TIDMAOR

RNS Number : 1239H

AorTech International PLC

15 August 2016

AorTech International plc

("AorTech", "the Company" or "the Group")

Audited results for the year ended 31 March 2016

AorTech International plc (AIM: AOR), the biomaterials and

medical device IP company, today announces its results for the year

ended 31 March 2016.

Financial summary

-- Total Group revenue increased by over 5% from previous year

to US$901k

-- Net trading profit of $128k (2015: US$96k profit) before

exceptional costs, exchange rate differences and bad debt

provisions

-- Operating loss after charging $312k in amortisation of

intangible assets and $369k in bad debt provisions

Other developments

-- Maintained 2015 level of administrative expenses before

exceptional costs and bad debt provisions

-- Share Capital reorganisation taken place, with contingent

liability extinguished.

For further information contact:

AorTech International plc

Eddie McDaid, Chief Executive Tel: +44 (0)7802 920869

AorTech International plc

Bill Brown, Chairman Tel: +44 (0)7730 718296

finnCap Limited

Giles Rolls / Jonny Franklin-Adams Tel: +44 20 7220 0500

A copy of this announcement will be available at

www.aortech.net/investor-relations/rns-and-insider-information/.

The content of the website referred to in this announcement is not

incorporated into and does not form part of this announcement.

About AorTech:

AorTech has developed biostable, implantable polymers, including

Elast-Eon(TM) and ECSil(TM) the world's leading long-term

implantable co-polymers, now manufactured on their behalf by

Biomerics LLC in Utah, USA. With several million implants and seven

years of successful clinical use, AorTech polymers are being

developed and used in cardiology and urological applications,

including pacing leads, cardiac cannulae, stents and neuro

stimulation devices. Devices manufactured from AorTech polymers

have numerous US FDA PMA approvals, 510k's, CE Marks, Australian

TGA and Japanese Ministry of Health approvals.

Elast-Eon(TM) and ECSil(TM)'s biostability is comparable to

silicone while exhibiting excellent mechanical, blood contacting

and flex-fatigue properties. These polymers can be processed using

conventional thermoplastic extrusion and moulding techniques. A

range of materials in a variety of application-specific

formulations for use in medical devices and components are

available.

CHAIRMAN'S STATEMENT

In the year to 31 March 2016, Revenue and Other Income increased

from $857,000 to $901,000, an increase of just over 5%.

Administrative expenses, before exceptional costs, foreign exchange

differences and bad debt provisions, were maintained in line with

the prior year, $773,000 (2015: $761,000), resulting in a net

trading profit of $128,000 before exceptional costs, exchange

differences and bad debt provisions. However, after bad debt

provisions of $369,000 the net trading profit has been reduced to a

net trading loss of $241,000. The Company incurred an overall

operating loss of $575,000 after amortisation of intangible assets

of $312,000 (2015: $332,000) after exceptional litigation costs of

$80,000 (2015: $204,000) and exchange rate differences of $58,000

(2015: $15,000). Operating losses increased from $455,000 to

$575,000 with the year-end cash balances reducing from $360,000 in

2015 to $314,000. This reduction was mainly due to the significant

bad debt provisions required in respect of two major debtors. In

addition, further investment was made in development costs of

$168,000 during the year.

Your Board has, however, continued to maintain close control on

all of its overheads, as is demonstrated by maintaining the costs

at the same level as the previous year.

Bad Debt Provision

During the year, we had to provide for a sum of $150,000 due

from SynCardia and $219,000 from iSense. The SynCardia debt had

been the subject of a mediated settlement which was being repaid at

the rate of $25,000 per month. Unfortunately, monthly payments

ceased from October 2015 and appropriate legal action was

immediately instigated for recovery. AorTech achieved an arrestment

on the debtor's bank account but then our recovery was frustrated

due to SynCardia filing for bankruptcy under Chapter 11. The other

substantial debt of $219,000 was due under the terms of a licence

regarding the continuous glucose monitoring business. AorTech's US

attorneys, who were pursuing this debt on our behalf, have recently

informed the Board that all of the assets of this company have been

transferred to another company of a similar name, leaving the

debtor company with substantial liabilities, including its debt

obligations to AorTech. Your Board is taking advice from its US

attorneys to determine what recovery options may be appropriate in

respect of this debt.

