Effects (1) (2

%) -- (2 %) (2 %) Total Reported Sales

Growth 7 % 4 % (3 %) 4 %

(1) - Currency effects are approximated by translating last

year's amounts at this year's foreign exchange rates.

Commenting on the quarter, Stephen Hagge, President and CEO,

said, “I’m pleased that we achieved record earnings that were

substantially driven by strong operating margins across each

segment. The recently acquired Mega Airless business also

contributed to our reported results. Our consolidated reported

pre-tax earnings margin was approximately 14%, and our consolidated

EBITDA margin reached approximately 22% in the quarter.”

Hagge continued, “We continue to benefit from our diversified

business model that serves eight different markets with a broad

portfolio of dispensing and sealing solutions across many different

geographies. This diversification consistently supports our overall

growth even though we may face softness in one market or region.

Our Beauty + Home segment posted core sales growth primarily due to

increased demand from the beauty market. Our Pharma segment also

grew core sales due to increased demand across each market. Core

sales declined in our Food + Beverage segment due in part to

decreased custom tooling sales and the negative effects of passing

through lower resin costs to our customers. In addition, our Food +

Beverage segment was negatively impacted by a decrease in demand

from food and beverage customers in Asia.”

AptarGroup reported earnings per share rose 1% to $0.91 compared

to $0.90 per share a year ago. Prior year second quarter earnings

per share included a positive impact of approximately $0.08

(after-tax) related to a change in accounting for certain

inventories from the last-in, first-out (LIFO) method to the

first-in, first-out (FIFO) method. Excluding the effect of the

inventory valuation method change, and adjusting to achieve a

comparable foreign exchange rate environment, comparable prior year

second quarter earnings per share were $0.81. Taking into account

these adjustments, current year earnings per share increased 12%

over the prior year adjusted earnings per share.

YEAR-TO-DATE RESULTS

For the six months ended June 30, 2016, reported sales increased

2% to $1.20 billion from $1.18 billion a year ago. Excluding the

negative impact from changes in currency exchange rates and the

positive impact from acquisitions, core sales increased by

approximately 2%.

Six Months Year to Date Segment Sales Analysis

(Change Over Prior Year) Beauty +

Pharma Food + Total Home Beverage

AptarGroup Core Sales Growth 1 % 4 % 3 % 2 % Acquisitions 4

% 1 % -- 2 % Currency Effects (1) (4 %) (2 %) (3 %)

(2 %) Total Reported Sales Growth 1 % 3 % 0 %

2 %

(1) - Currency effects are approximated by translating last

year's amounts at this year's foreign exchange rates.

Hagge commented on the year-to-date results, “We continue to

focus on our customers’ needs and end consumer behavior in order to

offer the best dispensing and sealing solutions worldwide. Our

ability to execute on this strategy has delivered core sales growth

and strong margins across each of our business segments through the

first half of this year. This achievement is despite some lingering

softness in certain markets such as the U.S. personal care market,

and recently reduced demand from the food and beverage markets in

Asia that we saw toward the end of the second quarter.”

For the six months year to date, AptarGroup reported earnings

per share decreased approximately 1% to $1.58 compared to $1.59 per

share a year ago. Comparable adjusted earnings per share increased

9% to $1.63 compared to $1.50 for 2015. Adjustments to reported

results necessary to arrive at comparable adjusted earnings per

share are set forth in the accompanying tables.

EXPANDING CONGERS, NEW YORK FACILITY TO INCLUDE ELASTOMER

COMPONENT CAPACITY

AptarGroup is investing in elastomer component capacity at its

facility in Congers, New York. The investment is expected to total

approximately $10 million and will provide an array of processing,

finishing and product testing capabilities to better serve

customers in the U.S. injectables market. It is expected that the

new capacity will be installed by the end of 2016 and will be

validated and ready for commercial supply during the first half of

2017.

OUTLOOK

Commenting on AptarGroup’s outlook, Hagge said, “Looking to the

third quarter, while we expect continued weakness in the Asian

beverage market, we are expecting growth in other markets and our

level of project dialog with our customers across each segment

remains high. We’re also very excited to be investing in our

elastomer capacity for the U.S. market and look forward to that

capacity being validated by customers in the first half of

2017.”

AptarGroup expects earnings per share for the third quarter,

excluding any potential impacts of the timing of costs incurred and

any related insurance reimbursements associated with the Aptar

Annecy facility fire, to be in the range of $0.79 to $0.84 compared

to $0.83 per share reported in the prior year. Assuming a

comparable foreign currency exchange rate environment, comparable

earnings per share for the prior year were approximately $0.81.

