TIDMANTO

RNS Number : 0099V

Antofagasta PLC

25 January 2017

NEWS RELEASE, 25 JANUARY, 2017

Q4 2016 PRODUCTION REPORT

STRONG FINISH TO THE YEAR

Antofagasta plc CEO, Iván Arriagada said: "As expected

Antofagasta put in a strong performance in the final quarter of

2016 with production up 13.8% versus the previous quarter. As a

result, copper production for the full year was just under 710,000

tonnes, 12.5% higher than in 2015.

"Reflecting our continued focus on profitable tonnes, net cash

costs for 2016 fell by 20.0% year-on-year, to $1.20/lb benefiting

from rigorous cost control, increased production and lower input

prices.

"During the year our new Antucoya mine successfully ramped up to

full production and our latest acquisition, Zaldívar, contributed

its first full year of production. Both operations are now fully

integrated into the Group and are operating well.

"Looking ahead into 2017 we remain focused on operating and cost

efficiencies, and achieving our production targets. Although we

believe the industry has passed the low point in this commodity

cycle, uncertainty persists and we need to build carefully on the

solid foundations of our existing operations."

HIGHLIGHTS

PRODUCTION

-- Copper production in Q4 2016 was 205,500 tonnes, 13.8% higher

than the previous quarter with strong performances from Centinela,

Zaldívar and Los Pelambres driven by higher grades and increased

throughput.

-- Group copper production for the full year increased by 12.5%

compared to 2015 to 709,400 tonnes. This was driven by higher

copper production at Centinela and additional production coming

from the Group's new Antucoya and Zaldívar operations, partly

offset by the closure of Michilla at the end of 2015.

-- Gold production was 91,100 ounces in Q4 2016, a 29.7%

increase on Q3 2016 due to higher grades and throughput at

Centinela. For the full year production was 270,900 ounces, 26.6%

higher than in 2015, again reflecting better grades and throughput

at Centinela.

-- Molybdenum production at Los Pelambres was 2,000 tonnes in Q4

2016 and 7,100 tonnes for the full year. This was a small increase

for the quarter and a 3,000 tonne decrease for the full year as

grades and recoveries fell.

CASH COSTS

-- Cash costs before by-product credits in Q4 2016 were

$1.46/lb, 5.2% lower than in Q3 2016 as production volumes

increased, particularly at Centinela.

-- Cash costs before by-product credits for the full year were

$1.54/lb, 27c/lb lower than last year as a result of the successful

cost savings achieved during the year, higher production and the

previously announced change in the estimation method for deferred

stripping costs.

-- Net cash costs were $1.13/lb in Q4 2016, a 4.2% decrease

compared with the previous quarter. This was primarily due to lower

cash costs before by-products credits and higher production of gold

and molybdenum

-- Net cash costs for 2016 were $1.20/lb, 20.0% lower than in

2015. This reflected the lower cash costs before by-product

credits, higher gold production and higher realised prices for gold

and molybdenum, partly offset by lower molybdenum production.

2017 GUIDANCE

-- Group production in 2017 is expected to be in the range of

685-720,000 tonnes of copper (as previously announced), 185-205,000

ounces of gold and 8,500-9,500 tonnes of molybdenum.

-- Group cash cost before by-product credits in 2017 are

expected to be similar to this year's at $1.55/lb and net cash cost

are expected to be approximately $1.30/lb.

OTHER

-- As previously announced in November, the Group agreed the

sale of the majority of the assets of Michilla for a total

consideration of $52 million.

-- As announced on 20 January, Los Pelambres will transfer its

40% interest in Alto Maipo to AES Gener and the pricing of the

electricity provided by the project to Los Pelambres will be

reduced. This transaction is subject to approval by the

lenders.

GROUP PRODUCTION AND CASH COSTS Full Year Q4 Q3

-------------------------------------- ----------------------- ------ ------ ------

2016 2015 % 2016 2016 %

------------------------------ ------ ------ ------ ------- ------ ------ ------

Copper production(1) kt 709.4 630.3 12.5 205.5 180.6 13.8

Copper sales(2) kt 698.5 636.0 9.8 206.7 182.3 13.4

Gold production koz 270.9 213.9 26.6 91.1 70.3 29.7

Molybdenum production kt 7.1 10.1 (29.7) 2.0 1.9 5.3

------------------------------ ------ ------ ------ ------- ------ ------ ------

Cash costs before by-product

credits(3) $/lb 1.54 1.81 (14.9) 1.46 1.54 (5.2)

Net cash costs(3) $/lb 1.20 1.50 (20.0) 1.13 1.18 (4.2)

------------------------------ ------ ------ ------ ------- ------ ------ ------

(1) Includes pre-commercial production at Antucoya of 12,700

tonnes, which is not included in the unit cost calculations.

