TIDMANTO

RNS Number : 4327W

Antofagasta PLC

27 April 2016

NEWS RELEASE, 27 APRIL, 2016

Q1 2016 PRODUCTION REPORT

Antofagasta plc CEO, Iván Arriagada said:

"We made good progress during the first quarter of 2016, with

the integration of Zaldivar and the ramp-up at Antucoya. Combined,

these projects added 25,000 tonnes of production over the period.

Our cost savings programme is also benefiting our results,

contributing to a fall in our net cash costs of 4% versus Q1 2015

to $1.37/lb and our guidance for the year remains unchanged at

710-740,000 tonnes, at a net cash cost of $1.35/lb.

"Movements in the copper price over the quarter may suggest the

market is beginning to stabilise. However, with price growth likely

to remain subdued in the near term our focus continues to be on

operating safely, efficiently and profitably."

HIGHLIGHTS

PRODUCTION

-- Copper production in Q1 2016 was 157,100 tonnes, an increase

of 7.3% on Q1 2015 with the first full quarter of production from

Zaldívar and increases at Antucoya offset by lower production at

Centinela Cathodes, as grade declined, and no contribution from

Michilla, now that it is on care and maintenance

-- Copper production in the quarter was 7.5% lower than in Q4

2015 despite the production from Zaldívar and Antucoya following

extended maintenance during the quarter at Los Pelambres coupled

with lower production at Centinela Cathodes and no production from

Michilla

-- Gold production in Q1 2016 was 56,700 ounces, a 1.8% increase

on Q4 2015 largely due to higher gold recoveries at Centinela

-- Molybdenum production at Los Pelambres was 1,700 tonnes in Q1

2016, compared to 2,100 tonnes in Q1 2015, principally due to a

fall in grade

CASH COSTS

-- Cash costs before by-product credits in Q1 2016 were

$1.72/lb, 6.0% lower than in Q1 2015, but 4.2% higher than in Q4

2015. The increase from Q4 2015 is mainly related to lower

production offset by cost savings and lower input prices,

particularly energy

-- Net cash costs were better than expected at $1.37/lb in Q1

2016, a 4.2% decrease compared with Q1 2015 with a significantly

higher realised gold price offsetting the impact of lower

production

OTHER

-- As previously announced, Iván Arriagada succeeded Diego

Hernández as CEO on 8 April 2016

-- Antucoya achieved commercial production at the end of the quarter

-- Group production and cash cost guidance for the full year is

unchanged with an improvement in throughput expected at Los

Pelambres and Centinela Concentrates, and in copper grade at

Centinela Concentrates together with the continued ramp-up of

Antucoya

-- Michilla was put on care and maintenance at the end of 2015

with no production in this quarter.

GROUP PRODUCTION AND Year to date Q1 Q4

CASH COSTS

------------------------------- ----------------------- ------ ------ -------

2016 2015 % 2016 2015 %

----------------------- ------ ------ ------ ------- ------ ------ -------

Copper production(1) kt 157.1 146.4 7.3 157.1 169.9 (7.5)

Gold production koz 56.7 57.4 (1.2) 56.7 55.7 1.8

Molybdenum production kt 1.7 2.1 (19.0) 1.7 2.8 (39.3)

----------------------- ------ ------ ------ ------- ------ ------ -------

Cash costs before

by-product credits $/lb 1.72 1.83 (6.0) 1.72 1.65 4.2

Net cash costs $/lb 1.37 1.43 (4.2) 1.37 1.38 (0.7)

----------------------- ------ ------ ------ ------- ------ ------ -------

(1) Copper production tonnage includes pre-commercial production

at Antucoya, which is not included in unit costs, and attributable

production from Zaldívar from 1 December 2015

MINING OPERATIONS

Los Pelambres

Los Pelambres produced 82,200 tonnes of copper in Q1 2016

compared with 78,800 tonnes in the same quarter in the prior year.

This increase of 4.3% was primarily due to one-off community

disruptions at the mine access road during Q1 2015. Compared to the

previous quarter copper production decreased by 15.8%, mainly due

to lower throughput as a result of extended maintenance in February

and harder ore.

Molybdenum production was lower at 1,700 tonnes in Q1 2016

compared to the previous quarter, primarily due to the lower

grades.

