AptarGroup Announces $250 Million Accelerated Share Repurchase and Closes Private Placement of $475 Million

December 17 2014 - 7:00AM

Business Wire

AptarGroup, Inc. (NYSE: ATR) announced today that it has entered

into an agreement to repurchase approximately $250 million of its

common stock under an accelerated share repurchase program (the

“ASR program”). The ASR program is part of AptarGroup’s $350

million share repurchase authorization announced on October 30,

2014. Today, AptarGroup will pay $250 million to Wells Fargo Bank

N.A. in exchange for approximately 3.1 million shares, currently

estimated to represent approximately 80% of the total number of

shares expected to be purchased in the ASR program based on current

market prices. The ultimate number of shares to be repurchased

under the ASR program will be based on the volume-weighted average

price of AptarGroup’s common stock during the term of the ASR

program, less a discount.

Yesterday, AptarGroup completed a note purchase agreement for

the private placement of $475 million in Senior Notes to

institutional investors and expects to use proceeds from this

private placement for the ASR program and to refinance existing

debt.

“Share repurchases are an important element of our capital

allocation strategy,” said Stephen Hagge, President and Chief

Executive Officer. “Our strong financial condition allows us to

take advantage of the current favorable interest rate environment,

better optimize our capital structure, and return value to

shareholders with this $250 million accelerated repurchase.”

The private placement of $475 million in Senior Notes is

expected to be funded on two dates. An initial funding of $250

million was completed yesterday and includes two maturity tranches,

with $125 million of 3.49% Senior Notes due in December of 2023 and

$125 million of 3.61% Senior Notes due in December of 2025. A

second funding of $225 million is expected to occur in February of

2015 and will be comprised of $100 million of 3.49% Senior Notes

due in February of 2024 and $125 million of 3.61% Senior Notes due

in February of 2026.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy securities. The securities have not

been and will not be registered under the Securities Act of 1933,

as amended, and may not be offered or sold in the United States

absent registration or an applicable exemption from registration

under the Securities Act and applicable state securities laws.

AptarGroup, Inc. is a leading global supplier of a broad range

of innovative dispensing solutions for the beauty, personal care,

home care, prescription drug, consumer health care, injectables,

food, and beverage markets. AptarGroup is headquartered in Crystal

Lake, Illinois, with manufacturing facilities in North America,

Europe, Asia and Latin America. For more information, visit

www.aptar.com.

This press release contains forward-looking statements.

Forward-looking statements are made pursuant to the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 and are based on

management’s beliefs as well as assumptions made by and information

currently available to management. Our forward looking statements

include statements regarding our intentions to repurchase stock,

the method and timing as well as the number of shares repurchased,

related expenditures and the benefits of such transactions, as well

as statements regarding the anticipated closing of the second

funding of the private placement. Actual results may differ

materially from those expressed or implied in such forward-looking

statements due to known or unknown risks and uncertainties that

exist including, but not limited to, economic, environmental or

political conditions in the various markets and countries in which

AptarGroup operates; fiscal and monetary policies and other

regulation; and the ability of AptarGroup to satisfy the conditions

to the closing of the second funding of the private placement. For

additional information on these and other risks and uncertainties,

please see AptarGroup’s filings with the Securities and Exchange

Commission, including its Form 10-K’s and Form 10-Q’s. Readers are

cautioned not to place undue reliance on forward-looking

statements. AptarGroup undertakes no obligation to update

any forward-looking statements, whether as a result of new

information, future events or otherwise.

AptarGroup, Inc.Matthew DellaMaria, 815-477-0424

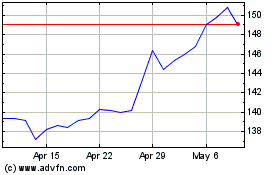

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Mar 2024 to Apr 2024

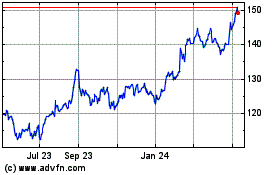

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Apr 2023 to Apr 2024