(2) Includes pre-commercial production sales at Antucoya of

11,800 tonnes

(3) Cash cost is a non-GAAP measure used by the mining industry

to express the cost of production in US dollars per pound of copper

produced

Investors - London Media - London

Andrew Lindsay alindsay@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Paresh Bhanderi pbhanderi@antofagasta.co.uk Will Medvei antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone +44 20 7404 5959

Investors - Santiago Media - Santiago

Alfredo Atucha aatucha@aminerals.cl Pablo Orozco porozco@aminerals.cl

Telephone +56 2 2798 7000 Carolina Pica cpica@aminerals.cl

Telephone +56 2 2798 7000

MINING OPERATIONS

Los Pelambres

Los Pelambres produced 96,100 tonnes of copper in Q4 2016

compared with 87,200 tonnes in the previous quarter. This increase

is mainly due to higher grades and improved plant reliability. In

the full year 2016, copper production decreased by 2.1% compared

with last year. This decrease is primarily due to lower throughput

as a greater proportion of harder ore is processed in the plant,

which was partly offset by higher mined grades.

Molybdenum production was slightly higher at 2,000 tonnes in Q4

2016 compared to 1,900 in the previous quarter, primarily due to

higher grades partially offset by lower recoveries. Production for

the full year of 7,100 tonnes was 29.7% lower than in 2015, due to

lower grades and recoveries during the course of 2016.

Cash costs before by-product credits in Q4 2016 were $1.35/lb,

compared with $1.43/lb in the previous quarter. This improvement

was principally a result of higher grades and lower energy

consumption. For the full year, cash costs before by-product

credits at $1.36/lb were 9.3% lower than in 2015, primarily due to

a change in the estimation method for deferred stripping costs.

Net cash costs in Q4 2016 at $1.11/lb were 2.8% higher than in

the previous quarter due to lower realised prices for by-products.

Net cash costs for the full year 2016 were $1.06/lb compared with

$1.23/lb in 2015. This decrease is mainly due to higher realised

prices for gold and molybdenum, slight offset by lower molybdenum

production.

As previously announced, negotiations between Los Pelambres, AES

Gener SA ("Gener", the majority shareholder of Alto Maipo SpA) and

the lenders to the project have reached an advanced stage, subject

to final approval by the lenders. Los Pelambres has agreed with

Gener that it will transfer its 40% interest in Alto Maipo to Gener

and the electricity price applicable to the Power Purchase

Agreement with Alto Maipo will be reduced. The carrying value of

Los Pelambres's investment in Alto Maipo of $356 million will be

written off.

LOS PELAMBRES Full Year Q4 Q3

------------------------------

2016 2015 % 2016 2016 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

Daily ore throughput kt 155.6 168.2 (7.5) 160.8 158.1 1.7

Copper grade % 0.73 0.70 4.3 0.77 0.70 10.0

Copper recovery % 88.6 87.9 0.8 87.2 88.6 (1.6)

Copper production kt 355.4 363.2 (2.1) 96.1 87.2 10.2

Copper sales kt 351.6 366.0 (3.9) 97.4 80.6 20.8

------------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.017 0.021 (19.0) 0.020 0.016 25.0

Molybdenum recovery % 75.8 80.4 (5.7) 69.7 79.0 (11.7)

Molybdenum production kt 7.1 10.1 (29.7) 2.0 1.9 5.3

Molybdenum sales kt 7.2 9.9 (27.3) 1.8 2.3 (21.7)

Gold production koz 57.8 51.4 12.5 14.7 14.2 3.5

Gold sales koz 62.8 53.4 17.6 15.7 14.5 8.3

------------------------------ ------ ------ ------ ------- ------ ------ -------

Cash costs before by-product

credits(1) $/lb 1.36 1.50 (9.3) 1.35 1.43 (5.6)

Net cash costs(1) $/lb 1.06 1.23 (13.8) 1.11 1.08 2.8

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes tolling charges of $0.27/lb in Q4 2016, $0.27/lb in

Q3 2016, $0.27/lb in FY 2016 and $0.27/lb in FY 2015

Centinela

Centinela finished the year with a strong quarter. Total copper

production was 22.6% higher in the fourth quarter than the third

quarter following a significant increase in grades and improved

throughput. Total production for the full year 2016 was 6.8% higher

than in 2015 primarily as a result of higher sulphides grades and

completion of the concentrator expansion project, although this was

partly offset by lower throughput in the Centinela Cathodes plant

and the expected continued decline in oxide grades.

