Appliance Makers Find Profit Growth in U.S., Europe

October 23 2015 - 1:10PM

Dow Jones News

By James R. Hagerty

The U.S. and Western Europe--markets once widely derided as

mature and stodgy--are providing the main sparks of growth for

makers of home appliances.

Whirlpool Corp. and Electrolux AB, two of the world's biggest

makers of home appliances, reported higher third quarter earnings

Friday as profit growth in those markets offset weakness in Brazil,

Russia and China. Both companies, though, are struggling to compete

in the U.S. with imported appliances made by South Korean rivals

Samsung Electronics Co. and LG Electronics Inc.

Though Whirlpool reported record operating profits and margins

in North America, worries over its loss of U.S. market share helped

push the stock down about 10% near midday on the New York Stock

Exchange. Marc Bitzer, promoted two days earlier to president and

chief operating officer of the Benton Harbor, Mich.-based company,

said new products should start to drive the company's U.S. sales

higher in the current quarter.

Electrolux also has run into problems in the U.S. this year. New

refrigerators and freezers designed to meet tougher U.S.

energy-efficiency standards were "over-engineered," resulting in

excessive costs, said Keith McLoughlin, the Swedish company's, in

an interview. Meanwhile, a new cooking-product plant in Memphis

suffered from "too much complexity, too many new people" lacking

experience in such manufacturing, he said, adding that those

problems slashed productivity but now are being resolved.

Emerging markets have become drags on earnings. Both companies

are finding that China has too many tough local competitors and a

glutted housing market, Brazil swings from boom to bust and Russia

is overly reliant on the energy industry.

Excluding the effect of currencies, industrywide unit shipments

of appliances this year will rise about 5% in North America and 2%

in Europe, the Middle East and Africa, while falling 20% in Brazil

and 2% in Asia, Whirlpool forecast. Mr. McLoughlin of Electrolux

said the recovery of the U.S. housing market and lower unemployment

are spurring U.S. sales. Recent economic news, including big

layoffs by major U.S. companies, doesn't appear to have dented

consumer confidence so far, he said.

Electrolux is trying to expand in the U.S. by buying General

Electric Co.'s appliance business, but the Justice Department is

challenging that plan, saying it would hurt competition, Lawyers

for the U.S. agency reacted skeptically this week to a settlement

offer from Electrolux.

Electrolux is going back to the drawing board in China, just two

years after it launched a new line of premium appliances there.

Those haven't proved "economically viable," Mr. McLoughlin said,

partly because the company's distribution strategy hasn't worked

out. Electrolux wrote down the value of its inventory in China by

70 million Swedish kronor ($8.2 million). It will come up with a

new China strategy early in 2016, Mr. McLoughlin said.

Whirlpool expanded what had been a tiny presence in China last

year by acquiring 51% of Hefei Rongshida Sanyo Electric Co. there.

This year, appliance demand in China is down about 4%, Whirlpool

said, though the company expects an eventual return to healthy

growth.

Whirlpool's purchase of Italy's Indesit Co. last year doubled

the company's business in Europe, in time to benefit from a

recovery in much of Western Europe. But Indesit also has brought a

much larger share of Russia's deeply depressed market.

Whirlpool reported profit of $235 million, or $2.95 a share, up

from $230 million, or $2.88 a share, a year earlier. Sales climbed

9.4% to $5.28 billion. Stripping out currency fluctuations, sales

were up 25%.

Electrolux profit rose to 1.01 billion Swedish kronor, or 3.51

kronor per share, from 933 million kronor, or 3.24 kronor per

share, a year earlier. Sales grew 8.7% to 31.28 billion kronor.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 23, 2015 12:55 ET (16:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

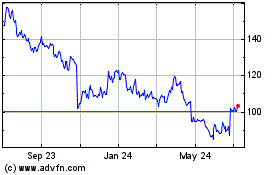

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

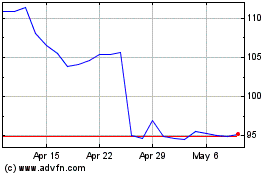

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Apr 2023 to Apr 2024