Luxembourg, July 27, 2016

| Highlights |

|

|

| |

|

Aperam (referred to as "Aperam" or the "Company")

(Amsterdam, Luxembourg, Paris: APAM and NYRS: APEMY), announced

today results for the three month ending June 30,

2016

Timoteo Di Maulo, CEO of Aperam, commented:

"Despite headwinds from the current market conditions, Aperam

continues to improve its operational performance, delivering a

record high of operating cash flow generation over a second

quarter.

Looking ahead, we remain confident in our capacity to deliver solid

operational results and cash flow with the contribution of our

Leadership Journey®6 and Top Line strategy." |

-

Net debt5 of USD 280 million as of June

30, 2016, representing a gearing of 11% compared to a net debt of

USD 338 million as of March 31, 2016

|

|

| |

|

| Prospects |

|

|

|

| |

|

Financial Highlights

(on the basis of IFRS)

| (USDm)

unless otherwise stated |

Q2 16 |

Q1 16 |

Q2 15 |

H1

2016 |

H1

2015 |

| Sales |

1,121 |

1,076 |

1,264 |

2,197 |

2,522 |

| EBITDA |

123 |

112 |

155 |

235 |

288 |

| Operating income |

80 |

73 |

109 |

153 |

195 |

| Net income |

53 |

49 |

66 |

102 |

108 |

| Free cash flow before dividend4 |

87 |

6 |

56 |

93 |

102 |

|

| Steel shipments (000t) |

520 |

483 |

486 |

1,003 |

955 |

| EBITDA/tonne (USD) |

237 |

232 |

319 |

234 |

302 |

| Basic earnings per share (USD) |

0.68 |

0.63 |

0.85 |

1.31 |

1.39 |

| Diluted earnings per share (USD) |

0.52 |

0.57 |

0.66 |

1.09 |

1.30 |

Health & Safety

results

Health and Safety

performance based on Aperam personnel figures and contractors' lost

time injury frequency rate2, was 2.1 in the second quarter of 2016

compared to 1.1 in the first quarter of 2016.

Financial results

analysis for the three months period ending June 30, 2016

Sales in the second

quarter of 2016 increased by 4% to USD 1,121 million compared to

USD 1,076 million in the first quarter of 2016. Shipments in the

second quarter of 2016 increased by 8% at 520 thousand tonnes

compared to 483 thousand tonnes in the first quarter of 2016.

EBITDA continued to

improve over the quarter from USD 112 million in the first quarter

of 2016 to USD 123 million in the second quarter of 2016. The

Leadership Journey®6 has continued to progress over the quarter and

has contributed a total amount of USD 497 million to EBITDA since

the beginning of 2011.

Depreciation and

amortisation expense in the second quarter of 2016 was USD 43

million.

Aperam had an operating

income in the second quarter of 2016 of USD 80 million compared to

an operating income of USD 73 million in the previous quarter.

Net interest expense and

other financing costs in the second quarter of 2016 were USD 13

million, primarily related to financing costs of USD 4 million.

Realised and unrealised foreign exchange and derivative gains were

USD 3 million in the second quarter of 2016.

The Company recorded a

net income of USD 53 million, inclusive of an income tax expense of

USD 17 million, in the second quarter of 2016.

Cash flows from

operations in the second quarter of 2016 were positive at USD 112

million, with a working capital decrease of USD 18 million. CAPEX

in the second quarter was USD 25 million.

Free cash flow before

dividend4 in the second quarter of 2016 amounted to USD 87

million.

As of June 30, 2016,

shareholders' equity was USD 2,466 million and net financial debt5

was USD 280 million (gross financial debt as of June 30, 2016 was

USD 472 million and cash and cash equivalents were USD 192

million).

The Company had

liquidity of USD 647 million as of June 30, 2016, consisting of

cash and cash equivalents of USD 192 million and undrawn credit

lines7 of USD 456 million (borrowing base facility of USD 400

million and EIB financing of EUR 50 million described below).

Operating segment

results analysis

Stainless & Electrical Steel

The Stainless &

Electrical Steel segment had sales of USD 932 million in the second

quarter of 2016. This represents an increase of 6% compared to

sales of USD 876 million in the first quarter of 2016. Shipments

during the second quarter were 516 thousand tonnes. This is an

increase of 9% compared to shipments of 474 thousand tonnes in the

previous quarter. The volume increase was mainly due to the

traditional seasonal recovery in South America. Overall, average

selling prices for the Stainless & Electrical Steel segment

slightly decreased compared to the previous quarter.

The segment had EBITDA

of USD 101 million in the second quarter of 2016 compared to USD 90

million in the first quarter of 2016. The challenging environment,

especially in Brazil, was more than compensated by volume recovery

in South America as well as the good contribution of the Top Line

strategy.

