Applied Materials Announces Record Results

August 18 2016 - 4:01PM

Applied Materials, Inc. (NASDAQ:AMAT) today reported results for

its third quarter ended July 31, 2016.

New orders were $3.66 billion, up 6 percent sequentially and up

26 percent year over year. Backlog of $4.95 billion was up 19

percent sequentially and up 60 percent year over year. Net sales of

$2.82 billion were up 15 percent sequentially and up 13 percent

year over year.

The company recorded gross margin of 42.3 percent, operating

margin of 21.1 percent, and net income of $505 million or $0.46 per

diluted share. On a non-GAAP adjusted basis, the company reported

third quarter gross margin of 43.7 percent, operating margin of

22.8 percent, and net income of $550 million or $0.50 per diluted

share.

The company generated $981 million in cash from operations, paid

dividends of $108 million and used $196 million to repurchase 9

million shares of common stock at an average price of $21.88.

“With earnings and orders at an all-time high, Applied is

performing better than ever and in a great position to sustainably

outperform our markets,” said Gary Dickerson, president and CEO.

“We are in the early stages of large, multi-year industry

inflections that are driving our business today and creating new

opportunities for future growth.”

Quarterly Results Summary

| |

|

|

|

|

|

|

Change |

| |

Q3 FY2016 |

|

Q2 FY2016 |

|

Q3 FY2015 |

|

Q3 FY2016 vs. Q2 FY2016 |

|

Q3 FY2016 vs. Q3 FY2015 |

| |

(In millions, except per share amounts and

percentages) |

| New orders |

$ |

3,658 |

|

|

$ |

3,451 |

|

|

$ |

2,892 |

|

|

6 |

% |

|

26 |

% |

| Net sales |

$ |

2,821 |

|

|

$ |

2,450 |

|

|

$ |

2,490 |

|

|

15 |

% |

|

13 |

% |

| Gross margin |

42.3 |

% |

|

41.0 |

% |

|

40.9 |

% |

|

1.3 |

points |

|

1.4 |

points |

| Operating margin |

21.1 |

% |

|

17.3 |

% |

|

15.9 |

% |

|

3.8 |

points |

|

5.2 |

points |

| Net income |

$ |

505 |

|

|

$ |

320 |

|

|

$ |

329 |

|

|

58 |

% |

|

53 |

% |

| Diluted earnings per share

(EPS) |

$ |

0.46 |

|

|

$ |

0.29 |

|

|

$ |

0.27 |

|

|

59 |

% |

|

70 |

% |

| |

|

|

|

|

|

|

Change |

|

Non-GAAP Adjusted Results |

Q3 FY2016 |

|

Q2 FY2016 |

|

Q3 FY2015 |

|

Q3 FY2016 vs. Q2 FY2016 |

|

Q3 FY2016 vs. Q3 FY2015 |

| |

(In millions, except per share amounts and

percentages) |

| Non-GAAP adjusted gross

margin |

43.7 |

% |

|

42.7 |

% |

|

43.9 |

% |

|

1.0 |

points |

|

(0.2 |

) points |

| Non-GAAP adjusted

operating margin |

22.8 |

% |

|

19.2 |

% |

|

20.8 |

% |

|

3.6 |

points |

|

2.0 |

points |

| Non-GAAP adjusted net

income |

$ |

550 |

|

|

$ |

376 |

|

|

$ |

410 |

|

|

46 |

% |

|

34 |

% |

| Non-GAAP adjusted diluted

EPS |

$ |

0.50 |

|

|

$ |

0.34 |

|

|

$ |

0.33 |

|

|

47 |

% |

|

52 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A reconciliation of the GAAP and non-GAAP adjusted results is

provided in the financial tables included in this release. See also

“Use of Non-GAAP Adjusted Financial Measures” section.

Business Outlook

In the fourth quarter of fiscal 2016, Applied expects net sales

to be up 15 percent to 19 percent sequentially. Non-GAAP adjusted

diluted EPS is expected to be in the range of $0.61 to $0.69.

This outlook for non-GAAP adjusted diluted EPS excludes known

charges related to completed acquisitions of $0.04 per share and

any additional charges related to completed or future acquisitions

or other non-operational or unusual items that are unknown at this

time, as well as other tax related items, which we are not able to

predict without unreasonable efforts due to their inherent

uncertainty.

Third Quarter Reportable Segment

Information

Effective in the third quarter of fiscal 2016, Applied has

expanded its Display segment to now include roll-to-roll web

coating systems (previously in Energy and Environmental Solutions)

and display upgrade equipment (previously in Applied Global

Services). The Display segment is now named Display and Adjacent

Markets. Applied no longer reports Energy and Environmental

Solutions as a segment and its solar business is now included in

Corporate and Other. The Silicon Systems segment is now named

Semiconductor Systems and is otherwise unchanged. Applied Global

Services continues to include 200-millimeter semiconductor

equipment sales. Segment operating results for previous periods

have been recast to conform to the current presentation in the

table below and in the supplemental historical information

accompanying this release.

