TIDMANTO

RNS Number : 5121U

Antofagasta PLC

25 October 2017

NEWS RELEASE, 25 OCTOBER, 2017

Q3 2017 PRODUCTION REPORT

Antofagasta plc CEO, Iván Arriagada said: "We have had a further

quarter of improved production with tonnages increasing by 3%

compared to the previous quarter and by 4.5% on a year to date

basis. Unit costs have kept flat, despite increased cost pressures,

with higher production at Centinela and Antucoya, and our continued

focus on improving efficiencies. With these savings achieved to

date we now expect our net cash costs to be below our original

guidance for the full year of $1.30/lb.

"In 2018 we plan to increase production to 705-740,000 tonnes of

copper as Encuentro Oxides ramps-up to full production."

HIGHLIGHTS

PRODUCTION

-- Group copper production in Q3 2017 was 180,200 tonnes, 3.3%

higher than in the previous quarter on increased production at Los

Pelambres.

-- Group copper production for the first nine months of the year

was 526,500 tonnes, 4.5% higher than in the same period last year.

This was primarily due to higher production at Centinela and

Antucoya.

-- Gold production during the quarter increased by 1.2% to

59,600 ounces and for the first nine months fell by 4.4% with lower

production at Centinela and Los Pelambres.

-- Molybdenum production at Los Pelambres increased in Q3 2017

to 2,700 tonnes and for the year to date was 38.5% higher than in

the same period last year, due to higher molybdenum grades.

CASH COSTS

-- Cash costs before by-product credits in Q3 2017 were

$1.56/lb, 1.3% higher than in Q2 2017 as costs increased at

Centinela after a strong performance in the previous quarter.

-- Cash costs before by-product credits for the first nine

months were $1.56/lb, 1.3% better than last year due to higher

production and cost savings achieved from the Cost and

Competitiveness Programme.

-- Net cash costs were $1.18/lb in Q3 2017, a 1.7% improvement

compared with the previous quarter, as the higher cash costs before

by-product credits were offset by increased by-product volumes and

realised prices.

-- Net cash costs for the first nine months were $1.22/lb, 0.8%

better than in the same period last year.

GUIDANCE

-- Copper production guidance for 2017 remains unchanged at

685-720,000 tonnes, and production is expected to increase to

705-740,000 tonnes in 2018.

-- Cash costs before by-product credits guidance for the full

year is unchanged at $1.55/lb and net cash costs are now expected

to be lower than the $1.30/lb guided at the beginning of the year

reflecting stronger than expected by-product revenue.

-- Total capital expenditure for the year is expected to be

approximately $900 million, as previously guided.

OTHER

-- Successfully concluded labour negotiations at Zaldívar during the quarter.

-- Labour negotiations have commenced at Los Pelambres and are

expected to be concluded before the deadline in February 2018.

GROUP PRODUCTION AND Year to Date Q3 Q2

CASH COSTS

------------------------------- ---------------------- ------ ------ ------

2017 2016 % 2017 2017 %

----------------------- ------ ------ ------ ------ ------ ------ ------

Copper production(1) kt 526.5 503.9 4.5 180.2 174.4 3.3

Copper sales kt 522.4 491.7 6.2 188.3 158.4 18.9

Gold production koz 171.8 179.7 (4.4) 59.6 58.9 1.2

Molybdenum production kt 7.2 5.2 38.5 2.7 2.4 12.5

----------------------- ------ ------ ------ ------ ------ ------ ------

Cash costs before

by-product credits $/lb 1.56 1.58 (1.3) 1.56 1.54 1.3

Net cash costs $/lb 1.22 1.23 (0.8) 1.18 1.20 (1.7)

----------------------- ------ ------ ------ ------ ------ ------ ------

(1) Includes pre-commercial production at Antucoya of 12,700

tonnes in 2016, which are not included in unit cost

calculations.

Investors Media - London

- London

Andrew alindsay@antofagasta.co.uk Carole antofagasta@brunswickgroup.com

Lindsay Cable

Paresh pbhanderi@antofagasta.co.uk Will antofagasta@brunswickgroup.com

Bhanderi Medvei

+44 20 7808

Telephone 0988 Telephone +44 20 7404 5959

Investors - Santiago Media - Santiago

Francisco fveloso@aminerals.cl Pablo porozco@aminerals.cl

Veloso Orozco

Carolina cpica@aminerals.cl

Pica

Telephone +56 2 2798 7000 Telephone +56 2 2798 7000

MINING OPERATIONS

Los Pelambres

Los Pelambres produced 86,800 tonnes of copper in Q3 2017, 6.6%

higher than in the previous quarter as higher throughput was

achieved due to softer ore and slightly higher grades. In the first

nine months of 2017, copper production decreased slightly by 3.2%

to 251,000 tonnes, compared with the same period last year. This

decrease was primarily due to lower grades, despite increased

throughput.

