AorTech International PLC Interim Results (1818H)

November 27 2015 - 2:33AM

UK Regulatory

TIDMAOR

RNS Number : 1818H

AorTech International PLC

27 November 2015

AORTECH INTERNATIONAL PLC ("AorTech", "the Company" or "the

Group")

Unaudited Interim Results

For the six months ended 30 September 2015

CHAIRMAN'S STATEMENT

Trading

Trading in the half year to 30 September 2015 was in line with

the Board's expectations. Revenues for the period were $380,000 and

administrative costs amounted to $365,000 resulting in the Company

achieving a profit at the EBITDA level. However, after charging

$163,000 for amortisation of intangible assets and incurring a

further $45,000 of exceptional litigation costs, the reported

operating loss was $193,000. Also charged to the profit and loss

account is a $363,000 finance cost relating to the residual loan

note interest. At the AGM in September, shareholders approved the

Company's intention to approach loan note holders to convert their

residual interest into ordinary shares. This charge recognises the

full cost of the shares to be issued, less the provisions

previously made.

Debtor Recovery

We mentioned in the year end accounts that the last $300,000 of

a long standing debtor was being recovered by monthly payments. Up

to the period end, all payments had been received on the due date.

Since the end of September, no payments have been received and

steps are being taken to ensure full recovery of the final balance

of $150,000 together with our costs of recovery. No provision has

been made against this debt.

We are currently owed in excess of $300,000 by one of our

licensees; a provision of $100k has been made in the accounts and

legal counsel has been retained to recover all sums due.

These matters are disappointing and will, as a result, impact on

the timing and potentially the values of cash flows going

forward.

Maguire Litigation

A great deal of time and effort is still having to be committed

by the Directors in pursuing the US litigation against AorTech's

former CEO and related parties. The case is in the pre-trial

discovery phase in which AorTech is able to gather the evidence to

support its allegations. The Directors intend to continue to

vigorously pursue this action in order to protect the Company and

shareholders from the actions of Maguire and other related

parties.

Heart Valve

I set out a brief history and analysis of the Heart Valve

project in the Annual Report and Accounts. Current commercial

bioprosthetic and mechanical heart valves are compromised by either

their durability or need for long term anticoagulation. Creating an

analogue of the human valve out of polymer that has the benefits of

current bioprosthetic and mechanical valves without the drawbacks

has been recognised as the "Holy Grail" of heart valve technology

for over 50 years.

There has been no real step change in surgical valve technology

over the past 20 to 30 years, although evolutionary improvements

have been made. There have been major developments in surgical

techniques with the advent of catheter delivered valves (TAVI). By

nature of the TAVI procedure, only bioprosthetic valves can be

delivered this way and it is believed that the already limited

durability of bioprosthetic valves may be further compromised by

them being crushed into the narrow catheter. TAVI valves are

currently only suitable for the much older patient who is unable to

have open heart surgery.

Further independent review and initial consultation on the

AorTech heart valve project has demonstrated that AorTech's

Elast-Eon(TM) material is still the most appropriate polymer for

making durable heart valves. The progress made in the AorTech heart

valve project includes a valve design that has now completed proof

of concept at clinical trials; a strong IP portfolio that comprises

polymer patents; valve design and basis of manufacture; patents,

significant know how and trade secrets regarding design history and

manufacturing processes.

We have now identified a team of industry specialists covering

the key areas of manufacturing, quality, regulatory, clinical

marketing and business development expertise. The team has reviewed

and bought into the potential for a polymer valve utilising

AorTech's technology.

The market opportunities have been analysed for this disruptive

technology as well as the surgical version of the valve being a

replacement for current technology in the developed western

markets. The ability to use inexpensive mass production techniques

will produce a cost effective solution for developing countries

where rheumatic heart disease is so prevalent and young patients

require a relatively low cost valve that is both durable and avoids

anticoagulation. In addition, in the area of TAVI, the valve

leaflets can be incorporated into a TAVI stent and dry stored and

pre-loaded in a smaller catheter, thus dramatically improving TAVI

technology.

A non-binding Heads of Terms has been agreed whereby AorTech

will transfer its Heart Valve technology into a new company

established with the objective of replicating the testing work

under regulatory conditions and which will then commercialise the

valve in both surgical and TAVI uses.

The deal is contingent upon the new company raising sufficient

funding in order to set up a manufacturing plant and take the heart

valve through initial regulatory testing. AorTech will have a

significant equity interest in the new company together with future

royalty income. I will personally have a directorship in the new

company and I am presently working with the team members identified

to raise the necessary finance and establish a manufacturing

facility. Discussions and meetings on the project have been

positive to date and I would be hopeful that AorTech could make a

formal announcement in due course. Should the transaction proceed,

it will constitute a related party transaction under the AIM

rules.

Conclusion

The business continues to make progress and our Manufacturing

Licensee has a growing prospects list. We recently commissioned a

detailed report from a world leading biomaterials expert to review

the potential of AorTech's IP portfolio. The report is extremely

positive in that the Elast-Eon(TM) family of materials continues to

be the leading material for implantable medical devices. Your

Board, in conjunction with the author of the report will be

reviewing all of the recommendations contained therein. A range of

opportunities have been identified which also includes the filing

of additional patents to further strengthen AorTech's IP

portfolio.

Your Board, despite the problems and issues which have arisen

over the past two years, remain enthusiastic about the potential of

Elast-Eon(TM), not just in the field of heart valves but also in

other exciting medical device applications.

Bill Brown, Chairman

25 November 2015

CONDENSED CONSOLIDATED INTERIM INCOME STATEMENT

Six months ended 30 September 2015 Unaudited Unaudited Audited

Twelve

months

Six months Six months to 31

to 30 to 30 March

Note Sept 2015 Sept 2014 2015

US$000 US$000 US$000

Revenue 380 524 844

-------------------- -------------------- ----------------

Other income - - 13

-------------------- -------------------- ----------------

Cost of sales - (46) -

Administrative expenses (365) (340) (776)

Exceptional administrative expenses

2 (45) (212) (204)

Other expenses - amortisation of intangible

assets 7 (163) (141) (332)

-------------------- -------------------- ----------------

Operating loss (193) (215) (455)

Finance income / (expense) 3 (363) 117 129

-------------------- -------------------- ----------------

Loss from continuing operations attributable

to owners of the parent company (556) (98) (326)

-------------------- -------------------- ----------------

Loss from discontinued operations 4 - - (44)

-------------------- -------------------- ----------------

Loss attributable to owners of the parent

company (556) (98) (370)

Taxation - - -

-------------------- -------------------- ----------------

Loss attributable to equity holders of

(MORE TO FOLLOW) Dow Jones Newswires

November 27, 2015 02:33 ET (07:33 GMT)

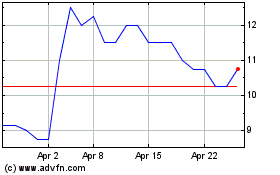

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Apr 2023 to Apr 2024