Cash costs before by-product credits in Q1 2016 were $1.49/lb,

6.9% lower than in Q1 2015. This decrease was principally due to

higher production during 2016, and lower input prices and cost

savings. Compared with the previous quarter cash costs before

by-product credits were 6.4% higher mainly due to lower production,

offset slightly by lower input prices, such as diesel and

energy.

Net cash costs in Q1 2016 at $1.22/lb were 3.9% lower than in Q1

2015, reflecting higher copper and gold production and a higher

realised gold price, offset by a much lower contribution from

molybdenum with production down and lower realised prices.

LOS PELAMBRES Year to date Q1 Q4

2016 2015 % 2016 2015 %

------------------------ ------ ------ ------ ------- ------ ------ -------

Daily ore throughput kt 147.5 151.8 (2.8) 147.5 170.2 (13.3)

Copper grade % 0.70 0.69 1.4 0.70 0.72 (2.8)

Copper recovery % 89.3 87.0 2.6 89.3 89.3 -

Copper production kt 82.2 78.8 4.3 82.2 97.6 (15.8)

Copper sales kt 83.4 79.9 4.4 83.4 103.8 (19.7)

------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.016 0.019 (15.8) 0.016 0.022 (27.3)

Molybdenum recovery % 76.5 81.3 (5.9) 76.5 76.6 (0.1)

Molybdenum production kt 1.7 2.1 (19.0) 1.7 2.8 (39.3)

Molybdenum sales kt 1.9 1.9 - 1.9 2.8 (32.1)

Gold production koz 14.2 11.3 25.7 14.2 15.9 (10.7)

Gold sales koz 15.7 12.4 26.6 15.7 17.3 (9.2)

------------------------ ------ ------ ------ ------- ------ ------ -------

Cash costs before

by-product credits(1) $/lb 1.49 1.60 (6.9) 1.49 1.40 6.4

Net cash costs(1) $/lb 1.22 1.27 (3.9) 1.22 1.15 6.1

------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes tolling charges of $0.26/lb in Q1 2016, $0.26/lb in

Q4 2015 and $0.24/lb in Q1 2015

Centinela

Total copper production at Centinela was 49,800 tonnes in Q1

2016, 17.5% lower than in the same quarter last year due to

significantly lower grades at both Centinela Concentrates and

Centinela Cathodes offset in part by higher throughput at Centinela

Concentrates. Compared with the previous quarter production was

4.4% lower due to lower production of copper cathodes slightly

offset by higher production of copper in concentrates.

Production of copper in concentrates was 37,200 tonnes in Q1

2016, compared with 38,400 tonnes in the same period last year as

grade declined by 26.8% to 0.52% offset by throughput increasing by

23.2% to 92,000 tonnes of ore per day. Compared to the previous

quarter production increased by 6.6% primarily due to higher

recoveries partially offset by slightly lower throughput.

The copper grade at Centinela Concentrates is expected to

increase during the second half of the year together with

throughput, which will increase throughput to a maximum of 105,000

tonnes of ore per day once the final thickener is completed in the

fourth quarter of the year.

Cathode production in Q1 2016 was 12,600 tonnes, a 42.5%

decrease on the 21,900 tonnes produced in Q1 2015 as grades

declined as expected as mining moved to the lower grade zones of

the Tesoro Central and Tesoro Noreste pits, together with lower

throughput and recoveries. Compared with the last quarter, cathode

production was 26.7% lower largely as a result of lower throughput,

due to restrictions at the reclamation system, and lower

grades.

Gold production was 42,500 ounces in Q1 2016, 3,600 ounces lower

than in the same quarter last year primarily due to higher

recoveries slightly offset by a drop in the grade.

Cash costs before by-product credits were $2.14/lb in Q1 2016

were 3.9% higher than in Q1 2015 as grades at Centinela

Concentrates and Centinela Cathodes declined significantly.

Compared with the previous quarter costs were 13.4% lower as lower

input prices and cost savings more than offset the impact of lower

production.

Net cash costs in Q1 2016 at $1.57/lb were marginally better

than in the same period last year and 24.5% lower than in the

previous quarter with the substantial improvement in realised gold

prices and higher gold production.