Production of copper in concentrates was 59,500 tonnes in Q4

2016, compared with 47,700 tonnes in the previous quarter primarily

as a result of significantly higher grades.

Copper in concentrate production for the full year was 24.2%

higher year-on-year mainly reflecting expanded throughput capacity

following the installation of new tailings thickeners and

modifications to the grinding and flotation circuits. Higher grades

and slightly higher recoveries also helped increase production

during the year.

Cathode production in Q4 2016 was 16,500 tonnes, a 15.4%

increase on the 14,300 tonnes produced in Q3 2016 largely as a

result of higher grades and slightly higher throughput, partly

offset by lower recoveries. Compared with the full year 2015,

cathode production during 2016 was 26.5% lower as grades declined

as expected with mining in the lower grade zones of the Tesoro

Central and Tesoro Noreste pits.

Gold production was 76,400 ounces in Q4 2016, 20,300 ounces

higher than in the previous quarter primarily due to significant

increase in grade slightly offset by lower recovery. For the full

year 2016 gold production was 213,000 ounces, some 31% higher than

in 2015 mainly due to higher throughput and grades as recoveries

remained flat across the two years.

Cash costs before by-product credits were $1.45/lb in Q4 2016

compared with $1.63/lb in the previous quarter. This decrease in

costs was mainly due to higher production in the quarter. Cash

costs before by-product credits for the year were 22.9%, or 52c/lb,

lower than in 2015 of which 23c/lb was a result of a change in the

estimation method for deferred stripping costs and the balance was

due to higher production.

In addition to the fall in cash costs before by-product credits,

higher gold production helped reduce net cash costs by 17.1% in Q4

2016 compared to the previous quarter and, combined with a higher

realised gold price, by 35.7% to $1.19/lb for the full year.

CENTINELA Full Year Q4 Q3

2016 2015 % 2016 2016 %

------------------------------- ------ ------ ------ ------- ----- ----- -------

CONCENTRATES

------ ------ ------ ------- -----

Daily ore throughput kt 92.1 84.2 9.4 95.7 92.2 3.8

Copper grade % 0.63 0.58 8.6 0.82 0.65 26.2

Copper recovery % 87.7 85.5 2.6 88.7 88.5 0.2

Copper production kt 180.4 145.2 24.2 59.5 47.7 24.7

Copper sales kt 171.7 145.6 17.9 56.5 55.8 1.3

------------------------------- ------ ------ ------ ------- ----- ----- -------

Gold grade g/t 0.28 0.24 16.7 0.40 0.29 37.9

Gold recovery % 72.2 72.3 (0.1) 71.3 73.0 (2.3)

Gold production koz 213.0 162.5 31.1 76.4 56.1 36.2

Gold sales koz 208.7 165.8 25.9 75.4 68.8 9.6

------------------------------- ------ ------ ------ ------- ----- ----- -------

CATHODES

------------------------------- ------ ------ ------ ------- ----- ----- -------

Daily ore throughput kt 22.1 25.4 (13.0) 24.0 23.4 2.6

Copper grade % 0.81 0.98 (17.3) 0.90 0.82 9.8

Copper recovery % 70.7 68.9 2.6 72.8 74.2 (1.9)

Copper production - heap

leach kt 46.7 64.4 (27.5) 14.5 12.4 16.9

Copper production - total((1) kt 55.8 75.9 (26.5) 16.5 14.3 15.4

Copper sales kt 55.8 78.8 (29.2) 17.5 14.5 20.7

Total copper production kt 236.2 221.1 6.8 76.0 62.0 22.6

------------------------------- ------ ------ ------ ------- ----- ----- -------

Cash costs before by-product

credits(2) $/lb 1.75 2.27 (22.9) 1.45 1.63 (11.0)

------------------------------- ------ ------ ------ ------- ----- ----- -------

Net cash costs(2) $/lb 1.19 1.85 (35.7) 0.87 1.05 (17.1)

------------------------------- ------ ------ ------ ------- ----- ----- -------

(1) Includes production from ROM material

(2) Includes tolling charges for copper in concentrates of

$0.23/lb in Q4 2016, $0.21/lb in Q3 2016, $0.22/lb in FY 2016 and

$0.20/lb FY 2015

Antucoya

Copper production at Antucoya was 19,700 tonnes in Q4 2016, 1.5%

higher than in the previous quarter as higher throughput was offset

by lower grade and recoveries. For the full year, Antucoya produced

66,200 tonnes of copper, in line with guidance for the year and

54,000 tonnes more than in its 2015 start-up year.

