TIDMAOR

RNS Number : 1144Y

AorTech International PLC

27 November 2014

AORTECH INTERNATIONAL PLC ("AorTech", "the Company" or "the

Group")

Unaudited Interim Results

For the six months ended 30 September 2014

CHAIRMAN'S STATEMENT

I set out below a commentary on the key matters over the past

six months.

Unaudited results for the Six Months to 30 September 2014

During the period, total Group revenue grew from the $71,000

achieved from continuing operations last year to $524,000. Our

Licence fee income increased by $200,000 to $271,000 and we also

saw growth in Royalty income from $nil to $134,000.

Administration Costs for the period were $340,000, a decrease

from the actual spend disclosed in last years Interim Accounts of

$740,000; however some of those prior year costs related to

discontinued activities.

We suffered a charge of $212,000 in exceptional administration

costs relating to the legal case being pursued against our former

CEO. The operating loss has been reduced from $373,000 in 2013 to

$215,000 and would have been broadly break even but for those

litigation costs.

Litigation

We continue to pursue the case against our former CEO Frank

Maguire. We have recognised all of the costs incurred to date and

are hopeful that a proportion of these, together with 90% of all

future costs, will be recoverable from our insurers. There has

recently been ongoing correspondence between AorTech's attorney and

the insurer's attorney to clarify and resolve certain matters that

have arisen from queries raised by the insurers. We are however

confident that there will be a successful outcome to these

matters.

We are in continuing discussions with our insurer to extend the

litigation to cover the former CEO's new business interest and

certain related parties.

Biomerics, LLC Manufacturing Licence

Biomerics, our manufacturing licensee, has now fully validated

the manufacturing process, and materials have been supplied to

customers. We previously reported that we had reimbursed Biomerics

$47,000 of the $155,000 they had incurred on labour costs relating

to the validation process. In the 6 months to 30 September 2014 a

further $96,000 had been reimbursed, leaving an outstanding balance

of $12,000.

Whilst there have been a number of enquiries from potential

customers, both Biomerics and AorTech are disappointed that these

have not progressed further. Biomerics have submitted a proposal to

amend the terms of a supply agreement relating to one of AorTech's

licensees. Biomerics and AorTech have begun discussions on this and

a number of other issues relating to the contractual relationship

between the two companies. It is hoped that agreement on all these

issues can be reached but there can be no certainty that this will

be achieved.

Other Licensees

A number of in-depth discussions have been ongoing with several

licensees to resolve issues which have arisen and, in some cases,

to restructure and revise licence terms. This has created an

increased workload but the benefits from this should arise in

future years.

The vast majority of our licensees are continuing to progress

their products through the development and regulatory process with

two of our licensees achieving commercialisation.

As can be seen from the financial results, there was increased

income from licence and royalty fees during the period and we are

hopeful that certain of our licensees will continue to achieve

successful launches of their products, resulting in further

increased revenue flows for AorTech. As mentioned previously,

AorTech's future success is dependent on the future success of

AorTech's licensees.

Cash and Debtors Position

Cash at 30 September 2014 was $335,000, a decrease of $307,000

from the 31 March 2014 balance of $642,000.

Debtors due within one year increased from $401,000 at 31 March

2014 to $725,000. These include a long-standing debtor where the

agreed payment schedule is being met through monthly repayments,

with $300,000 expected to be recovered within the next 12 months.

In addition there is a balance of $175,000 due which we have not

provided against because a blue chip company has a secondary

obligation in respect of the debt and thus we are hopeful of full

recovery. The cash and working capital position of the Company is

reliant upon the timely collection of the debtor book.

We continue to rigorously monitor and control overheads. As a

quoted IP Company, patent and insurance costs are significant and

these together with the costs associated with our stock market

listing accounted for almost 50% of the Administrative expense of

$340,000.

Heart Valve

We are actively exploring a number of areas for maximising the

return for AorTech from the Heart Valve project and we will report

on progress in this area as and when there is news flow.

Conclusion

Although there has been progress during the six months to 30

September 2014, the Board and our CEO, Eddie McDaid in particular

have been faced with almost daily challenges to try and resolve a

myriad of issues that have arisen, some of which are related to the

tenure of the previous CEO. The litigation against the former CEO

has added to the workload and has been a necessary but unwelcome

distraction from focusing on the generation of income to create

increased value for shareholders.