Sales of copper were 95,400 tonnes in Q3 2017, higher than

production, as the stocks accumulated at the port as a result of

poor sea conditions at the end of the previous quarter were

shipped.

Molybdenum production was higher at 2,700 tonnes in Q3 2017

compared to the previous quarter, as the grade improved although

recoveries fell. Production for the first nine months of the year

was 7,200 tonnes, which was 38.5% higher than in the comparable

period in 2016 as a result of higher grade.

Cash costs before by-product credits in Q3 2017 were $1.46/lb,

compared with $1.50/lb in the previous quarter. This decrease was

principally due to higher production, the reduced use of

consumables and the continuation of the Cost and Competitiveness

Programme. For the first nine months of the year, cash costs before

by-product credits were $1.45/lb, 6.6% higher than in 2016

primarily due to lower production and higher consumables'

prices.

Net cash costs during the quarter were $1.01/lb, 10.6% lower

than in the previous quarter as a result of higher by-product

production and realised prices. Net cash costs for the first nine

months of the year were $1.06/lb, 1.9% higher than the same period

last year as increased by-product credits were insufficient to

offset the rise in cash costs before by-products.

LOS PELAMBRES Year to Date Q3 Q2

------------------------

2017 2016 % 2017 2017 %

------------------------ ------ ------ ------ ------- ------ ------ -------

Daily ore throughput kt 159.3 153.8 3.6 161.3 155.6 3.7

Copper grade % 0.67 0.70 (4.3) 0.68 0.67 1.5

Copper recovery % 89.0 89.1 (0.1) 89.5 89.9 (0.4)

Copper production kt 251.0 259.3 (3.2) 86.8 81.4 6.6

Copper sales kt 245.6 254.2 (3.4) 95.4 67.5 41.3

------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.021 0.016 31.3 0.022 0.021 4.8

Molybdenum recovery % 79.2 78.6 0.8 80.9 81.9 (1.2)

Molybdenum production kt 7.2 5.2 38.5 2.7 2.4 12.5

Molybdenum sales kt 7.3 5.4 35.2 2.9 2.3 26.1

Gold production koz 40.1 43.1 (7.0) 13.3 12.9 3.1

Gold sales koz 38.4 47.1 (18.5) 14.4 10.4 38.5

------------------------ ------ ------ ------ ------- ------ ------ -------

Cash costs before

by-product credits(1) $/lb 1.45 1.36 6.6 1.46 1.50 (2.7)

Net cash costs(1) $/lb 1.06 1.04 1.9 1.01 1.13 (10.6)

------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes tolling charges of $0.25/lb in Q3 2017, $0.26/lb in

Q2 2017, $0.26/lb YTD 2017 and $0.27/lb YTD 2016

Centinela

Total copper production at Centinela was 60,600 tonnes in Q3

2017, 1.0% lower than in the previous quarter due to lower

production of copper cathodes, and copper in concentrates flat

across the quarters. Total production for the first nine months of

the year 2017 was 10.7% higher than in 2016 primarily as a result

of higher grades.

Production of copper in concentrates was 47,300 tonnes in Q3

2017, unchanged compared with the previous quarter as higher grades

and higher recoveries were offset by lower throughput as a result

of harder ore, and scheduled maintenance during the quarter.

Copper in concentrate production for the first nine months of

the year was 10.5% higher than in the same period last year mainly

reflecting higher grades.

Production of copper cathodes for the quarter was 13,300 tonnes,

a 4.3% decrease from the previous quarter due to lower grades and

recoveries which were slightly offset by higher throughput. For the

first nine months of the year cathode production rose 10.9% to

43,600 tonnes as a result of higher grades and throughput offset

slightly by lower recoveries.

Gold production in the quarter was 46,300 ounces as a result of

higher grades and recoveries. During the first nine months of the

year gold production was 3.5% lower than the same period last year

due to lower recoveries.

Cash costs before by-product credits were $1.67/lb in the

quarter, an increase of 7.1% compared to the previous quarter as

spare parts and maintenance costs were higher as a result of the

scheduled major maintenance in the quarter. In addition, a new

labour agreement was reached with the supervisors' union during the

quarter which increased cash costs by a one-off amount of 3.5 c/lb

in the quarter and 1 c/lb for the full year. Cash costs before

by-product credits for the first nine months of 2017 were 11.6%

lower than in 2016 with higher copper production and cost savings

from the Cost and Competitiveness Programme.