During the quarter cash costs were inflated by the payment of

one-off signing bonuses following the conclusion of labour

negotiations with the unions in October equivalent to 14c/lb. Costs

in Q4 2016 were $1.98/lb compared to $1.68/lb in Q3. Cash costs for

the full year were $1.83/lb.

ANTUCOYA Full Year Q4 Q3

2016 2015 % 2016 2016 %

---------------------- ------ ----- ----- ------ ----- ----- -------

Daily ore throughput kt 67.6 31.7 113.2 81.7 69.7 17.2

Copper grade % 0.39 0.36 8.3 0.37 0.43 (14.0)

Copper recovery % 70.6 73.2 (3.6) 70.5 71.9 (1.9)

Copper production kt 66.2 12.2 442.6 19.7 19.4 1.5

Copper sales kt 66.6 9.2 623.9 21.1 19.6 7.7

---------------------- ------ ----- ----- ------ ----- ----- -------

Cash costs(1) $/lb 1.83 1.98 1.68 17.9

---------------------- ------ ----- ----- ------ ----- ----- -------

(1) Cash costs from Q2 2016 onwards following commercial

production being reached on 1 April 2016

Zaldívar

Copper production at Zaldívar was 13,700 tonnes in Q4 2016,

14.2% higher than in the previous quarter as the mine achieved its

highest level of throughput since it was acquired by the Group. The

benefit of the increased throughput and the significantly higher

grades in the quarter will be spread over the 330 days of the heap

leach cycle. For the full year Zaldívar produced 51,700 tonnes of

copper cathodes.

Cash costs decreased to $1.47/lb in Q4 2016 compared with

$1.73/lb in the previous quarter primarily due to higher copper

production and an adjustment to inventory values. Cash costs for

2016 were even lower than expected at the beginning of the year at

$1.54/lb as sulphide leach recoveries benefitted from experience

gained at other Group operations and grades were higher than

anticipated.

ZALDÍVAR Full Year Q4 Q3

2016 2015(1) % 2016 2016 %

-------------------------------- ------ ----- -------- ----- ----- -------

Daily ore throughput kt 48.1 52.7 45.2 16.6

Copper grade % 0.66 0.81 0.62 30.6

Copper recovery % 66.4 67.3 70.4 (4.4)

Copper production - heap

leach((2) kt 35.6 9.6 8.5 12.9

Copper production - total(2,3) kt 51.7 13.7 12.0 14.2

Copper sales((2) kt 51.7 14.2 11.9 19.3

-------------------------------- ------ ----- -------- ----- ----- -------

Cash costs $/lb 1.54 1.47 1.73 (15.0)

-------------------------------- ------ ----- -------- ----- ----- -------

(1) No 2015 figures. Group acquired its interest in Zaldívar on 1 December 2015

(2) Group's 50% share

(3) Includes production from secondary leaching

Transport

Total volumes transported by the division were 1.5 million

tonnes in Q4 2016, 5.0% lower than in the previous quarter, due to

a decline in acid availability in the region. For the year

transport volumes were 6.5 million tonnes, 6.3% higher than in 2015

due to increased customer demand and improved performance of the

rolling stock fleet and better fleet utilisation.

Full Year Q4 Q3

2016 2015 % 2016 2016 %

--------------------------- ---- ------- ------- ---- ------- ------- -------

Rail kt 5,310 4,933 7.6 1,269 1,318 (3.7)

Road kt 1,186 1,180 0.5 280 313 (10.5)

--------------------------- ---- ------- ------- ---- ------- ------- -------

Total tonnage transported kt 6,496 6,113 6.3 1,548 1,630 (5.0)