| Semiconductor

Systems |

Q3 FY2016 |

|

Q2 FY2016 |

|

Q3 FY2015 |

| |

(In millions, except percentages) |

| New orders |

$ |

2,215 |

|

|

$ |

1,966 |

|

|

$ |

2,007 |

|

| Foundry |

57 |

% |

|

23 |

% |

|

32 |

% |

| DRAM |

14 |

% |

|

17 |

% |

|

18 |

% |

| Flash |

15 |

% |

|

49 |

% |

|

39 |

% |

| Logic and

other |

14 |

% |

|

11 |

% |

|

11 |

% |

| Net sales |

1,786 |

|

|

1,587 |

|

|

1,635 |

|

| Operating income |

511 |

|

|

364 |

|

|

411 |

|

| Operating margin |

28.6 |

% |

|

22.9 |

% |

|

25.1 |

% |

|

Non-GAAP Adjusted Results |

|

|

|

|

| Non-GAAP adjusted

operating income |

$ |

556 |

|

|

$ |

410 |

|

|

$ |

455 |

|

| Non-GAAP adjusted

operating margin |

31.1 |

% |

|

25.8 |

% |

|

27.8 |

% |

| Applied Global

Services |

Q3 FY2016 |

|

Q2 FY2016 |

|

Q3 FY2015 |

| |

(In millions, except percentages) |

| New orders |

$ |

590 |

|

|

$ |

636 |

|

|

$ |

543 |

|

| Net sales |

657 |

|

|

633 |

|

|

646 |

|

| Operating income |

175 |

|

|

165 |

|

|

162 |

|

| Operating margin |

26.6 |

% |

|

26.1 |

% |

|

25.1 |

% |

|

Non-GAAP Adjusted Results |

|

|

|

|

| Non-GAAP adjusted

operating income |

$ |

176 |

|

|

$ |

165 |

|

|

$ |

165 |

|

| Non-GAAP adjusted

operating margin |

26.8 |

% |

|

26.1 |

% |

|

25.5 |

% |

| Display and

Adjacent Markets |

Q3 FY2016 |

|

Q2 FY2016 |

|

Q3 FY2015 |

| |

(In millions, except percentages) |

| New orders |

$ |

803 |

|

|

$ |

762 |

|

|

$ |

318 |

|

| Net sales |

313 |

|

|

187 |

|

|

185 |

|

| Operating income |

63 |

|

|

31 |

|

|

35 |

|

| Operating margin |

20.1 |

% |

|

16.6 |

% |

|

18.9 |

% |

|

Non-GAAP Adjusted Results |

|

|

|

|

| Non-GAAP adjusted

operating income |

$ |

63 |

|

|

$ |

31 |

|

|

$ |

36 |

|

| Non-GAAP adjusted

operating margin |

20.1 |

% |

|

16.6 |

% |

|

19.5 |

% |

| |

|

|

|

|

|

|

|

|

Backlog Information

Applied's backlog increased 19 percent to $4.95

billion and included negative adjustments of $56 million, primarily

consisting of order cancellations, partially offset by favorable

foreign currency impacts. Backlog composition by reportable segment

was as follows:

| Semiconductor Systems |

50 |

% |

| Applied Global

Services |

15 |

% |

| Display and Adjacent

Markets |

33 |

% |

| Corporate and Other |

2 |

% |

| |

|

|

Use of Non-GAAP Adjusted Financial Measures

Applied provides investors with certain non-GAAP

adjusted financial measures, which are adjusted to exclude the

impact of certain costs, expenses, gains and losses, including

certain items related to mergers and acquisitions; restructuring

charges and any associated adjustments; impairments of assets, or

investments; gain or loss on sale of strategic investments; income

tax items and certain other discrete adjustments. Reconciliations

of these non-GAAP measures to the most directly comparable

financial measures calculated and presented in accordance with GAAP

are provided in the financial tables included in this release.

Management uses these non-GAAP adjusted financial measures to

evaluate the company’s operating and financial performance and for

planning purposes, and as performance measures in its executive

compensation program. Applied believes these measures enhance an

overall understanding of our performance and investors’ ability to

review the company’s business from the same perspective as the

company’s management, and facilitate comparisons of this period’s

results with prior periods on a consistent basis by excluding items

that we do not believe are indicative of our ongoing operating

performance. There are limitations in using non-GAAP financial

measures because the non-GAAP financial measures are not prepared

in accordance with generally accepted accounting principles, may be

different from non-GAAP financial measures used by other companies,

and may exclude certain items that may have a material impact upon

our reported financial results. The presentation of this additional

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with GAAP.

Webcast Information

Applied Materials will discuss these results during an earnings

call that begins at 1:30 p.m. Pacific Time today. A live webcast

will be available at www.appliedmaterials.com. A replay will be

available on the website beginning at 5:00 p.m. Pacific Time

today.

Forward-Looking Statements

This press release contains forward-looking statements,

including those regarding anticipated growth and trends in our

businesses and markets, industry outlooks, technology transitions,

our business and financial performance and market share positions,

our earnings expectations, our business outlook for the fourth

quarter of fiscal 2016, and other statements that are not

historical facts. These statements and their underlying assumptions

are subject to risks and uncertainties and are not guarantees of

future performance. Factors that could cause actual results to

differ materially from those expressed or implied by such

statements include, without limitation: the level of demand for our

products; global economic and industry conditions; consumer demand

for electronic products; the demand for semiconductors; customers’

technology and capacity requirements; the introduction of new and

innovative technologies, and the timing of technology transitions;

our ability to develop, deliver and support new products and

technologies; the concentrated nature of our customer base;

our ability to expand our current markets, increase market share

and develop new markets; market acceptance of existing and newly

developed products; our ability to obtain and protect intellectual

property rights in key technologies; our ability to achieve the

objectives of operational and strategic initiatives, align our

resources and cost structure with business conditions, and attract,

motivate and retain key employees; the variability of operating

expenses and results among products and segments, and our ability

to accurately forecast future results, market conditions, customer

requirements and business needs; and other risks and uncertainties

described in our SEC filings, including our most recent Forms 10-Q

and 8-K. All forward-looking statements are based on management’s

current estimates, projections and assumptions, and we assume no

obligation to update them.

About Applied Materials

Applied Materials, Inc. (Nasdaq:AMAT) is the leader in materials

engineering solutions used to produce virtually every new chip and

advanced display in the world. Our expertise in modifying materials

at atomic levels and on an industrial scale enables customers to

transform possibilities into reality. At Applied Materials, our

innovations make possible the technology shaping the future. Learn

more at www.appliedmaterials.com.

