TIDMANTO

RNS Number : 0813N

Antofagasta PLC

27 January 2016

NEWS RELEASE, 27 JANUARY 2016

Q4 2015 PRODUCTION REPORT

STRONGEST QUARTER OF 2015

Antofagasta plc CEO, Diego Hernández said:

"We have finished the year strongly with our best quarter of the

year. Copper and molybdenum production were up against Q3 and gold

production was 22% higher. Our production benefited from an

improved performance at Los Pelambres and Centinela, and the

addition of new production from Antucoya and Zaldívar. As

production rose we kept a tight grip on our costs, with net cash

costs for the quarter falling to $1.38/lb, down 2.8% against

Q3.

"Whilst we have finished the year on a good note, 2015 has been

undeniably difficult. The continued deterioration of the

macro-environment and associated falling commodity prices combined

with several operational set-backs resulted in copper production

declining 11% year-on-year and cash costs before by-product credits

declining by 1% to $1.81/lb. Although we achieved significant

savings during the year and benefited from the weaker Chilean Peso

and falling energy and diesel prices, this was outweighed by our

lower production.

"Looking to 2016, we are focused on operational excellence and

improving productivity across all our mines in order to continue to

maintain a tight control on costs. We will benefit from growth at

Antucoya and Centinela Concentrates and we will have a full year of

production from our share of Zaldívar. With this focus on our

operations, we expect the Group's total copper production for 2016

to be in the range of 710,000 and 740,000 tonnes at a net cash cost

of $1.35/lb."

HIGHLIGHTS

PRODUCTION

-- Copper production in Q4 2015 was 169,900 tonnes, 8.2% higher

than Q3 2015. This increase was primarily driven by higher

production at Los Pelambres and Centinela Concentrates and the

contribution from Antucoya and Zaldívar.

-- Group copper production for the full year of 630,300 tonnes

was 10.6% lower than in 2014, primarily due to lower production at

Los Pelambres and Centinela.

-- Gold production was 55,700 ounces in Q4 2015, a 21.8%

increase on Q3 2015 as grades increased at Centinela.

-- Gold production for the year was 213,900 ounces compared to

270,900 in 2014, mainly reflecting lower grades at Centinela in the

second half of the year.

-- Molybdenum production at Los Pelambres was 10,100 tonnes in

2015, compared to 7,900 tonnes in 2014, as a new, higher grade

phase of the pit was mined.

CASH COSTS

-- Cash costs before by-product credits in Q4 2015 were $1.65/lb, 1.2% less than in Q3 2015.

-- Cash costs before by-product credits for the year were

$1.81/lb, 1.1% lower than last year as the benefit of the weaker

Chilean Peso and lower input prices were offset by lower

throughputs.

-- Net cash costs were $1.38/lb in Q4 2015, a 2.8% decrease

compared with the previous quarter primarily due to higher gold and

molybdenum production offset by lower realised prices.

-- Net cash costs for 2015 were $1.50/lb, 4.9% higher than the

same period last year as lower realised by-product prices and lower

gold production outweighed the lower cash costs before by-product

credits.

2016 GUIDANCE

-- Group production in 2016 is expected in the range of

710-740,000 tonnes of copper, 245-275,000 ounces of gold and

8-9,000 tonnes of molybdenum.

-- Group cash cost before by-product credits in 2016 are

expected to reduce by nearly 9% compared to 2015 to $1.65/lb and

net cash cost to fall by 10% to $1.35/lb as production increases

and further savings are achieved.

OTHER

-- As previously announced, on 1 December 2015 the Group

completed the acquisition of a 50% controlling interest in the

Zaldívar copper mine in Chile from Barrick Gold Corporation.

GROUP PRODUCTION AND CASH COSTS Q4 Q3 Full Year

-------------------------------------- ------ ------ ------ -----------------------

2015 2015 % 2015 2014 %

------------------------------ ------ ------ ------ ------ ------ ------ -------

Copper production (1) kt 169.9 157.0 8.2 630.3 704.8 (10.6)

Gold production koz 55.7 45.7 21.9 213.9 270.9 (21.0)

Molybdenum production kt 2.8 2.6 7.7 10.1 7.9 27.8

------------------------------ ------ ------ ------ ------ ------ ------ -------

Cash costs before by-product

credits $/lb 1.65 1.67 (1.2) 1.81 1.83 (1.1)

Net cash costs $/lb 1.38 1.42 (2.8) 1.50 1.43 4.9

------------------------------ ------ ------ ------ ------ ------ ------ -------

(1) Copper production tonnage includes pre-commercial production

at Antucoya of 10,000 tonnes in Q4 2015 and 2,200 tonnes in Q3

2015, which are not included in unit costs, and 4,400 tonnes of

attributable production from Zaldívar.