Your Board continues to meet challenges but is determined to

overcome them and, together with its licensees, to achieve and

deliver the necessary revenue and profitability for AorTech and its

shareholders.

Bill Brown, Chairman

Enquiries

AorTech International Pls

Bill Brown, Chairman

Tel: +44 (0) 7730 718296

Eddie McDaid, Chief Executive

Tel: +44 (0) 7802 920869

finnCap

Stuart Andrews/James Thompson

finnCap as Nominated Advisor

Tel: 020 7220 0500

CONDENSED CONSOLIDATED INTERIM

INCOME STATEMENT

Six months ended 30 September

2014 Unaudited Unaudited Audited

Six Six Twelve

months months months

to 30 to 30 to 31

Sept Sept March

Note 2014 2013 2014

US$000 US$000 US$000

Revenue 524 71 418

------------------ ------------------ ------------------

Other income - - 1

------------------ ------------------ ------------------

Cost of sales (46) (48) -

Administrative expenses (340) (284) (859)

Exceptional administrative

expenses 2 (212) - (83)

Other expenses - amortisation

of intangible assets (141) (112) (241)

------------------ ------------------ ------------------

Operating loss (215) (373) (764)

Finance income / (expense) 3 117 (47) (59)

------------------

Loss from continuing operations

attributable to owners of the

parent company (98) (420) (823)

------------------

Loss from discontinued operations

4 - (300) (486)

------------------

Loss attributable to owners

of the parent company (98) (720) (1,309)

Taxation - - -

Loss attributable to equity

holders of the parent company (98) (720) (1,309)

================== ================== ==================

Loss per share (basic and diluted)

- US cents (2.03) (14.90) (27.09)

CONDENSED CONSOLIDATED INTERIM STATEMENT OF

COMPREHENSIVE INCOME

Unaudited Unaudited Audited

Six Twelve

Six months months

months to to

to 30 31

30 Sept Sept March

2014 2013 2013

US$000 US$000 US$000

Loss for the period (98) (720) (1,309)

Other comprehensive income:

Exchange differences on translating

foreign operations (487) (99) (51)

Income tax relating to other - - -

comprehensive income

------------------------- ------------- ---------------

Other comprehensive income for

the period, net of tax (487) (99) (51)

------------------------- ------------- ---------------

Total comprehensive income for

the period, attributable to

equity holders of the parent

company (585) (819) (1,360)

------------------------- ------------- ---------------

CONDENSED CONSOLIDATED INTERIM

BALANCE SHEET

Unaudited Unaudited Audited

30

Sept 30 Sept 31 March

2014 2013 2014

US$000 US$000 US$000

Assets

Non current assets

Intangible assets 1,673 1,603 1,861

Property, plant and

equipment - 7 -

Trade and other receivables 150 - 300

Total non current assets 1,823 1,610 2,161

---------------- --------------- ------------

Current assets

Inventories - 56 46

Trade and other receivables 725 1,027 401

Cash and cash equivalents 335 1,023 642

Total current assets 1,060 2,106 1,089

---------------- --------------- ------------

Total assets 2,883 3,716 3,250

---------------- --------------- ------------

Liabilities

Current liabilities

Trade and other payables (228) (242) (306)

---------------- --------------- ------------

Total current liabilities (228) (242) (306)

---------------- --------------- ------------

Non current liabilities

Change of control redemption

premium (76) (182) (193)

---------------- --------------- ------------

Total non current liabilities (76) (182) (193)

---------------- --------------- ------------

Total liabilities (304) (424) (499)

================ =============== ============

Net assets 2,579 3,292 2,751

================ =============== ============

Equity

Issued capital 19,597 19,550 20,144

Share premium 3,796 3,786 3,901

Other reserve (3,249) (3,241) (3,340)

Foreign exchange reserve 4,278 4,353 3,791

Profit and loss account (21,843) (21,156) (21,745)

Total equity attributable

to equity holders of

the parent company 2,579 3,292 2,751

================ =============== ============

CONDENSED CONSOLIDATED INTERIM

CASH FLOW STATEMENT

Unaudited Unaudited Audited

Six Six Twelve

months months months

to 30 to 30 to 31

Sept Sept March

2014 2013 2014

US$000 US$000 US$000

Cash flows from operating

activities

Group loss after tax (98) (420) (823)

Adjustments for:

Amortisation of intangible

assets 141 112 241

Finance (income) / expense (117) - 59

(Increase) / decrease in

trade and other receivables (174) (46) 102

Decrease in inventories 46 - -

(Decrease) / increase in

trade and other payables (78) 4 69

-------------------- ------------------- ----------------

Net cash flow from continuing

operations (280) (350) (352)

Net cash flow from discontinued

operations - 315 312

-------------------- ------------------- ----------------

Net cash flow from operating

activities (280) (35) (40)

-------------------- ------------------- ----------------

Cash flows from investing

activities

Purchase of intangible

assets (20) (62) (439)

-------------------- ------------------- ----------------

Net cash flow from continuing

investing activities (20) (62) (439)

Net cash flow from discontinued

investing activities - (3) -

Net cash flow from investing

activities (20) (65) (439)

-------------------- ------------------- ----------------

Net decrease in cash and

cash equivalents (300) (100) (479)

Foreign exchange movements

on cash held in foreign

currencies (7) 136 134

Cash and cash equivalents

at beginning of period 642 987 987

Cash and cash equivalents

at end of period 335 1,023 642

==================== =================== ================

CONDENSED CONSOLIDATED INTERIM STATEMENT OF

CHANGES IN EQUITY

Profit

Share Foreign and

Share premium Other exchange loss Total

(Unaudited) capital account reserve reserve account equity

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 1

April

2013 18,351 3,555 (3,043) 5,684 (20,436) 4,111

Transactions

with owners - - - - - -

Loss for the

period - - - - (720) (720)

Other

comprehensive

income

Exchange

difference

on translating

foreign

operations 1,199 231 (198) (1,331) - (99)

Income tax

relating

to components

of other

comprehensive

income - - - - - -

------------------------ --------------- ---------------- ----------------------- ----------------- -------------

Total

comprehensive

income for the

period 1,199 231 (198) (1,331) (720) (819)

------------------------ --------------- ---------------- ----------------------- ----------------- -------------

Balance at 30

September

2013 19,550 3,786 (3,241) 4,353 (21,156) 3,292

Transactions

with owners - - - - - -

Loss for the

period - - - - (589) (589)

Other

comprehensive

income

Exchange

difference

on translating

foreign

operations 594 115 (99) (562) - 48

Income tax

relating

to components

of other

comprehensive

income - - - - - -

------------------------ --------------- ---------------- ----------------------- ----------------- -------------

Total

comprehensive

income for the

period 594 115 (99) (562) (589) (637)

Balance at 31

March

2014 20,144 3,901 (3,340) 3,791 (21,745) 2,751

Transactions

with owners - - - - - -

Profit for the

period - - - - (98) (98)

Other

comprehensive

income

Exchange

difference

on translating

foreign

operations (547) (105) 91 487 - (74)

Income tax

relating

to components

of other

comprehensive

income - - - - - -

------------------------ --------------- ---------------- ----------------------- ----------------- -------------

Total

comprehensive

income for the

period (547) (105) 91 487 (98) (172)

Balance at 30

September

2014 19,597 3,796 (3,249) 4,278 (21,843) 2,579

======================== =============== ================ ======================= ================= =============

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. BASIS OF PREPARATION

These condensed consolidated interim financial statements are

for the six months ended 30 September 2014, and have been prepared

with regard to the requirements of IAS 34 on "Interim Financial

Reporting". They do not include all of the information required for

full financial statements, and should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 31 March 2014.

These condensed consolidated interim financial statements have

been prepared in accordance with the accounting policies set out

below which are based on the recognition and measurement principles

of IFRS in issue as adopted by the European Union (EU) and

effective at 31 March 2014. They were approved for issue by the

Board of Directors on 26 November 2014.

After considering the period end cash position, making

appropriate enquiries and reviewing budgets and profit and cash

flow forecasts for a period of at least twelve months from the date

of signing these financial statements, the Directors have formed a

judgement at the time of approving the financial statements that

there is a reasonable expectation that the Group has sufficient

resources to continue in operational existence for the foreseeable

future. For this reason the Directors consider the adoption of the

going concern basis in preparing the condensed consolidated interim

financial statements is appropriate.

The financial information for the six months ended 30 September

2014 and the comparative figures for the six months ended 30

September 2013 are unaudited and have been prepared on the basis of

the accounting policies set out in the consolidated financial

statements of the Group for the year ended 31 March 2014.