Contact:

Kevin Winston (editorial/media) 408.235.4498Michael Sullivan

(financial community) 408.986.7977

| |

| APPLIED MATERIALS, INC.UNAUDITED CONSOLIDATED

CONDENSED STATEMENTS OF OPERATIONS |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| (In millions, except

per share amounts) |

July 31, 2016 |

|

May 1, 2016 |

|

July 26, 2015 |

|

July 31, 2016 |

|

July 26, 2015 |

| Net sales |

$ |

2,821 |

|

|

$ |

2,450 |

|

|

$ |

2,490 |

|

|

$ |

7,528 |

|

|

$ |

7,291 |

|

| Cost of products sold |

1,629 |

|

|

1,446 |

|

|

1,472 |

|

|

4,416 |

|

|

4,298 |

|

| Gross profit |

1,192 |

|

|

1,004 |

|

|

1,018 |

|

|

3,112 |

|

|

2,993 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

| Research,

development and engineering |

386 |

|

|

386 |

|

|

372 |

|

|

1,146 |

|

|

1,088 |

|

| Marketing

and selling |

107 |

|

|

102 |

|

|

112 |

|

|

315 |

|

|

332 |

|

| General and

administrative |

103 |

|

|

91 |

|

|

135 |

|

|

276 |

|

|

392 |

|

| Loss (gain)

on derivatives associated with terminated business combination |

— |

|

|

— |

|

|

3 |

|

|

— |

|

|

(89 |

) |

| Total operating

expenses |

596 |

|

|

579 |

|

|

622 |

|

|

1,737 |

|

|

1,723 |

|

| Income from

operations |

596 |

|

|

425 |

|

|

396 |

|

|

1,375 |

|

|

1,270 |

|

| Interest expense |

38 |

|

|

37 |

|

|

24 |

|

|

117 |

|

|

71 |

|

| Interest income and other

income, net |

6 |

|

|

7 |

|

|

3 |

|

|

15 |

|

|

2 |

|

| Income before income

taxes |

564 |

|

|

395 |

|

|

375 |

|

|

1,273 |

|

|

1,201 |

|

| Provision for income

taxes |

59 |

|

|

75 |

|

|

46 |

|

|

162 |

|

|

160 |

|

| Net income |

$ |

505 |

|

|

$ |

320 |

|

|

$ |

329 |

|

|

$ |

1,111 |

|

|

$ |

1,041 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.47 |

|

|

$ |

0.29 |

|

|

$ |

0.27 |

|

|

$ |

1.00 |

|

|

$ |

0.85 |

|

| Diluted |

$ |

0.46 |

|

|

$ |

0.29 |

|

|

$ |

0.27 |

|

|

$ |

0.99 |

|

|

$ |

0.84 |

|

| Weighted average number of

shares: |

|

|

|

|

|

|

|

|

|

| Basic |

1,083 |

|

|

1,113 |

|

|

1,221 |

|

|

1,115 |

|

|

1,225 |

|

| Diluted |

1,093 |

|

|

1,119 |

|

|

1,231 |

|

|

1,123 |

|

|

1,238 |

|

| APPLIED MATERIALS, INC.UNAUDITED CONSOLIDATED

CONDENSED BALANCE SHEETS |

| |

| (In millions) |

July 31, 2016 |

|

May 1, 2016 |

|

October 25, 2015 |

| ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| Cash and

cash equivalents |

$ |

2,828 |

|

|

$ |

2,470 |

|

|

$ |

4,797 |

|

| Short-term

investments |

438 |

|

|

170 |

|

|

168 |

|

| Accounts

receivable, net |

1,852 |

|

|

1,913 |

|

|

1,739 |

|

|

Inventories |

2,026 |

|

|

1,924 |

|

|

1,833 |

|

| Other

current assets |

255 |

|

|

251 |

|

|

724 |

|

| Total current assets |

7,399 |

|

|

6,728 |

|

|

9,261 |

|

| Long-term investments |

960 |

|

|

934 |

|

|

946 |

|

| Property, plant and

equipment, net |

905 |

|

|

904 |

|

|

892 |

|

| Goodwill |

3,305 |

|

|

3,304 |

|

|

3,302 |

|

| Purchased technology and

other intangible assets, net |

621 |

|

|

668 |

|

|

762 |

|

| Deferred income taxes and

other assets |

509 |

|

|

537 |

|

|

145 |

|

| Total assets |

$ |

13,699 |

|

|

$ |

13,075 |

|

|

$ |

15,308 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

| Short-term

debt |

$ |

— |

|

|

$ |

— |

|

|

$ |

1,200 |

|

| Accounts

payable and accrued expenses |

1,800 |

|

|

1,630 |

|

|

1,833 |

|

| Customer

deposits and deferred revenue |

1,164 |

|

|

981 |

|

|

765 |

|

| Total current

liabilities |

2,964 |

|

|

2,611 |

|

|

3,798 |

|

| Long-term debt |

3,343 |

|

|

3,343 |

|

|

3,342 |

|

| Other liabilities |

573 |

|

|

556 |

|

|

555 |

|

| Total liabilities |

6,880 |

|

|

6,510 |

|

|

7,695 |

|

| Total stockholders’