Litigation against Frank Maguire and Others

One of the key tasks assigned to Mr Maguire in the final two

years of his employment at AorTech, in addition to the management

and licensing of AorTech's polymer intellectual property, was to

seek a partner or funding for the polymer heart valve project. This

was always viewed as an important area of business and of potential

value to shareholders, and indeed Mr Maguire often reported to the

Board the potential value of the heart valve IP and know-how.

Mr Maguire tendered his resignation on 26 November 2013

providing the Company with three days' notice. Since his

resignation, Mr Maguire has worked with Foldax, Inc. as its

CEO.

Shortly after his resignation, AorTech asked Mr Maguire to

confirm that he had returned to the Company all files, data and

confidential information. AorTech understands that at the time Mr

Maguire possessed substantial amounts of AorTech information

related to both its heart valve project and its polymers. Mr

Maguire did not respond to this request. Given this lack of

response and our growing concern over other issues related to Mr

Maguire's involvement with Foldax, Inc., AorTech asked its legal

representatives to write to Mr Maguire demanding return of all

Company property. As a result of Mr Maguire's lack of response,

litigation ensued. To date, AorTech's information has not been

fully returned.

Our focus in the litigation is to ensure that AorTech has

returned to it all of the confidential data misappropriated by Mr

Maguire, that Mr Maguire's new business does not use or benefit

from that confidential information and that the manufacturing trade

secrets for AorTech polymers and heart valve remain secret and are

not used or disclosed in the future.

Loan Note Share Issue

At last year's AGM, shareholders authorised the Directors to

take all steps necessary to allot shares to loan note holders in

return for the surrender of their remaining rights under the notes

issued in October 2012. These rights were extinguished in January

2016 by the issue of new shares in the Company. The dilution to

ordinary shareholders amounted to 15% which, in the opinion of the

Directors, is a level substantially less than would have been

suffered if an equity issue had been undertaken in October

2012.

Licenses

Over the years, AorTech has made substantial investment in the

development of bio stable polymers and medical device designs. The

objective is to capitalise on this investment for the benefit of

shareholders. The AorTech polymers have significant benefits for

medical device companies and in certain cases facilitate the

underlying performance of the devices. With our polymers being a

critical component in the supply chain, the device manufacturers

must have confidence in the long term supply of material. AorTech

was neither large enough nor perceived as secure enough to allow a

greater acceptance of the material, particularly by the larger

device companies. AorTech recognized this limitation and rather

than seek to continue as a small sub-scale supplier elected to

license the rights to manufacture polymer to Biomerics. Biomerics

is not only a polymer manufacturer but is an added value extruder,

molder and sub-contract manufacturer of medical device components

and devices itself. Over the past year, driven by customer

contracts and market interest, Biomerics has transferred the

Elast-Eon(TM) manufacture from a small scale set up into a fully

validated, commercial scale facility. In partnership with

Biomerics, AorTech has supported this scale up with an additional

investment during the financial year of $168,000 paid from a share

of gross margin on product sales. Biomerics have further developed

upon the Elast-Eon(TM) family of materials and are now marketing a

lower cost, potentially higher volume version of the material.

Business development activities continue and a growing list of

companies testing material is evidence of these efforts. Although

some of AorTech's licencees continue to experience delays in both

the achievement and the increased commercialisation of their

products, the performance of Elast-Eon(TM) is recognized as

critical in our customers' success. Significant funding has been

achieved by AorTech licencees in developing and commercialising

their products with AorTech's Elast-Eon(TM) seen as critical to

their success. In one instance, funds in excess of $100 million

have been raised to achieve successful commercialisation. We

anticipate that with the renewed interest in our material being

generated through our licencing partner, Biomerics, that additional

licences may be completed during the course of the next twelve

months.