MINING OPERATIONS

Los Pelambres

Los Pelambres produced 97,600 tonnes of copper in Q4 2015

compared with 96,200 tonnes in the previous quarter. This increase

is mainly due to slightly higher throughput rates. In the full year

2015, copper production decreased by 7.2% compared with last year.

This decrease was primarily due to lower throughput in the first

quarter as a result of the community protests as well as the higher

proportion of harder ore being processed during 2015 which also

affected recoveries.

Molybdenum production was 2,800 tonnes in Q4 2015 compared to

2,600 tonnes in Q3 2015. This increase was due to a slightly higher

grade and processing of inventory during the quarter, offset by

lower recoveries. Production for the year of 10,100 tonnes was the

highest since 2012 and a 27.8% increase on 2014 as a new, higher

grade area of the pit was mined.

Cash costs before by-product credits in Q4 2015 were $1.40/lb,

compared with $1.32/lb in the previous quarter. This increase was

principally due to increased maintenance and services costs in the

quarter and greater mine movements. For the full year, cash costs

before by-product credits at $1.50/lb were 3.8% lower than in 2014,

primarily due to lower input prices such as energy and diesel. For

the full year energy costs were $116/MWh (including transmission

and other costs), compared with $149/MWh in 2014.

Net cash costs in Q4 2015 at $1.15/lb were 6.5% higher than in

the previous quarter, again reflecting higher maintenance and

services costs in the quarter partly offset by increased copper,

gold and molybdenum production.

Net cash costs for the full year 2015 were $1.23/lb compared

with $1.18/lb in 2014. This increase is mainly due to lower gold

production and lower realised molybdenum prices, which almost

halved.

LOS PELAMBRES Q4 Q3 Full Year

2015 2015 % 2015 2014 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

Daily ore throughput kt 170.2 169.7 0.3 168.2 176.3 (4.6)

Copper grade % 0.72 0.72 0.0 0.70 0.70 0.0

Copper recovery % 89.3 89.2 0.1 87.9 89.4 (1.7)

Copper production kt 97.6 96.2 1.5 363.2 391.3 (7.2)

Copper sales kt 103.8 98.9 5.0 366.0 386.0 (5.2)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.022 0.022 0.0 0.021 0.015 40.0

Molybdenum recovery % 76.6 83.8 (8.6) 80.4 83.8 (4.1)

Molybdenum production kt 2.8 2.6 7.7 10.1 7.9 27.8

Molybdenum sales kt 2.8 2.6 7.7 9.9 8.2 20.7

Gold production koz 15.9 13.2 20.5 51.4 66.5 (22.7)

Gold sales koz 17.3 13.6 27.2 53.4 63.8 (16.3)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Cash costs before by-product

credits(1) $/lb 1.40 1.32 6.1 1.50 1.56 (3.8)

Net cash costs(1) $/lb 1.15 1.08 6.5 1.23 1.18 4.2

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes tolling charges of $0.26/lb in Q4 2015, $0.28/lb in

Q3 2015, $0.27/lb in FY 2015 and $0.21/lb in FY 2014

Centinela

Total Q4 2015 copper production at Centinela was 52,100 tonnes,

2.8% higher than in the previous quarter due to higher production

of copper in concentrate, partly offset by lower cathode

production. Total production for the full year 2015 was 17.1% lower

than in 2014 primarily as a result of lower grades and

recoveries.

Production of copper in concentrate was 34,900 tonnes in Q4

2015, compared with 31,900 tonnes in the previous quarter primarily

due to significantly higher throughput offset by lower grades and

recoveries. The new secondary and tertiary crushers operated for

periods at full capacity during the quarter having been delayed by

the heavy rainfall earlier in the year.

Copper in concentrate production for the full year was 16.0%

lower year-on-year mainly reflecting grades falling from 0.65% to

0.58% as expected, lower recoveries and, to a lesser extent, lower

throughput.

Cathode production in Q4 2015 was 17,200 tonnes, an 8.0%

decrease on the 18,700 tonnes produced in Q3 2015 largely as a

result of lower grades and slightly lower recoveries. Compared with

the same period last year, cathode production during 2015 was 19.1%

lower as grades declined as expected. Mining activity moved to the

lower grade zones of the Tesoro Central and Tesoro Noreste (TNE)

pits before stopping at TNE in November.