equity |

6,819 |

|

|

6,565 |

|

|

7,613 |

|

| Total liabilities and

stockholders’ equity |

$ |

13,699 |

|

|

$ |

13,075 |

|

|

$ |

15,308 |

|

| APPLIED MATERIALS, INC.UNAUDITED CONSOLIDATED

CONDENSED STATEMENTS OF CASH FLOWS |

|

|

| (In

millions) |

Three Months Ended |

|

Nine Months Ended |

| July 31, 2016 |

|

May 1, 2016 |

|

July 26, 2015 |

July 31, 2016 |

|

July 26, 2015 |

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

|

| Net

income |

$ |

505 |

|

|

$ |

320 |

|

|

$ |

329 |

|

|

$ |

1,111 |

|

|

$ |

1,041 |

|

| Adjustments

required to reconcile net income to cash provided by operating

activities: |

|

|

|

|

|

|

|

|

|

| Depreciation

and amortization |

97 |

|

|

96 |

|

|

93 |

|

|

289 |

|

|

275 |

|

| Share-based

compensation |

48 |

|

|

48 |

|

|

46 |

|

|

150 |

|

|

141 |

|

| Excess tax

benefits from share-based compensation |

(5 |

) |

|

(3 |

) |

|

(3 |

) |

|

(18 |

) |

|

(54 |

) |

| Deferred

income taxes |

21 |

|

|

(22 |

) |

|

18 |

|

|

14 |

|

|

25 |

|

| Other |

5 |

|

|

5 |

|

|

43 |

|

|

20 |

|

|

64 |

|

| Net change

in operating assets and liabilities |

310 |

|

|

37 |

|

|

(192 |

) |

|

103 |

|

|

(800 |

) |

| Cash provided by operating

activities |

981 |

|

|

481 |

|

|

334 |

|

|

1,669 |

|

|

692 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

| Capital

expenditures |

(50 |

) |

|

(47 |

) |

|

(49 |

) |

|

(165 |

) |

|

(162 |

) |

| Cash paid

for acquisitions, net of cash acquired |

3 |

|

|

(8 |

) |

|

(2 |

) |

|

(5 |

) |

|

(2 |

) |

| Proceeds

from sales and maturities of investments |

208 |

|

|

232 |

|

|

583 |

|

|

681 |

|

|

900 |

|

| Purchases of

investments |

(483 |

) |

|

(182 |

) |

|

(616 |

) |

|

(947 |

) |

|

(960 |

) |

| Cash used in investing

activities |

(322 |

) |

|

(5 |

) |

|

(84 |

) |

|

(436 |

) |

|

(224 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

| Debt

repayments |

(2 |

) |

|

— |

|

|

— |

|

|

(1,207 |

) |

|

— |

|

| Proceeds

from common stock issuances and others |

— |

|

|

42 |

|

|

1 |

|

|

44 |

|

|

43 |

|

| Common stock

repurchases |

(196 |

) |

|

(900 |

) |

|

(625 |

) |

|

(1,721 |

) |

|

(625 |

) |

| Excess tax

benefits from share-based compensation |

5 |

|

|

3 |

|

|

3 |

|

|

18 |

|

|

54 |

|

| Payments of

dividends to stockholders |

(108 |

) |

|

(113 |

) |

|

(123 |

) |

|

(336 |

) |

|

(368 |

) |

| Cash used in financing

activities |

(301 |

) |

|

(968 |

) |

|

(744 |

) |

|

(3,202 |

) |

|

(896 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

— |

|

|

— |

|

|

1 |

|

|

— |

|

|

— |

|

| Increase (decrease) in

cash and cash equivalents |

358 |

|

|

(492 |

) |

|

(493 |

) |

|

(1,969 |

) |

|

(428 |

) |

| Cash and cash

equivalents — beginning of period |

2,470 |

|

|

2,962 |

|

|

3,067 |

|

|

4,797 |

|

|

3,002 |

|

| Cash and cash

equivalents — end of period |

$ |

2,828 |

|

|

$ |

2,470 |

|

|

$ |

2,574 |

|

|

$ |

2,828 |

|

|

$ |

2,574 |

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

|

|

|

| Cash

payments for income taxes |

$ |

49 |

|

|

$ |

51 |

|

|

$ |

51 |

|

|

$ |

144 |

|

|

$ |

258 |

|

| Cash refunds

from income taxes |

$ |

1 |

|

|

$ |

98 |

|

|

$ |

5 |

|

|

$ |

104 |

|

|

$ |

10 |

|

| Cash

payments for interest |

$ |

34 |

|

|

$ |

42 |

|

|

$ |

39 |

|

|

$ |

110 |

|

|

$ |

85 |

|

| APPLIED MATERIALS, INC.UNAUDITED SUPPLEMENTAL

INFORMATION |

| |

|

|

|

|

|

| Corporate and

Other |

|

|

|

|

|

| |

|

|

|

|

|

| (In millions) |

Q3 FY2016 |

|

Q2 FY2016 |

|

Q3 FY2015 |

| New orders |

$ |

50 |

|

|

$ |

87 |

|

|

$ |

24 |

|

| |

|

|

|

|

|

| Unallocated net sales |

$ |

65 |

|

|

$ |

43 |

|

|

$ |

24 |

|

| Unallocated cost of

products sold and expenses |

(170 |

) |

|

(130 |

) |

|

(186 |

) |

| Share-based

compensation |

(48 |

) |

|

(48 |

) |

|

(46 |

) |

| Certain items

associated with terminated business combination |

— |

|

|

— |

|

|

(1 |

) |

| Loss on derivatives

associated with terminated business combination, net |

— |

|

|

— |

|

|

(3 |

) |

| Total |

$ |

(153 |

) |

|

$ |

(135 |

) |

|

$ |

(212 |

) |

|

Additional Information |

|

|

| |

Q3 FY2016 |

|

Q2 FY2016 |

|

Q3 FY2015 |

| New Orders and Net Sales

by Geography |

|

|

|

|

|

|

|

|

