TIDMANTO

RNS Number : 7095N

Antofagasta PLC

20 May 2015

FOR IMMEDIATE RELEASE, 20 MAY 2015

CHAIRMAN'S COMMENTS AT THE 2015 ANNUAL GENERAL MEETING

Antofagasta plc (the "Company") today released the script to be

used by the Chairman, Jean-Paul Luksic at the Company's Annual

General Meeting that commences at 10:30am today.

Thank you for joining us today.

As you can see all of your directors, except for Hugo Dryland

who has an important commitment in the US today, are in attendance,

as well as several members of senior management including our Group

CEO, Diego Hernandez, and the new CEO of our mining division, Ivan

Arriagada.

I would like to take this opportunity to welcome Mr. Jorge Bande

as our latest director who joined our Board in December. Jorge has

extensive experience across the energy, mining, and water sectors

and will be standing for election later during this meeting.

Before we present the resolutions on today's formal agenda, I

would first like to provide you with an overview of Antofagasta's

financial and operational performance during 2014 and the outlook

for the rest of this year.

Antofagasta spent 2014 consolidating the business which we

believe will continue to secure the company's margins while copper

prices remain weak and volatile, and put the company in a stronger

financial position once the market recovers. The last few years

have seen declining commodity prices, heightened geopolitical

tensions and a higher cost of mining around the world, including in

Chile. This macro environment has created an atmosphere of

uncertainty for investors and they have looked for companies with

the lowest risk profile. Our strategy in this environment remains

robust and consistent: we focus on lower risk / higher return

projects such as brownfield expansions while steadily advancing our

greenfield projects as part of our long term growth. We seek only

to invest in projects that we expect to offer strong returns. We

continue to concentrate on what we know best - producing copper,

reducing our costs and building a platform for long-term growth.

When the world economy picks up again and demand growth

accelerates, the supply side response will be constrained by the

lack of development in these past few years which we believe will

ensure that the long-term copper fundamentals remain strong.

Antofagasta is in a strong position to capitalise from that

stronger market environment.

Before saying a few words about our operating performance I

would just like to repeat my comments in the Annual Report about

the fatalities that occurred last year. Despite our continued

efforts five people died during the course of the year. This is

terrible, and the Board and I offer our heartfelt sympathy to their

families. We owe it to their memory, and the memory of the others

lost over the years, to redouble our efforts to achieve our target

of zero fatalities. I know that this is much easier to say than to

do, but I want to make sure that each and every employee knows that

it is our top priority.

In 2014, we produced almost 705,000 tonnes of copper, slightly

lower than the record production levels achieved in 2013.

Whilst the Group has enjoyed a number of years of significant

growth, 2014 was a year of consolidation during which the Group

created a strong base from which to grow over the coming years. We

have focused on increasing our productivity and optimising the use

of our plant and equipment to ensure the highest levels of

efficiency. During the year, we completed the merger of Esperanza

and El Tesoro to form Minera Centinela, which has allowed us to

capture synergies arising from shared operational overheads, the

integration of mine plans and sharing properties and facilities.

The copper price is low at the moment and our strategy when prices

are down is to focus on higher return, lower risk projects such as

brownfield expansions whilst steadily advancing greenfield projects

as part of our long-term development. We seek only to invest in

projects that we expect to offer strong returns.

During 2014, we made good progress advancing the projects under

construction at Antucoya and Centinela, and early works started at

Encuentro Oxides shortly before the completion of its feasibility

study in November. The feasibility study on the Pelambres

Incremental Expansion continued through the year and the

pre-feasibility study on Centinela's Second Concentrator will be

brought to the Board for approval in the coming months, before it

progresses to the feasibility study stage. A pre-feasibility study

was also completed in 2014 on the Twin Metals Minnesota project.

These projects provide a healthy growth pipeline for the Group over

the coming five to ten years.

From a financial perspective, 2014's revenues were impacted by

lower realised commodity prices and slightly lower sales volumes.

