April Trading For UK Pubs, Restaurants, Worsens On Wet Weather -Study

May 17 2012 - 8:48AM

Dow Jones News

Trading for pubs and restaurants across the U.K. worsened in

April largely due to cold and wet weather amid an uncertain

economic outlook, a study released Thursday showed, although

analysts expect a pickup in May and June.

The Coffer Peach Business Tracker reported that comparable sales

in April fell 2% on the year, following a rise of 1.9% in March.

Total sales, which include new openings, rose 1.9%.

The tracker monitors trends in the eating and drinking-out

market by collecting monthly performance data from 24 companies,

including Whitbread PLC (WTB.LN), Mitchells & Butlers PLC

(MAB.LN), Spirit Pub Co. PLC (SPRT.LN) and Marston's PLC

(MARS.LN).

Pubs, and in particular drink-led businesses, were worst hit,

although high-street casual dining restaurants saw sales increase,

it said.

"As ever, the weather is a major factor in where, or whether,

people choose to go out and eat. In general, if it's sunny people

go to the pub; when it's wet restaurants tend to benefit," said

analyst Peter Martin of Peach Factory, a market intelligence group

that produces the report in partnership with UBS AG (UBS) and

investment advisory service The Coffer Group.

Martin also said the same period a year ago provides a tough

comparison.

"Last April, not only did we have hotter weather, but we had the

Royal Wedding and Mother's Day in the month, as well as the Easter

holidays."

Martin said the market remains "volatile," with the uplift in

March preceded by falling comparable sales in January and

February.

Economists and businesses are concerned that economic weakness,

below-inflation pay rises and unemployment are crimping consumer

spending.

Still, analysts hope for a rebound in May on more favorable

comparisons and in June thanks to trading benefits from the Queen's

Jubilee bank holiday and the European soccer championships.

Jonathan Leinster, European leisure research analyst at UBS,

said: "We believe consumers are still happy to allocate

discretionary spend to eating and drinking out, and pub-restaurants

and other low-cost food options are growing share within that

market."

-By Simon Zekaria, Dow Jones Newswires; +44 207 842-9410;

simon.zekaria@dowjones.com

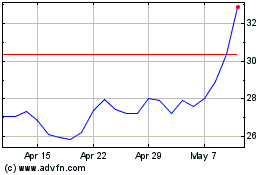

Marston's (LSE:MARS)

Historical Stock Chart

From Mar 2024 to Apr 2024

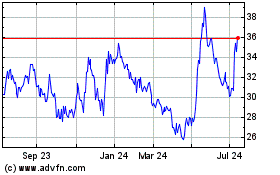

Marston's (LSE:MARS)

Historical Stock Chart

From Apr 2023 to Apr 2024