|

|

|

| (In $ millions) |

NewOrders |

|

NetSales |

|

NewOrders |

|

NetSales |

|

NewOrders |

|

NetSales |

| United States |

259 |

|

|

289 |

|

|

386 |

|

|

272 |

|

|

262 |

|

|

488 |

|

| % of

Total |

7 |

% |

|

10 |

% |

|

11 |

% |

|

11 |

% |

|

9 |

% |

|

20 |

% |

| Europe |

212 |

|

|

124 |

|

|

194 |

|

|

97 |

|

|

142 |

|

|

148 |

|

| % of

Total |

6 |

% |

|

5 |

% |

|

6 |

% |

|

4 |

% |

|

5 |

% |

|

6 |

% |

| Japan |

270 |

|

|

321 |

|

|

339 |

|

|

260 |

|

|

727 |

|

|

283 |

|

| % of

Total |

7 |

% |

|

11 |

% |

|

10 |

% |

|

10 |

% |

|

25 |

% |

|

11 |

% |

| Korea |

689 |

|

|

472 |

|

|

792 |

|

|

506 |

|

|

349 |

|

|

343 |

|

| % of

Total |

19 |

% |

|

17 |

% |

|

23 |

% |

|

21 |

% |

|

12 |

% |

|

14 |

% |

| Taiwan |

1,240 |

|

|

741 |

|

|

445 |

|

|

311 |

|

|

828 |

|

|

825 |

|

| % of

Total |

34 |

% |

|

26 |

% |

|

13 |

% |

|

13 |

% |

|

29 |

% |

|

33 |

% |

| Southeast Asia |

139 |

|

|

303 |

|

|

392 |

|

|

252 |

|

|

142 |

|

|

101 |

|

| % of

Total |

4 |

% |

|

11 |

% |

|

11 |

% |

|

10 |

% |

|

5 |

% |

|

4 |

% |

| China |

849 |

|

|

571 |

|

|

903 |

|

|

752 |

|

|

442 |

|

|

302 |

|

| % of

Total |

23 |

% |

|

20 |

% |

|

26 |

% |

|

31 |

% |

|

15 |

% |

|

12 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Employees (In

thousands) |

|

|

|

|

|

|

|

|

|

|

|

| Regular Full Time |

15.2 |

|

|

14.8 |

|

|

14.5 |

|

| APPLIED MATERIALS, INC.UNAUDITED RECONCILIATION

OF GAAP TO NON-GAAP ADJUSTED RESULTS |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| (In millions, except

percentages) |

July 31, 2016 |

|

May 1, 2016 |

|

July 26, 2015 |

|

July 31, 2016 |

|

July 26, 2015 |

| Non-GAAP Adjusted Gross

Profit |

|

|

|

|

|

|

|

|

|

| Reported gross profit -

GAAP basis |

$ |

1,192 |

|

|

$ |

1,004 |

|

|

$ |

1,018 |

|

|

$ |

3,112 |

|

|

$ |

2,993 |

|

| Certain items associated

with acquisitions1 |

42 |

|

|

41 |

|

|

41 |

|

|

125 |

|

|

120 |

|

| Inventory charges

(reversals) related to restructuring3, 5 |

(1 |

) |

|

— |

|

|

34 |

|

|

(2 |

) |

|

34 |

|

| Non-GAAP adjusted gross

profit |

$ |

1,233 |

|

|

$ |

1,045 |

|

|

$ |

1,093 |

|

|

$ |

3,235 |

|

|

$ |

3,147 |

|

| Non-GAAP adjusted gross

margin |

43.7 |

% |

|

42.7 |

% |

|

43.9 |

% |

|

43.0 |

% |

|

43.2 |

% |

| Non-GAAP Adjusted

Operating Income |

|

|

|

|

|

|

|

|

|

| Reported operating income

- GAAP basis |

$ |

596 |

|

|

$ |

425 |

|

|

$ |

396 |

|

|

$ |

1,375 |

|

|

$ |

1,270 |

|

| Certain items associated

with acquisitions1 |

47 |

|

|

46 |

|

|

47 |

|

|

141 |

|

|

138 |

|

| Acquisition integration

and deal costs |

2 |

|

|

— |

|

|

1 |

|

|

2 |

|

|

2 |

|

| Loss (gain) on derivatives

associated with terminated business combination, net |

— |

|

|

— |

|

|

3 |

|

|

— |

|

|

(89 |

) |

| Certain items associated

with terminated business combination2 |

— |

|

|

— |

|

|

1 |

|

|

— |

|

|

50 |

|

| Inventory charges

(reversals) related to restructuring and asset impairments, net3,

4, 5 |

(1 |

) |

|

(1 |

) |

|

50 |

|

|

(3 |

) |

|

50 |

|

| Foreign exchange loss due

to functional currency change6 |

— |

|

|

— |

|

|

19 |

|

|

— |

|

|

19 |

|

| Non-GAAP adjusted

operating income |

$ |

644 |

|

|

$ |

470 |

|

|

$ |

517 |

|

|

$ |

1,515 |

|

|

$ |

1,440 |

|

| Non-GAAP adjusted

operating margin |

22.8 |

% |

|

19.2 |

% |

|

20.8 |

% |

|

20.1 |

% |

|

19.8 |

% |

| Non-GAAP Adjusted Net

Income |

|

|

|

|

|

|

|

|

|

| Reported net income - GAAP

basis7 |

$ |

505 |

|

|

$ |

320 |

|

|

$ |

329 |

|

|

$ |

1,111 |

|

|

$ |

1,041 |

|

| Certain items associated

with acquisitions1 |

47 |

|

|

46 |

|

|

47 |

|

|

141 |

|

|

138 |

|

| Acquisition integration

and deal costs |

2 |

|

|

— |

|

|

1 |

|

|

2 |

|

|

2 |

|

| Loss (gain) on derivatives

associated with terminated business combination, net |

— |

|

|

— |

|

|

3 |

|

|

— |

|

|

(89 |

) |

| Certain items associated

with terminated business combination2 |

— |

|

|

— |

|

|

1 |

|

|

— |

|

|

50 |

|

| Inventory charges

(reversals) related to restructuring and asset impairments, net3,

4, 5 |

(1 |

) |

|

(1 |

) |

|

50 |

|

|

(3 |

) |

|

50 |

|

| Impairment (gain on sale)