Unit operating costs also increased, impacted by lower grades and

one-off signing bonuses paid to mine employees during the year,

partly offset by the weakening of the Chilean peso and lower input

costs. In addition, the Group made some $80 million of cost savings

during the year, which equated to some $0.05/lb. By-product

revenues were also impacted by lower production and a weaker gold

price. This has meant EBITDA decreased by 18% compared with 2013 to

$2.2 billion, however, our EBITDA margin remained resilient at 42%,

which is healthy compared to our peers.

Despite the difficult market conditions, the Group continued to

generate respectable operating cash flows of $2.5 billion during

the year, only some $150 million less than last year. By the end of

the year the Group's attributable net cash was still positive at

$315 million, which will soon be improved by the proceeds arising

from the recent sale of our water division.

The Board has proposed a final dividend of 9.8 cents per share,

which along with the 11.7 cents per share interim dividend, paid in

October 2014, results in a total dividend of 21.5 cents per share

for the year. This represents a total distribution of $212.0

million and a pay-out ratio of 35%.

Antofagasta has a history of returning excess capital to

shareholders, as illustrated last year when we paid down our net

cash position as a dividend with a pay-out ratio of over 140%. The

decision this year to pay a total dividend equal to 35% of net

earnings, excluding the deferred tax provision arising as a result

of the Chilean tax reform, was taken in view of the uncertainty in

the copper market at the start of this year, as well as

uncertainties at Los Pelambres arising from an adverse court

decision and actions by some protestors in February and March of

this year.

These uncertainties came to prominence within days of each other

at the beginning of March this year. One was related to the

scarcity of water in Choapa Valley near Los Pelambres and the other

was related to a court ruling about the flow of water in the Pupio

stream in a neighbouring valley. As these issues have been going on

for some time and have recently received some prominence, I would

like to spend a few moments explaining what happened and what the

current situation is.

There has been below average annual rainfall in the Los

Pelambres region for some years and this year it has been

particularly severe. A small group of protesters from the Choapa

Valley blocked the access road to the mine for ten days in early

March, disrupting normal operations and reducing throughput at the

mine. The protests were triggered by a small group of people

seeking action by Los Pelambres and the local government to help

alleviate the drought. Following a period of negotiation

facilitated by the government, Los Pelambres agreed to contribute

funding for the study of a desalination plant project, which would

be developed under a private-public alliance or public concession

scheme. Los Pelambres also agreed to contribute funds to complete

studies for the construction of a water dam for local use, which if

constructed would be developed under a private-public alliance.

Finally, Los Pelambres agreed that it will use sea water for any

further expansions of its mining operations.

The other uncertainty arose when the Civil Court of Los Vilos

notified Los Pelambres that the plan submitted by it was not

sufficient to address the requirements of the Supreme Court order

on the basis that the proposed works do not allow the natural flow

of the Pupío stream to the town of Caimanes and that as a

consequence Los Pelambres must destroy part, or all, of the

tailings dam wall. Los Pelambres has appealed the decision to the

Appeal Court of La Serena. The dam will continue to operate

normally while the appeal process proceeds, however the parties may

seek interim relief during this period.

I can assure you that Los Pelambres has always complied with all

applicable laws, regulations and controls, but it is likely that we

will continue to have legal and other challenges over the coming

years. We will seek to resolve these challenges and will continue

to engage with the local community as well as considering the

exercise of all available legal measures that may be required to

overturn any adverse court decisions.

Turning to corporate governance - maintaining high standards of

corporate governance is fundamental to the Board's ability to

discharge its duties to shareholders. The Board and I remain

committed to ensuring that the structures and procedures in place

across the Group reflect the best principles of good governance and

take into account the expectations of our stakeholders.

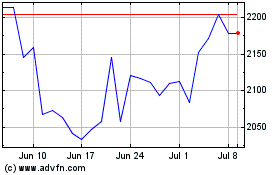

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

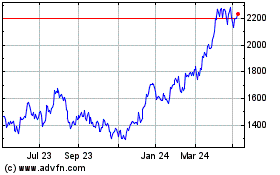

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024