Depreciation and

amortisation expense was USD 37 million in the second quarter of

2016.

The Stainless &

Electrical Steel segment had an operating income of USD 64 million

during the second quarter of 2016 compared to an operating income

of USD 56 million in the first quarter of 2016.

Services & Solutions

The Services &

Solutions segment had a 4% increase in sales during the quarter,

from USD 500 million in the first quarter of 2016 to USD 519

million in the second quarter of 2016. In the second quarter of

2016, shipments were 213 thousand tonnes compared to 210 thousand

tonnes in the previous quarter. The Services & Solutions

segment had higher average selling prices during the period

compared to the previous period.

The segment had EBITDA

in the second quarter of 2016 of USD 27 million compared to EBITDA

of USD 19 million in the first quarter of 2016. Overall, the

increase in EBITDA was mainly driven by good volumes and

improvement of selling prices.

Depreciation and

amortisation expense was USD 4 million in the second quarter of

2016.

The Services &

Solutions segment had an operating income of USD 23 million in the

second quarter of 2016 compared to an operating income of USD 16

million in the first quarter of 2016.

Alloys

& Specialties

The Alloys &

Specialties segment had sales of USD 107 million in the second

quarter of 2016, representing a decrease of 2% compared to USD 109

million in the first quarter of 2016. Shipments were lower in the

second quarter of 2016 at 7 thousand tonnes compared to 8 thousand

tonnes in the first quarter of 2016. Average selling prices

increased over the quarter due to mix.

The Alloys &

Specialties segment achieved EBITDA of USD 7 million in the second

quarter of 2016 compared to USD 6 million in the first quarter of

2016.

Depreciation and

amortisation expense in the second quarter of 2016 was USD 2

million.

The Alloys &

Specialties segment had an operating income of USD 5 million in the

second quarter of 2016 compared to an operating income of USD 5

million in the first quarter of 2016.

Recent

developments

-

On June 27, 2016, Aperam

and the European Investment Bank announced the signature of a

financing contract of an amount of EUR 50 million for the purpose

of financing a research and development programme over the period

2016-2019 as well as the upgrade of two plants located in cohesion

regions (Isbergues - Hauts-de-France and Châtelet - Hainaut).

New

developments

-

On July 27, 2016, Aperam

announced a change to its dividend calendar for 2016 with the

payment date of the 3rd quarterly payment to take place on

September 9, 2016 instead of September 12, 2016 (the other dates

remaining identical to the detailed dividend calendar announced on

February 10, 2016). This change follows a recommendation of the

Dutch Advisory Committee Securities Industry to avoid corporate

transactions close to the migration date of the securities

settlement system to a harmonised European system.

-

On July 27, 2016, Aperam

published its Half-Year Report for the six month period ended June

30, 2016. The report is available in the Luxembourg Stock

Exchange's electronic database OAM on www.bourse.lu and on

www.aperam.com under Investors & shareholders, Aperam Financial

Reports.

Investor conference

call

Aperam management will

host a conference call for members of the investment community to

discuss the second quarter 2016 financial performance at the

following time:

| Date |

New York |

London |

Luxembourg |

Wednesday,

July 27, 2016 |

12:30

pm |

5:30

pm |

6:30

pm |

The dial-in numbers for the call are:

France (+33(0)1 76 77 22 24); USA (+1212 444 0412); and

international (+44(0)20 3427 1906). The participant access code is:

5905084#.

A replay of the conference call will be available until August 2nd,

2016: France (+33 (0)1 74 20 28 00); USA (+1 347 366 9565) and

international (+44 (0)20 3427 0598). The participant access code is

5905084#.

Contacts

Corporate Communications / Laurent

Beauloye: +352 27 36 27 27

Investor Relations / Romain Grandsart: +352 27 36 27 36

About Aperam

Aperam is a global player in stainless,

electrical and specialty steel, with customers in over 40

countries. The business is organised in three primary operating

segments: Stainless & Electrical Steel, Services &

Solutions and Alloys & Specialties.

Aperam has 2.5 million

tonnes of flat Stainless and Electrical steel capacity in Brazil

and Europe and is a leader in high value specialty products. Aperam

has a highly integrated distribution, processing and services

network and a unique capability to produce stainless and specialty

from low cost biomass (charcoal). Its industrial network is

concentrated in six production facilities located in Brazil,

Belgium and France.

In 2015, Aperam had

sales of USD 4.7 billion and shipments of 1.89 million tonnes.