of strategic investments, net |

— |

|

|

(1 |

) |

|

(1 |

) |

|

(3 |

) |

|

6 |

|

| Foreign exchange loss due

to functional currency change6 |

— |

|

|

— |

|

|

19 |

|

|

— |

|

|

19 |

|

| Loss on early

extinguishment of debt |

— |

|

|

— |

|

|

— |

|

|

5 |

|

|

— |

|

| Reinstatement of federal

R&D tax credit, resolution of prior years’ income tax filings

and other tax items7 |

1 |

|

|

16 |

|

|

(21 |

) |

|

(12 |

) |

|

(92 |

) |

| Income tax effect of

non-GAAP adjustments8 |

(4 |

) |

|

(4 |

) |

|

(18 |

) |

|

(13 |

) |

|

(15 |

) |

| Non-GAAP adjusted net

income |

$ |

550 |

|

|

$ |

376 |

|

|

$ |

410 |

|

|

$ |

1,228 |

|

|

$ |

1,110 |

|

| 1 |

These

items are incremental charges attributable to completed

acquisitions, consisting of amortization of purchased intangible

assets. |

| |

|

| 2 |

These

items are incremental charges related to the terminated business

combination agreement with Tokyo Electron Limited, consisting of

acquisition-related and integration planning costs. |

| |

|

| 3 |

Results

for the three and nine months ended July 31, 2016 primarily

included benefit from sales of solar equipment tools for which

inventory had been previously reserved related to the cost

reductions in the solar business. |

| |

|

| 4 |

Results

for the three months ended May 1, 2016 included a $1 million

favorable adjustment of employee-related costs associated with the

cost reductions in the solar business. |

| |

|

| 5 |

Results

for the three and nine months ended July 26, 2015 primarily

included $34 million of inventory charges and $17 million of

restructuring charges and asset impairments related to cost

reductions in the solar business. |

| |

|

| 6 |

Results

for the three and nine months ended July 26, 2015 included a $19

million foreign exchange loss due to an immaterial correction of an

error related to functional currency change. |

| |

|

| 7 |

Amounts

for nine months ended July 26, 2015 included an adjustment to

decrease the provision for income taxes by $35 million with a

corresponding increase in net income, resulting in an increase in

diluted earnings per share of $0.03. The adjustment was excluded in

Applied's non-GAAP adjusted results and was made primarily to

correct an error in the recognition of cost of sales in the U.S.

related to intercompany sales, which resulted in overstating

profitability in the U.S. and the provision for income taxes in

immaterial amounts in each year since fiscal 2010. |

| |

|

| 8 |

These

amounts represent non-GAAP adjustments above multiplied by the

effective tax rate within the jurisdictions the adjustments

affect. |

| APPLIED MATERIALS, INC.UNAUDITED RECONCILIATION OF

GAAP TO NON-GAAP ADJUSTED RESULTS |

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| (In millions, except

per share amounts) |

July 31, 2016 |

|

May 1, 2016 |

|

July 26, 2015 |

|

July 31, 2016 |

|

July 26, 2015 |

| Non-GAAP Adjusted Earnings

Per Diluted Share |

|

|

|

|

|

|

|

|

|

| Reported earnings per

diluted share - GAAP basis1 |

$ |

0.46 |

|

|

$ |

0.29 |

|

|

$ |

0.27 |

|

|

$ |

0.99 |

|

|

$ |

0.84 |

|

| Certain items associated

with acquisitions |

0.04 |

|

|

0.04 |

|

|

0.03 |

|

|

0.11 |

|

|

0.10 |

|

| Certain items associated

with terminated business combination |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

0.03 |

|

| Gain on derivatives

associated with terminated business combination, net |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.05 |

) |

| Restructuring, inventory

charges and asset impairments |

— |

|

|

— |

|

|

0.03 |

|

|

— |

|

|

0.03 |

|

| Reinstatement of federal

R&D tax credit, resolution of prior years’ income tax filings

and other tax items1 |

— |

|

|

0.01 |

|

|

(0.02 |

) |

|

(0.01 |

) |

|

(0.07 |

) |

| Foreign exchange loss due

to functional currency change |

— |

|

|

— |

|

|

0.02 |

|

|

— |

|

|

0.02 |

|

| Non-GAAP adjusted earnings

per diluted share |

$ |

0.50 |

|

|

$ |

0.34 |

|

|

$ |

0.33 |

|

|

$ |

1.09 |

|

|

$ |

0.90 |

|

| Weighted average number of

diluted shares |

1,093 |

|

|

1,119 |

|

|

1,231 |

|

|

1,123 |

|

|

1,238 |

|

| 1 |

Amounts for nine months

ended July 26, 2015 included an adjustment to decrease the

provision for income taxes by $35 million with a corresponding

increase in net income, resulting in an increase in diluted

earnings per share of $0.03. The adjustment was excluded in

Applied's non-GAAP adjusted results and was made primarily to

correct an error in the recognition of cost of sales in the U.S.