Heart Valve Project

We have previously announced a potential transaction with a new

business established to commercialise the AorTech heart valve

technology. Fund raising for the new project is continuing but is

not yet finalised and any license will be dependent upon the new

business being fully funded. The package of data and information

that AorTech is able to deliver to the project is substantial. This

ranges from specific manufacturing know how and trade secrets for

the precise polymer best suited to a heart valve, detailed design

files for a polymer valve with a stress/strain profile

substantially less than the material mechanical properties,

together with a fully documented manufacturing process that allows

a clinical quality valve to be made on a repeatable basis. All of

these processes have been developed over a number of years of trial

and error and experimentation at considerable investment by

AorTech.

New accounting framework applying for the year ended 31 March

2016

The Company has elected to adopt FRS 101 'Reduced Disclosure

Framework' (FRS 101) for its parent company financial statements

for the year ended 31 March 2016. Following the application of FRS

101, the results, the financial position of the parent company, and

disclosures are the same as, or follow closely, those reported

under previous UK GAAP.

The Company's decision to adopt FRS 101 for its parent company's

financial statements does not require shareholder approval and

therefore no resolution on this matter is being put to the Annual

General Meeting. However, as stipulated in FRS 101, the Company is

required to notify all shareholders of this election, and any

shareholder or shareholders holding in aggregate 5 per cent or more

of the total allotted shares in the Company may serve an objection.

Objections must be served in writing and delivered to the Company

Secretary at Level Two, Springfield House, 23 Oatlands Drive,

Weybridge, Surrey, KT13 9LZ no later than 2 September 2016.

This election will apply on an ongoing basis until such time as

the Company notifies its shareholders of any change to its chosen

accounting framework for the parent company financial

statements.

Conclusion

The principal disappointment of the past year has been the

requirement to provide for sums of money contractually due to

AorTech. The ongoing litigation has also been a major consumption

of management time and is likely to continue to be so. AorTech has

sought to pursue an alternative dispute resolution route with the

objective being to have our confidential information returned to

us, the defendants precluded from using that information, and

compensation for our time and costs incurred. The defendants are

presently unwilling to engage in this process. While disputed by

defendants, our conclusion is that the defendants have retained and

are using or intend to use AorTech information in their

business.

We are however comfortable with how Biomerics is developing the

polymer manufacturing license and with the progress from other

licenses.

Bill Brown

Chairman

12 August 2016

Consolidated income statement

Year ended 31 March Year ended 31 March

2016 2015

Pre-exceptional Pre-exceptional

items Exceptional items Exceptional

items Total items Total

Notes US$000 US$000 US$000 US$000 US$000 US$000

Revenue 3 751 - 751 844 - 844

Other income 150 - 150 13 - 13

Administrative

expenses (1,084) (80) (1,164) (776) (204) (980)

Other expenses

- amortisation

of intangible

assets 11 (312) - (312) (332) - (332)

--------------

Operating loss 3 (495) (80) (575) (251) (204) (455)

Finance (expense)

/ income 8 - (29) (29) - 129 129

---------------- -------------- ---------- ---------------- -------------- ---------

Loss from

continuing

operations

attributable

to owners of

the parent

company 5 (495) (109) (604) (251) (75) (326)

Loss from

discontinued

operations 16 - - - (44) - (44)

---------------- -------------- ---------- ---------------- -------------- ---------

Loss attributable

to owners of

the parent

company (495) (109) (604) (295) (75) (370)

Loss per share

Basic and diluted

(US cents per

share) 10 (12.00) (7.66)

Consolidated statement of comprehensive income

Year

ended Year

31 ended

March 31 March

2016 2015

US$000 US$000

Loss for the year (604) (370)

Other comprehensive income:

Exchange differences (35) 17

Income tax relating to other

comprehensive income - -

-------- ----------

Other comprehensive income

for the year, net of tax (35) 17

-------- ----------

Total comprehensive income

for the year, attributable

to owners of the parent

company (639) (353)

No items of other comprehensive income can be subsequently

reclassified to profit and loss.