Net cash costs in Q3 2017 were $1.18/lb, 9.3% higher than in the

previous quarter as higher gold prices were not able to offset the

increase in cash costs before by-products. In the first nine months

of the year, net cash costs were down 11.9% at $1.19/lb due to

higher gold sales offset by a slightly lower realised gold

price.

CENTINELA Year to Date Q3 Q2

2017 2016 % 2017 2017 %

------------------------- ------ ------ ------ ------- ----- ----- -------

CONCENTRATES

------ ------ ------ ------- -----

Daily ore throughput kt 89.1 90.9 (2.0) 85.8 92.2 (6.9)

Copper grade % 0.65 0.57 14.0 0.70 0.67 4.5

Copper recovery % 87.2 87.2 - 88.4 88.0 0.5

Copper production kt 133.6 120.9 10.5 47.3 47.3 -

Copper sales kt 139.5 115.2 21.1 49.8 45.8 8.7

------------------------- ------ ------ ------ ------- ----- ----- -------

Gold grade g/t 0.25 0.24 4.2 0.26 0.25 4.0

Gold recovery % 71.1 72.7 (2.2) 72.2 70.3 2.7

Gold production koz 131.8 136.6 (3.5) 46.3 46.0 0.7

Gold sales koz 139.3 133.3 4.5 48.8 45.0 8.4

------------------------- ------ ------ ------ ------- ----- ----- -------

CATHODES

------------------------- ------ ------ ------ ------- ----- ----- -------

Daily ore throughput kt 23.6 21.5 9.8 24.7 21.4 15.4

Copper grade % 0.93 0.78 19.2 0.90 0.95 (5.3)

Copper recovery % 66.3 69.8 (5.0) 58.7 65.5 (10.4)

Copper production

- heap leach kt 38.9 33.1 17.5 11.8 12.2 (3.3)

Copper production

- total((1) kt 43.6 39.3 10.9 13.3 13.9 (4.3)

Copper sales kt 43.3 38.4 12.8 12.7 14.6 (13.0)

Total copper production kt 177.3 160.2 10.7 60.6 61.2 (1.0)

------------------------- ------ ------ ------ ------- ----- ----- -------

Cash costs before

by-product credits(2) $/lb 1.67 1.89 (11.6) 1.67 1.56 7.1

------------------------- ------ ------ ------ ------- ----- ----- -------

Net cash costs(2) $/lb 1.19 1.35 (11.9) 1.18 1.08 9.3

------------------------- ------ ------ ------ ------- ----- ----- -------

(1) Includes production from ROM material

(2) Includes tolling charges of $0.19/lb in Q3 2017, $0.20/lb in

Q2 2017, $0.20/lb YTD 2017 and $0.22/lb YTD 2016

Antucoya

Copper production at Antucoya was 19,800 tonnes in Q3 2017, 3.1%

higher than in the previous quarter as slightly improved grades

were partly offset by lower recoveries. Compared to last year,

production in the first nine months of 2017 was 28.0% higher than

in the same period last year as significantly higher throughput and

higher recoveries were only slightly offset by a decline in

grade.

During the quarter the cash costs were $1.67/lb, almost

unchanged compared to Q2 2017. For the first nine months cash costs

were down by 2.3% to $1.70/lb compared to the same period last

year.

ANTUCOYA Year to Date Q3 Q2

2017 2016 % 2017 2017 %

---------------------- ------ ----- ----- ------ ----- ----- ------

Daily ore throughput kt 78.2 62.8 24.5 79.7 79.1 0.8

Copper grade % 0.37 0.40 (7.5) 0.37 0.36 2.8

Copper recovery % 73.9 70.3 5.1 71.2 74.5 (4.4)

Copper production kt 59.4 46.4 28.0 19.8 19.2 3.1

Copper sales kt 57.4 45.5 26.2 18.1 19.1 (5.2)

---------------------- ------ ----- ----- ------ ----- ----- ------

Cash costs(1) $/lb 1.70 1.74 (2.3) 1.67 1.66 0.6

---------------------- ------ ----- ----- ------ ----- ----- ------

(1) Cash costs from Q2 2016 onwards following commercial

production being reached on 1 April 2016

Zaldívar

Production for the quarter was 2.4% higher than in Q2 2017 at

12,900 tonnes. Throughput for the quarter fell compared to the

previous quarter to close to the year-to-date average while the

grade of the ore placed on the heap increased slightly. Copper

production in the first nine months of the year was 38,800 tonnes,

some 2.1% higher than in the same period last year, on higher grade

and despite lower recoveries. Recoveries have decreased this year

as a result of the significantly higher proportion of sulphide ores

being processed, compared to 2016.