related to intercompany sales, which resulted in overstating

profitability in the U.S. and the provision for income taxes in

immaterial amounts in each year since fiscal 2010. |

| APPLIED MATERIALS, INC.UNAUDITED RECONCILIATION OF

GAAP TO NON-GAAP ADJUSTED RESULTS |

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| (In millions, except

percentages) |

July 31, 2016 |

|

May 1, 2016 |

|

July 26, 2015 |

|

July 31, 2016 |

|

July 26, 2015 |

| Semiconductor Systems

Non-GAAP Adjusted Operating Income |

|

|

|

|

|

|

|

|

|

| Reported operating income

- GAAP basis |

$ |

511 |

|

|

$ |

364 |

|

|

$ |

411 |

|

|

$ |

1,140 |

|

|

$ |

1,092 |

|

| Certain items associated

with acquisitions1 |

45 |

|

|

46 |

|

|

44 |

|

|

138 |

|

|

131 |

|

| Non-GAAP adjusted

operating income |

$ |

556 |

|

|

$ |

410 |

|

|

$ |

455 |

|

|

$ |

1,278 |

|

|

$ |

1,223 |

|

| Non-GAAP adjusted

operating margin |

31.1 |

% |

|

25.8 |

% |

|

27.8 |

% |

|

26.9 |

% |

|

26.4 |

% |

| AGS Non-GAAP Adjusted

Operating Income |

|

|

|

|

|

|

|

|

|

| Reported operating income

- GAAP basis |

$ |

175 |

|

|

$ |

165 |

|

|

$ |

162 |

|

|

$ |

489 |

|

|

$ |

470 |

|

| Certain items associated

with acquisitions1 |

1 |

|

|

— |

|

|

— |

|

|

1 |

|

|

1 |

|

| Inventory charges related

to restructuring2 |

— |

|

|

— |

|

|

3 |

|

|

— |

|

|

3 |

|

| Non-GAAP adjusted

operating income |

$ |

176 |

|

|

$ |

165 |

|

|

$ |

165 |

|

|

$ |

490 |

|

|

$ |

474 |

|

| Non-GAAP adjusted

operating margin |

26.8 |

% |

|

26.1 |

% |

|

25.5 |

% |

|

25.8 |

% |

|

25.8 |

% |

| Display and Adjacent

Markets Non-GAAP Adjusted Operating Income |

|

|

|

|

|

|

|

|

|

| Reported operating income

- GAAP basis |

$ |

63 |

|

|

$ |

31 |

|

|

$ |

35 |

|

|

$ |

142 |

|

|

$ |

163 |

|

| Certain items

associated with acquisitions1 |

— |

|

|

— |

|

|

1 |

|

|

— |

|

|

3 |

|

| Non-GAAP adjusted

operating income |

$ |

63 |

|

|

$ |

31 |

|

|

$ |

36 |

|

|

$ |

142 |

|

|

$ |

166 |

|

| Non-GAAP adjusted

operating margin |

20.1 |

% |

|

16.6 |

% |

|

19.5 |

% |

|

18.8 |

% |

|

23.4 |

% |

| 1 |

These

items are incremental charges attributable to completed

acquisitions, consisting of amortization of purchased intangible

assets. |

| |

|

| 2 |

Results for the three and nine months ended July 26, 2015 included

$3 million of inventory charges related to cost reduction in the

solar business. |

| |

|

| Note: The

reconciliation of GAAP and non-GAAP adjusted segment results above

does not include certain revenues, costs of products sold and

operating expenses that are reported within corporate and other and

included in consolidated operating income. |

| APPLIED MATERIALS, INC.UNAUDITED RECONCILIATION OF GAAP

TO NON-GAAP ADJUSTED OPERATING EXPENSES |

| |

| |

Three Months Ended |

| (In millions) |

July 31, 2016 |

|

May 1, 2016 |

| Operating expenses - GAAP

basis |

$ |

596 |

|

|

$ |

579 |

|

| Reversals related to

restructuring, net |

— |

|

|

1 |

|

| Certain items associated

with acquisitions |

(5 |

) |

|

(5 |

) |

| Acquisition integration

and deal costs |

(2 |

) |

|

— |

|

| Non-GAAP adjusted

operating expenses |

$ |

589 |

|

|

$ |

575 |

|

| UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED

EFFECTIVE INCOME TAX RATE |

| |

| |

Three Months Ended |

| (In millions, except

percentages) |

July 31, 2016 |

| Provision for income taxes

- GAAP basis (a) |

$ |

59 |

|

| Reinstatement of federal

R&D tax credit, resolutions of prior years’ income tax filings

and other tax items |

(1 |

) |

| Income tax effect of

non-GAAP adjustments |

4 |

|

| Non-GAAP adjusted

provision for income taxes (b) |

$ |

62 |

|

| |

|

| Income before income taxes

- GAAP basis (c) |

$ |

564 |

|

| Certain items associated

with acquisitions |

47 |

|

| Reversals related to

restructuring, net |

(1 |

) |

| Acquisition integration

costs |

2 |

|

| Non-GAAP adjusted income

before income taxes (d) |

$ |

612 |

|

| |

|

| Effective income tax rate

- GAAP basis (a/c) |

10.5 |

% |

| |

|

| Non-GAAP adjusted

effective income tax rate (b/d) |

10.1 |

% |

| APPLIED MATERIALS, INC.UNAUDITED SUPPLEMENTAL

HISTORICAL INFORMATION |

|

|

| Semiconductor

Systems |

Q2 FY2016 |

|

Q1 FY2016 |

|

Q4 FY2015 |