For further information,

please refer to our website at www.aperam.com

Forward-looking statements

This document may

contain forward-looking information and statements about Aperam and

its subsidiaries. These statements include financial projections

and estimates and their underlying assumptions, statements

regarding plans, objectives and expectations with respect to future

operations, products and services, and statements regarding future

performance. Forward-looking statements may be identified by the

words "believe," "expect," "anticipate," "target" or similar

expressions. Although Aperam's management believes that the

expectations reflected in such forward-looking statements are

reasonable, investors and holders of Aperam's securities are

cautioned that forward-looking information and statements are

subject to numerous risks and uncertainties, many of which are

difficult to predict and generally beyond the control of Aperam,

that could cause actual results and developments to differ

materially and adversely from those expressed in, or implied or

projected by, the forward-looking information and statements. These

risks and uncertainties include those discussed or identified in

Aperam's filings with the Luxembourg Stock Market Authority for the

Financial Markets (Commission de Surveillance du Secteur

Financier). Aperam undertakes no obligation to publicly update its

forward-looking statements or information, whether as a result of

new information, future events, or otherwise.

APERAM CONDENSED

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| (in million of U.S. dollars) |

June 30,

2016 |

March 31,

2016 |

June 30,

2015 |

| Non current assets |

2,780 |

2,771 |

2,894 |

| Intangible assets |

596 |

587 |

619 |

| Property, plant and equipments (incl. Biological

assets) |

1,733 |

1,729 |

1,774 |

| Investments & Other |

451 |

455 |

501 |

| |

|

|

|

| Current assets & working

capital |

884 |

815 |

842 |

| Inventories, trade receivables and trade

payables |

591 |

595 |

650 |

| Other assets |

101 |

90 |

120 |

| Cash and cash equivalents |

192 |

130 |

72 |

| |

|

|

|

| Shareholders' equity |

2,466 |

2,411 |

2,449 |

| Group share |

2,461 |

2,406 |

2,445 |

| Non-controlling interest |

5 |

5 |

4 |

| |

|

|

|

| Non current liabilities |

898 |

900 |

924 |

| Interest bearing liabilities |

458 |

454 |

446 |

| Deferred employee benefits |

184 |

191 |

193 |

| Provisions and other |

256 |

255 |

285 |

| |

|

|

|

| Current liabilities (excluding

trade payables) |

300 |

275 |

363 |

| Interest bearing liabilities |

14 |

14 |

80 |

| Other |

286 |

261 |

283 |

APERAM CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS

|

(in million of U.S. dollars) |

Three Months Ended |

|

Six Months Ended |

| June 30, 2016 |

March 31, 2016 |

June 30,

2015 |

|

June 30, 2016 |

June 30, 2015 |

| Sales |

1,121 |

1,076 |

1,264 |

|

2,197 |

2,522 |

| EBITDA |

123 |

112 |

155 |

|

235 |

288 |

| EBITDA margin (%) |

11.0% |

10.4% |

12.3% |

|

10.7% |

11.4% |

| Depreciation & amortisation |

(43) |

(39) |

(46) |

|

(82) |

(93) |

| Operating income |

80 |

73 |

109 |

|

153 |

195 |

| Loss from other investments and associates |

- |

- |

(6) |

|

- |

(6) |

| Net interest expense and other net financing

costs |

(13) |

(9) |

(15) |

|

(22) |

(50) |

| Foreign exchange and derivative gains /

(losses) |

3 |

(3) |

2 |

|

- |

5 |

| Income before taxes and

non-controlling interests |

70 |

61 |

90 |

|

131 |

144 |

| Income tax expense |

(17) |

(12) |

(23) |

|

(29) |

(35) |

| Income before non-controlling

interests |

53 |

49 |

67 |

|

102 |

109 |

| Non-controlling interests |

- |

- |

1 |

|

- |

1 |

| Net income |

53 |

49 |

66 |

|

102 |

108 |

APERAM CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS

|

(in million of U.S. dollars) |

Three Months Ended |

|

Six Months Ended |

| June 30, 2016 |

March 31, 2016 |

June 30,

2015 |

|

June 30, 2016 |

June 30, 2015 |

| Net income |

53 |

49 |

66 |

|

102 |

108 |

| Non-controlling interests |

- |

- |

1 |

|

- |

1 |

| Depreciation and amortisation |

43 |

39 |

46 |

|

82 |

93 |

| Change in working capital |

18 |

(40) |

(24) |

|

(22) |

(67) |

| Other |

(2) |

(9) |

(11) |

|

(11) |

23 |

| Net cash provided by operating

activities |

112 |

39 |

78 |

|

151 |

158 |

| Purchase of PPE, intangible and biological assets

(CAPEX) |

(25) |

(33) |

(24) |

|

(58) |

(58) |

| Other investing activities (net) |

- |

- |

3 |

|

- |

2 |

| Net cash used in investing

activities |

(25) |