Cash costs increased by 1.3% to $1.57/lb in Q3 2017 compared to

the previous quarter due to upgrading work on the stacking system

and water pipeline. During the quarter a three-year labour

agreement was successfully concluded with the union, increasing

cash costs by 1c/lb. Cash costs for the first nine months of 2017

were $1.59/lb, almost unchanged compared with the same period in

2016.

ZALDÍVAR Year to Date Q3 Q2

2017 2016 % 2017 2017 %

---------------------- ------ ----- ----- ------ ----- ----- -------

Daily ore throughput kt 47.7 46.5 2.6 47.3 53.6 (11.8)

Copper grade % 0.79 0.60 31.7 0.77 0.76 1.3

Copper recovery(1) % 60.9 67.5 (9.8) 58.9 59.4 (0.8)

Copper production

- heap leach(2) kt 28.6 26.7 7.1 9.3 9.1 2.2

Copper production

- total(2,3) kt 38.8 38.0 2.1 12.9 12.6 2.4

Copper sales(2) kt 36.6 37.5 (2.4) 12.4 11.4 8.8

---------------------- ------ ----- ----- ------ ----- ----- -------

Cash costs $/lb 1.59 1.58 0.6 1.57 1.55 1.3

---------------------- ------ ----- ----- ------ ----- ----- -------

(1) Average over full leach cycle

(2) Group's 50% share

(3) Includes production from secondary leaching

Transport

The total tonnage transported by the Division in Q3 2017

increased by 7.2% to 1.7 million tonnes as lower copper tonnages

were offset by higher acid volumes, although tonnes transported for

the year to date are still lower than in the same period last year

following the disruptions at two of its customers in the first

quarter.

TRANSPORT Year to Date Q3 Q2

2017 2016 % 2017 2017 %

--------------------------- ---- ------- ------- ------ ------- ------- ----

Rail Kt 3,732 4,043 (7.7) 1,337 1,250 7.0

Road kt 895 907 (1.2) 320 296 8.0

--------------------------- ---- ------- ------- ------ ------- ------- ----

Total tonnage transported kt 4,628 4,949 (6.5) 1,657 1,547 7.2

--------------------------- ---- ------- ------- ------ ------- ------- ----

Commodity prices and exchange rates

PRICES AND EXCHANGE Year to Date Q3 Q2

RATES

2017 2016 % 2017 2017 %

--------------------- ------ ------ ------ ------ ------ ------ ------

Copper

-----------------------------------------------------------------------------

Market price $/lb 2.70 2.14 25.9 2.88 2.57 12.1

Realised price $/lb 2.85 2.18 30.8 3.09 2.61 18.6

--------------------- ------ ------ ------ ------ ------ ------ ------

Gold

-----------------------------------------------------------------------------

Market price $/oz 1,252 1,258 (0.5) 1,278 1,257 1.6

Realised price $/oz 1,281 1,300 (1.6) 1,295 1,267 2.2

--------------------- ------ ------ ------ ------ ------ ------ ------

Molybdenum

-----------------------------------------------------------------------------

Market price $/lb 8.0 6.4 24.5 8.1 8.1 0.5

Realised price $/lb 8.6 7.3 18.5 9.6 7.7 24.9

--------------------- ------ ------ ------ ------ ------ ------ ------

Exchange rates

-----------------------------------------------------------------------------

per

Chilean peso $ 654 681 (3.9) 643 664 (3.2)

--------------------- ------ ------ ------ ------ ------ ------ ------

The spot commodity prices for copper, gold and molybdenum as at

30 September 2017 were $2.92/lb, $1,280/oz and $7.09/lb

respectively compared with $2.69/lb, $1,242/oz and $7.12/lb as at

30 June 2017 and $2.20/lb, $1,316/oz and $6.71/lb as at 30

September 2016.

The provisional pricing adjustments for copper, gold and

molybdenum for the quarter were positive $96.3 million, $0.2

million and $10.4 million respectively.

The provisional pricing adjustments for copper, gold and

molybdenum for the first nine months of the year were positive

$173.6 million, $0.2 million and $9.3 million respectively.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMIBFTMBTTBMR

(END) Dow Jones Newswires

October 25, 2017 02:00 ET (06:00 GMT)

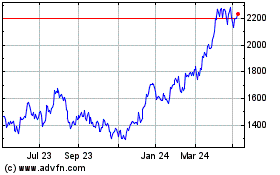

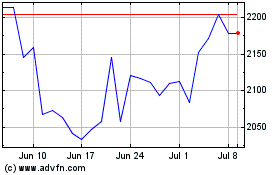

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024