(MORE TO FOLLOW) Dow Jones Newswires

January 27, 2016 02:00 ET (07:00 GMT)

Production is focused on copper and therefore gold production,

as a by-product, can vary. In Q4 2015 gold production was 22.5%

higher than in the previous quarter primarily due to higher grade

and throughput. However, for the full year 2015 gold production at

162,500 ounces was 20.5% lower than in 2014 mainly due to lower

grades and recoveries.

Cash costs before by-product credits were $2.47/lb in Q4 2015

compared with $2.36/lb in the previous quarter. This increase was

due to increased activity and lower inventory variations partially

offset by lower input prices. Cash costs before by-product credits

for 2015 were 7.1% higher than in 2014 as copper production fell by

17.1%. This was offset by lower input prices, a weaker Chilean Peso

and a reduction in fixed costs.

Net cash costs in Q4 2015 at $2.08/lb were 3.0% higher than in

the previous quarter, as the lower realised prices countered the

higher gold production. Net cash costs for 2015 were $1.85/lb

compared with $1.63/lb in 2014. This increase is due to the higher

cash costs before by-product credits and lower gold production and

realised gold prices.

CENTINELA Q4 Q3 Full Year

2015 2015 % 2015 2014 %

------------------------------- ------ ----- ----- ------- ------ ------ -------

CONCENTRATES

------ ----- ----- ------- ------

Daily ore throughput kt 93.3 85.9 8.6 84.2 85.8 (1.9)

Copper grade % 0.50 0.51 (2.0) 0.58 0.65 (10.8)

Copper recovery % 83.0 84.2 (1.4) 85.5 88.2 (3.1)

Copper production kt 34.9 31.9 9.4 145.2 172.8 (16.0)

Copper sales kt 35.4 39.7 (10.8) 145.6 178.8 (18.6)

------------------------------- ------ ----- ----- ------- ------ ------ -------

Gold grade g/t 0.22 0.19 15.8 0.24 0.28 (14.3)

Gold recovery % 68.0 69.8 (2.6) 72.3 74.7 (3.2)

Gold production koz 39.8 32.5 22.5 162.5 204.4 (20.5)

Gold sales koz 40.6 41.7 (2.6) 165.8 203.6 (18.6)

------------------------------- ------ ----- ----- ------- ------ ------ -------

CATHODES

------------------------------- ------ ----- ----- ------- ------ ------ -------

Daily ore throughput kt 25.0 25.0 0.0 25.4 25.2 0.8

Copper grade % 0.85 0.97 (12.4) 0.98 1.31 (25.2)

Copper recovery % 69.6 71.1 (2.1) 68.9 70.5 (2.3)

Copper production - heap

leach kt 14.3 15.7 (8.9) 64.4 83.6 (23.0)

Copper production - total((1) kt 17.2 18.7 (8.0) 75.9 93.8 (19.1)

Copper sales kt 19.8 19.0 4.2 78.8 92.1 (14.4)

Total copper production kt 52.1 50.7 2.8 221.1 266.6 (17.1)

------------------------------- ------ ----- ----- ------- ------ ------ -------

Cash costs before by-product

credits (2) $/lb 2.47 2.36 4.7 2.27 2.12 7.1

------------------------------- ------ ----- ----- ------- ------ ------ -------

Net cash costs (2) $/lb 2.08 2.02 3.0 1.85 1.63 13.5

------------------------------- ------ ----- ----- ------- ------ ------ -------

(1) Includes production from ROM material

(2) Includes tolling charges for copper in concentrate of

$0.30/lb in Q4 2015, $0.31/lb in Q3 2015, $0.30/lb in FY 2015 and

$0.24/lb FY 2014

Michilla

Copper production at Michilla was 5,800 tonnes in Q4 2015, 27.5%

lower than in the previous quarter as mining stopped in the first

half of the year and production ceased completely in December as

part of the mine closure plan. Production for the full year fell

37.4% to 29,400 tonnes compared to 2014. The programme for reducing

the number of onsite employees and contractors continued in the

fourth quarter as per the mine closure plan.

Cash costs decreased slightly to $1.97/lb in Q4 2015 compared

with $2.06/lb in the previous quarter primarily due to lower

activity at the mine. Cash costs for 2015 were $2.14/lb compared

with $2.38/lb in 2014. This decrease was primarily due to lower

onsite costs as a result of lower activity at the site.