--------------------------- ---- ------- ------- ---- ------- ------- -------

Commodity prices and exchange rates

Full Year Q4 Q3

2016 2015 % 2016 2016 %

---------------- ------ ------ ------ ------- ------ ------ -------

Copper

--------------------------------------------------------------------------

Market price $/lb 2.21 2.50 (11.6) 2.40 2.17 10.6

Realised price $/lb 2.33 2.28 2.2 2.69 2.18 23.4

---------------- ------ ------ ------ ------- ------ ------ -------

Gold

--------------------------------------------------------------------------

Market price $/oz 1,248 1,160 7.6 1,220 1,335 (8.6)

Realised price $/oz 1,256 1,155 8.7 1,168 1,315 (11.2)

---------------- ------ ------ ------ ------- ------ ------ -------

Molybdenum

--------------------------------------------------------------------------

Market price $/lb 6.5 6.7 (3.0) 6.6 7.0 (5.7)

Realised price $/lb 6.8 5.7 19.3 5.2 7.2 (27.8)

---------------- ------ ------ ------ ------- ------ ------ -------

Exchange rates

--------------------------------------------------------------------------

per

Chilean peso $ 677 654 3.5 666 662 0.6

---------------- ------ ------ ------ ------- ------ ------ -------

The spot commodity prices for copper, gold and molybdenum as at

the end of 2016 were $2.51/lb, $1,148/oz and $6.75/lb respectively

compared with $2.20/lb, $1,316/oz and $6.71/lb as at 30 September

2016 and $2.13/lb, $1,062/oz and $5.30/lb as at 31 December

2015.

The provisional pricing adjustments for copper, gold and

molybdenum for the quarter were positive $127.9 million, negative

$5.6 million and negative $6.8 million respectively.

The provisional pricing adjustments for copper, gold and

molybdenum for the year were positive $153.6 million, negative $1.9

million and positive $2.4 million respectively.

Depreciation, amortisation and tax

As previously announced, depreciation and amortisation for the

full year is expected to be similar to 2015 ($576 million).

The effective tax rate is now expected to be lower than

previously announced at approximately 35%.

2017 Guidance

Los Pelambres Centinela Antucoya Zaldívar Group

-------------------- ------ -------------- ---------- --------- -------------- ----------

Production

-------------------- ------ -------------- ---------- --------- -------------- ----------

Copper kt 330 - 345 220 - 230 80 - 85 55 - 60 685 - 720

Gold koz 45 - 55 140 - 150 - - 185 - 205

Molybdenum kt 8.5 - 9.5 - - - 8.5 - 9.5

-------------------- ------ -------------- ---------- --------- -------------- ----------

Grade

-------------------- ------ -------------- ---------- --------- -------------- ----------

Copper % 0.66 0.60 0.37 0.75 -

-------------------- ------ -------------- ---------- --------- -------------- ----------

Cash costs

-------------------- ------ -------------- ---------- --------- -------------- ----------

Cash costs

before by-product

credits $/lb 1.45 1.75 1.60 1.50 1.55

Net cash costs((1) $/lb 1.15 1.35 1.60 1.50 1.30

-------------------- ------ -------------- ---------- --------- -------------- ----------

(1) Includes by-product credits at a gold price of $1,250/oz and

a molybdenum price of $6.0/lb

Group copper production for 2017 is expected to be in the range

of 685-720,000 tonnes, similar to the 709,400 tonnes produced in

2016. Centinela will be operating at its newly expanded capacity

and the Group will benefit from the first year of full production

from Antucoya and start-up production from Encuentro Oxides.

However, this growth will be offset by lower mined grades at

Centinela and Los Pelambres.

Group gold production for 2017 is expected to be in the range of

185-205,000 ounces, a decrease of 24-32% on 2016, and molybdenum

production is expected to be 8,500-9,500 tonnes, 20-34% higher than

in 2016, reflecting changes in mined grade.

Group cash costs before by-product credits for 2017 are expected

to be almost unchanged at $1.55/lb as further expected savings and

the decrease in costs at Antucoya and Zaldívar are offset by a

lower contribution from the lowest cost mine, Los Pelambres. Net

cash costs are expected to increase by some 10c/lb to $1.30/lb.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLBIMFTMBATBBR

(END) Dow Jones Newswires

January 25, 2017 02:00 ET (07:00 GMT)

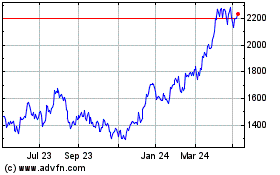

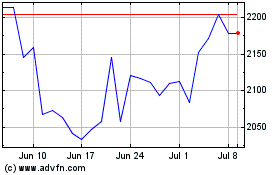

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024