CENTINELA Year to date Q1 Q4

2016 2015 % 2016 2015 %

------------------------- ------ ------ ----- ------- ----- ----- -------

CONCENTRATES

------ ------ ----- ------- -----

Daily ore throughput kt 92.0 74.7 23.2 92.0 93.3 (1.4)

Copper grade % 0.52 0.71 (26.8) 0.52 0.50 4.0

Copper recovery % 85.6 88.0 (2.7) 85.6 83.0 3.1

Copper production kt 37.2 38.4 (3.1) 37.2 34.9 6.6

Copper sales kt 33.6 37.8 (11.1) 33.6 35.4 (5.1)

------------------------- ------ ------ ----- ------- ----- ----- -------

Gold grade g/t 0.21 0.30 (30.0) 0.21 0.22 (4.5)

Gold recovery % 75.9 78.8 (3.7) 75.9 68.0 11.6

(MORE TO FOLLOW) Dow Jones Newswires

April 27, 2016 02:00 ET (06:00 GMT)

Gold production koz 42.5 46.1 (7.8) 42.5 39.8 6.8

Gold sales koz 37.5 46.9 (20.0) 37.5 40.6 (7.6)

------------------------- ------ ------ ----- ------- ----- ----- -------

CATHODES

------------------------- ------ ------ ----- ------- ----- ----- -------

Daily ore throughput kt 21.9 25.4 (13.8) 21.9 25.0 (12.4)

Copper grade % 0.75 1.17 (35.9) 0.75 0.85 (11.8)

Copper recovery % 66.2 70.6 (6.2) 66.2 69.6 (4.9)

Copper production

- heap leach kt 10.5 19.4 (45.9) 10.5 14.3 (26.6)

Copper production

- total((1) kt 12.6 21.9 (42.5) 12.6 17.2 (26.7)

Copper sales kt 13.0 21.8 (40.4) 13.0 19.8 (34.3)

Total copper production kt 49.8 60.4 (17.5) 49.8 52.1 (4.4)

------------------------- ------ ------ ----- ------- ----- ----- -------

Cash costs before

by-product credits(2) $/lb 2.14 2.06 3.9 2.14 2.47 (13.4)

------------------------- ------ ------ ----- ------- ----- ----- -------

Net cash costs(2) $/lb 1.57 1.58 (0.6) 1.57 2.08 (24.5)

------------------------- ------ ------ ----- ------- ----- ----- -------

(1) Includes production from ROM material

(2) Includes tolling charges for copper in concentrates of

$0.28/lb in Q1 2016, $0.27/lb in Q4 2015 and $0.25/lb in Q1

2015

Zaldívar

Following the acquisition of 50% of Zaldívar in December last

year attributable copper production was 12,400 tonnes in Q1 2016

compared with 4,400 tonnes in December. Lower plant throughput was

due to maintenance of the stacking and reclaiming system, which was

completed during the quarter.

Zaldívar has a heap leach operation with secondary leaching as

well as a run-of-mine (ROM) dump leach and production is separated

between the two principal process routes in the table below. A

small quantity of copper in concentrates is also produced, which is

reported as part of total production.

Despite the fall in throughput in the heap leach, cash costs in

Q1 2016 were $1.59/lb compared with $1.73/lb in the previous

quarter primarily due to savings under the Group's Cost and

Competitiveness Programme and lower input costs.

ZALDÍVAR(1) Year to date Q1 Q4

2016 2015 % 2016 2015 %

---------------------- ------ ------ ----- ----- ----- -------

Daily ore throughput kt 44.8 - - 44.8 51.6 (13.2)

Copper grade % 0.65 - - 0.65 0.65 -

Copper recovery % 62.9 - - 62.9 64.9 (3.1)

Copper production -

heap leach kt 8.2 - - 8.2 2.9 182.8

Copper production -

total(2) kt 12.4 - - 12.4 4.4 181.8

Copper sales kt 11.5 - - 11.5 5.5 109.1

---------------------- ------ ------ ----- ----- ----- -------

Cash costs(3) $/lb 1.59 - - 1.59 1.73 (8.1)

---------------------- ------ ------ ----- ----- ----- -------

(1) Acquired 1 December 2015. Attributable production and sales

(2) Includes production from ROM material and in concentrates

Antucoya

The ramp-up of Antucoya advanced, with production of 12,700

tonnes during the quarter and full capacity expected to be reached

by mid-2016. A solution for the problem with excessive dust has

started and is expected to be completed by the end of the year.