(33) |

(21) |

|

(58) |

(56) |

| Payments to banks and long term debt |

(3) |

(4) |

(265) |

|

(7) |

(213) |

| Dividends paid |

(24) |

(24) |

- |

|

(48) |

- |

| Other financing activities (net) |

- |

- |

(1) |

|

(1) |

(1) |

| Net cash used in financing

activities |

(28) |

(28) |

(266) |

|

(56) |

(214) |

| Effect of exchange rate changes on cash |

3 |

4 |

5 |

|

7 |

(13) |

| Change in cash and cash

equivalent |

62 |

(18) |

(204) |

|

44 |

(125) |

| |

|

|

|

|

|

|

| Free cash flow before

dividend4 |

87 |

6 |

56 |

|

93 |

102 |

Appendix 1a - Health

& Safety statistics

|

Health & Safety Statistics |

Three Months Ended |

| June 30, 2016 |

March 31, 2016 |

June 30,

2015 |

| Frequency

Rate |

2.1 |

1.1 |

0.8 |

Lost time injury frequency rate equals

lost time injuries per 1,000,000 worked hours, based on own

personnel and contractors.

Appendix 1b - Key

operational and financial information

Quarter Ended

June 30, 2016 |

Stainless & Electrical Steel |

Services & Solutions |

Alloys & Specialties |

Others & Eliminations |

Total |

| Operational information |

|

|

|

|

|

| Steel Shipment (000t) |

516 |

213 |

7 |

(216) |

520 |

| Steel selling price (USD/t) |

1,760 |

2,317 |

13,653 |

|

1,931 |

| |

|

|

|

|

|

| Financial information |

|

|

|

|

|

| Sales (USDm) |

932 |

519 |

107 |

(437) |

1,121 |

| EBITDA (USDm) |

101 |

27 |

7 |

(12) |

123 |

| Depreciation & amortisation (USDm) |

37 |

4 |

2 |

- |

43 |

| Operating income / (loss) (USDm) |

64 |

23 |

5 |

(12) |

80 |

Quarter Ended

March 31, 2016 |

Stainless & Electrical Steel |

Services & Solutions |

Alloys & Specialties |

Others & Eliminations |

Total |

| Operational information |

|

|

|

|

|

| Steel Shipment (000t) |

474 |

210 |

8 |

(209) |

483 |

| Steel selling price (USD/t) |

1,794 |

2,266 |

12,828 |

|

2,150 |

| |

|

|

|

|

|

| Financial information |

|

|

|

|

|

| Sales (USDm) |

876 |

500 |

109 |

(409) |

1,076 |

| EBITDA (USDm) |

90 |

19 |

6 |

(3) |

112 |

| Depreciation & amortisation (USDm) |

34 |

3 |

1 |

1 |

39 |

| Operating income / (loss) (USDm) |

56 |

16 |

5 |

(4) |

73 |

| |

|

|

|

|

|

1 The financial

information in this press release and Appendix 1 has been prepared

in accordance with the measurement and recognition criteria of

International Financial Reporting Standards ("IFRS") as adopted in

the European Union. While the interim financial information

included in this announcement has been prepared in accordance with

IFRS applicable to interim periods, this announcement does not

contain sufficient information to constitute an interim financial

report as defined in International Accounting Standard 34, "Interim

Financial Reporting". Unless otherwise noted the numbers and

information in the press release have not been audited. The

financial information and certain other information presented in a

number of tables in this press release have been rounded to the

nearest whole number or the nearest decimal. Therefore, the sum of

the numbers in a column may not conform exactly to the total figure

given for that column. In addition, certain percentages presented

in the tables in this press release reflect calculations based upon

the underlying information prior to rounding and, accordingly, may

not conform exactly to the percentages that would be derived if the

relevant calculations were based upon the rounded

numbers.

2 Lost time injury frequency rate equals lost time injuries per

1,000,000 worked hours, based on own personnel and

contractors.

3 EBITDA is defined as operating income plus depreciation and

impairment expenses.

4 Free cash flow before dividend is defined as net cash provided by

operating activities less net cash used in investing

activities.

5 Net debt refers to long-term debt, plus short-term debt, less

cash and cash equivalents (including short-term investments) and

restricted cash.

6 The Leadership Journey® is an initiative launched on December 16,

2010, and subsequently accelerated and increased, to target

management gains and profit

enhancement. Aperam targets a contribution to EBITDA of a total

amount of USD 475 million by end of 2015 and of USD 575 million by

end of 2017, since the beginning of 2011.

7 Subject to eligible collateral available.

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Aperam via Globenewswire

HUG#2031134

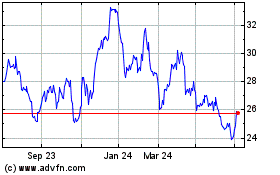

Aperam (EU:APAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

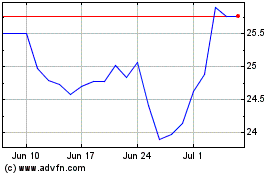

Aperam (EU:APAM)

Historical Stock Chart

From Apr 2023 to Apr 2024