Antofagasta Shares Up as Results Beat Expectations -- Update

August 16 2016 - 6:04AM

Dow Jones News

By Alex MacDonald

LONDON--Shares in Antofagasta PLC (ANTO.LN) rose as the Chilean

copper producer beat market expectations on first-half net profit

by slashing costs faster-than-expected, while cautioning the copper

market will remain volatile in the near term.

The U.K.-listed miner Tuesday reported a net profit of $88.1

million for the first six months of the year compared with $706

million in the same period a year earlier, when it benefited from a

$620 million gain on proceeds from the sale of its water

division.

Revenue fell 19% to $1.45 billion, reflecting lower copper

prices and sale volume but earnings before interest, taxes,

depreciation and amortization, a closely watched earnings metric,

rose 2.3% to $572 million, thanks to a near-25% reduction in

operating costs.

The Ebitda and net profit figure beat analysts expectations of

$532 million and $62 million respectively, according to a

company-complied consensus forecast of 12 analysts. This helped the

stock to rise 5% to 539.5 pence a share by 0825 GMT, while the FTSE

350 mining index was up 2.6%.

Chief Executive Iván Arriagada said the company has already

achieved $124 million of this year's forecast $160 million in

cost-savings by lowering spending on contractors and energy

consumption as well as by reorganizing its support

infrastructure.

The company also said two longstanding cases relating to the Los

Pelambres Mauro tailings dam and its impact on a local community's

water-rights have been resolved. This helps pave the way for the

company to take a decision on one or possibly two major expansion

projects at Los Pelambres and Centinela at the end of 2017.

Mr. Arriagada said the company doesn't plan to return excess

cash to shareholders by way of a special dividend or share buyback,

given the need to maintain a strong balance sheet for potential

investment in expansion projects.

Antofagasta's net debt was almost unchanged at $1.04 billion as

of June-end compared with December-end.

Mr. Arriagada said the company remains interested in acquiring

assets, notably in the Americas, but "we don't think that it is

likey that significant new opportunities will come into the

market," anytime soon. He declined to comment on whether

Antofagasta would be interested in Glencore PLC's (GLEN.LN) Chilean

Lomas Bayas copper mine, which is for sale. Antofagasta was sitting

on a cash and liquid asset pile of $2.2 billion at June-end.

The company also reaffirmed it plans to meet the lower end of

this year's 710,000 to 740,000 metric ton copper production

guidance range, up from 630,000 tons a year earlier, reflecting a

ramp-up at its Antucoya project and the purchase of a 50% stake in

the Chiean Zaldivar mine last December.

The miner declared an interim dividend of $0.031 a share,

unchanged from last year.

"Given the current economic uncertainty we are cautious in our

outlook and remain conservative in our approach to managing

capital," said Mr. Arriagada. He expects the global copper market

will deliver a small surplus of around 300,000 tons of copper this

year and then again next year before swinging to a 300,000 tons

deficit in 2018.

"There are no new projects [in the pipeline]....That will put

pressure on the market," he said.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

August 16, 2016 05:49 ET (09:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

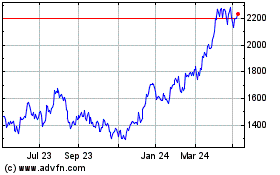

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

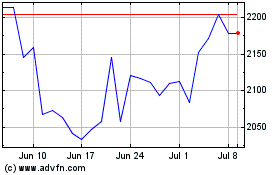

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024