CASH DIVIDEND

As previously reported, the Board declared on July 13, 2016 a

quarterly dividend of $0.30 per share, payable August 17, 2016 to

shareholders of record as of July 27, 2016.

OPEN CONFERENCE CALL

There will be a conference call on Friday, July 29, 2016 at 8:00

a.m. Central Time to discuss AptarGroup’s second quarter results

for 2016. The call will last approximately one hour. Interested

parties are invited to listen to a live webcast by visiting the

Investor Relations page at www.aptar.com. Replay of the conference

call can also be accessed on the Investor Relations page of the

website.

AptarGroup, Inc. is a leading global supplier of a broad range

of innovative dispensing and sealing solutions for the beauty,

personal care, home care, prescription drug, consumer health care,

injectables, food, and beverage markets. AptarGroup is

headquartered in Crystal Lake, Illinois, with manufacturing

facilities in North America, Europe, Asia and South America. For

more information, visit www.aptar.com.

Presentation of Non-GAAP Information

This press release refers to certain non-GAAP financial

measures, including adjusted earnings per share, adjusted EBIT and

adjusted EBITDA, which exclude the impact of transaction costs and

purchase accounting adjustments that affected inventory values

related to the recently closed Mega Airless acquisition, certain

items included in the provision for income taxes (primarily a

significant tax refund) that were recorded in the first quarter of

2016, and income from a change in the method of valuing inventory

(from LIFO to FIFO) that was recorded in the second quarter of

2015. Comparable core sales and adjusted earnings per share also

exclude the impact of foreign currency translation effects.

Non-GAAP financial measures may not be comparable to similarly

titled non-GAAP financial measures provided by other companies.

AptarGroup’s management believes it is useful to present these

non-GAAP financial measures because they allow for a better period

over period comparison of operating results by removing the impact

of items that, in management’s view, do not reflect AptarGroup’s

core operating performance. These non-GAAP financial measures

should not be considered in isolation or as a substitute for GAAP

financial results, but should be read in conjunction with the

unaudited condensed consolidated statements of income and other

information presented herein. A reconciliation of non-GAAP

financial measures to the most directly comparable GAAP measures is

included in the accompanying tables.

This press release contains forward-looking statements,

including certain statements set forth under the “Outlook” section

of this press release. Words such as “expects,” “anticipates,”

“believes,” “estimates,” “future” and other similar expressions or

future or conditional verbs such as “will,” “should,” “would” and

“could” are intended to identify such forward-looking statements.

Forward-looking statements are made pursuant to the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 and are based on our

beliefs as well as assumptions made by and information currently

available to us. Accordingly, our actual results may differ

materially from those expressed or implied in such forward-looking

statements due to known or unknown risks and uncertainties that

exist in our operations and business environment including, but not

limited to, the possible impact and consequences of the fire at the

Company’s facility in Annecy, France, the ability to integrate the

acquired Mega Airless business; economic conditions worldwide

including potential deflationary conditions in regions we rely on

for growth; political conditions worldwide; significant

fluctuations in foreign currency exchange rates; changes in

customer and/or consumer spending levels; financial conditions of

customers and suppliers; consolidations within our customer or

supplier bases; fluctuations in the cost of materials, components

and other input costs; the availability of raw materials and

components; our ability to successfully implement facility

expansions and new facility projects; our ability to increase

prices, contain costs and improve productivity; changes in capital

availability or cost, including interest rate fluctuations;

volatility of global credit markets; cybersecurity threats that

could impact our networks and reporting systems; fiscal and

monetary policies and other regulations, including changes in tax

rates; direct or indirect consequences of acts of war or terrorism;

work stoppages due to labor disputes; and competition, including

technological advances. For additional information on these and

other risks and uncertainties, please see our filings with the

Securities and Exchange Commission, including the discussion under

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” in our Form 10-Ks

and Form 10-Qs. We undertake no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

AptarGroup, Inc. Condensed Consolidated Financial

Statements (Unaudited) (In Thousands, Except Per Share Data)

Consolidated Statements of Income

Three Months Ended Six Months Ended June 30, June 30,

2016

2015

2016

2015

Net Sales $ 619,999 $ 594,275 $ 1,202,337 $ 1,184,086 Cost

of Sales (exclusive of depreciation and amortization shown below)