|

Q3 FY2015 |

|

Q2 FY2015 |

|

Q1 FY2015 |

|

FY2014 |

| |

(In millions, except percentages) |

| New orders |

$ |

1,966 |

|

|

$ |

1,275 |

|

|

$ |

1,444 |

|

|

$ |

2,007 |

|

|

$ |

1,704 |

|

|

$ |

1,426 |

|

|

$ |

6,132 |

|

| Net sales |

|

1,587 |

|

|

|

1,373 |

|

|

|

1,494 |

|

|

|

1,635 |

|

|

|

1,560 |

|

|

|

1,446 |

|

|

|

5,978 |

|

| Operating income |

|

364 |

|

|

|

265 |

|

|

|

318 |

|

|

|

411 |

|

|

|

374 |

|

|

|

307 |

|

|

|

1,391 |

|

| Operating margin |

|

22.9 |

% |

|

|

19.3 |

% |

|

|

21.3 |

% |

|

|

25.1 |

% |

|

|

24.0 |

% |

|

|

21.2 |

% |

|

|

23.3 |

% |

| Non-GAAP Adjusted

Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjusted

operating income |

$ |

410 |

|

|

$ |

312 |

|

|

$ |

365 |

|

|

$ |

455 |

|

|

$ |

418 |

|

|

$ |

350 |

|

|

$ |

1,565 |

|

| Non-GAAP adjusted

operating margin |

25.8 |

% |

|

22.7 |

% |

|

|

24.4 |

% |

|

|

27.8 |

% |

|

|

26.8 |

% |

|

|

24.2 |

% |

|

|

26.2 |

% |

| Applied Global

Services |

Q2 FY2016 |

|

Q1 FY2016 |

|

Q4 FY2015 |

|

Q3 FY2015 |

|

Q2 FY2015 |

|

Q1 FY2015 |

|

FY2014 |

| |

(In millions, except percentages) |

| New orders |

$ |

636 |

|

|

$ |

755 |

|

|

$ |

743 |

|

|

$ |

543 |

|

|

$ |

620 |

|

|

$ |

676 |

|

|

$ |

2,345 |

|

| Net sales |

633 |

|

|

606 |

|

|

611 |

|

|

646 |

|

|

627 |

|

|

563 |

|

|

2,114 |

|

| Operating income |

165 |

|

|

149 |

|

|

160 |

|

|

162 |

|

|

162 |

|

|

146 |

|

|

538 |

|

| Operating margin |

26.1 |

% |

|

24.6 |

% |

|

26.2 |

% |

|

25.1 |

% |

|

25.8 |

% |

|

25.9 |

% |

|

25.4 |

% |

|

Non-GAAP Adjusted Results |

|

|

|

|

| Non-GAAP adjusted

operating income |

$ |

165 |

|

|

$ |

149 |

|

|

$ |

159 |

|

|

$ |

165 |

|

|

$ |

162 |

|

|

$ |

147 |

|

|

$ |

541 |

|

| Non-GAAP adjusted

operating margin |

26.1 |

% |

|

24.6 |

% |

|

26.0 |

% |

|

25.5 |

% |

|

25.8 |

% |

|

26.1 |

% |

|

25.6 |

% |

| Display and

Adjacent Markets |

Q2 FY2016 |

|

Q1 FY2016 |

|

Q4 FY2015 |

|

Q3 FY2015 |

|

Q2 FY2015 |

|

Q1 FY2015 |

|

FY2014 |

| |

(In millions, except percentages) |

| New orders |

$ |

762 |

|

|

$ |

208 |

|

|

$ |

219 |

|

|

$ |

318 |

|

|

$ |

159 |

|

|

$ |

132 |

|

|

$ |

1,066 |

|

| Net sales |

187 |

|

|

254 |

|

|

235 |

|

|

185 |

|

|

208 |

|

|

316 |

|

|

848 |

|

| Operating income |

31 |

|

|

48 |

|

|

28 |

|

|

35 |

|

|

49 |

|

|

79 |

|

|

202 |

|

| Operating margin |

16.6 |

% |

|

18.9 |

% |

|

11.9 |

% |

|

18.9 |

% |

|

23.6 |

% |

|

25.0 |

% |

|

23.8 |

% |

|

Non-GAAP Adjusted Results |

|

|

|

|

| Non-GAAP adjusted

operating income |

$ |

31 |

|

|

$ |

48 |

|

|

$ |

28 |

|

|

$ |

36 |

|

|

$ |

50 |

|

|

$ |

80 |

|

|

$ |

206 |

|

| Non-GAAP adjusted

operating margin |

16.6 |

% |

|

18.9 |

% |

|

11.9 |

% |

|

19.5 |

% |

|

24.0 |

% |

|

25.3 |

% |

|

24.3 |

% |

| Corporate and

Other |

Q2 FY2016 |

|

Q1 FY2016 |

|

Q4 FY2015 |

|

Q3 FY2015 |

|

Q2 FY2015 |

|

Q1 FY2015 |

|

FY2014 |

| |

(In millions) |

| New orders |

$ |

87 |

|

|

$ |

37 |

|

|

$ |

18 |

|

|

$ |

24 |

|

|

$ |

32 |

|

|

$ |

39 |

|

|

$ |

105 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unallocated net sales |

$ |

43 |

|

|

$ |

24 |

|

|

$ |

28 |

|

|

$ |

24 |

|

|

$ |

47 |

|

|

$ |

34 |

|

|

$ |

132 |

|

| Unallocated cost of

products sold and expenses |

(130 |

) |

|

(78 |

) |

|

(65 |

) |

|

(186 |

) |

|

(154 |

) |

|

(118 |

) |

|

(523 |

) |

| Share-based

compensation |

(48 |

) |

|

(54 |

) |

|

(46 |

) |

|

(46 |

) |

|

(47 |

) |

|

(48 |

) |

|

(177 |

) |

| Certain items associated

with terminated business combination |

— |

|

|

— |

|

|

— |

|

|

(1 |

) |

|

(29 |

) |

|

(20 |

) |

|

(73 |

) |

| Gain (loss) on derivatives

associated with terminated business combination, net |

— |

|

|

— |

|

|

— |

|

|

(3 |

) |

|

14 |

|

|

78 |

|

|

30 |

|

| Total |

$ |

(135 |

) |

|

$ |

(108 |

) |

|

$ |

(83 |

) |

|

$ |

(212 |

) |

|

$ |

(169 |

) |

|

$ |

(74 |

) |

|

$ |

(611 |

) |

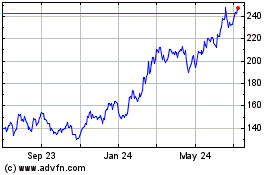

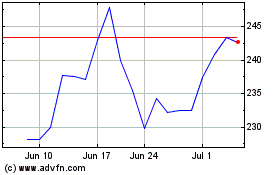

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024