Consolidated balance sheet

31 March 31 March

2016 2015

US$000 US$000

Notes

Assets

Non current assets

Intangible assets 11 1,367 1,546

Total non current assets 1,367 1,546

---------- ------------

Current assets

Trade and other receivables 13 243 737

Cash and cash equivalents 14 314 360

Total current assets 557 1,097

---------- ------------

Total assets 1,924 2,643

---------- ------------

Liabilities

Current liabilities

Trade and other payables 15 (165) (192)

Total current liabilities (165) (192)

---------- ------------

Non current liabilities

Change of control redemption

premium 15 - (53)

---------- ------------

Total non current liabilities - (53)

Total liabilities (165) (245)

Net assets 1,759 2,398

========== ============

Equity

Issued capital 19 17,426 17,937

Share premium 19 3,595 3,474

Other reserve (2,881) (2,974)

Foreign exchange reserve 6,627 6,076

Profit and loss account (23,008) (22,115)

Total equity attributable

to equity holders of the

parent 1,759 2,398

========== ============

The Consolidated financial statements were approved by the Board

on 12 August 2016 and were signed on its behalf by W Brown,

Chairman and E McDaid, Director

Company number SC170071

Consolidated cash flow statement

Year

ended Year ended

31 March 31 March

2016 2015

US$000 US$000

Cash flows from operating activities

Group loss after tax (604) (326)

Adjustments for:

Amortisation of intangible assets 312 332

Finance expense / (income) 29 (129)

Decrease / (increase) in trade

and other receivables 494 (36)

Decrease in trade and other

payables (109) (125)

----------- --------------------

Net cash flow from continuing

operations 122 (284)

Net cash flow from discontinued

operations - 2

----------- --------------------

Net cash flow from operating

activities 122 (282)

Cash flows from investing activities

Purchase of intangible assets (168) -

----------- --------------------

Net cash flow from continuing

operations (168) -

Net cash flow from discontinued

operations - -

Net cash flow from investing

activities (168) -

----------- --------------------

Net cash flow from financing

activities - -

----------- --------------------

Net decrease in cash and cash

equivalents (46) (282)

Cash and cash equivalents at

beginning of year 360 642

Cash and cash equivalents at

end of year 314 360

=========== ====================

Consolidated statement of changes in equity

Profit

Issued Foreign and

Share Share Other exchange loss Total

capital premium reserve reserve account equity

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 31 March

2014 20,144 3,901 (3,340) 3,791 (21,745) 2,751

Transactions with owners - - - - - -

Loss for the year - - - - (370) (370)

Other comprehensive

income

Exchange difference

on translating foreign

operations (2,207) (427) 366 2,285 - 17

Total comprehensive

income for the year (2,207) (427) 366 2,285 (370) (353)

--------- ------ --------- ----------------- --------- -------

Balance at 31 March

2015 17,937 3,474 (2,974) 6,076 (22,115) 2,398

========= ====== ========= ================= ========= =======

Changes in equity

Issue of equity share

capital 54 235 - - (289) -

------- ------ -------- ------ --------- ------

Transactions with owners 54 235 - - (289) -

Loss for the year - - - - (604) (604)

Other comprehensive

income

Exchange difference

on translating foreign

operations (565) (114) 93 551 - (35)

Total comprehensive

income for the year (565) (114) 93 551 (604) (639)

------- ------ -------- ------ --------- ------

Balance at 31 March

2016 17,426 3,595 (2,881) 6,627 (23,008) 1,759

======= ====== ======== ====== ========= ======

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of preparation

The Consolidated financial statements are for the year ended 31

March 2016. They have been prepared in compliance with

International Financial Reporting Standards (IFRS) and IFRS

Interpretations Committee (IFRIC) interpretations as adopted by the

European Union as at 31 March 2016.