389,863 375,278 764,066 761,257 Selling, Research & Development

and Administrative 96,131 89,312 199,146 185,499 Depreciation and

Amortization

40,390

34,165 76,277

68,225 Operating Income 93,615 95,520 162,848

169,105 Other Income/(Expense): Interest Expense (9,203 ) (9,195 )

(17,794 ) (16,498 ) Interest Income 460 1,105 1,044 2,836 Equity in

Results of Affiliates (51 ) (407 ) (172 ) (526 ) Miscellaneous, net

(463 ) (1,268

) (1,723 )

(1,467 ) Income before Income Taxes

84,358 85,755 144,203 153,450 Provision for Income Taxes

25,307 28,214

41,286 50,810 Net

Income $ 59,051 $ 57,541 $ 102,917 $ 102,640 Net

(Income)/Loss Attributable to Noncontrolling Interests

(3 ) (2

) (6 )

70 Net Income Attributable to AptarGroup, Inc.

$ 59,048 $

57,539 $ 102,911

$ 102,710 Net Income

Attributable to AptarGroup, Inc. per Common Share: Basic

$ 0.94 $

0.92 $ 1.64

$ 1.64 Diluted

$

0.91 $ 0.90

$ 1.58 $

1.59 Average Numbers of Shares

Outstanding: Basic 63,053 62,697 62,888 62,496 Diluted 64,785

64,276 65,063 64,603

AptarGroup, Inc. Condensed

Consolidated Financial Statements (Unaudited) (continued) (In

Thousands)

Consolidated Balance Sheets

June 30,

2016

December 31,

2015

ASSETS Cash and Equivalents $ 361,664 $ 489,901 Short-term

Investments

- 29,816 Total

Cash and Equivalents, and Short-term Investments 361,664 519,717

Receivables, net 488,591 391,571 Inventories 325,724 294,912 Other

Current Assets

89,264

88,794 Total Current Assets 1,265,243 1,294,994 Net

Property, Plant and Equipment 816,438 765,383 Goodwill, net 421,745

310,240 Other Assets

143,496

66,428 Total Assets

$

2,646,922 $ 2,437,045

LIABILITIES AND EQUITY Short-Term Obligations $ 118,952 $

56,967 Accounts Payable and Accrued Liabilities

381,876 354,928 Total Current

Liabilities 500,828 411,895 Long-Term Obligations 771,695 760,848

Deferred Liabilities

115,807

114,596 Total Liabilities 1,388,330 1,287,339

AptarGroup, Inc. Stockholders' Equity 1,258,298 1,149,411

Noncontrolling Interests in Subsidiaries

294

295 Total Equity

1,258,592

1,149,706 Total Liabilities and Equity

$ 2,646,922 $

2,437,045 AptarGroup, Inc. Reconciliation of

Adjusted EBIT and Adjusted EBITDA to Net Income (Unaudited) (In

Thousands) Three Months

Ended June 30, 2016 Beauty + Food + Corporate Consolidated

Home Pharma Beverage & Other

Net Interest

Net Sales $ 619,999 340,321

191,034 88,644 - -

Reported net income $

59,051 Reported income taxes 25,307

Reported income before income taxes

84,358 30,547 58,597 13,593

(9,636 ) (8,743 ) Adjustments: None

Adjusted earnings before income taxes 84,358 30,547

58,597 13,593 (9,636 ) (8,743 ) Interest expense 9,203 9,203

Interest income (460 )

(460 ) Adjusted earnings before

net interest and taxes (Adjusted EBIT) 93,101 30,547 58,597 13,593

(9,636 ) (0 ) Depreciation and amortization 40,390

22,239 10,360

6,072 1,719 -

Adjusted earnings before net interest, taxes, depreciation

and amortization (Adjusted EBITDA) $ 133,491 $ 52,786

$ 68,957 $ 19,665 $

(7,917 ) $ (0 ) Segment income margins 9.0 % 30.7 %

15.3 % Adjusted EBITDA margins (Adjusted EBITDA / Reported Net

Sales) 21.5 % 15.5 % 36.1 % 22.2 % Three Months Ended June

30, 2015 Beauty + Food +

Corporate

Consolidated Home Pharma Beverage

& Other

Net Interest

Net Sales $ 594,275

319,124 183,300 91,851 - -

Reported net income

$ 57,541 Reported income taxes

28,214

Reported income before income

taxes 85,755 27,193 55,462 14,991

(3,801 ) (8,090 ) Adjustments: Change

in inventory valuation methods (from LIFO to FIFO) (7,427 ) (7,427

)

