Apollo Education Doesn't Have Enough Votes Yet to Approve Sale

April 29 2016 - 1:50AM

Dow Jones News

Apollo Education Group Inc. said it hasn't yet received enough

shareholder votes to approve its planned $1.1 billion sale, and

adjourned a shareholder meeting from Thursday until May 6.

The sale to Apollo Global Management LLC, Vistria Group and

Najafi Cos. was announced in February. It encountered resistance

from shareholder Schroders PLC, a U.K. asset-management firm.

Apollo Education, which owns University of Phoenix, said nearly

58% of the Class A shares voted so far have been in favor of the

deal. However, these votes don't yet constitute a majority of

shares outstanding.

On Tuesday, Apollo Education said in a filing that if the sale

isn't completed, the company could "face serious consequences"

including a share-price decline that could hurt access to

liquidity. The company said that if the sale doesn't take place, it

will review strategic alternatives including a sale of the

University of Phoenix.

Apollo Education has seen enrollment numbers deteriorate as

stricter regulation has reduced for-profit colleges' share of U.S.

financial aid and hurt the industry's reputation. The company has

moved to shut some of its locations and trim jobs, while expanding

abroad.

Given the headwinds at home, school operators including Apollo

and DeVry Education Group Inc. are more optimistic about prospects

in friendlier climates overseas.

The planned buyout is worth $9.50 a share. Shares closed

Thursday at $7.58, up 15 cents.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

April 29, 2016 01:35 ET (05:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

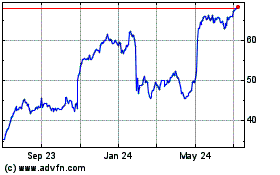

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Apr 2023 to Apr 2024