These extracts do not constitute statutory accounts under

section 434 of the Companies Act 2006. The financial statements for

the year ended 31 March 2014, prepared under IFRS, received an

unqualified audit report, did not contain statements under sections

498(2) and 498(3) of the Companies Act 2006 and have been delivered

to the Registrar of Companies.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

condensed consolidated interim financial statements.

Loss per share has been calculated on the basis of the result

for the period after tax, divided by the weighted average number of

ordinary shares in issue in the period of 4,832,778. The

comparatives are calculated by reference to the weighted average

number of ordinary shares in issue which were 4,832,778 for the

period to 30 September 2013 and 4,832,778 for the year ended 31

March 2014.

2. EXCEPTIONAL ADMINISTRATIVE EXPENSES

This comprises the exceptional administrative expense

represented by the cost of litigation against the Company's former

CEO.

3. FINANCE INCOME / (EXPENSE)

The change of control redemption premium represents the decrease

/ (increase) in the premium payable to the former loan note holders

in the event of a change of control of the Company. The amount

payable is based upon the market capitalisation of the Company at

the balance sheet date.

4. DISCONTINUED OPERATIONS

On 1 October 2013, the Group signed an agreement with Biomerics,

LLC for the manufacture and distribution of our patented materials,

including to our existing licensees. In the opinion of the

Directors, the Biomerics transaction transformed the Group into an

intellectual property holding company. As a consequence, results

attributable to manufacturing activity constitute a discontinued

operation, and have been presented as such in the Income Statement.

Comparative figures have been adjusted accordingly.

5. SEGMENTAL REPORTING

The Company is an Intellectual Property (IP)

holding company whose principal activity is

exploiting the value of its IP and know-how.

During the first six months of financial year

2014/15 all revenue originated in the United

Kingdom.

Unaudited Unaudited Audited

Twelve

Six Six months

months months to

to 30 to 30 31

Sept Sept March

2014 2013 2014

US$000 US$000 US$000

Analysis of revenue by

products and services and

by geographical area

Geographical segments

United Kingdom:

Supply of product 119 - 48

Licence fees - services 271 71 332

Royalty revenue 134 - 38

524 71 418

================= ================== ==============

Unaudited Unaudited Audited

Twelve

Six Six months

months months to

to 30 to 30 31

Sept Sept March

2014 2013 2014

US$000 US$000 US$000

Analysis of result - operating

loss

Continuing operations

United Kingdom (215) (373) (764)

Operating loss (215) (373) (764)

Finance income / (expense) - all UK 117 (47) (59)

----------------- ------------------ --------------

Loss on continuing operations before taxation (98) (420) (823)

----------------- ------------------ --------------

Discontinued operation

USA - (300) (486)

----------------- ------------------ --------------

Loss on discontinued operations - (300) (486)

================= ================== ==============

6. FINANCE (EXPENSE) / INCOME

Unaudited Unaudited Audited

Twelve

Six Six months

months months to

to 30 to 30 31

Sept Sept March

2014 2013 2014

US$000 US$000 US$000

Bank interest income / - 1 -

(expense)

Change of control redemption

premium 117 (48) (59)

---------- ---------- --------

117 (47) (59)

========== ========== ========

7. INTANGIBLE ASSETS

The following table shows the impact of additions,

exchange rate adjustments and amortisation on intangible

assets.

Intellectual Development

property costs Total

US$000 US$000 US$000

At 1 April 2013 1,840 - 1,840

Additions during period 62 - 62

Exchange rate adjustment (187) - (187)

Amortisation (112) - (112)

------------------- --------------------- ---------------

At 30 September 2013 1,603 - 1,603

Additions during period 58 319 377

Exchange rate adjustment 10 - 10

Amortisation (118) (11) (129)

------------------- --------------------- ---------------

At 1 April 2014 1,553 308 1,861

Additions during period 20 - 20

Exchange rate adjustment (67) - (67)

Amortisation (109) (32) (141)

------------------- --------------------- ---------------

At 30 September 2014 1,397 276 1,673

------------------- --------------------- ---------------

8. INTERIM ANNOUNCEMENT

The interim results announcement report was released on 27

November 2014. A copy of the Interim Report will become available

on the Company's website www.aortech.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QKADPABDDODB

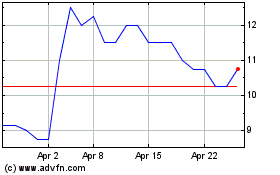

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Apr 2023 to Apr 2024