Adjusted earnings before income taxes 78,328 27,193

55,462 14,991 (11,228 ) (8,090 ) Interest expense 9,195 9,195

Interest income (1,105 )

(1,105 ) Adjusted earnings

before net interest and taxes (Adjusted EBIT) 86,418 27,193 55,462

14,991 (11,228 ) - Depreciation and amortization 34,165

18,790 8,856

5,121 1,398

- Adjusted earnings before net interest, taxes, depreciation

and amortization (Adjusted EBITDA) $ 120,583 $ 45,983

$ 64,318 $ 20,112 $

(9,830 ) $ - Segment income margins 8.5 % 30.3

% 16.3 % Adjusted EBITDA margins (Adjusted EBITDA / Reported Net

Sales) 20.3 % 14.4 % 35.1 % 21.9 %

AptarGroup, Inc.

Reconciliation of Adjusted EBIT and Adjusted EBITDA to Net

Income (Unaudited) (In Thousands)

Six Months Ended June 30, 2016 Beauty + Food +

Corporate

Consolidated Home Pharma Beverage &

Other

Net Interest

Net Sales $ 1,202,337 654,657 374,169 173,511

- -

Reported net income $ 102,917

Reported income taxes 41,286

Reported income before income taxes 144,203

54,075 111,833 22,876 (27,831 )

(16,750 ) Adjustments: Transaction costs related to

the Mega Airless acquisition 5,640 5,640 Purchase accounting

adjustments related to Mega Airless inventory 2,577

2,151 426

Adjusted earnings before income taxes

152,420 56,226 112,259 22,876 (22,191 ) (16,750 ) Interest expense

17,794 17,794 Interest income (1,044 )

(1,044 ) Adjusted

earnings before net interest and taxes (Adjusted EBIT) 169,170

56,226 112,259 22,876 (22,191 ) - Depreciation and amortization

76,277 41,497

19,617 11,896 3,267

- Adjusted earnings before net

interest, taxes, depreciation and amortization (Adjusted EBITDA) $

245,447 $ 97,723 $ 131,876

$ 34,772 $ (18,924 ) $ -

Segment income margins 8.3 % 29.9 % 13.2 % Adjusted EBITDA margins

(Adjusted EBITDA / Reported Net Sales) 20.4 % 14.9 % 35.2 % 20.0 %

Six Months Ended June 30, 2015 Beauty + Food +

Corporate Consolidated Home Pharma Beverage

& Other Net Interest

Net Sales $

1,184,086 648,539 361,969 173,578 - -

Reported net

income $ 102,640 Reported income taxes

50,810

Reported income before income

taxes 153,450 50,569 107,463 24,041

(14,961 ) (13,662 ) Adjustments: Change

in inventory valuation methods (from LIFO to FIFO) (7,427 ) (7,427

)

Adjusted earnings before income taxes 146,023 50,569

107,463 24,041 (22,388 ) (13,662 ) Interest expense 16,498 16,498

Interest income (2,836 )

(2,836 ) Adjusted earnings

before net interest and taxes (Adjusted EBIT) 159,685 50,569

107,463 24,041 (22,388 ) - Depreciation and amortization

68,225 37,818 17,629

10,252 2,526

- Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA) $ 227,910

$ 88,387 $ 125,092 $

34,293 $ (19,862 ) $ - Segment

income margins 7.8 % 29.7 % 13.9 % Adjusted EBITDA margins

(Adjusted EBITDA / Reported Net Sales) 19.2 % 13.6 % 34.6 % 19.8 %

AptarGroup, Inc. Reconciliation of Adjusted Earnings Per

Diluted Share (Unaudited) ($ in thousands, except per share

information) Three Months Ended Six Months

Ended June 30, June 30,

2016

2015

2016

2015

Income before Income Taxes $ 84,358

$ 85,755 $ 144,203 $

153,450

Adjustments:

Transaction costs related to the Mega Airless acquisition 5,640

Purchase accounting adjustments related to Mega Airless inventory

2,577 Change in inventory valuation methods (from LIFO to FIFO)

(7,427 ) (7,427 ) Foreign currency effects (1)