MICHILLA Q4 Q3 Full Year

2015 2015 % 2015 2014 %

------------------------------ ------ ----- ----- ------- ----- ----- -------

Daily ore throughput kt 2.9 6.8 (57.4) 5.9 12.2 (51.6)

Copper grade % 1.35 1.43 (5.6) 1.28 1.13 13.3

Copper recovery % 74.0 78.9 (6.2) 78.2 79.5 (1.6)

Copper production - heap

leach kt 4.4 6.1 (27.9) 22.1 40.1 (44.9)

Copper production - total(1) kt 5.8 8.0 (27.5) 29.4 47.0 (37.4)

Copper sales kt 6.7 8.0 (16.3) 30.8 46.1 (33.2)

------------------------------ ------ ----- ----- ------- ----- ----- -------

Cash costs $/lb 1.97 2.06 (4.4) 2.14 2.38 (10.1)

------------------------------ ------ ----- ----- ------- ----- ----- -------

(1) Includes production from secondary leaching

Antucoya

During Q4 2015 Antucoya produced 10,000 tonnes of copper as

commissioning advanced in line with the ramp-up schedule. The

project is expected to reach full capacity of 85,000 tonnes per

annum in mid-2016.

By the end of December, approximately 7 million tonnes of

crushed material were stacked on the leach-pads and full production

for the year was 12,200 tonnes of copper cathodes.

Production at Antucoya will be reported as part of total Group

production and costs will be reported in unit costs once commercial

production is achieved, which is expected to be in the first half

of 2016.

Zaldívar

The Group completed the acquisition of a 50% interest in the

Zaldívar copper mine from Barrick Gold Corporation on 1 December

and became the operator of the mine.

Zaldívar produced 4,400 tonnes of attributable copper during

December at a cash cost of $1.73/lb.

The Group's share of Zaldívar's production and costs have been

included in the Group's 2015 production from the beginning of

December.

Transport

Total volumes transported by the division were 1.7 million

tonnes in Q4 2015, 17.5% higher than in the previous quarter, and

6.8 million tonnes for the year, 6.8% lower than in the same period

last year. These changes reflected increased shipments for the

Sierra Gorda copper mine and higher utilisation of rolling stock

during 4Q 2015. However, shipments for the year were lower than had

originally been expected with the delay in the ramp-up of the

Sierra Gorda mine, and the heavy rains in northern Chile during Q2

2015.

Q4 Q3 Full Year

2015 2015 % 2015 2014 %

--------------------------- ---- ------ ------ ----- ------ ------ ------

Total tonnage transported kt 1,742 1,482 17.5 6,805 7,302 (6.8)

--------------------------- ---- ------ ------ ----- ------ ------ ------

Commodity prices and exchange rates

Q4 Q3 Full Year

2015 2015 % 2015 2014 %

---------------- ------ ------ ------ ------- ------ ------ -------

Copper

--------------------------------------------------------------------------

Market price $/lb 2.22 2.38 (6.9) 2.50 3.11 (19.8)

Realised price $/lb 2.00 2.12 (5.8) 2.28 3.00 (23.9)

---------------- ------ ------ ------ ------- ------ ------ -------

Gold

--------------------------------------------------------------------------

Market price $/oz 1,105 1,124 (1.8) 1,160 1,266 (8.4)

Realised price $/oz 1,077 1,107 (2.7) 1,155 1,261 (8.4)

---------------- ------ ------ ------ ------- ------ ------ -------

Molybdenum

--------------------------------------------------------------------------

Market price $/lb 4.8 5.8 (17.1) 6.7 11.4 (41.2)

Realised price $/lb 4.3 4.8 (10.1) 5.7 11.0 (48.6)

---------------- ------ ------ ------ ------- ------ ------ -------

Exchange rates

--------------------------------------------------------------------------

per

Chilean peso $ 698 676 3.2 654 570 14.7

---------------- ------ ------ ------ ------- ------ ------ -------

The spot commodity prices for copper, gold and molybdenum as at

31 December 2015 were $2.13/lb, $1,061/oz and $5.15/lb respectively

compared with $2.35/lb, $1,114/oz and $5.30/lb as at 30 September

2015 and $2.88/lb, $1,206/oz and $9.0/lb as at 31 December

2014.

The provisional pricing adjustments for copper, gold and

molybdenum for the year were negative $295.5 million, negative

$10.5 million and negative $23.9 million respectively.

Tax

(MORE TO FOLLOW) Dow Jones Newswires

January 27, 2016 02:00 ET (07:00 GMT)

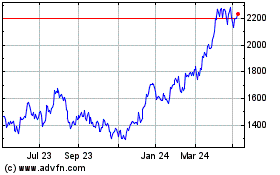

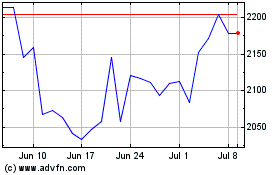

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024