The Consolidated financial statements have been prepared under

the historical cost convention.

The accounting policies remain unchanged from the previous

year.

2. Going concern

After considering the year end cash position, making appropriate

enquiries and reviewing budgets and profit and cash flow forecasts

to 31 March 2022, the Directors have formed a judgement at the time

of approving the financial statements that there is a reasonable

expectation that the Group has sufficient resources to continue in

operational existence for the foreseeable future. For this reason

the Directors consider the adoption of the going concern basis in

preparing the Consolidated financial statements is appropriate.

3. Preliminary announcement

The summary accounts set out above do not constitute statutory

accounts as defined by Section 434 of the UK Companies Act 2006.

The summarised consolidated balance sheet at 31 March 2016, the

summarised consolidated income statement, the summarised

consolidated statement of comprehensive income, the summarised

consolidated statement of changes in equity and the summarised

consolidated cash flow statement for the year then ended have been

extracted from the Group's statutory financial statements for the

year ended 31 March 2016 upon which the auditor's opinion is

unqualified and did not contain a statement under either sections

498(2) or 498(3) of the Companies Act 2006. The audit report for

the year ended 31 March 2015 did not contain statements under

Section 498(2) or Section 498(3) of the Companies Act 2006. The

statutory financial statements for the year ended 31 March 2015

have been delivered to the Registrar of Companies. The 31 March

2016 accounts were approved by the Directors on 12 August 2016, but

have not yet been delivered to the Registrar of Companies.

4. Earnings per share

The basic loss per Ordinary share of 12.00 US cents (2015: loss

of 7.66 US cents) is calculated on the loss of the Group of

US$604,000 (2015: loss of US$370,000) and on 5,032,823 (2015:

4,832,778) equity shares, being the weighted average number of

shares in issue during the year.

The diluted loss per share does not differ from the basic loss

per share as the exercise of share options would have the effect of

reducing the loss per share and is therefore not dilutive under the

terms of IAS 33.

5. Discontinued operations

On 1 October 2013, the Group signed an agreement with Biomerics

LLC for the manufacture and distribution of our patented materials,

including to our existing licensees. In the opinion of the

Directors, the Biomerics transaction transformed the Group into a

pure intellectual property company. As a consequence, results

attributable to manufacturing activity constitute a discontinued

operation, and have been presented as such in the prior year

figures in the Income Statement.

The results of the discontinued manufacturing operations are

shown in more detail below.

Pre-exceptional Pre-exceptional

items Exceptional items items Exceptional items

Total Total

2016 2016 2016 2015 2015 2015

$000 $000 $000 $000 $000 $000

Revenue - - - - - -

Other income - - - - - -

Cost of sales - - - (44) - (44)

Administrative - - - - - -

expenses

Profit on

disposal of - - - - - -

property, plant

and equipment

----------------- ------------------ ------- ------------------ ------------------ -------

Operating loss - - - (44) - (44)

----------------- ------------------ ------- ------------------ ------------------ -------

Notice of Annual General Meeting

Notice of the nineteenth Annual General Meeting of AorTech

International Plc will be posted with the Annual Report and

Accounts and will be held in the offices of Kergan Stewart LLP, 163

Bath Street, Glasgow G2 4SQ on Tuesday, 27 September 2016 at

11:00am.

Posting and availability of accounts

The annual report and accounts for the year ended 31 March 2016

will be sent by post to all registered shareholders on 26 August

2016. Additional copies will be available for a month thereafter

from the Company's Weybridge office. Alternatively, the document

may be viewed on, or downloaded from, the Company's website:

www.aortech.net.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PIMBTMBBBTTF

(END) Dow Jones Newswires

August 15, 2016 02:00 ET (06:00 GMT)

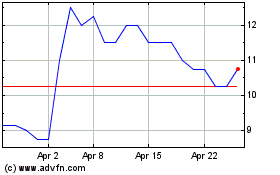

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Apr 2023 to Apr 2024