(777 ) (1,548 ) Adjusted Income before

Income Taxes $ 84,358 $ 77,551 $

152,420 $ 144,475

Provision

for Income Taxes $ 25,307 $ 28,214

$ 41,286 $ 50,810

Adjustments:

Net effect of items included in the Provision for Income Taxes (2)

2,923 Transaction costs related to the Mega Airless acquisition

1,483 Purchase accounting adjustments related to Mega Airless

inventory 859 Change in inventory valuation methods (from LIFO to

FIFO) (2,599 ) (2,599 ) Foreign currency effects (1)

(243 ) (524 ) Adjusted Provision

for Income Taxes $ 25,307 $ 25,372 $

46,551 $ 47,687

Net

(Income)/Loss Attributable to Noncontrolling Interests $

(3 ) $ (2 ) $ (6

) $ 70 Net Income Attributable to

AptarGroup, Inc. $ 59,048 $ 57,539

$ 102,911 $ 102,710

Adjustments:

Net effect of items included in the Provision for Income Taxes (2)

(2,923 ) Transaction costs related to the Mega Airless acquisition

4,157 Purchase accounting adjustments related to Mega Airless

inventory 1,718 Change in inventory valuation methods (from LIFO to

FIFO) (4,828 ) (4,828 ) Foreign currency effects (1)

(534 ) (1,024 ) Adjusted Net

Income Attributable to AptarGroup, Inc. $ 59,048 $

52,177 $ 105,863 $ 96,858

Average Number of Diluted Shares Outstanding 64,785

64,276 65,063 64,603 Net Income

Attributable to AptarGroup, Inc. Per Diluted Share $

0.91 $ 0.90 $ 1.58 $

1.59

Adjustments:

Net effect of items included in the Provision for Income Taxes (2)

(0.04 ) Transaction costs related to the Mega Airless acquisition

0.06 Purchase accounting adjustments related to Mega Airless

inventory 0.03 Change in inventory valuation methods (from LIFO to

FIFO) (0.08 ) (0.07 ) Foreign currency effects (1)

(0.01 ) (0.02 ) Adjusted Net

Income Attributable to AptarGroup, Inc. Per Diluted Share $ 0.91

$ 0.81 $ 1.63 $ 1.50

(1) Foreign currency effects are approximations of the

adjustment necessary to state the prior year earnings and earnings

per share using current period foreign currency exchange rates.

(2) Items included in the Provision for Income Taxes primarily

reflect the effect of a French income tax refund.

AptarGroup, Inc. Reconciliation of Adjusted Earnings Per

Diluted Share (Unaudited) ($ in thousands, except per share

information) Three Months Ended September 30,

Expected

2016

2015

Income before Income Taxes $ 79,377

Adjustments:

Foreign currency effects (1) (1,374 ) Adjusted Income before

Income Taxes $ 78,003

Provision for Income

Taxes $ 26,115

Adjustments:

Foreign currency effects (1) (452 ) Adjusted Provision for

Income Taxes $ 25,663

Net (Income)/Loss

Attributable to Noncontrolling Interests $ (15

) Net Income Attributable to AptarGroup, Inc.

$ 53,247

Adjustments:

Foreign currency effects (1) (922 ) Adjusted Net Income

Attributable to AptarGroup, Inc. $ 52,325

Average

Number of Diluted Shares Outstanding 64,454

Net Income Attributable to AptarGroup, Inc. Per Diluted Share

(2) $0.79 - $0.84

$ 0.83

Adjustments:

Foreign currency effects (1) (0.02 ) Adjusted

Net Income Attributable to AptarGroup, Inc. Per Diluted Share (2)

$0.79 - $0.84 $ 0.81

(1) Foreign currency effects are approximations of the

adjustment necessary to state the prior year earnings per share

using foreign currency exchange rates as of June 30, 2016.

(2) AptarGroup’s expected earnings per share range for the third

quarter of 2016 excludes any potential effects of the timing of

costs incurred and the related insurance reimbursements associated

with the Aptar Annecy facility fire.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160728006586/en/

Matthew DellaMariaAptarGroup, Inc.815-477-0424

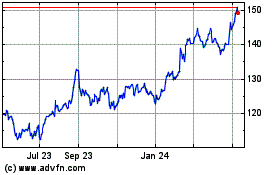

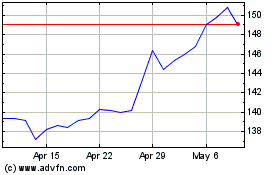

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Apr 2023 to Apr 2024