By the end of March, approximately 12 million tonnes of crushed

material were stacked on the heap, with 4.9 million tonnes of

material added to the heap during the quarter.

With both lines now operating simultaneously in the

electro-winning plant commercial production is regarded as starting

at the beginning of April.

The project's final total construction capital expenditure was

in line with the budget of $ 1.9 billion.

Transport

Total volumes transported by the division were 1.7 million

tonnes in Q1 2016, 12.8% higher than in the same period last year

and 4.1% lower than in the previous quarter. The increase compared

with Q1 2015 reflects the improved utilisation of rolling stock and

additional demand. The decrease since Q4 2015 is mainly due to the

seasonality of copper shipments.

Year to date Q1 Q4

2016 2015 % 2016 2015 %

--------------------------------- ------ --------- ------ ------ ------ ------

TONNAGE TRANSPORTED

---------------------------------- ------ --------- ------ ------ ------ ------

Rail kt 1,368 1,168(1) 17.1 1,368 1,417 (3.5)

Road kt 302 313 (3.5) 302 325 (7.1)

---------------------------- ---- ------ --------- ------ ------ ------ ------

Total tonnage transported kt 1,670 1,481 12.8 1,670 1,742 (4.1)

---------------------------- ---- ------ --------- ------ ------ ------ ------

(1) Excludes 233kt transported by FCA, which was sold in August 2015

Commodity prices and exchange rates

Year to date Q1 Q4

2016 2015 % 2016 2015 %

---------------- ------ ------ ------ ------- ------ ------ --------

Copper

---------------------------------------------------------------------------

Market price $/lb 2.12 2.64 (19.7) 2.12 2.22 (4.5)

Realised price $/lb 2.22 2.45 (9.4) 2.22 2.00 11.0

---------------- ------ ------ ------ ------- ------ ------ --------

Gold

---------------------------------------------------------------------------

Market price $/oz 1,180 1,220 (3.3) 1,180 1,105 6.8

Realised price $/oz 1,316 1,252 5.1 1,316 1,077 22.2

---------------- ------ ------ ------ ------- ------ ------ ------

Molybdenum

---------------------------------------------------------------------------

Market price $/lb 5.3 8.5 (37.6) 5.3 4.8 10.3

Realised price $/lb 5.4 7.6 (28.9) 5.4 4.3 24.5

---------------- ------ ------ ------ ------- ------ ------ --------

Exchange rates

---------------------------------------------------------------------------

per

Chilean peso $ 702 624 12.5 702 698 0.6

---------------- ------ ------ ------ ------- ------ ------ ------

The spot commodity prices for copper, gold and molybdenum as at

31 March 2016 were $2.21/lb, $1,236/oz and $5.3/lb respectively

compared with $2.13/lb, $1,062/oz and $5.3/lb as at 31 December

2015 and $2.75/lb, $1,188oz and $8.2/lb as at 31 March 2015.

The provisional pricing adjustments for copper, gold and

molybdenum for the quarter were positive $24.8 million, positive

$10.2 million and negative $0.04 million respectively.

Investors Media

- London - London

Andrew Lindsay alindsay@antofagasta.co.uk Carole antofagasta@brunswickgroup.com

Cable

Paresh Bhanderi pbhanderi@antofagasta.co.uk Will Medvei antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone +44 20 7404 5959

Investors Media

- Santiago - Santiago

Alfredo aatucha@aminerals.cl Pablo porozco@aminerals.cl

Atucha Orozco

Telephone +56 2 2798 7000 Carolina cpica@aminerals.cl

Pica

Telephone +56 2 2798 7000

----------------- ---------------------------- ------------ -------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLIFMPTMBITBIF

(END) Dow Jones Newswires

April 27, 2016 02:00 ET (06:00 GMT)

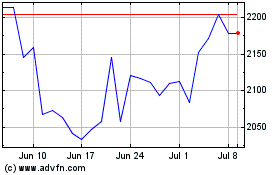

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

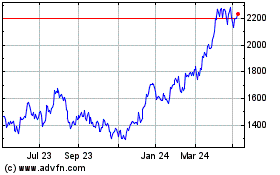

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024